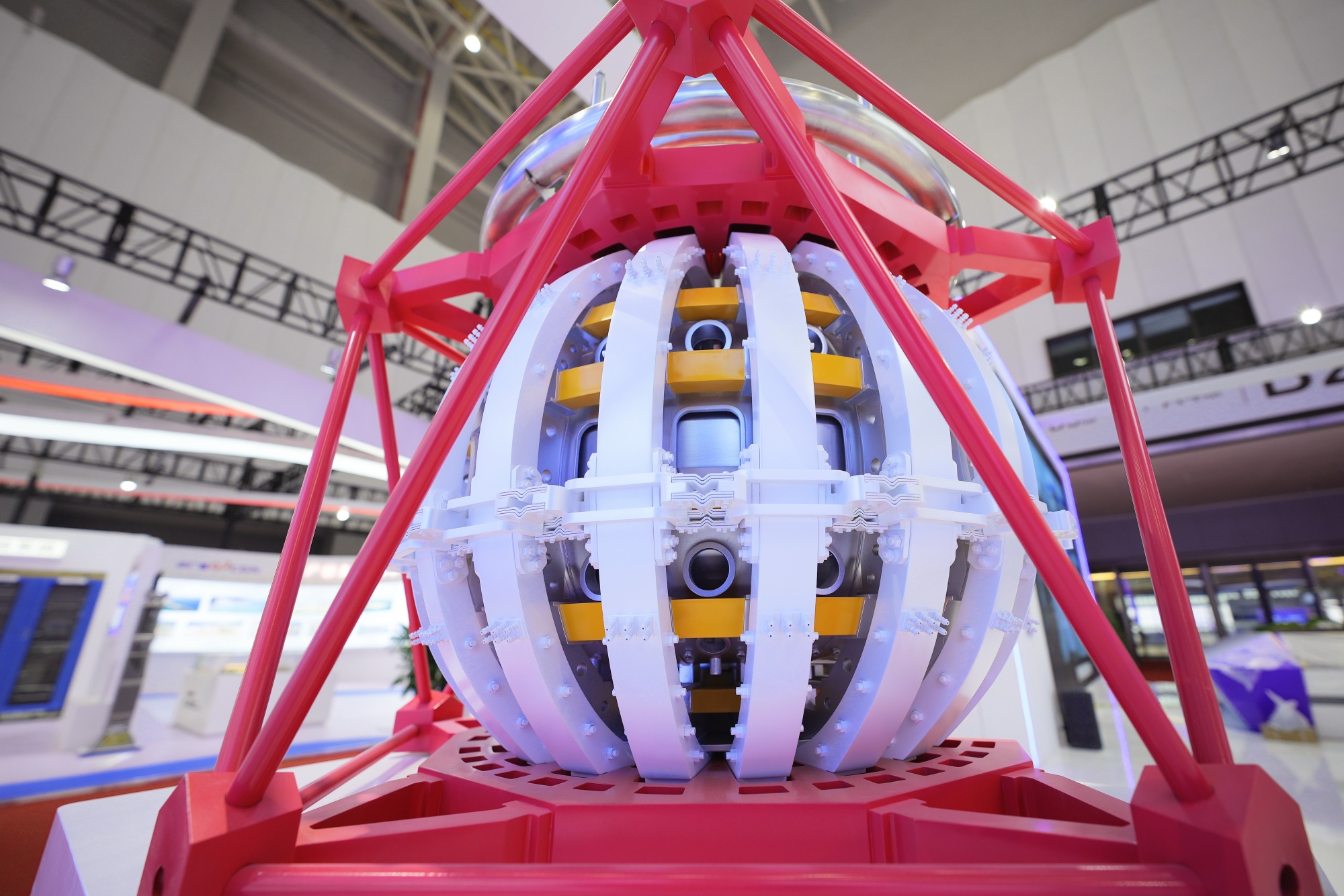

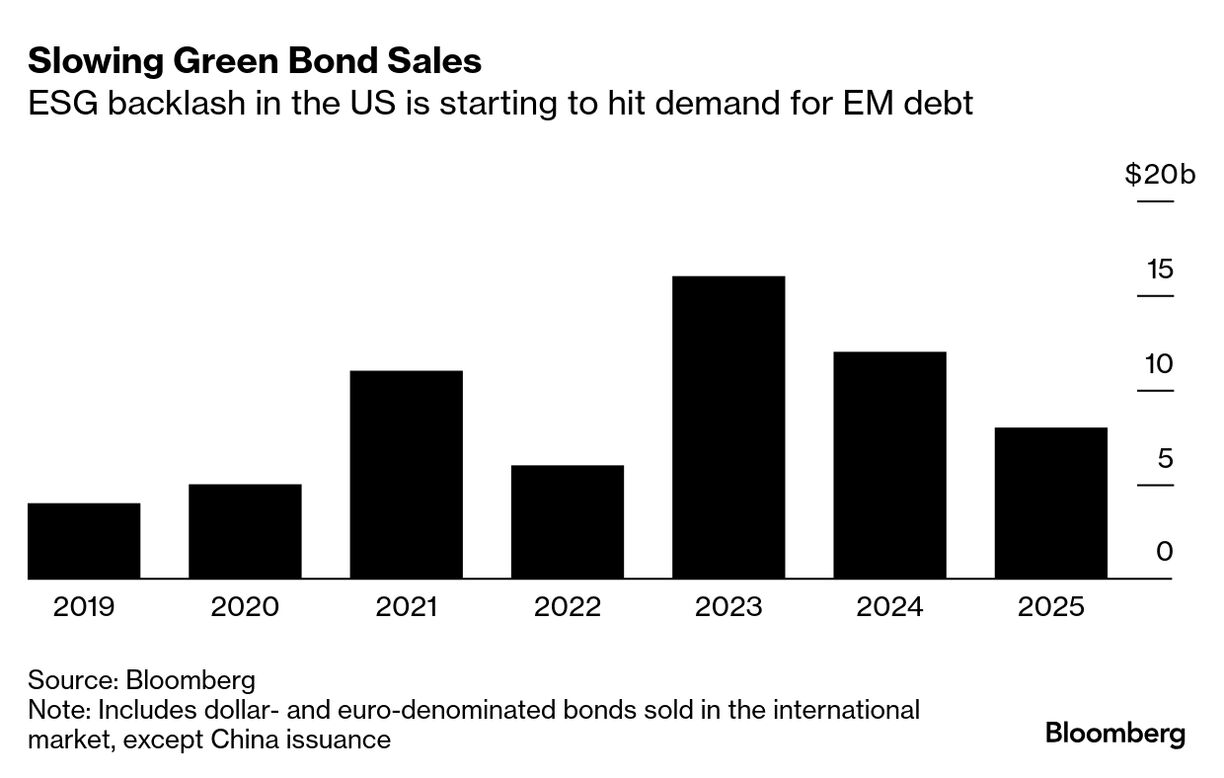

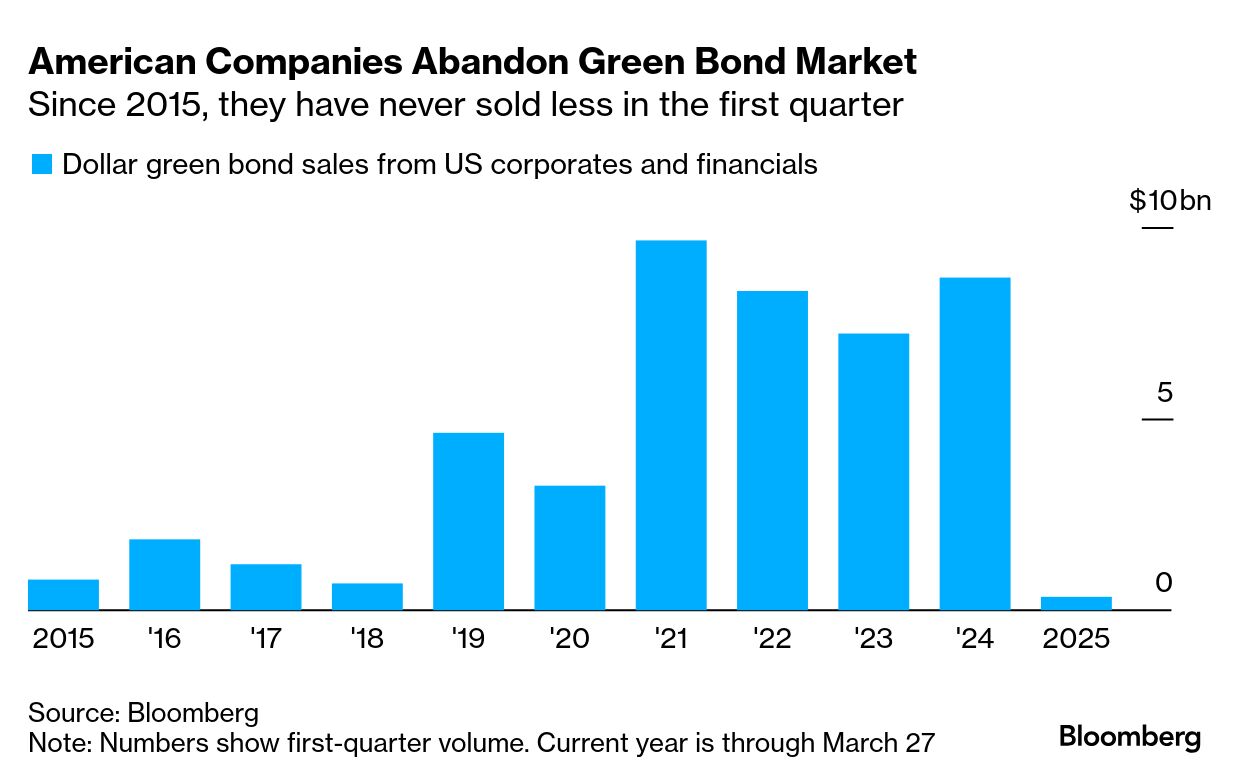

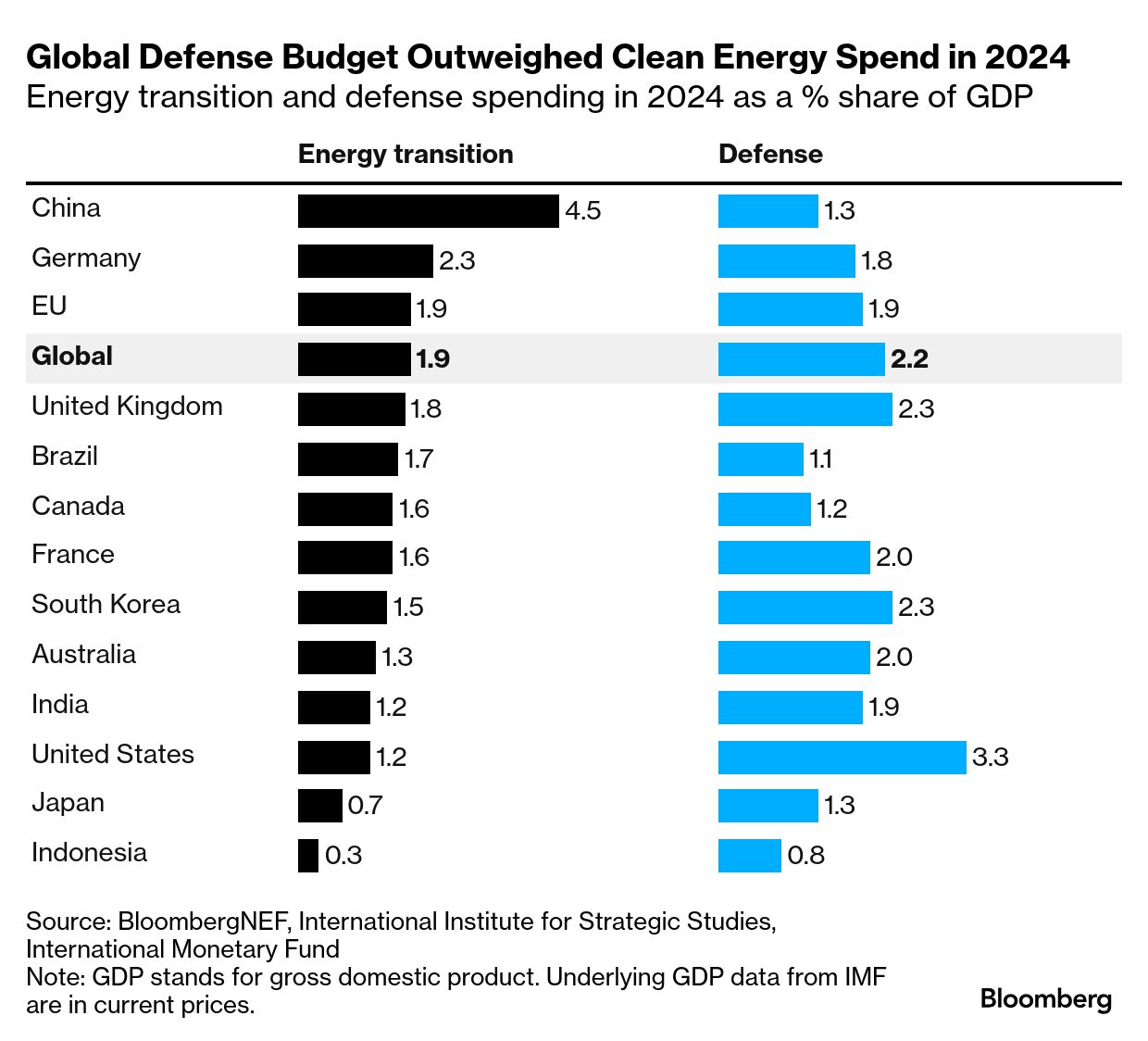

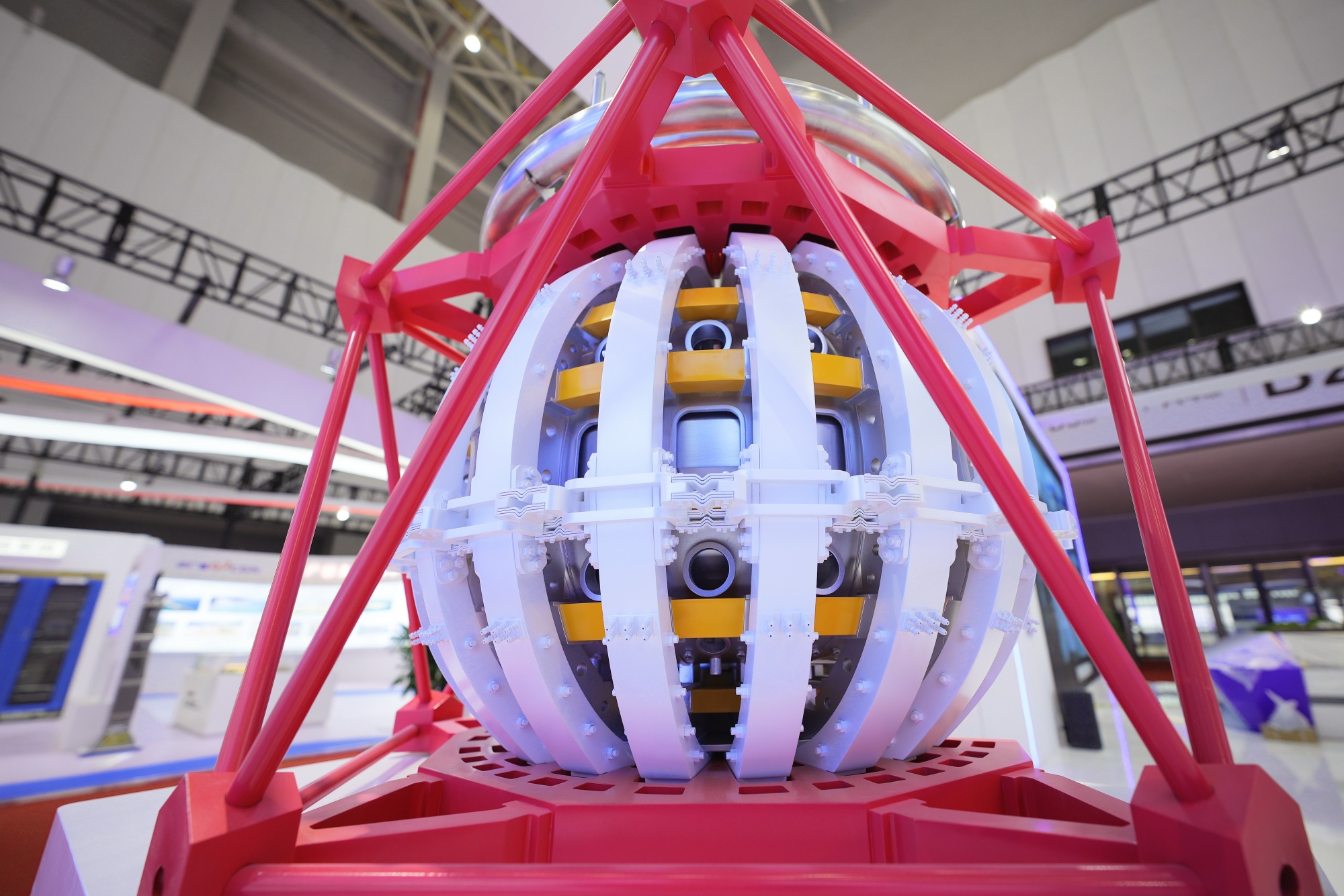

| By Siobhan Wagner Clean energy investments are lagging defense spending worldwide, according to new research from BloombergNEF. But there's a major outlier: China. The world's second biggest economy spent 4.5% of its gross domestic product on the energy transition last year, more than double the global average. Its defense budget accounted for just 1.3% of overall GDP, based on BNEF's aggregation of the latest data from the International Institute for Strategic Studies. Globally defense spending in 2024 reached $2.46 trillion, surpassing a record $2.1 trillion in clean energy investments, BNEF said. To a lesser degree, large economic powerhouses like Germany and Canada also directed more cash toward low-carbon energy systems, according to the BNEF research. The US, UK, France, Japan and India budgeted more for military capabilities last year. Broad economic and geopolitical factors will continue to change how budgets are allocated. The EU is boosting defense spending in support of Ukraine. At the same time, global energy needs are soaring as artificial intelligence turbocharges demand