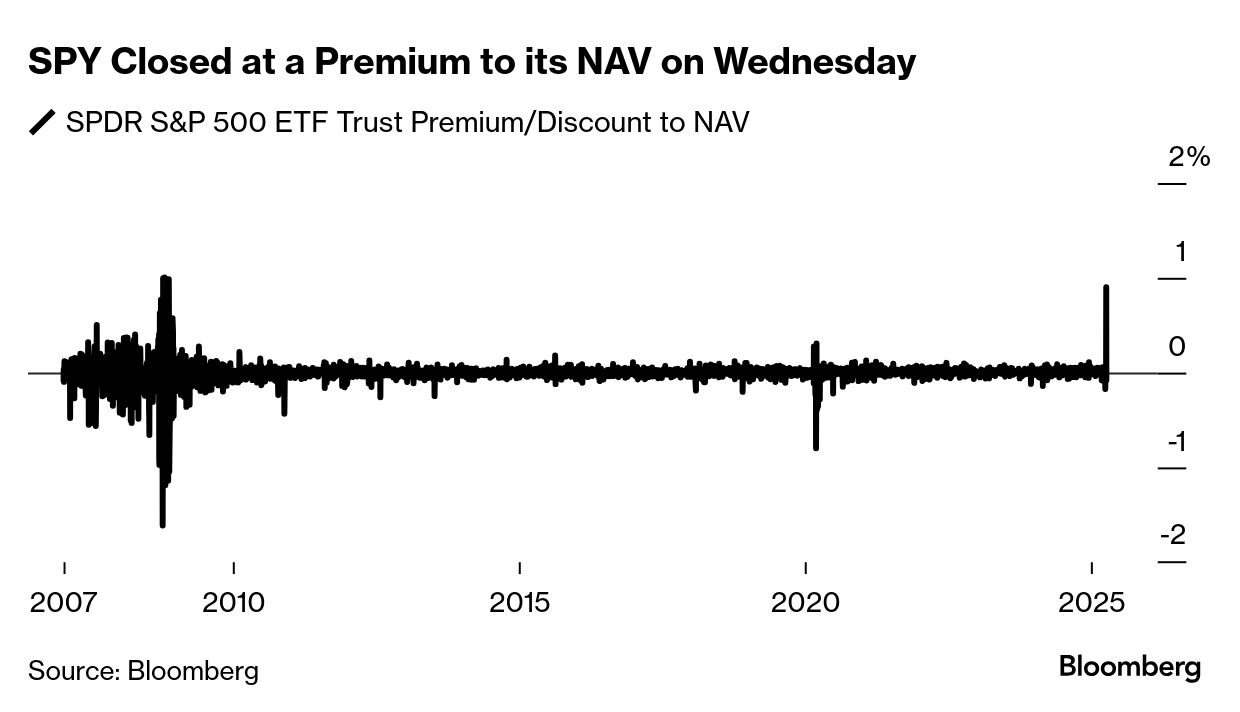

| Something amazing happened this week: even SPY got stressed out. Rewind to Wednesday, just before 1:20 p.m. New York time, when President Donald Trump posted on social media that the US would issue a 90-day pause on tariffs on certain trading partners. The SPDR S&P 500 ETF Trust surged 10.5% in response as traders desperately plowed in, outpacing the actual S&P 500's gain of 9.5%. The end result? SPY closed at a 90 basis point premium to its net-asset value on Wednesday. That's the biggest dislocation in the fund since the 2008 financial crisis. The episode speaks to how systemically important SPY has become to financial markets. As a source quipped to me this week, SPY is the liquidity vehicle of last resort — even if every other cash market seizes up, barring the heat death of the universe, SPY will still trade. A quick autopsy suggests that's what happened: Goldman Sachs's prime desk said that top-of-book liquidity on S&P 500 futures was near all-time-lows heading into the crash-up. Amid the melee, traders bee-lined to SPY. On Wednesday, losing-auction volumes were running roughly 300% higher than usual and likely a factor in driving up the premium, according to Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors. "That's just a function of the ETF, of SPY — it's a significant liquidity vehicle for a large swath of traders and investors to rotate into," Bartolini told Bloomberg's Vildana Hajric. "Given the sizable moves that we saw yesterday intraday, but also heading into the close, there was just a large balance of buy orders coming in to mark the close that then pushed the price up above," he said, referring to the price action on Wednesday. Still, to see SPY unmoor from its NAV in such a dramatic fashion underscores just how volatile worldwide markets are. There's plenty of superlatives to point to, from the VIX to Treasury yields to credit spreads. But SPY alone tells the story quite neatly. |

No comments:

Post a Comment