| Market data as of 06:13 am EST. Market data may be delayed depending on provider agreements. US stock futures tumbled and the dollar weakene |

| |

| | Markets Daily is now exclusively for Bloomberg.com subscribers. Your access will expire on May 10. If you'd like to continue receiving this newsletter, and gain unlimited digital access to all of Bloomberg.com, we invite you to subscribe now at the special rate of $149 for your first year (usually $299). | | | | | | |

| Markets Snapshot | | | | Market data as of 06:13 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- US stock futures tumbled and the dollar weakened as traders shifted their focus to concern that the trade war will bring lasting economic damage. Equities in Europe and Asia soared following a massive rally in the US, when Donald Trump shocked traders by pausing most of his tariffs. Treasuries gained after a tumultuous session.

- Trump's dramatic U-turn has isolated China as the primary target of his trade offensive, significantly narrowing Beijing's options for immediate de-escalation. Chinese leaders plan to meet today to discuss additional economic stimulus.

- The Fed is prepared to hold interest rates steady to minimize the risk of a tariff-induced rise in inflation, even if the job market softens. Officials are signaling publicly they're ruling out cuts that would act as an insurance policy against a slowing economy.

- US inflation likely cooled in March, thanks in part to a drop in energy costs, offering some relief to consumers before tariffs hit the economy. The consumer price index is seen rising 0.1%, economists say. The report is due at 8:30 a.m. in Washington.

- Taiwan Semiconductor's quarterly revenue rose a larger-than-anticipated 42%, reflecting strengthening demand for AI servers and smartphones before US tariffs kicked in. That marked the fastest pace of growth since 2022 for the company, which is the main chipmaker for Apple and Nvidia.

Now that the US has issued a reprieve for many of its broad tariffs, what are you doing with your investments? Tell us in the latest MLIV Pulse survey. | |

