| This is Bloomberg Opinion Today, the crucial fashion and leather-goods division of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. Today we will be talking about corporate earnings, but first we must talk about my scarf. I love my scarf. It's the most luxurious and perhaps valuable piece of clothing I own, which may be more of a statement on the quality of my suits than anything else, but it's still a lovely scarf. [1] It comes from a fairly high-end American fashion house, now part of the Zegna empire, and features the designer's iconic vertical red, white and dark blue stripe. Problem is, this iconic stripe is very close to the iconic stripe of another American designer whose scarves are more likely to be found in the bargain bin at Saks Off Fifth than the window at Bergdorf's. So, since I am absolutely certain that everybody in the office is as obsessed with my neckwear as I am, and I impressing them or not? You decide. Below are random images of my scarf, that other designer's scarf and — as a control group — a very similar design that falls between the two on what the consultants tell us is "price point" but I, dinosaur that I am, call "price." [2] Which is which? From left to right, we have Tommy Hilfiger, Moncler (control group) and the glorious piece of wool that can't quite keep me warm on an 11-degree day in Manhattan, by Thom Browne. At a quick glance, most people would never be able to tell the difference. (I'm willing to believe all three scarves above came from the same Bangladeshi sweat shop and don't much differ in quality.) Andrea Felsted, of course, could. Because Andrea knows everything about fashion, or at least a nearly infinite amount more about fashion than I do. Also, she knows watches. Which brings me to the Rolex my son offered to buy me last weekend. Or, should I say, a Faux-lex. Walking down Canal Street, it was no shock to see plenty of fake Rolexes, Cartiers and Patek Philippes and the like. But I was surprised by how real they looked — and how much they cost: many hundreds of dollars. According to Watchfinder & Co., the fake watch industry pulls in as much as $1 billion in profit a year. That's impressive, but to me not as impressive as the fact that the used luxury watch business rakes in 25 times that — and maybe even more revenue than the new luxury watch business. Mostly, I fear, as investments in ostentation rather than objects of ardor. [3] If used watches are the investment pool you want to swim in, you better jump now. "Time's up for the slump in second-hand watch values," Andrea writes. "After five years of ups and downs, prices for used timepieces are now steadily on the upswing. Progress from here depends on whether two trends can continue: new watch prices rising and equity markets melting up. While there's a good chance of the former, the latter looks less certain." Indeed, the former looks like a very good bet, according to the Bloomberg Subdial Watch Index. Yes, there really is such a thing!! [4] As for the rest of Andrea's fashion beat, the heels are higher than the expectations. "Even the well-off decide to stick with their older Louis Vuitton and Dior handbags sometimes, rather than splashing out on new ones," she writes in a separate piece. "French luxury giant LVMH Moet Hennessy Louis Vuitton SE on Tuesday reported a 1% revenue increase in the three months to Dec. 31, excluding currency movements. That was slightly better than expected, but the standout was sparkling jewelry. Sales at the crucial fashion