| Bloomberg Morning Briefing Americas |

| |

| Good morning. Donald Trump doubles down on his tariff plan. Wall Street billionaires criticize the president's strategy. And Africa is going big on luxury hotels. Listen to the day's top stories. | |

| Markets Snapshot | | | | Market data as of 07:11 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

| |

| |

| Wall Street isn't convinced either. JPMorgan Chief Executive Officer Jamie Dimon said tariff policy issues need to be resolved quickly. Bill Ackman, an ally of the president, said the levies are a "mistake" and urged Trump to call a 90-day time out. Another hedge fund billionaire joined in on the criticism. Elon Musk called for a "zero-tariff" system between the US and Europe that would effectively create "a free-trade zone." And attention is turning to the Fed. While investors are piling into US bonds, Goldman Sachs, UBS and TD Securities pulled forward their Fed easing expectations, going so far as to say the 10-year Treasury yield could drop to 3% this year. Meanwhile, market bets show an expectation the central bank will cut interest rates another five times this year, from just three last week. Goldman also raised its recession probability. Read here why the 10-year yield matters.  Photographer: Anna Moneymaker/Getty Images Benjamin Netanyahu visits the White House today, seeking to discuss a better tariff deal for Israel as well as other issues including Gaza, Syria and Iran. As a reminder, Israel was one of the hardest hit nations in the Middle East during "liberation day," with a 17% tariff. In Ukraine, Russian forces fired a ballistic missile at Kyiv and launched a barrage of missiles and drones at several other locations. President Volodymyr Zelenskiy said there isn't enough pressure on the Kremlin, and that the daily Russian strikes on the nation prove it. | |

| Related Stories |  | |  | | | |

Deep Dive: Conundrum for Manufacturers | |

The main landing gear of a Boeing 777-200 aircraft at a Haeco hangar in Hong Kong on March 21. Photographer: Paul Yeung/Bloomberg Supply chain issues, high costs, workforce needs and the laborious process of moving production—combined, these pose significant hurdles to Trump's vision of a golden age of manufacturing. - "The idea that you can move every part of the manufacturing process back to the US does not align with reality," said Kip Eideberg, senior vice president for the Association of Equipment Manufacturers. His group represents makers of equipment used in construction, agriculture, mining, utilities and forest products.

- One emerging challenge to bringing manufacturing back is Trump's own tariffs, companies say.

- Businesses have filed hundreds of requests in recent months to the US Trade Representative for exemptions on China tariffs for machinery needed to set up US production lines and that they say cannot be sourced domestically.

| |

| More on the Supply Chain |  | | | |

| Trade wars, tariff threats and logistics shocks are upending businesses and spreading volatility. Understand the new order of global commerce with the Supply Lines newsletter. | |

| |

Photographer: Michael Nagle/Bloomberg The American investor class—that top 10% that owns almost all of the stocks—is quickly coming to terms with its new, much-diminished status in the era of Donald Trump's trade offensive. | |

| Big Take Podcast |  | | | |

| |

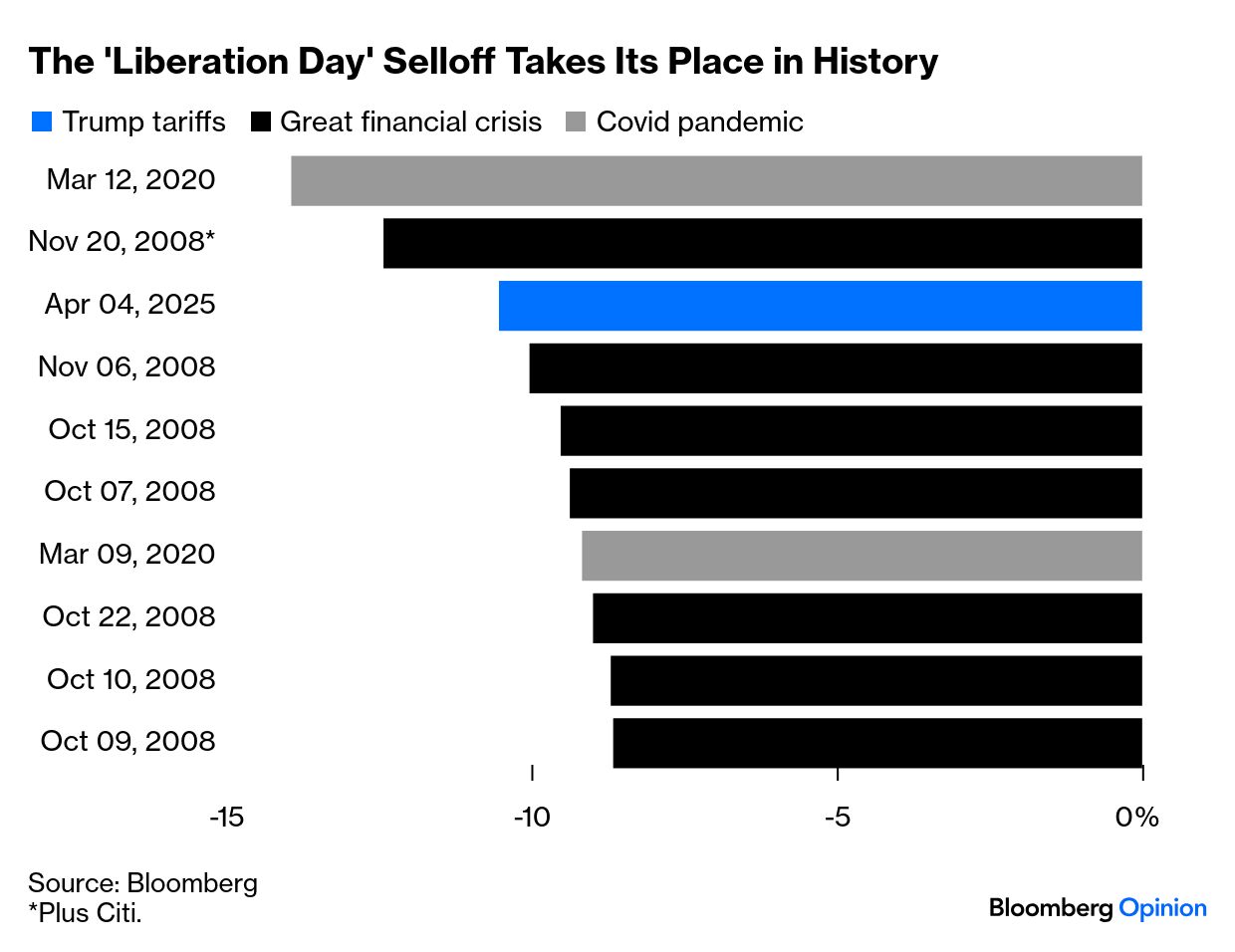

| Stock investors are convinced that Trump's tariffs will damage the US more than the rest of the world, John Authers writes. And while it's worth noting that retirement funds haven't been wiped out and that many ETFs have held onto their post-pandemic gains, there's no sign that the misery is over yet. Subscribe to Stock Movers, your 5-minute podcast on the winners and losers of each trading day. | |

| More Opinions |  | |  | | | |

| |

Few & Far Luvhondo in South Africa's Limpopo province. Source: Few & Far Luvhondo Africa is a boom market for high-end hotels and resorts, with top chains such as Marriot and Hilton backing new developments on the continent. Read here about Cape Town's plan to fix its $64 billion residential property market, and here on some of the plans for the continent's luxury sector. | |

| A Few More |  | |  | | | |

| Bloomberg Tech: Join top tech decisionmakers and influencers on June 4-5 in San Francisco. Decode technology's evolving role across business, culture and healthcare as we discuss the advances transforming industries and how they impact society. Learn more. | |

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold's weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment