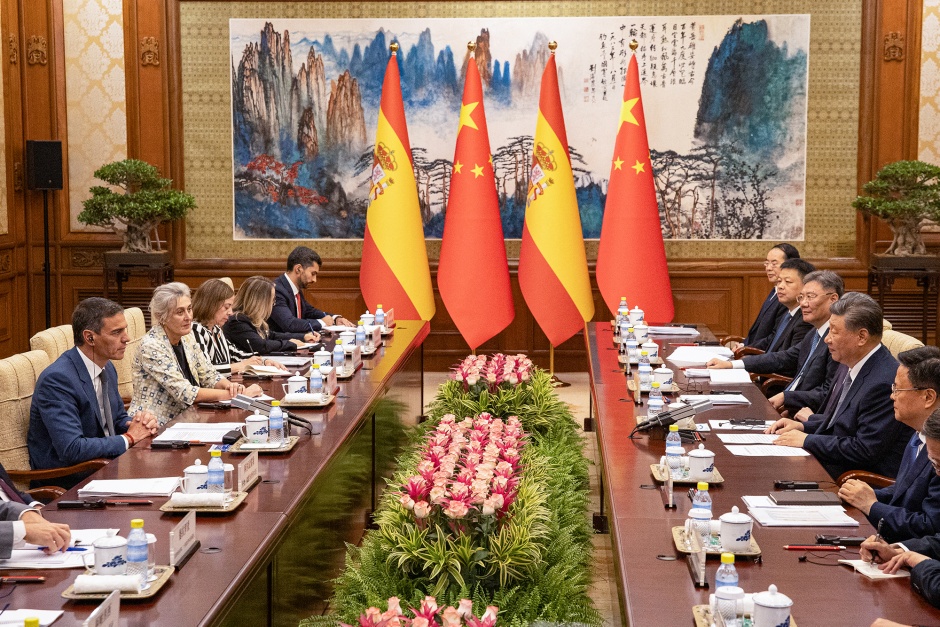

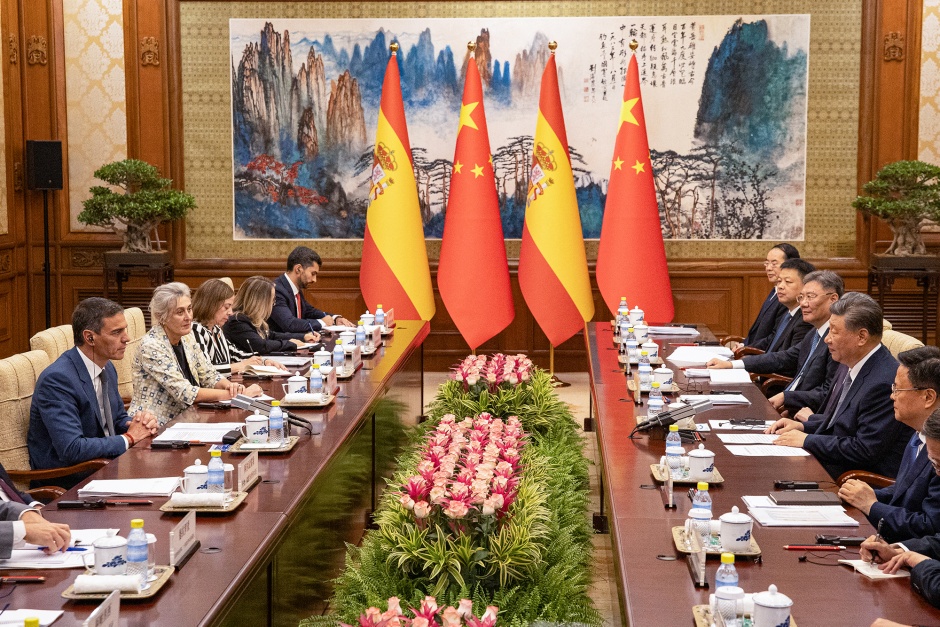

| Welcome to Balance of Power, bringing you the latest in global politics. If you haven't yet, sign up here. Looking back, the high point of Europe's recent relations with China was probably the signing of a comprehensive agreement on trade and investment in 2020. Within months, the main thing being traded were tit-for-tat sanctions. European capitals, angered by Beijing's aggressive diplomacy during the pandemic, rapidly soured on its human-rights record in Xinjiang, and the deal was put on ice. US strains placed on the transatlantic bond are causing a rethink of those ties. At least, that's what Spanish Prime Minister Pedro Sánchez is advocating. Sánchez is due to meet with President Xi Jinping on Friday during his third China trip in two years. He'll be the first European Union leader in Beijing since President Donald Trump launched his barrage of tariffs on leading trading partners, notably China and the EU.  Sanchez, left, and Xi in Beijing, on Sept. 9. Photographer: Andres Martinez Casares/AFP/Getty Images Sánchez says that what Trump is doing to global trade must push Europe to find alternative partners and new markets. That means changing its position toward China, but also Beijing revisiting its stance toward Europe. It's not an undisputed message. Spain has tangible benefits from Chinese investments, in electric vehicles, batteries and solar power. Elsewhere, much of Europe is warier of Beijing, joining US-led tech curbs and sharing concerns over threats against Taiwan. Worried at a flood of imports, the EU imposed tariffs on Chinese EVs last year. Most pointedly, China's alignment with Russia despite its invasion of Ukraine is beyond the pale for many capitals. Madrid, a defense spending laggard, is about as far from the war as you can get on the European mainland. Sánchez may have broken ranks with the EU as a whole, but Xi is bound to roll out the red carpet regardless. As Trump continues to upend the world, Spain's leader surely won't be the last to make the trip to Beijing. — Alan Crawford  The venue of a news conference by EU officials in Beijing in December 2023. Photographer: Andrea Verdelli/Bloomberg |

No comments:

Post a Comment