and leather-goods division fell 3%, much as feared." Yes, living vicariously through luxury goods is fun and all, but what about the stocks that are going to allow us to retire in style and buy Rolexes, fake or otherwise? The one everybody was waiting for — Apple — announced a monstrous $85.27 billion in revenue over the final quarter of 2025, largely on "unprecedented" demand for the newest iPhone. This is … troubling? "That Apple's shares were mostly flat in after-hours trading following the announcement on Thursday indicates that investors believe this might be as good as it gets for a while," Dave Lee writes. "It's hard to see how Apple comes out unscathed from 12 more months of President Donald Trump's tariff machinations, China's unpredictability, the tricky introduction of its long-delayed AI features and a risky revamp of the iPhone offerings to include a foldable model." That foldable phone may be Apple's answer to slip-ons and fanny packs, and as a newly minted member of the AARP, I cannot wait much longer. I'm also more than a bit scared that Trump's tariff tempest will batter a tech sector that is central to my early retirement plan (also to my normal-age retirement plan and my you-have-to-stick-it-out-'til-you're-70 retirement plan). "Since their peak last October, Microsoft shares have fallen by about 11% and, until Wednesday's close, had been flat since the start of 2026," Dave writes in a separate column about how Satya Nadella's AI push has lost its sparkle. Elon Musk, who sent a lot of federal workers into early retirement, mostly against their will, overshadowed Tesla's dismal fourth-quarter results with an announcement that the carmaker's investment budget will more than double. "Tesla is finally unleashing its financial firepower to own the future of autonomous vehicles, robots and artificial intelligence," writes Liam Denning. "Investors now own something more like a blank-check company. One that promises amazing abundance on any number of fronts even as its main existing business succumbs to the banalities of competitive pressure. One that feels free to intertwine its strategy and assets with the CEO's own ventures." Intel, I hope, has never been part of anybody's retirement plan. Its dismal earnings call on Jan. 22 led to shares taking a one-day drop of 17%. The problem, according to Scott Lincicome, stems from what was supposed to be Intel's salvation: The Trump administration scooping up a 10% share of the chipmaker. "The selloff shows how the Trump administration's 'state capitalism' experiment might be fueling significant and growing capital misallocation in the US today," Scott writes. "The initial gains were driven by politics and not capitalism. In other words, the government's investment had diverted tens of billions of dollars of private capital away from potentially more deserving firms and to Intel, with little support for the move beyond – as one semiconductor analyst put it – 'vibes and tweets.' " Trump's "state capitalism" has many faces: corporate investment, selling off export licenses, forced restructurings, and of course the massive Liberation Day tariffs. A few months ago, Trump relaxed those import rates on Swiss goods dramatically, not long after receiving another face. And I guarantee you it's not a Faux-lex.  Left, a Rolex clock auctioned in 2018, right, a newer model aboard the Resoute. Source: Watches of Espionage Bonus Fake Friends Reading: - Boeing Should Ignore the Siren Call of Maximizing Cash: Thomas Black

