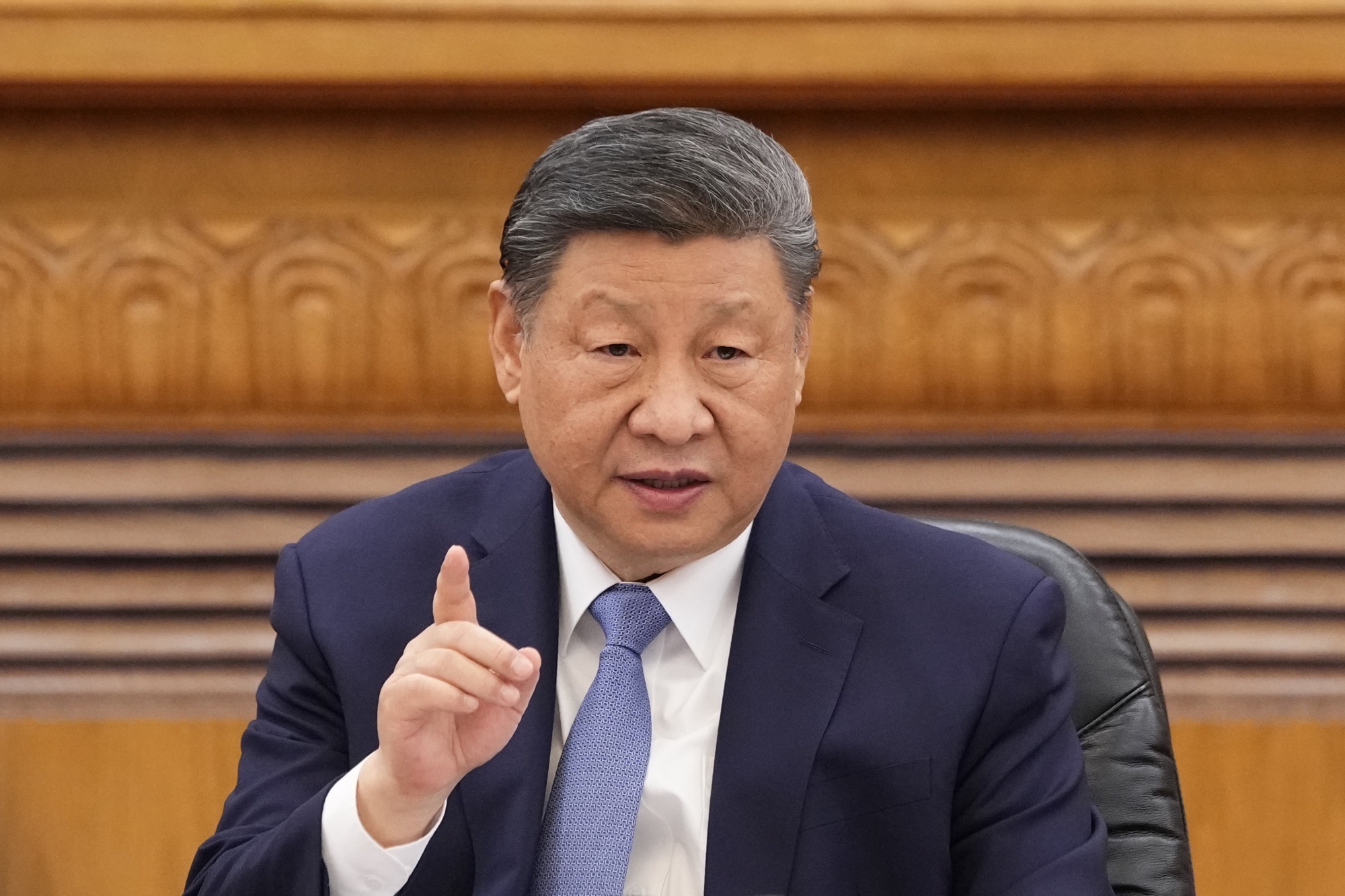

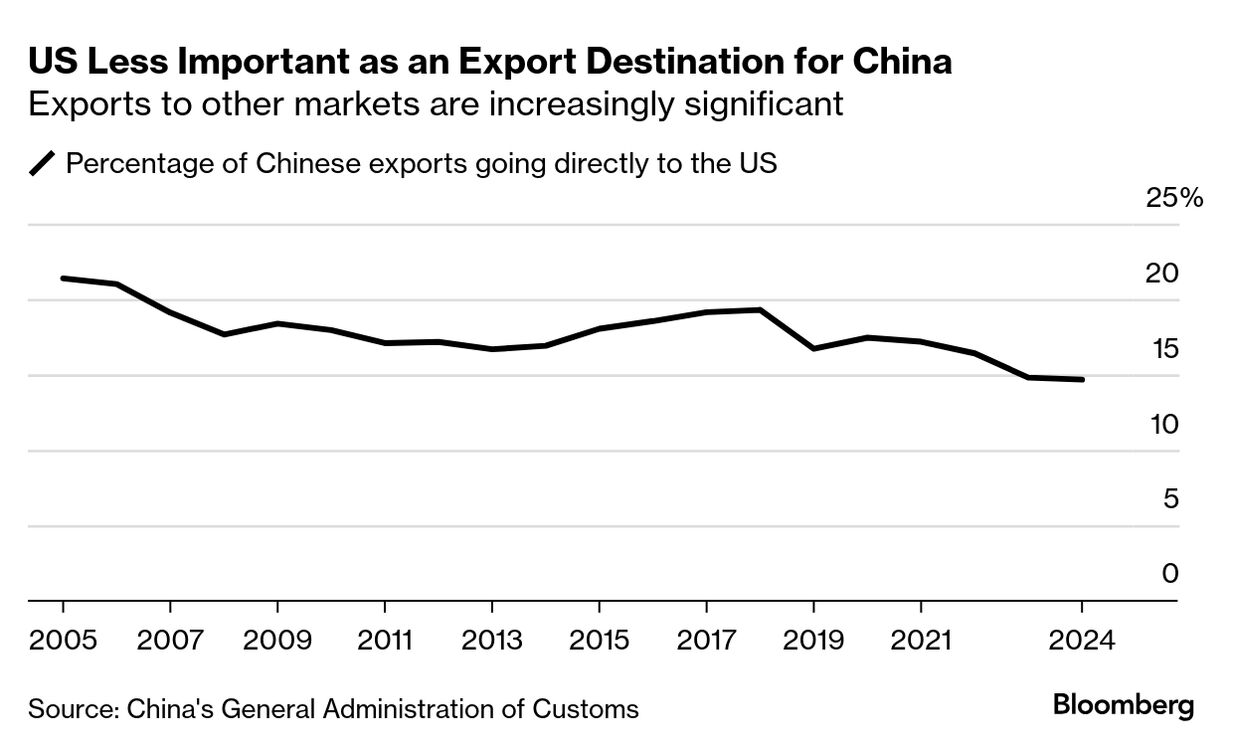

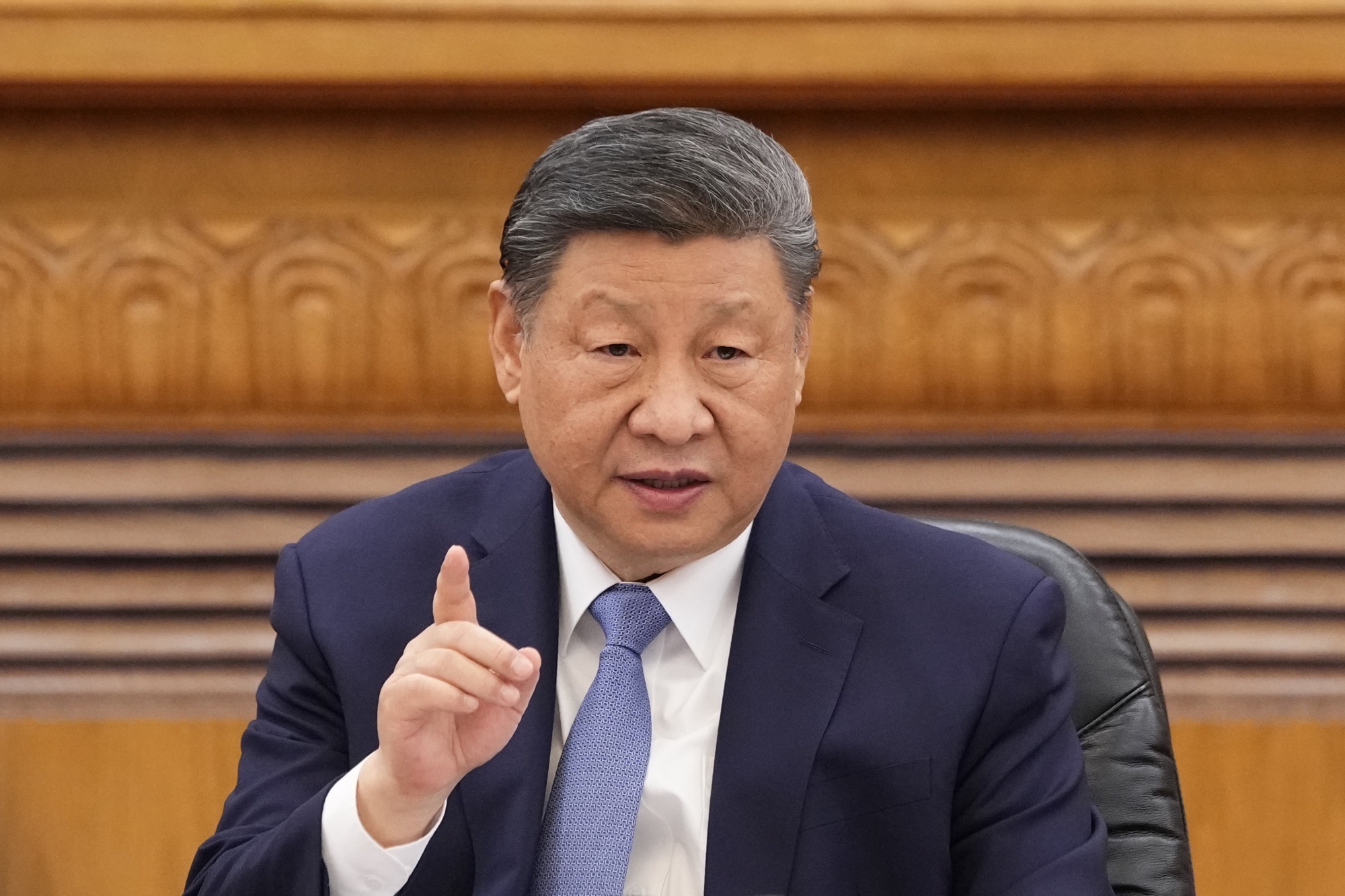

| Hi, this is Allen Wan in Shanghai, where the selloff ignited by the Trump administration's sweeping tariffs hammered markets that were closed for a holiday on Friday. On Monday, China's benchmark CSI 300 Index plunged 7.1% to its lowest level since September last year, while the yuan whipsawed. The damage came after the government of Xi Jinping responded to Donald Trump's move with commensurate levies on all American goods and export curbs on rare earths. Here's some stories to get you caught up on all things tariff, Trump and retaliation: While investors have been rattled by Trump's "Chart of Death" – as one Wall Street wit nicknamed the poster the US president held up when unveiling the levies – the response out of China can be described as calm resignation mixed with a dash of defiance. That's because Xi's government, which is led by a party whose DNA is defined by wartime hardships like the Long March, has long planned for the worst-case scenario, namely the day things got real with the US. For example, in the aftermath of the first trade war, China started diversifying its exports away from the US, and now relies on the world's biggest economy for just under 15% of total shipments, down from almost a fifth in 2018. Xi and his underlings have also refrained from resorting to big stimulus in recent years to boost an economy that came out of the pandemic wobbling, a problem worsened by an unfolding property crisis and pesky deflationary pressure. Now that Trump has shown his hand, Xi still has a big mix of monetary and fiscal tools at his disposal, including frontloading stimulus, expanding the fiscal deficit, cutting interest rates and allowing the yuan to weaken, a step that would help exports. Read about yuan devaluation chatter picking up here. Analysts at China Galaxy Securities, a brokerage headquartered in Beijing, said the chances of the Politburo rolling out stronger measures to boost demand at its meeting this month are rising. The potential scale of policy tools is upward of some $274 billion, they wrote. Some of these steps should spur domestic demand, helping China transition to an economy where consumption plays a much bigger role than in the past. Beijing has long valued self-reliance in a range of areas, like tech innovation. It may now finally be learning that domestic consumption is not only good for the economy — in a sense it's just as much about self-reliance as making its own semiconductors or AI tools. For sure, life's full of trade-offs and so are these moves. China would be adding to its debt load, undoing years of work to cut leverage. It may also spur fund outflows, hurting asset prices more — which would then undermine already-fragile business and consumer confidence.  Xi Jinping has an opportunity to give China a soft-power win. Photographer: Pool/Getty Images But with Trump's tariffs targeting nations around the world, China also has the chance it seems to have always wanted to stand front and center on the world stage. It can be the voice of reason, not to mention the voice of developing nations who would love to have stronger trade and economies. "Usually cast as a disruptor of the postwar economic order, and sometimes relishing the reputation, Beijing has much to gain in the public-relations arena," Bloomberg Opinion columnist Daniel Moss writes here. "The challenger can now present as the defender of the system. This is a soft-power gift." The door is open for Xi and China. They appear to be fully prepared to handle economic challenges and accomplish some major goals. The only question is how well they use the tools they've prepared – and if they're up to the challenge. |

No comments:

Post a Comment