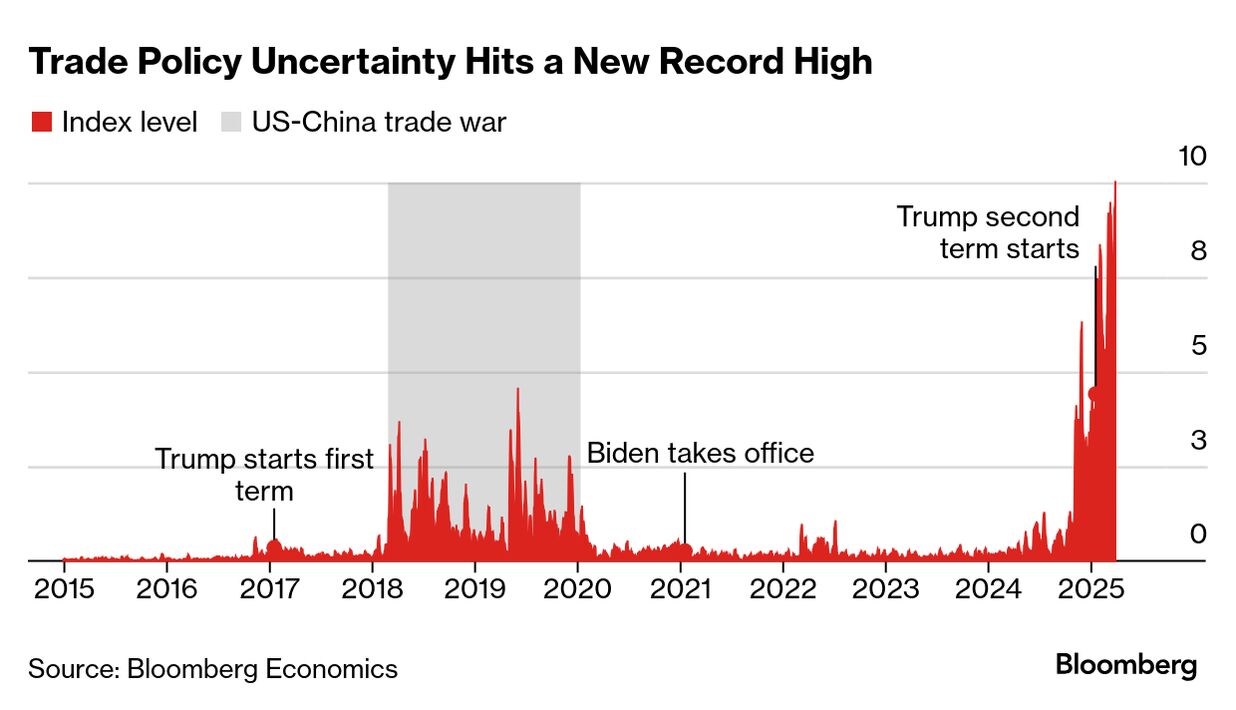

| A gauge of trade worries hit a record high heading into President Donald Trump's announcement Wednesday of higher tariffs on some of the US's biggest trading partners. The Bloomberg Economics Global Trade Policy Uncertainty Index topped 10 for the first time, exceeding the previous high of 9.48 set earlier this month. During Trump's previous term in office, the number peaked at 4.58. The concerns were apparent in the comments section of the Dallas Fed's manufacturing survey released Monday: - "Tariffs are a constant and increasing source of uncertainty," a computer and electronics maker said.

- "Our biggest concern is import taxes and the increase in price that it causes.," a food maker said.

- "There's optimism, but there's also an abundance of trepidation," a machinery producer said.

In a Rose Garden ceremony planned for 3 p.m. in Washington tomorrow, Trump will announce his so-called reciprocal tariffs, a step that — regardless of the outcome — will put his stamp on economic history, according to the latest Bloomberg Big Take from Shawn Donnan and Enda Curran. But the time and place are about the only key details made public so far. White House Press Secretary Karoline Leavitt said Monday the announcement would feature "country-based" tariffs. The president is also "committed to implementing" sectoral duties, she said, but they're not the focus of the event Wednesday. Auto tariffs, however, are still set to take effect Thursday and Detroit is making a last-ditch effort to seek some relief from the White House. Big Take Podcast: Everything We Know About Trump's Planned Tariffs Dovetailing with the tariff announcement, Trump administration officials are also due to submit a report on China's compliance with the "Phase One" trade deal Trump negotiated with Beijing during his first term. In that agreement, China committed to buying an extra $200 billion worth of US goods — a goal it missed. Meanwhile, the European Union said it will use a broad range of options to retaliate if Trump follows through on his threat to impose so-called reciprocal tariffs on the 27-nation bloc. Read More: US Recession Worries Raise 'Gray Swan' Risk for Bond Investors Trying to head off tariffs on its shipments to the US, Vietnam announced it slashed import levies on a range of products, including liquefied natural gas and automobiles, according to a statement on the government's website. Japan's prime minister announced support measures to help businesses cope with the levies. —Brendan Murray in London Bloomberg's tariff tracker follows all the twists and turns of global trade wars. Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. -

- "Tariffs are a constant and increasing source of uncertainty," a computer and electronics maker said.

- "Our biggest concern is import taxes and the increase in price that it causes.," a food maker said.

- "There's optimism, but there's also an abundance of trepidation," a machinery producer said.

|

No comments:

Post a Comment