- The Starbucks Comeback Story Is Finally More Than Just Froth: Andrea Felsted

- Powell's Survival Tip — Be Boring: John Authers

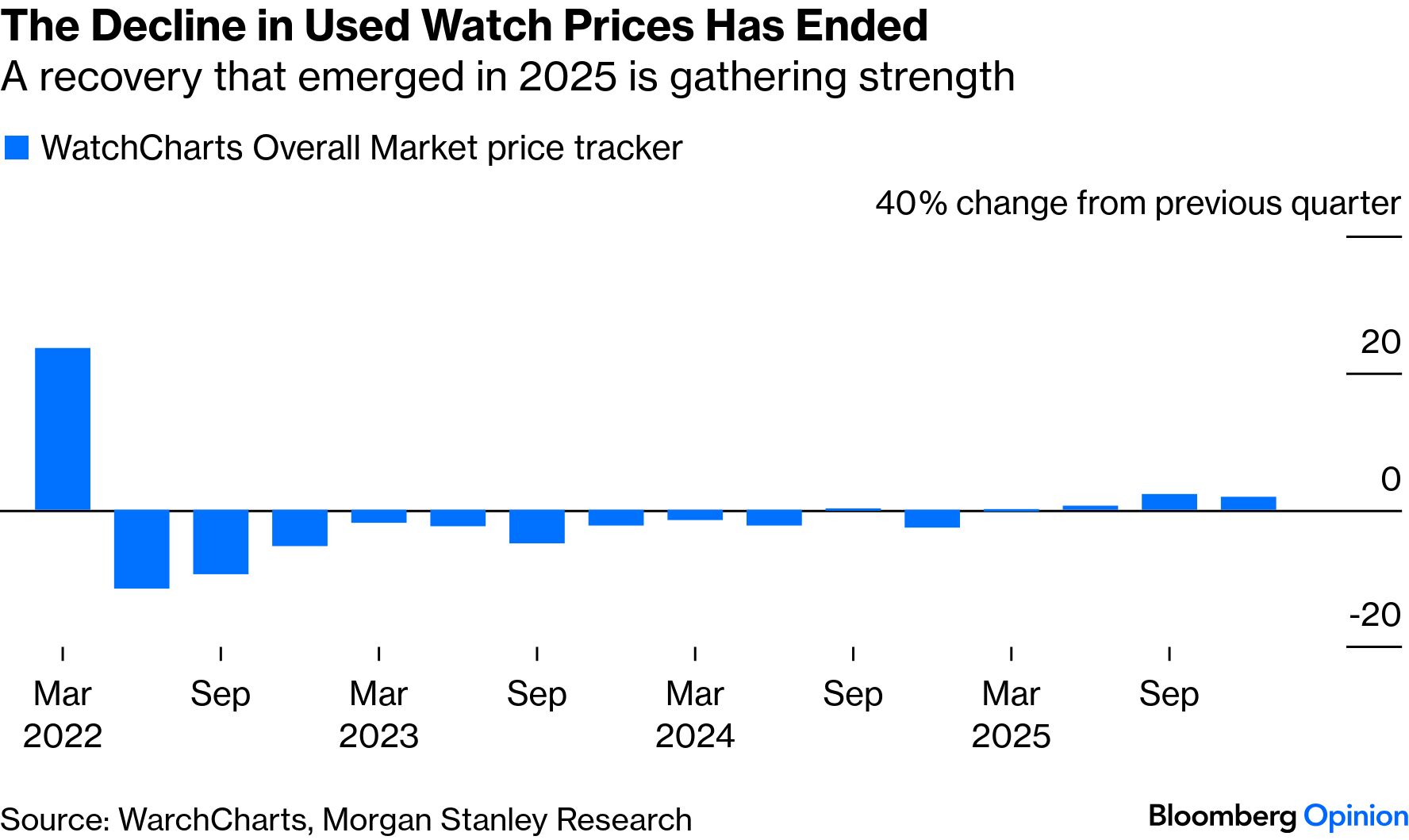

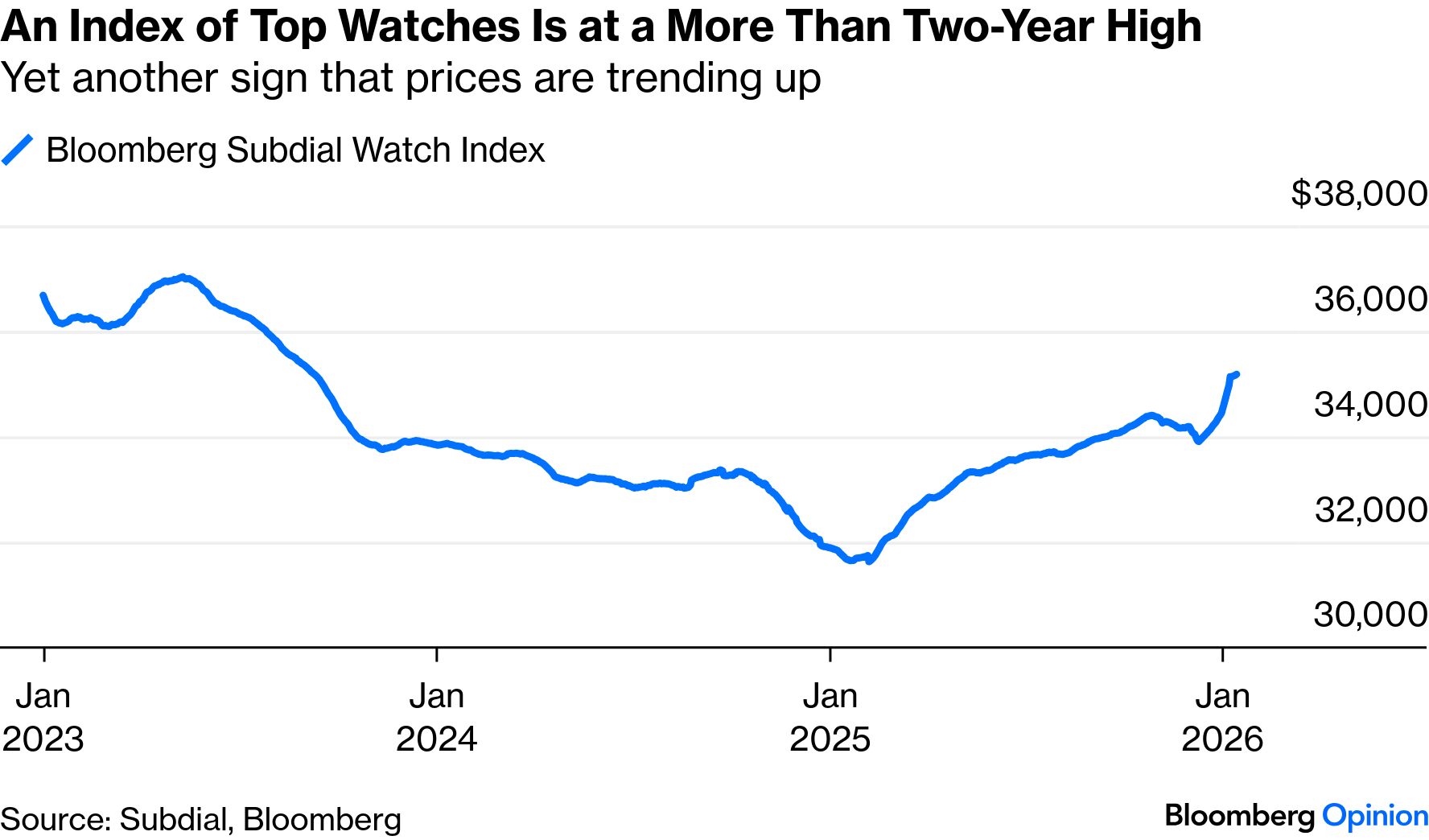

What's the World Got in Store ? - ECB, BOE rate decisions, Feb. 5: Christine Lagarde's World Has Been Upended by Hard Politics — Lionel Laurent & Marcus Ashworth

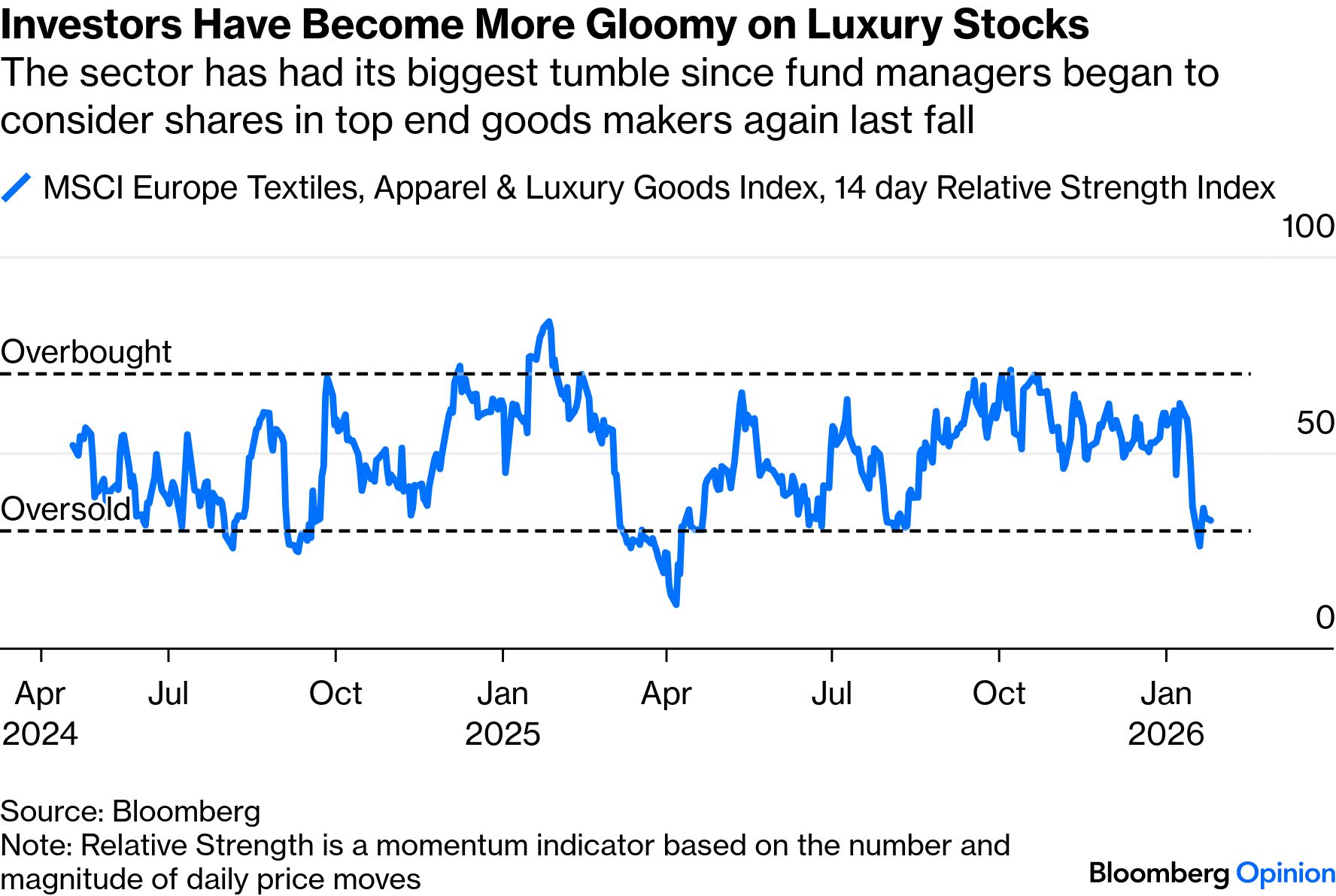

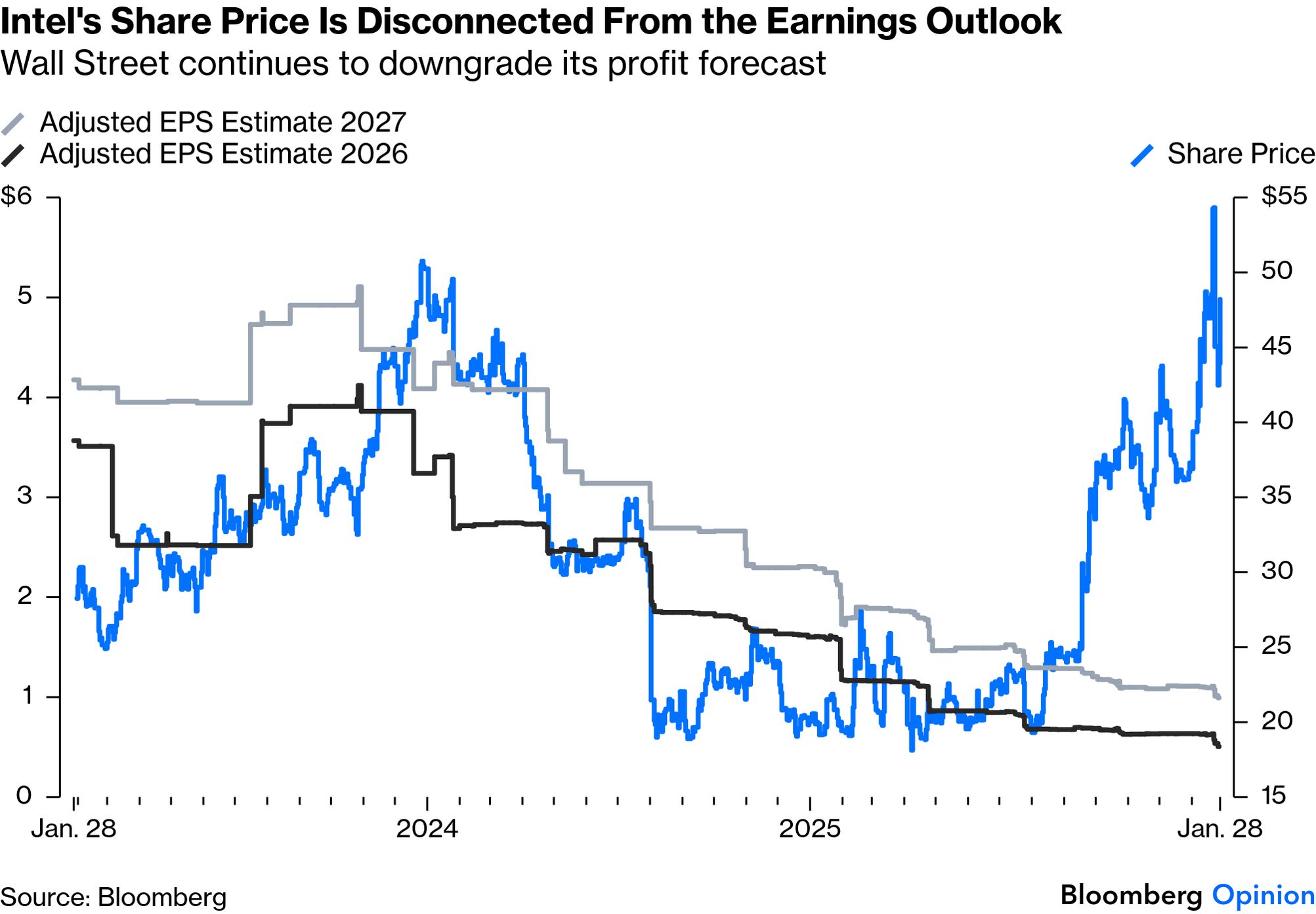

- Amazon, Sony earnings, Feb 5: See Below!!!

- US Jobs, Feb. 6: Why Powell Couldn't Have Rigged 2024 If He'd Tried — John Authers

