| I'm Craig Stirling, a senior editor in Frankfurt. Today we're looking at the latest euro-area inflation readings. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - President Donald Trump will announce his reciprocal tariff push on Wednesday during an event in the White House Rose Garden. Read the Big Take.

- There are concerns the tariffs will tip America into a recession.

- Activity in some of Asia's largest manufacturing nations slowed further in March, while China's factory activity improved at the fastest pace in four months and Japan's businesses remained relatively upbeat.

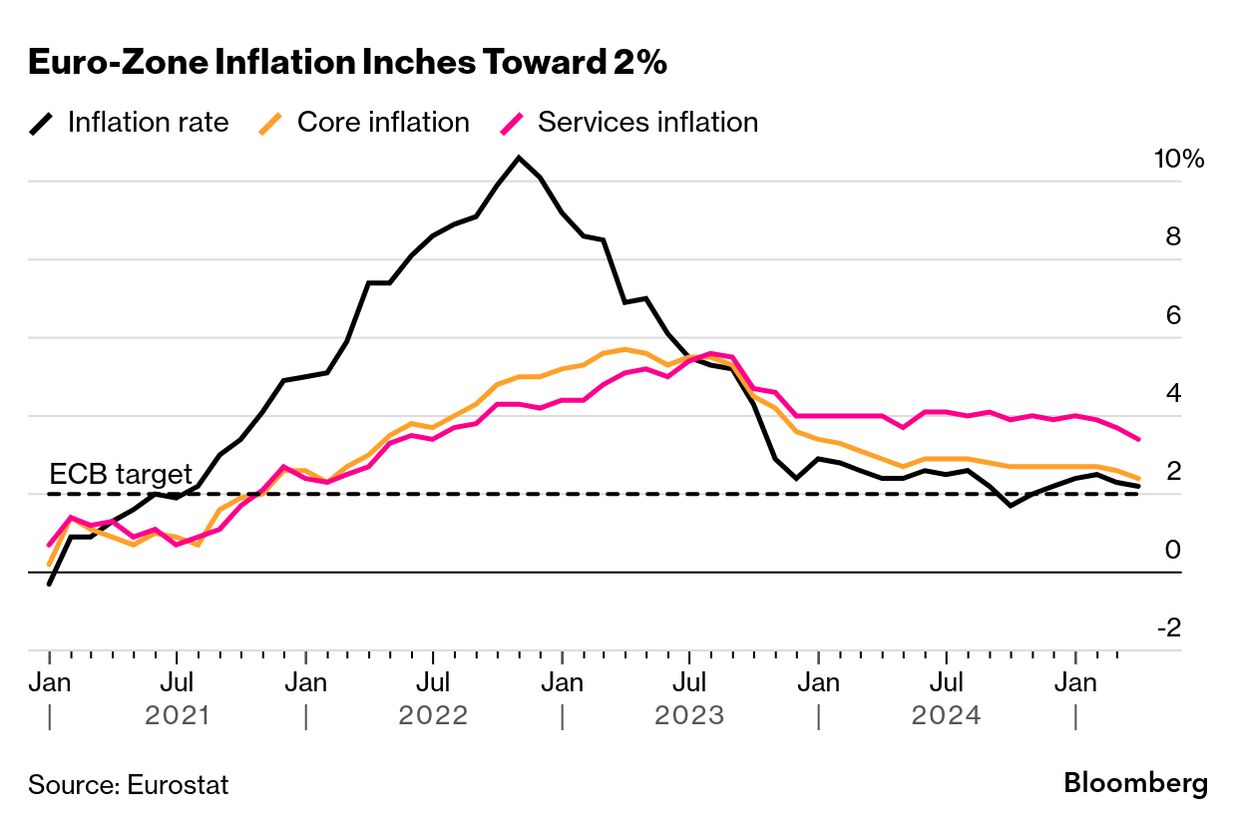

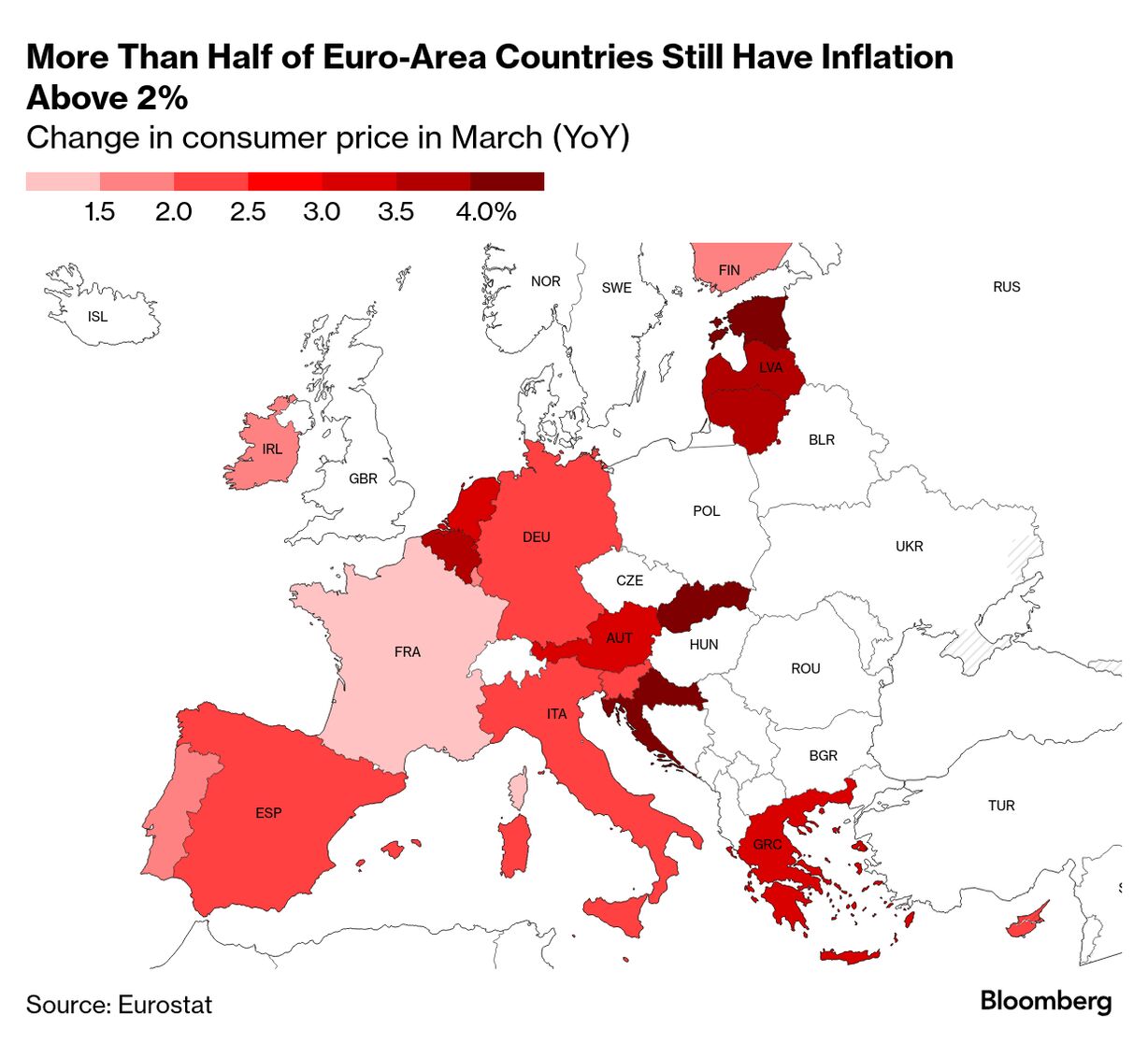

In the nervous prelude to Trump's big tariff announcement, European Central Bank officials just got some cause for cheer: a slowdown in inflation. Consumer-price growth in the euro zone weakened to a five-month low of 2.2% in March, according to data released on Tuesday. The core measure, which strips out volatile elements such as energy, was slower than anticipated, at 2.4%. But there's no sound of applause in Frankfurt. Instead, policymakers are gearing up for a big argument over what to do next, with their upcoming decision just over two weeks away. Hawks such as Bundesbank President Joachim Nagel warn against becoming "overly optimistic" after "encouraging" data. Yes, inflation is slowing, and helpfully so in three of the region's four biggest economies, but it's still above the 2% target. Dovish officials meanwhile insist that the economy is fragile and vulnerable to the tariff shocks Trump is inflicting on the global economy. Executive Board member Piero Cipollone, for example, said last week that the case for a rate cut has actually strengthened since March, when the ECB lowered borrowing costs but refrained from a clear signal on what to do next. While investors began the week betting on a reduction on April 17, Bloomberg News reported that some officials are currently leaning toward a pause. In truth, many policymakers want to see what Trump comes up with on Wednesday before forming a firm view on whether or not to cut this month. As with peers around the world, they need to gauge if the impact of his prospective tariffs will be reverberate more on growth or inflation. An important part of that calculation will rest on whatever reaction Brussels comes up with. "Retaliatory tariffs from the European Union could create an immediate inflationary impulse, but the longer-term impact is more likely to be disinflationary, reflecting the weaker demand outlook," said Jamie Rush, chief European economist at Bloomberg Economics. "Sweeping tariffs and a de-escalatory response would likely cement a cut." The Best of Bloomberg Economics | - Commerce Secretary Howard Lutnick has signaled he could withhold promised Chips Act grants as he pushes for companies in line for federal semiconductor subsidies to substantially expand their US projects.

- Global lenders expect China to deliver its long-awaited monetary stimulus as soon as in April, with timing likely dictated by the double threat of US tariff hikes and a seasonal cash shortage.

- The UK government insisted a boost to minimum wage rates will help Britons with the cost of living even as a slew of household bills rise.

- Vietnam, in a race to head off possible new US tariffs, announced it slashed import levies on a range of products, including LNG and automobiles. Meanwhile, China is willing to buy more Indian products to balance trade and Japan's government is scrambling to come up with support measures for businesses.

- Poverty in Argentina dropped sharply as the disinflationary effects of President Javier Milei's shock austerity program took root.

- Central bankers in Australia and Colombia kept their key rates unchanged.

One of the unorthodox ideas to address international economic imbalances circulated by White House chief economist Stephen Miran before he took office was a sort of debt swap. Countries under the US military umbrella would swap the regular Treasuries they now hold for low-, or no-interest 100-year bonds, alleviating Washington's debt and security burden. Deutsche Bank's report on any theoretical Mar-a-Lago accord — part of which this newsletter highlighted yesterday — included this observation: any such swap, if viewed as coerced, could spook private-sector foreign investors to dump their holdings, fearing "they would be next in line. That would send US rates higher, countering any benefit from the swap.  The US Treasury building in Washington, DC, Jan. 27, 2025 Photographer: Stefani Reynolds/Bloomberg "A quasi-debt restructuring could increase Treasury risk premia demanded by private investors — with the status of Treasuries as the global risk free asset coming into doubt," Deutsche Bank economist Peter Sidorov and his colleagues wrote last week. The same risk would come from other unorthodox ideas, such as imposing a tax on foreign investors in Treasuries, they wrote. |

No comments:

Post a Comment