| |

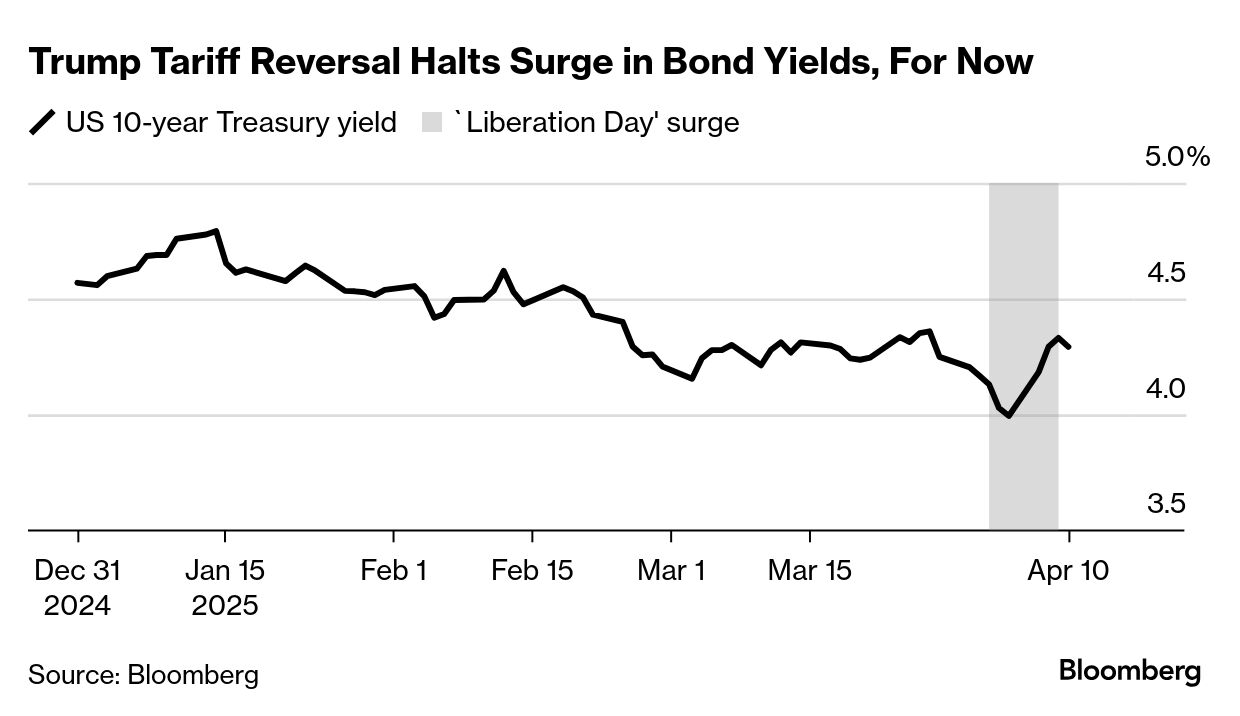

| For all of the attention paid to the slump in stocks since Donald Trump announced his tariffs, in the end it was the bond market that prompted him to reverse course. Yields soared as trade levies took effect just after midnight yesterday, with the 10-year Treasury seeing its biggest three-day jump since 2001. Within 14 hours, Trump would go on to execute one of the biggest economic policy reversals in modern presidential history, implementing a three-month pause on expanded tariffs on dozens of countries and rallying stocks that had been in free-fall since his announcement a week earlier. Today, bonds are gaining again, sending yields lower. "The 'blink' came sooner than we expected, probably forced by the markets," said Mohit Kumar, strategist at Jefferies International. Traders are now bracing for prolonged negotiations that could weigh on markets for months. They will face the increasingly complicated task of trying to figure out how shifts in global trade will impact the twin levers of growth and inflation — both important drivers of rate expectations. For Trump, the about-face came as he confronted a worst-case scenario: Voters who had returned him to the White House because of inflation now faced both increased prices and higher borrowing costs. During a meeting with race-car drivers on the South Lawn of the White House yesterday afternoon, Trump conceded that the decision was driven in no small part by the chaos roiling markets. Investors, he said, "were getting a little bit yippy, a little bit afraid." "The bond vigilantes have struck again,'' said Ed Yardeni, founder of Yardeni Research. "As far as we can tell, at least with respect to US financial markets, they are the only 1.000 hitters in history.'' —Ruth Carson, Alice Gledhill and Justin Sink | |

| |

- United States Steel is tumbling 12% in premarket trading after Trump said he doesn't want to see the steelmaker owned by a Japanese company.

- Volkswagen surges 6.8% in Frankfurt after the tariff pause, yet the German carmaker underperformed peers slightly, reporting a drop in first-quarter profit.

- Constellation Brands looks set to fall after the importer of Corona and Modelo beer forecast a downbeat guidance for the year because of US tariffs and muted demand.

- Trump Media & Technology Group rises 4%, after rallying 22% on Wednesday. Last week, a trust overseeing Donald Trump's $2.1 billion stake in the company that owns Truth Social said it's keeping the door open to cashing in on its position.

- Capri Holdings falls 3.4%. The company is close to an agreement to sell the struggling Versace brand to Prada, people familiar with the matter say, though the sides have discussed a reduction in the original price of almost €1.5 billion.