for data centers. This means electricity from any and all kinds of sources will be needed. Wind and solar are the fastest growing sources of electricity worldwide — helped by cheaper prices for equipment. "With rising geopolitical uncertainties, deteriorating confidence in the US security umbrella and the re-militarizing of Europe, defense spending may rise in the years ahead," Claudio Lubis, an analyst at BNEF in London, wrote in his analysis. "Nonetheless, as China and European nations have not wavered in the low-carbon transition, energy-related spend from these regions is also unlikely to slip." A 10 billion-yuan ($1.4 billion) fund created by the Shanghai government will invest in one of the nation's moonshot projects, a state-backed firm attempting to harness nuclear fusion technology. The Shanghai Future Industry Fund plans to make a strategic investment in China Fusion Corp., according to a statement on Tuesday, which didn't specify the amount. It's the first investment since the fund was created last year. Dozens of companies in the US, Europe, Japan and elsewhere are seeking to commercialize fusion technology, which will replicate the conditions of a star. The process offers the promise of abundant, clean energy but comes with numerous significant technical challenges. Read More: China May Be Ready to Use Nuclear Fusion for Power by 2050  A model of the new generation artificial solar "China Circulation III" at the 2023 China International Nuclear Power Industry and Equipment Expo in Shandong province. Photographer: CFOTO/Future Publishing/Getty Images Climate startup Aspiration Partners Inc. has gone bankrupt. The company, which boasted a roster of celebrity backers and arranged carbon credits for Meta Platforms Inc., Microsoft Corp. and other large firms, filed bankruptcy weeks after its co-founder was arrested on fraud charges. Trump wants to reinstate 2020 auto emissions standards. President Donald Trump said the the vehicle pollution curbs imposed by former President Joe Biden are too onerous. Trump has frequently criticized the requirements as an EV mandate. France's emissions fell at a slower pace. Emissions fell by 1.8% last year to 366 million tons of carbon dioxide equivalent, compared with a 5.8% drop in 2023. A nonproft group that provides the data to the government cited stalled efforts to reduce emissions in the building and transport sectors. By Brian K Sullivan California is emerging from its wettest time of the year with new fire and drought risks. The state is scheduled to measure the snowpack amassed over winter on Tuesday — April 1 is the typical