| Plus, a prediction markets review. |

| |

| Welcome back to The Forecast, where we help you think about the future — from next week to next decade. This week we're looking at the deeper causes of today's economic uncertainty. Then we've got a preview of next week's US bank earnings and a quarterly prediction market review. | |

The Uncertainty Is Not Going To End | |

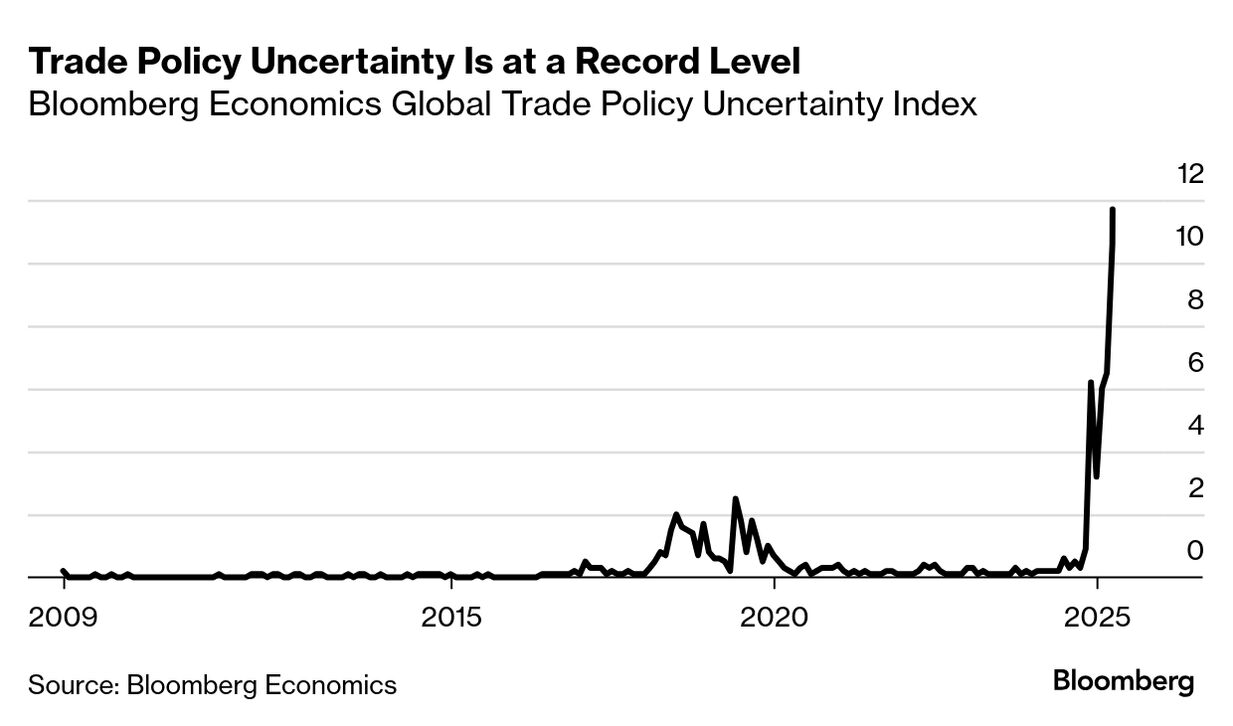

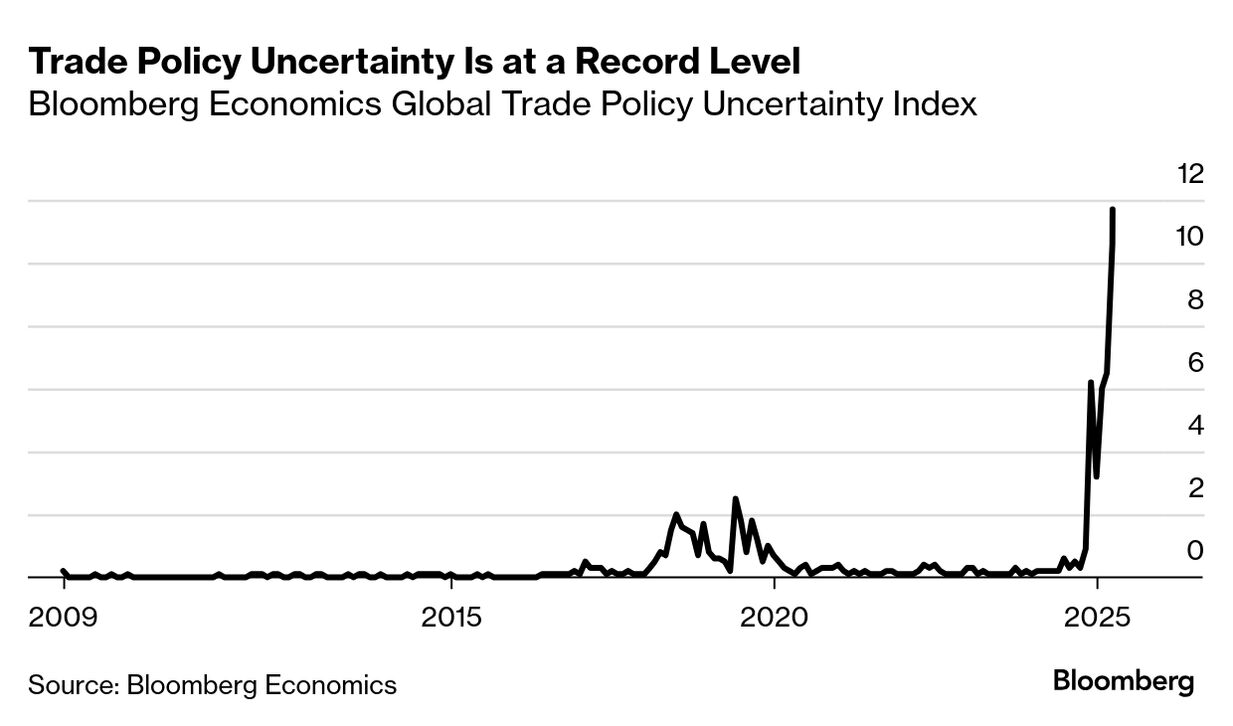

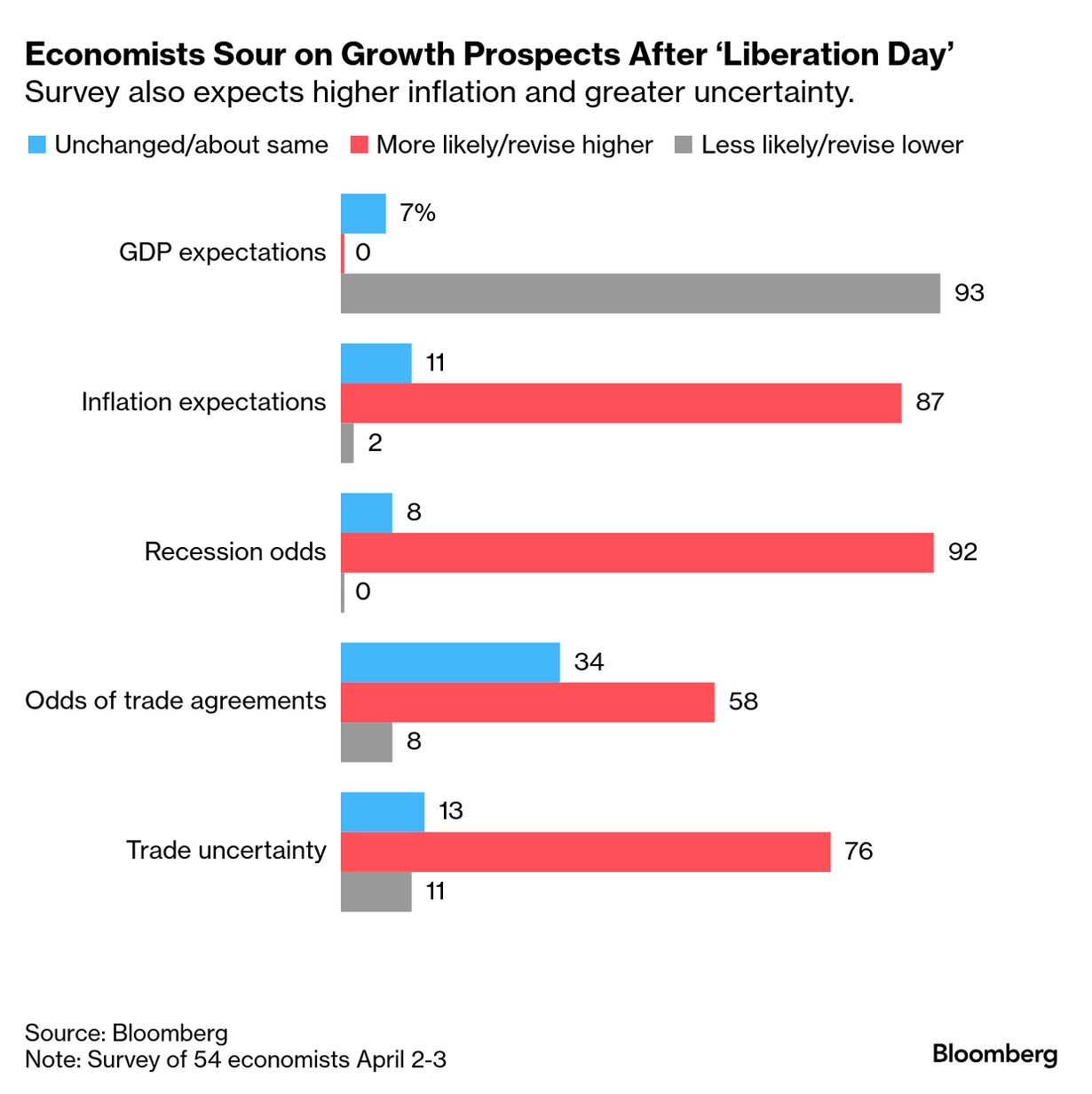

| One of the consequences of the 'move fast and break things' approach at the core of Trumponomics is that it has brought a toxic uncertainty to the global economy. And yet the uncertainty that Trump is injecting isn't entirely new — and it's also not going to go away. The predictable pillars of the modern economy are crumbling. The global economy is now a perpetual uncertainty machine. Get used to it.