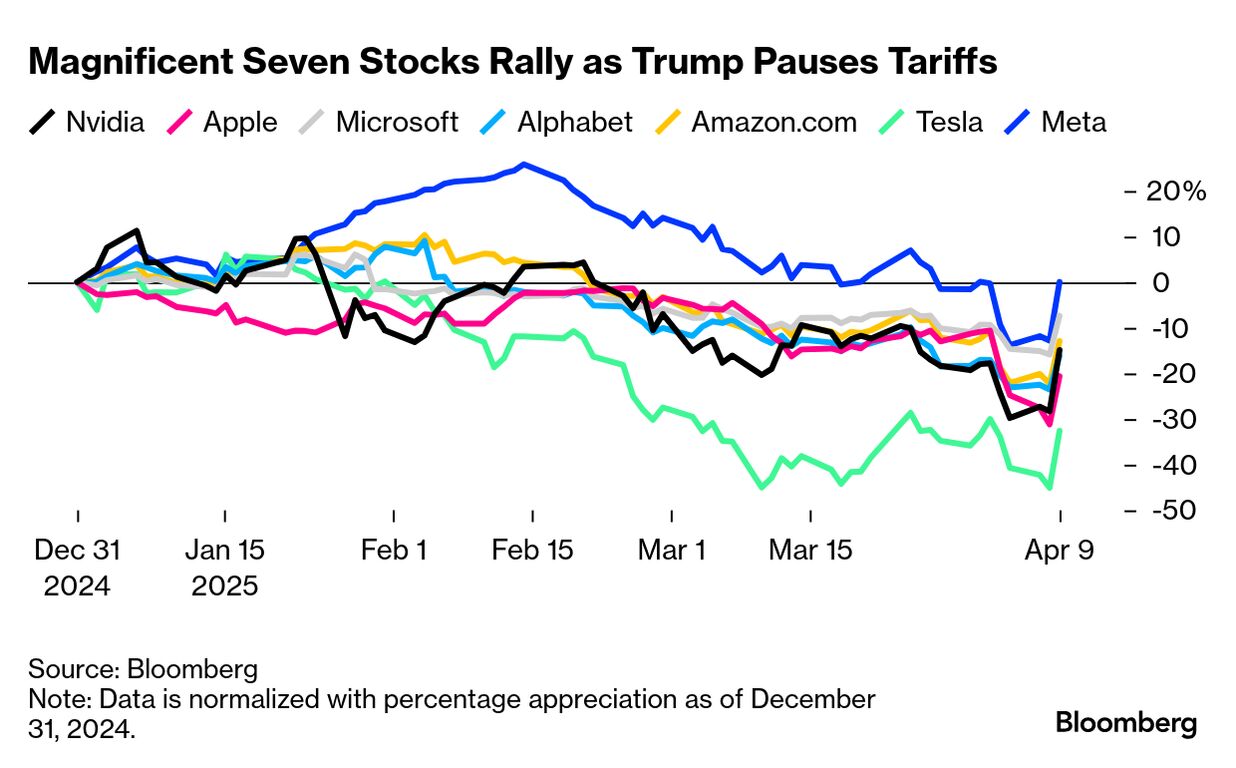

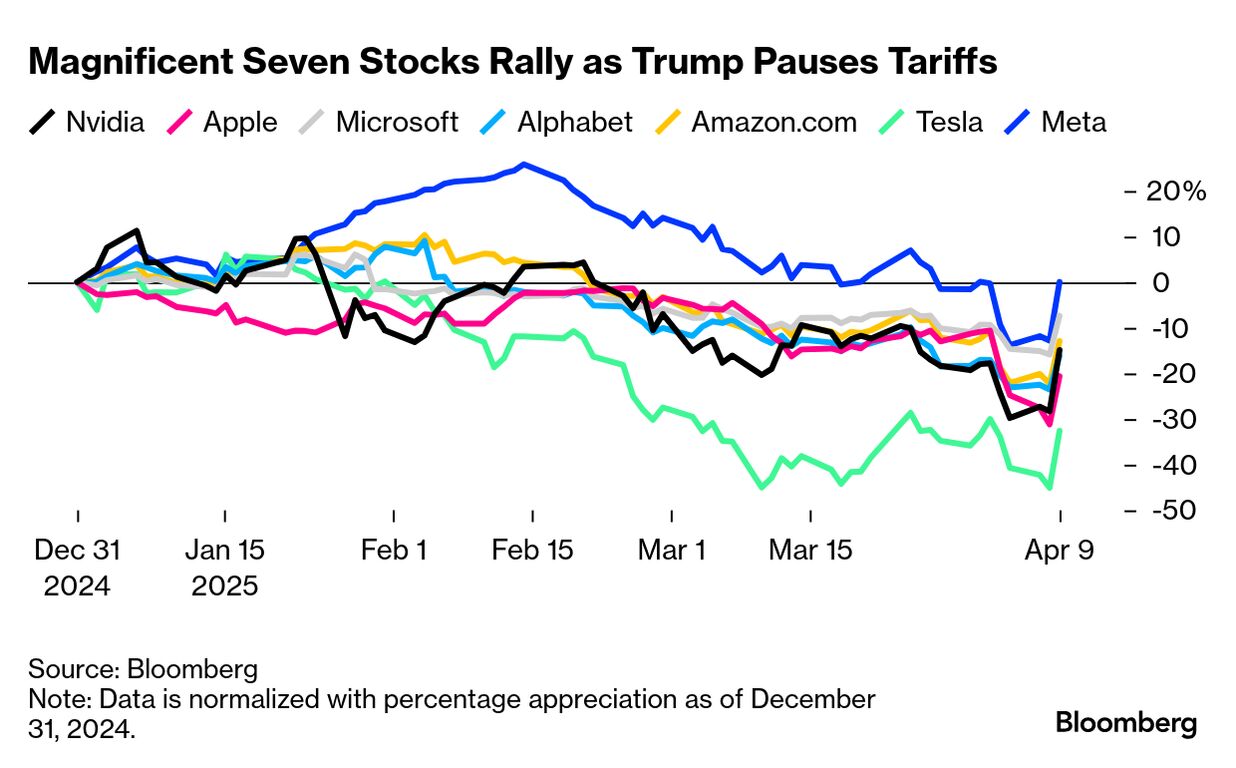

- It's looking like another risk-off day in the US and the Magnificent Seven stocks are headed lower. Tesla (-3.4%) and Nvidia (-3.2%) are leading premarket losses after a blinding rally on Wednesday. Meta slips 2.7%, Apple falls 2.9%, while Amazon loses 2.2%, Alphabet drops 1.9% and Microsoft slips 1.5%.

- Tesco shares drop 5.3% in London after the UK's largest supermarket chain warned profit would slip due to higher costs and competition for price-conscious shoppers. —Subrat Patnaik

| |

| |

| |

| A few other notable items in the wake of a crazy day for markets: -

Retail investors had an especially sweet victory. They had kept buying shares in recent days even as indexes tumbled and institutional investors fled. In yesterday's reversal, they notched a 17% gain, helping them almost break even for the year, according to data from JPMorgan Chase's Emma Wu. -

Traders can't say they weren't warned. Seven minutes after the market opened yesterday, with the S&P 500 down about 0.4%, Trump posted on Truth Social: "This is a great time to buy." He then did an about-face on tariffs, and the index ended with a 9.5% gain. "Does that break the rules? I don't know, not that Trump follows any set of rules," said David Wagner of Aptus Capital Advisors. - Legendary investor Bill Gross points to one reason why the whole tariff episode has alarmed fund managers: "Would you want to own highly volatile US stocks whose price depends on whether POTUS had a good night's sleep and woke up the next morning to reverse yesterday's policies?'' —Phil Serafino