peak point before springtime melting. This data will help determine how much water will be available for residents and agriculture. The above-average and near-normal snow conditions in mountains in northern and central California should give the state enough water to meet its needs for summer and fall, according to Daniel Swain, a climatologist at the University of California Los Angeles. For California, however, this isn't all good news. More water helps grasses and shrubs grow more abundantly across the state's hills and mountains. These smaller plants dry out quicker when the rain stops and temperatures rise becoming what scientists call "fine fuels" that can burn quickly and easily spread embers on the winds, causing trees to also catch fire. In addition, the extra moisture also helps invasive plant species to thrive as well, meaning there is more fuel to burn.  The snow-covered San Gabriel mountain range past the downtown Los Angeles skyline after a winter storm in Los Angeles in March 2023. Photographer: Eric Thayer/Bloomberg At the same time, nearly 40% of California is in drought, with the driest conditions occurring across the southern and eastern portions along the border with Arizona, according to the US Drought Monitor. Long-range forecasts for the state suggest spring and early summer may bring hotter and drier conditions than normal, which would also raise the fire risks, Swain said. This is the third year in a row where California has found itself in such a potentially combustible situation — where wet winters led to more vegetation growing across its landscape. Already this year, devastating fires around Los Angeles killed at least 29. The Pacific Palisades and Eaton blazes were among the most destructive in state history, according to the California Department of Forestry and Fire Protection, commonly called Cal Fire. California is grappling with the harsh realities of climate change, driven by runaway greenhouse gas emissions that have made the state hotter, drier and more fire prone. Climate change made Southern California's dangerous wildfire conditions in early January 35% more likely than they would have been before the industrial era, according to a analysis by the scientific group World Weather Attribution. In a recent webinar Dan McEvoy, a researcher at the Western Regional Climate Center, said many areas in the state experienced their top 10% warmest winters in records going back to 1895. Read this story on Bloomberg.com — and for similar insights sent straight to your inbox, sign up for the Weather Watch newsletter. |

No comments:

Post a Comment