By now the context should be familiar. We've just survived a decade of monumental shifts in the global economy — the resurgence of populism, a pandemic, trade wars and bloody real wars of attrition that have brought back Cold War geopolitics and, more recently, scrambled them all over again. We're facing the end of a decades-old order and confronting existential questions around artificial intelligence and climate change.  This current bout of unpredictability will pass eventually. But history indicates that one period of uncertainty feeds into another. The Smoot-Hawley tariffs of 1930 helped lengthen and deepen the Great Depression and led to the collapse of global trade, which hit German exports. That in turn contributed to the downturn that helped Adolf Hitler recover from a false start in German politics, as William Shirer documents in The Rise and Fall of the Third Reich.

Applying that historical scenario to today's world is a frightening exercise. But it's a reminder that the real uncertainty coming out of this week is not only what the impact of Trump's tariffs will be on the US and global economies, but what they will do to American power and its influence around the world. The surge in anti-Americanism seen already in places like Canada is one tangible effect. But what if the world's largest economy becomes the source of instability rather than a ballast for the world? Will China fill the gap? Will anybody? Epochal challenges from climate change to AI, combined with the interregnum between global orders, will make each shock more difficult to navigate. If there is a committee to save the world forming, it's doing so in hiding. The day a financial market swoon turns into a crash and sets off a deep and prolonged economic disaster it's hard to know who will be leading the rescue. — Shawn Donnan, Bloomberg News Read more: The Uncertainty Is Not Going to End | |

| |

| |

| |

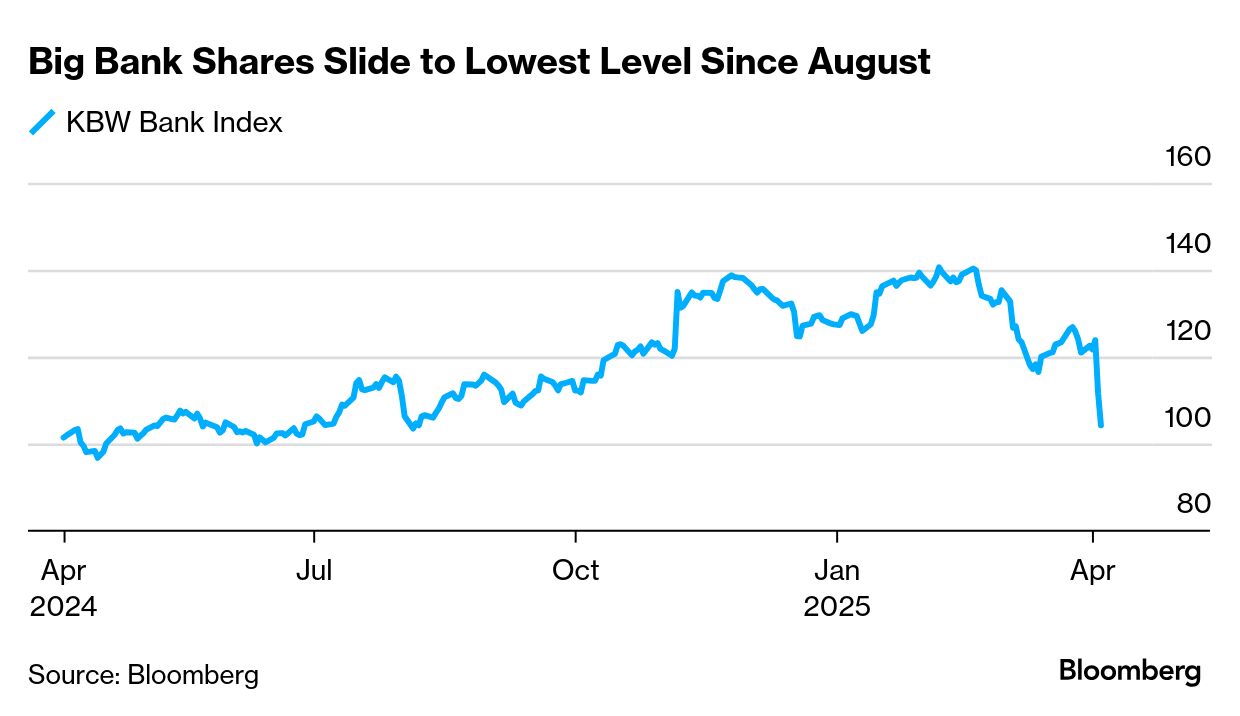

| Banks vs. Tariffs Shares of big US banks plummeted this past week, notching their biggest two-day drop since March 2020, after Trump's barrage of new tariffs led to calamity and chaos for global equity markets and sparked retaliation from China. The quarterly bank earnings starting this coming week are now secondary to the macroeconomic chaos engulfing equity markets. Still, the results will give management a chance to say their piece on the current outlook given, well, everything. JPMorgan Chase, Wells Fargo and Morgan Stanley will kick off the quarterly earnings for the biggest US banks on Friday, April 11. Last month's report from Jefferies Financial Group Inc. gave an early read on the sector. The New York-based firm's investment-banking and capital-markets revenue dropped, suggesting a much-anticipated boom in dealmaking activity and initial public offerings was yet to materialize. That potential warning sign came in even before worse-than-expected tariffs hammered market sentiment and put billions of dollars worth of acquisitions and IPOs on hold. Now, the question is whether banks will maintain, revise, or even pull their guidance in the wake of the altered outlook. — Georgie Mckay, Bloomberg News | |

What Are the Chances... | | 23 | | Number of prediction markets we've cited since launching The Forecast. | | |

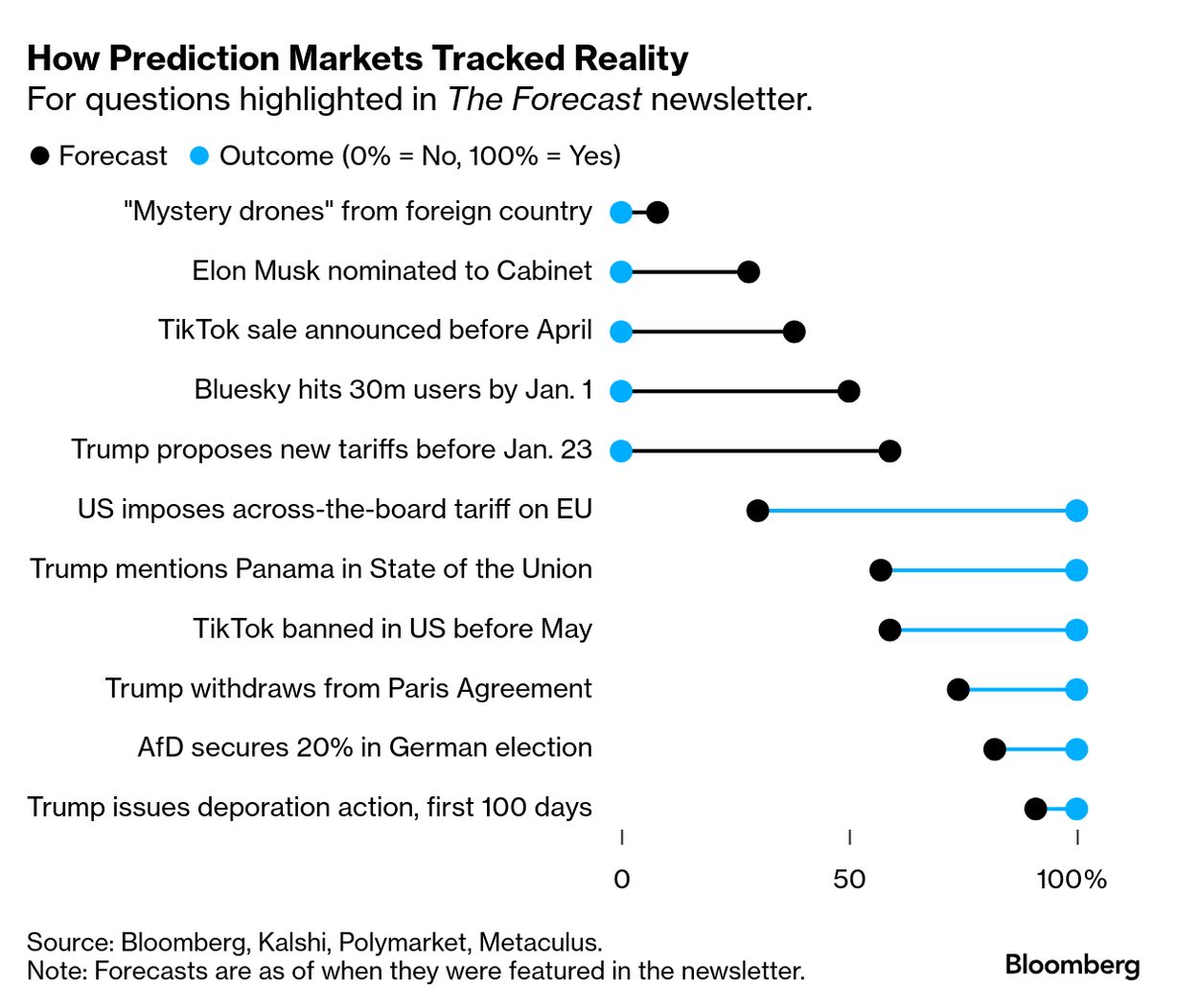

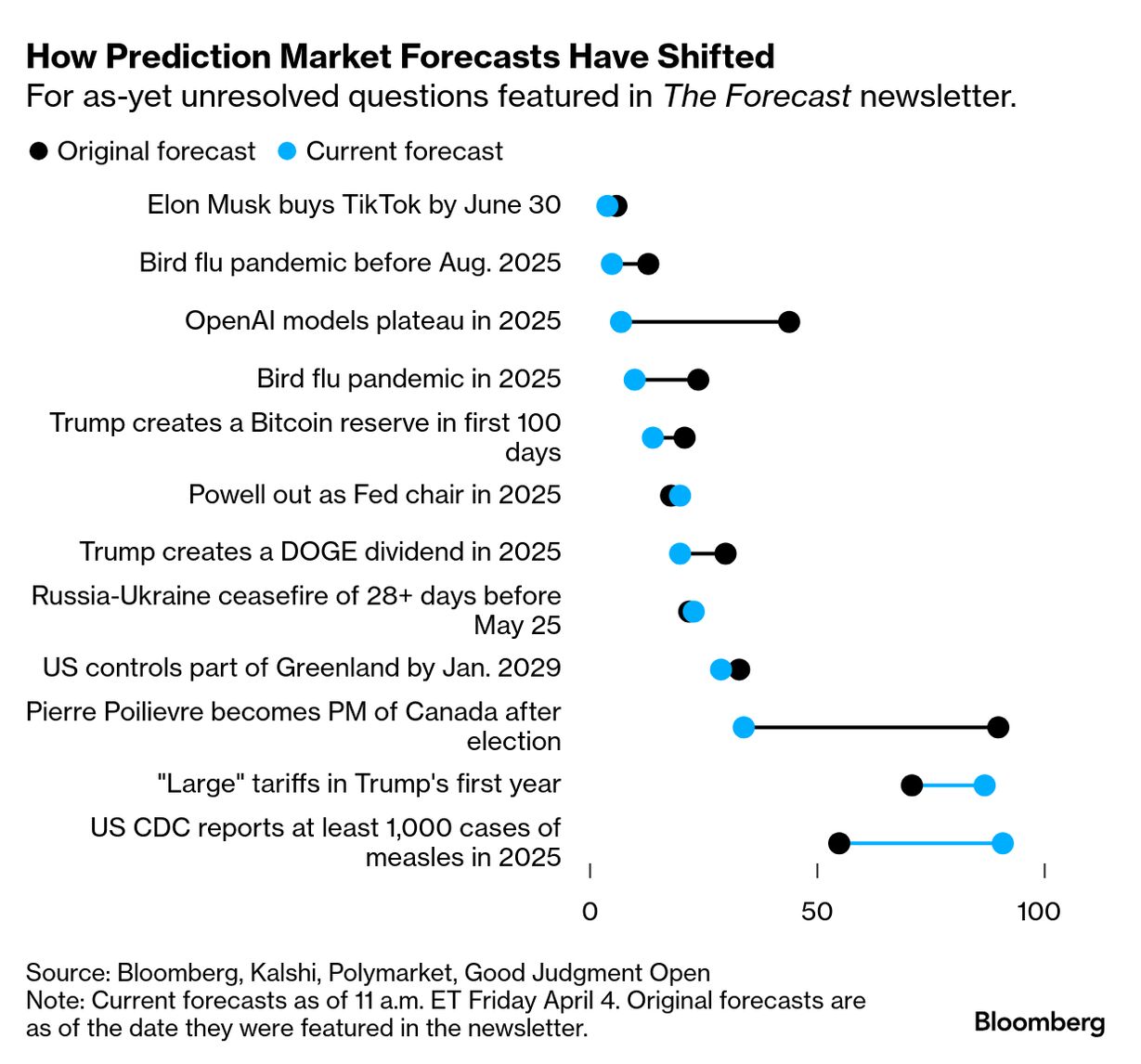

| Every quarter we look back at the prediction markets we've cited here, to see what's changed. First, since launching the newsletter in November there are 11 markets we've cited that have resolved — meaning the event in question either happened or it didn't. Five resolved "No" – marked 0% in the chart below — and six resolved "Yes." In nearly all of these instances, the markets leaned in the right direction: The average forecast for the five events that didn't happen was 37%, compared to 66% for the six that did. The two forecasts that were furthest from the eventual outcome? They both involved tariffs. That leaves 12 other markets we've cited in this newsletter that haven't yet resolved one way or another. For those, we've charted the market value at the time of the newsletter vs. the market value now. Chances of a bird flu pandemic, an AI plateau and a conservative prime minister in Canada are down. The chances of measles and large tariffs in the US are up. — Walter Frick, Bloomberg Weekend Edition | |

| |

| |

| |

| Monday: EU trade ministers meet in Luxembourg to discuss a response to US tariffs; Germany reports industrial production. Tuesday: Samsung and Walgreens report earnings. Wednesday: Trump's reciprocal tariffs take effect; the Reserve Bank of India is expected to cut interest rates by 50 bps; Mexico reports CPI; Delta reports earnings. Thursday: US CPI is expected to show core inflation inching higher; China's CPI is expected to show a second month of deflation; TSMC reports March sales. Friday: JPMorgan, Morgan Stanley, Wells Fargo, Bank of New York Mellon and BlackRock report earnings; Argentina, Brazil, Germany, Spain and Russia report CPI. | |

| Have a great Sunday and a productive week. — Walter Frick and Silvia Killingsworth, Bloomberg Weekend Edition; Shawn Donnan and Georgia Mckay, Bloomberg News | |

| As President Trump's trade war rattles global markets, Bloomberg Surveillance goes beyond the headlines with special coverage Sunday April 6th 5-7pm EDT. Join hosts Jonathan Ferro and Lisa Abramowicz for real-time insight from top economists, market strategists and policymakers. Watch on Bloomberg.com/live and TV<GO> on the Terminal. Enjoying The Forecast? Check out these newsletters: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's The Forecast newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment