| |

| |

| Markets Snapshot | | | | Market data as of 05:47 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

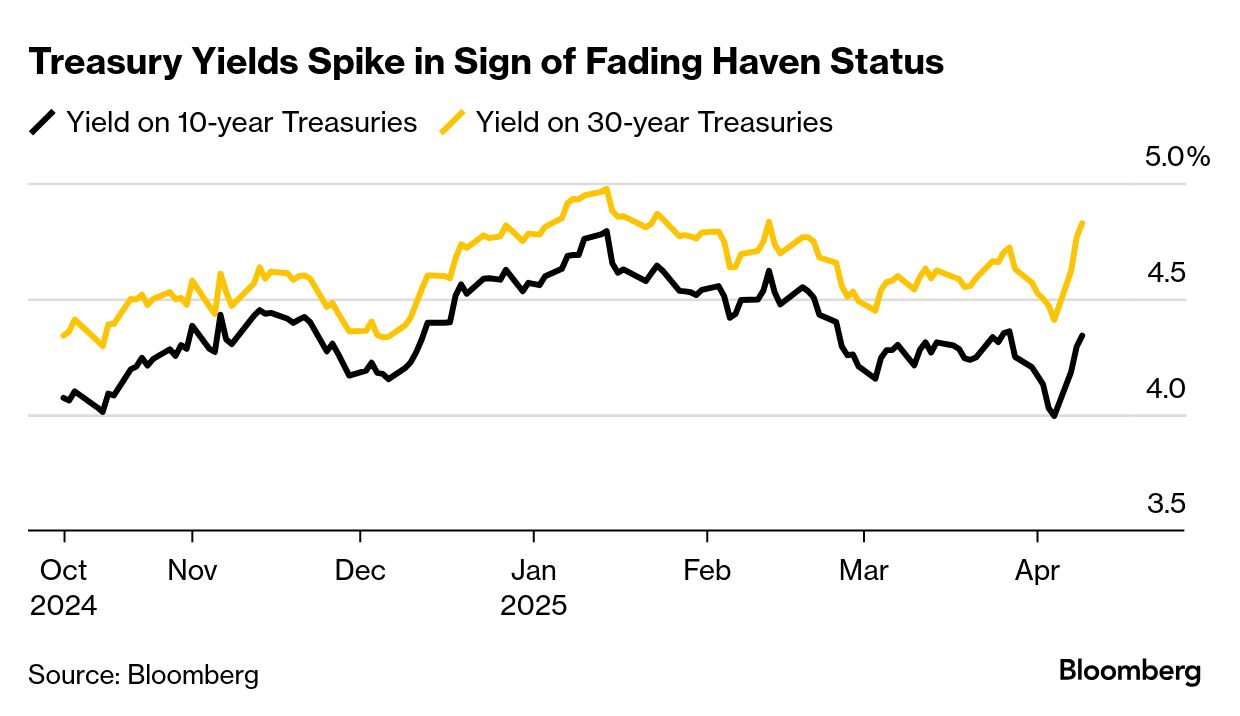

- Treasuries tumbled as the trade war sowed doubts over the haven status of US government debt. Traders also cited dislocations in a popular hedge fund trade and speculation of foreign selling of US bonds.

- Donald Trump's so-called reciprocal tariffs are now in place, dealing a thunderous blow to the world economy as he pushes to reorder global trade. China hasn't immediately responded, a departure from the last two episodes when Beijing hit back within minutes.

- European and Japanese stocks slumped anew on the worsening trade war, while US futures point to a stable market at the open. The S&P 500 has dropped to a level where long-term investors are starting to buy, says Goldman Sachs's John Flood.

- The Bank of England said hedge funds have faced "significant" margin calls from brokers as they navigated volatility following the tariff announcements. The central bank's Financial Policy Committee warned the risk environment has deteriorated and the chance of "further sharp corrections" remains high.

- Argentina reached an agreement with International Monetary Fund staff, a major step before the lender officially votes on a new $20 billion deal for the crisis-prone nation. The deal would give Argentina much needed cash to shore up the peso and begin removing currency and capital controls.