| |

| |

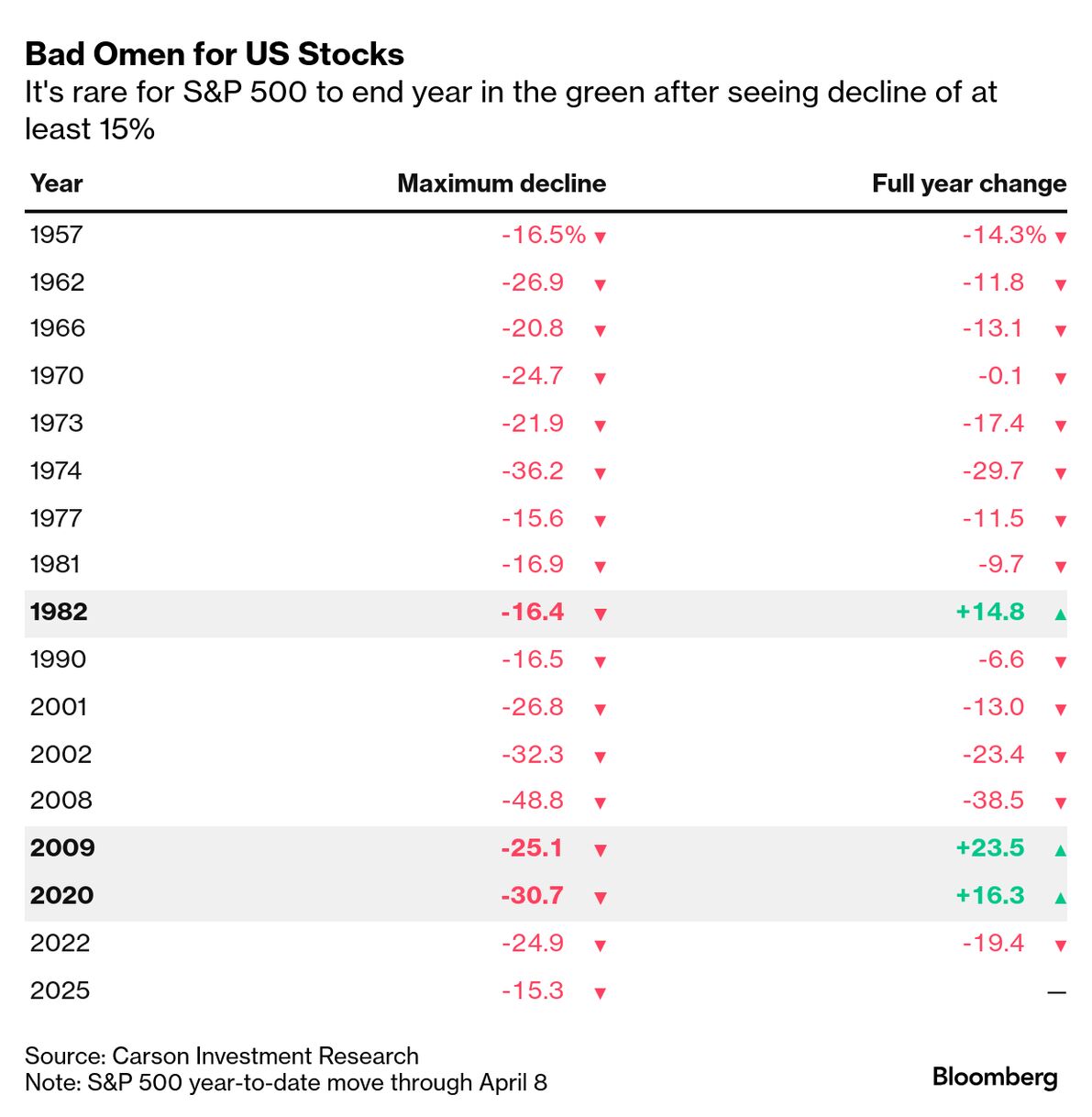

| Even after yesterday's furious rebound in US stocks, the chances that the S&P 500 Index will end the year with a gain remain slim, if history is any guide. In the 16 times the US stock benchmark has dropped 15% or more at any point in a year, like it had before the rally, the S&P 500 has only recovered to end the 12-month period positive on three occasions, according to data compiled by Ryan Detrick at Carson Group. Those instances — 2020, 2009, 1982 — occurred in times when the Federal Reserve moved to support the economy, and the central bank has given no signal that it's about to take such a step any time soon as White House trade policies threaten to reignite inflation. "The Fed probably isn't going to come to the rescue this time, since they're still very worried about inflation," Detrick said. "That puts them in a hard spot right now." —Alexandra Semenova | |

One number to start your day | | $304 billion | | The increase yesterday in the combined net worth of the world's wealthiest people, the largest one-day gain in the history of the Bloomberg Billionaires Index. | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- Supply Lines for daily insights into supply chains and global trade

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment