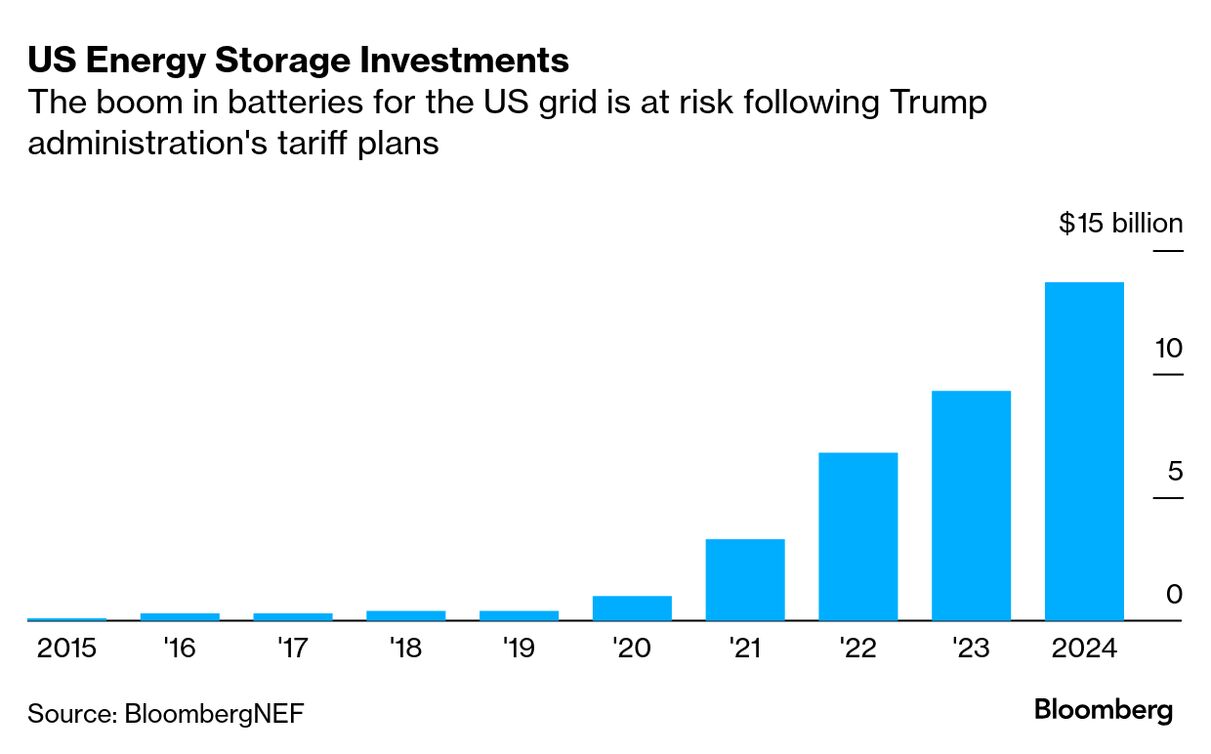

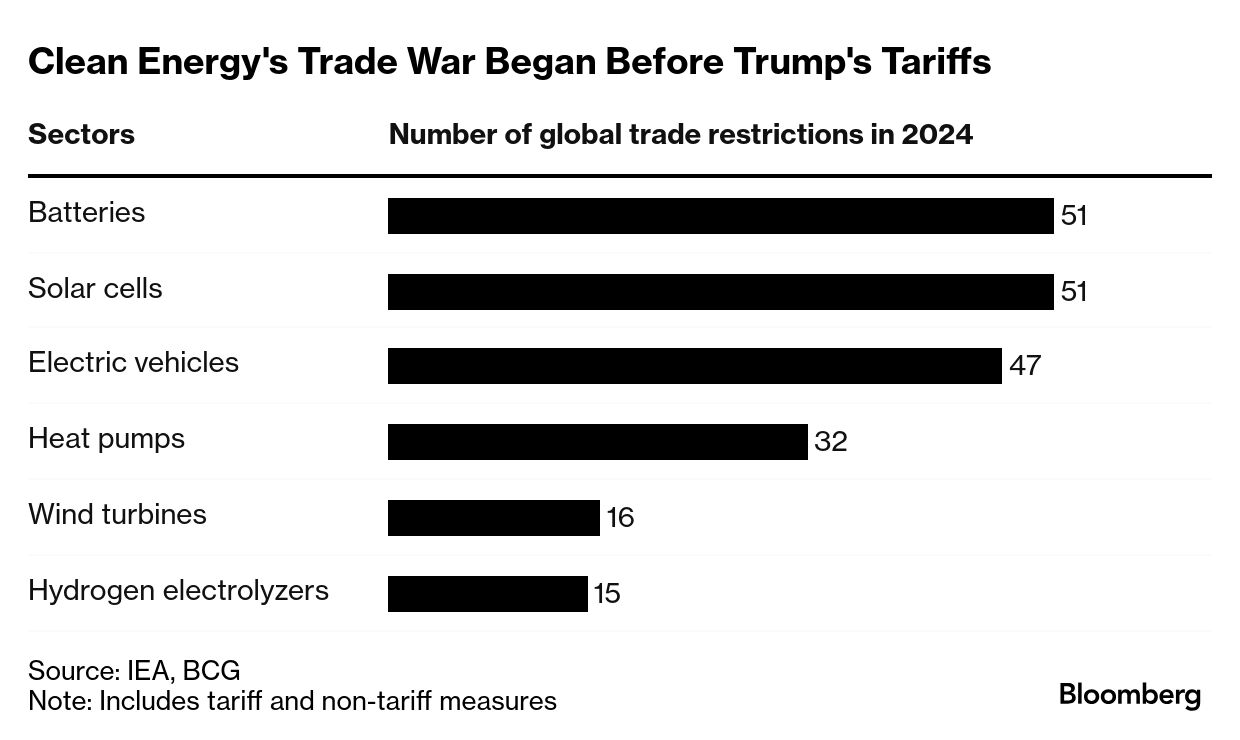

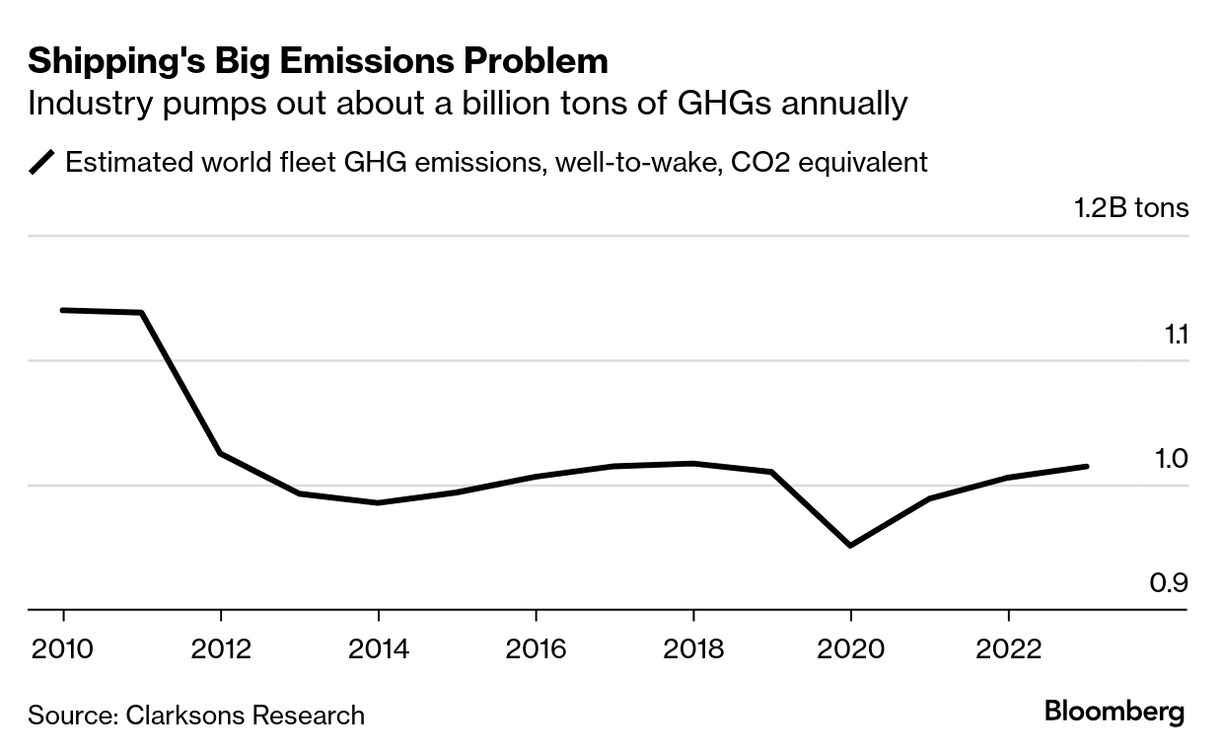

| By Akshat Rathi One set of US President Donald Trump's tariffs went into effect on Saturday. The rest are due to begin Wednesday. Stock markets around the world have taken a nosedive, with some indices cratering even worse than they did in 2020 when the world was reeling from a global pandemic. If the tariffs stick around, every economic sector will see an impact. "Is this going to be an issue for the energy transition? Absolutely," said Bas Sudmeijer, managing director at Boston Consulting Group. The Economic Policy Uncertainty Index — developed by economists and widely tracked across the business community — is higher than it's been in decades. That's a worrying sign for the majority of energy-transition projects, which involve large investments in infrastructure that need decades-long returns to recoup costs. The severity of impacts will vary by sector and country, say analysts at researcher BloombergNEF. Yet energy-transition companies are already in many ways battle-hardened when it comes to trade wars. Here's what experts are saying could happen next: Southeast and East Asia will be the hardest hit. While Trump's plan levies a 10% import tax—aka tariffs—across the board, his administration is hitting many Asian economies with much higher rates and many of those economies have a higher dependence on clean-energy exports to the US. Compare the European Union (tariff rate of 20%) with Cambodia (tariff rate of 49%): The EU sent $25 billion worth of clean-energy goods to the US last year, compared with Cambodia's $820 million worth, according to BNEF analysis. But those made up less than 1% of EU's exports to the US, compared to 9% for Cambodia. Tariffs might bring to halt the battery boom for the US grid. Lithium iron phosphate (LFP) is the preferred chemistry for grid batteries, and most of it comes from China. BNEF estimates that Trump's additional duties on Chinese imports would translate into a 17.5% increase in storage battery prices by 2026, beyond the cost rise that would have happened as a result of former President Joe Biden's tariff decisions. BCG's calculations show that roughly 85% of all materials in US-made batteries are imported. "You cannot replace that overnight," said Sudmeijer. It's why BNEF estimates virtually all battery separators, 83% of battery cathodes, and 67% of battery anodes would need to be imported in 2025 to meet local demand. That will simply raise the prices of batteries in the US in the short term. Solar and onshore wind might fair better in the US relative to other sectors. The US has a strong supply chain for onshore wind manufacturing and thus BNEF expects that the sector's deployments and costs will likely be spared by the trade war. Additionally, the US has roughly 50 gigawatts of solar panels sitting in warehouses that was imported from Southeast Asia before the tariffs were announced. (See story below.) That should, in the short term, help relieve the sting that other energy-transition sectors are likely to face. If there's any silver lining here, it's that energy-transition industries might be more prepared than others for a trade war. They have seen a rapid rise in trade restrictions across the world over the past decade. BCG, along with the International Energy Agency, has seen tariff and non-tariff trade restrictions affect everything from solar panels to electrolyzers. That might mean they are able to navigate the current situation than other large industries, said Sudmeijer. Beyond the costs, Sudmeijer said the biggest worry for the energy transition still remains the kind of attack that closes down the Suez Canal and brings global supply chains to a screeching halt. "Every manufacturer will tell you it takes 3,000 components to make a transformer, and it takes only one component to not be there and you have a problem," he said. Read and share this story on Bloomberg.com. The US's solar stockpile may soften the blow | By Josh Saul, Shoko Oda, and Jennifer A Dlouhy US solar power developers have been amassing piles of panels for more than a year, in part because of other US levies imposed before President Donald Trump took office in January. The stockpile is now so big that analysts estimate there's roughly 50 gigawatts worth of the equipment in warehouses. That's enough panels to power about 8.6 million homes. The backup inventory will help ease the immediate sting of Trump's new levies. That's especially true since so much of the country's supply comes from Southeast Asia, a part of the world that was hit by some of the highest tariff rates. It's a small silver lining for US solar developers, who have grappled with the headwinds of previous duties, high interest rates, slow permitting timelines and the risk of tax credits being repealed. Of course, there are caveats. US developers are projected to build about 54 gigawatts of total solar capacity this year, according to BloombergNEF. Much of that will be for big solar farms, but most of what's in warehouses are panels designed for rooftops. There are other major stumbling blocks to consider. To find out more, read the full story on Bloomberg.com.  Workers install solar panels on the roof of a home in San Francisco, California. Photographer: Michaela Vatcheva/Bloomberg |

No comments:

Post a Comment