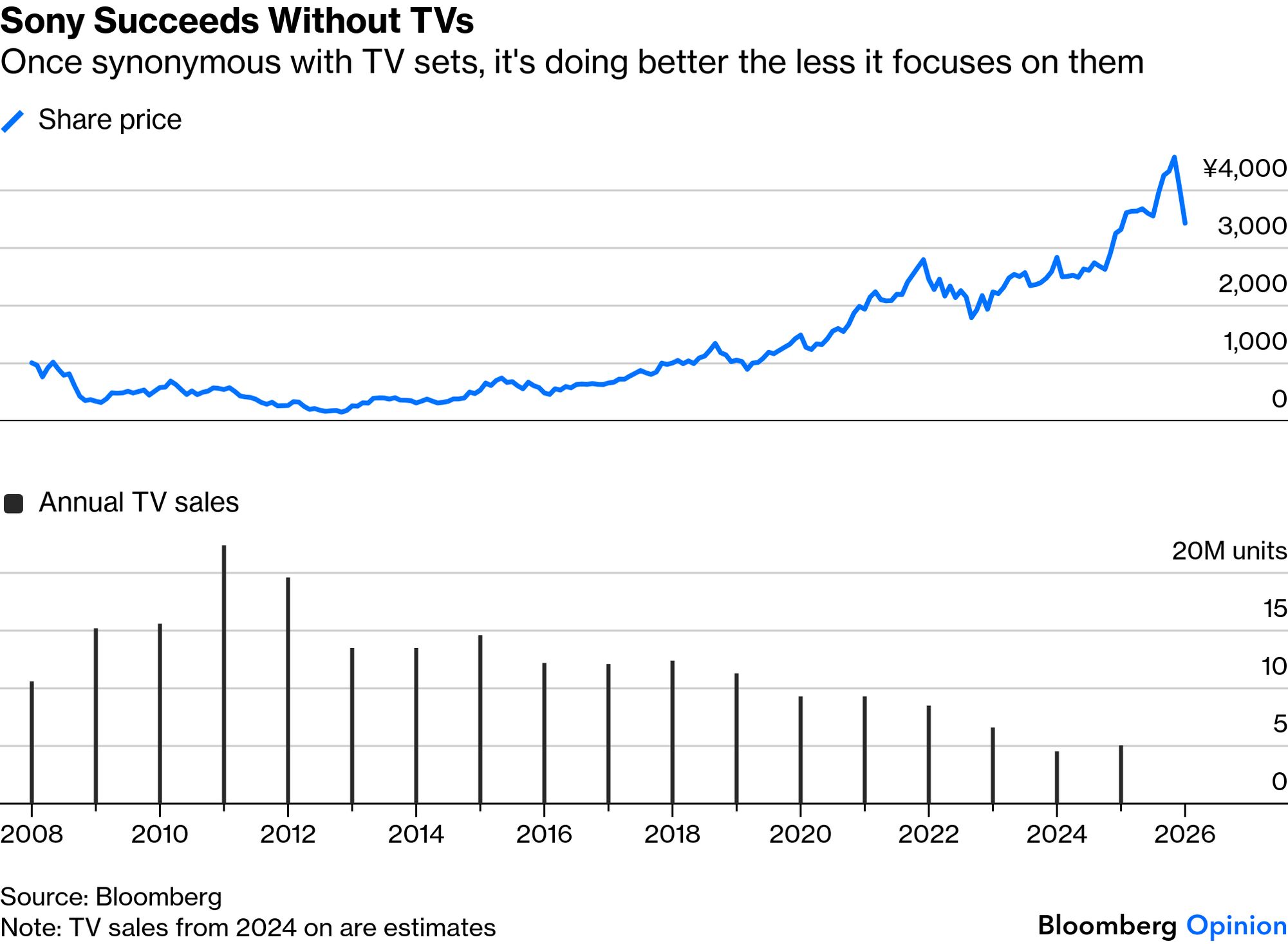

Remember when Sony just sold TVs and Amazon just sold books? If so, I hope your 401(k) is in better shape than mine and your AARP membership is up to date. "TV buffs were stunned by the announcement last week that Sony Group Corp. was handing control of its TV operations to TCL Electronics Holdings Ltd., the Chinese firm that is the world's second-largest maker of sets," writes Gearoid Reidy. "Along with cars, home electronics were once synonymous with Japan's rise as a global power in the 1970s and 1980s. Few devices carried more prestige than the television, and no maker had more cachet than Sony." "TVs may once have been symbolic of Japan's ascent," adds Gearoid. "But so were textiles and toymaking. The future of Japanese industry is simply being broadcast elsewhere." Remember when Amazon sold food? The shocking thing isn't that the company plans to shut down its 57 Amazon Fresh and 15 Amazon Go stores, it's that they still existed. Yet the owner of Whole Foods isn't abandoning its quest for grocery dominance, Beth Kowitt tells us: "Food is still critical to Amazon's success, and not just because of the size of the market." "The company has announced plans to open a supercenter, which raises the question of whether Amazon has really learned its brick-and-mortar lesson," writes Beth. "A big-box store is a much more complicated endeavor than what it tried to accomplish with Go and Fresh. The company said it also plans to open more than a 100 new Whole Foods stores over the next few years. The best thing Amazon can do to ensure their success is let Whole Foods be Whole Foods. It might actually learn something this time." If the food thing doesn't work out, Amazon can always muscle its way onto Canal Street.  I'll take the Oyster. Photographer: Spencer Platt/Getty Images Note: Please send a Santos de Cartier skeleton and feedback to Tobin Harshaw at tharshaw@bloomberg.net |

No comments:

Post a Comment