| |

All about that basis trade | |

| An unnerving development is starting to unfold as Donald Trump's trade war hammers financial markets: US Treasuries, far from offering shelter from the turmoil, are suddenly losing their haven appeal. The plunge in bond prices brings back memories of the onset of the pandemic, says James Athey of Marlborough Investment Management, when widespread deleveraging sparked blowups of a popular hedge fund strategy known as the basis trade. While there's little concrete evidence of dealers cutting off financing or hedge funds getting caught wrong-footed thus far, Athey said he can't shake the feeling that recent moves are just a taste of the hidden risk lurking beneath the market's surface. "It looked like in March 2020 when we got these wild moves, possibly relating to the basis trade," he said. "Last week we had not seen any signs of hedge funds getting stopped out of the bond futures basis, but suddenly you're seeing yields spike." The basis trade is a strategy hedge funds use to wager on the minuscule gaps between prices of cash Treasuries and futures. They typically borrow to multiply their bets, up to 50 or 100 times the capital invested. Recent estimates put the amount of existing wagers at about $1 trillion, roughly double what is was five years ago. Problems can arise when market turmoil upends the economics of the trade and forces investors to rapidly unwind their positions to repay their loans. It can create a cascading effect that causes yields to surge, or even worse, the Treasury market to seize up, much like what occurred in 2020. There are plenty of other reasons bonds might be selling off: The trade war will trigger stagflation that may prevent interest-rate cuts from the Federal Reserve. Foreign investors may be ditching US debt. Maybe fund managers are flocking to cash-like shorter-dated securities as risk assets swoon. And finally, portfolio managers may be selling to make room for a flood of new Treasury securities this week. —Liz Capo McCormick and Michael Mackenzie | |

| |

- Apple shares rise 1.8% in premarket trading. Jefferies raised its recommendation to hold from underperform following the stock's drop since last week's tariffs announcement. Apple's market value yesterday fell below that of Microsoft, with the software giant becoming the largest listed company in the world.

- Drug stocks are dropping after Trump said the US was planning to announce "a major tariff on pharmaceuticals" soon. In London, Glaxo and AstraZeneca are each down about 5.5%, while Roche and Novartis are down 6.4% and 7.1%, respectively, in Zurich.

- Peabody Energy climbs 16% after Trump signed executive orders to expand coal mining and use in the US.

- Starbucks rises 1.3%. Jefferies upgrades to hold from underperform after the coffee chain's stock quickly retreated about 29% from its February high.

- Keurig Dr Pepper rises 1.3%. Piper Sandler upgrades to overweight from neutral, citing strong retail sales growth momentum.

- Metals stocks are slumping, hit by the intensifying trade war and concern that a recession is in the offing. In London, Rio Tinto falls 1.9%, Anglo American drops 4.4% and Glencore slips 0.8%, while in Amsterdam ArcelorMittal slides 2.4%.

- Delta Air Lines reports earnings before the opening bell. Investors will be clamoring for an updated outlook after an early 2025 dip in US leisure and business travel began to spread to corporate customers and some international areas in recent weeks.

- Constellation Brands, which imports Modelo and Corona beer, reports after the close. Focus will be on how the company plans to deal with the 25% tariffs on imported beer and aluminum cans. —Subrat Patnaik

| |

| |

| |

| After the biggest four-day stock market rout in five years, traders are watching key technical indicators for signs of a bottom. Stocks are the most oversold since the depths of the pandemic, conditions that briefly lifted the S&P 500 Index by as much as 4% yesterday. But the US equity benchmark erased its gains to end the session 1.6% lower at about 4,983 — teetering on the brink of a bear market. Here are some key levels: - The S&P 500 found support late yesterday around 4,910, which is about 20% below the February peak. The gauge quickly reversed and trimmed about half of its drop in the final seven minutes of trading after touching that level.

- Monday's intraday low of 4,835. That's a crucial psychological threshold that, if broken, will lead to further selling, says Mark Newton of Fundstrat Global Advisors.

- A next level of resistance around 5,119. That was the S&P 500's low on Aug. 5, when the unwinding of the yen carry trade rattled markets.

- A range between 5,300 and 5,500, which would be a roughly 50% retracement of this year's entire correction.

"It's hard to trust any rally," Newton said. "Stocks are getting close to bottoming after being massively oversold, but we still haven't seen the final low, and there's still room to fall even further. No one knows what's happening with tariffs." —Jessica Menton | |

Word from Wall Street | | "The stock and bond vigilantes are signaling that the Trump administration may be playing with liquid nitro. Something may be about to blow up in the capital markets as a result of the stress created by the administration's trade war. If so, then the S&P 500 will fall into a bear market for sure." | | Ed Yardeni Founder, Yardeni Research | | Click here for more takes on the outlook for the US stock market | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| | Unlock full access to all markets stories, create unlimited watchlists and track the stocks you care about by becoming a Bloomberg.com subscriber. For a limited time as a Markets Daily reader, you can get half off a full year's subscription – don't miss out. | | | | | | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment