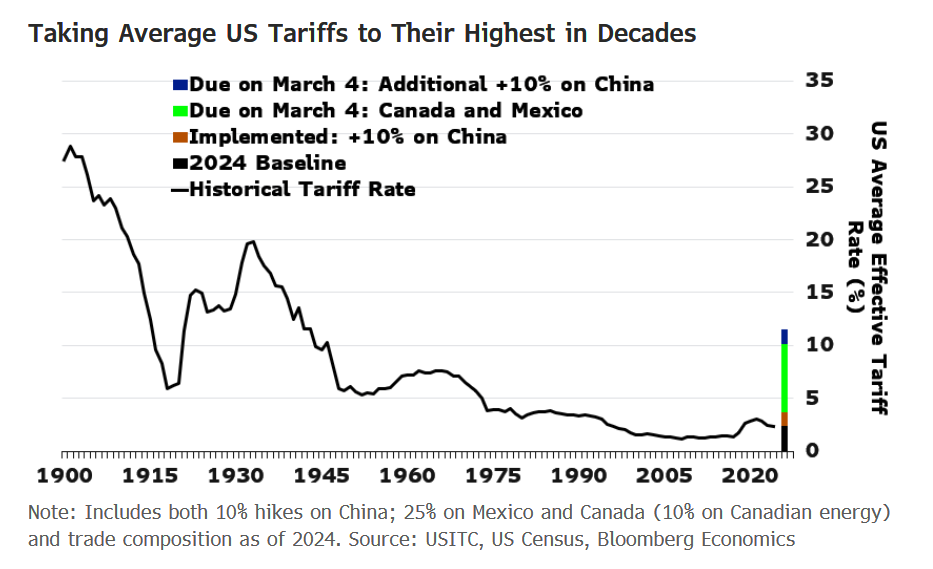

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at the deepening global trade war. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. So it wasn't just a negotiating tactic after all. For weeks, economists debated whether Trump would go ahead with tariffs on imports from Canada and Mexico and higher levies against China. The earlier deferral of tariffs on his North American neighbors, a last-minute reprieve for Colombia, and his art-of-the-deal reputation had fueled bets that Trump would end up winning concessions from Mexico, Canada and possibly even China that would see him pull back from the levies and claim a win for his America First agenda. That all changed when the clock ticked over to 12:01 am Washington time Tuesday. The new tariffs — 25% duties on most Canadian and Mexican imports and the doubling of an existing 10% charge on China to 20% — impact roughly $1.5 trillion in annual imports and marks one of the largest increases in US tariffs since the 1930s. It's a move that signals to all that the Republican president is committed to wielding import duties to obtain fresh revenue and create manufacturing jobs, even in the face of retaliation and the potential for a hit to economic growth and a spur to inflation. And the retaliation was swift indeed. Canada hit back with phased levies on $107 billion worth of US goods, while China imposed tariffs of as high as 15%, mainly on American agricultural shipments. Mexican President Claudia Sheinbaum on Monday said her government would await Trump's decision before reacting with any retaliatory measures and is expected to address reporters on Tuesday morning local time. "We are in a new era where the mantra is to protect markets and the US is leading in this," said Alicia Garcia Herrero, chief Asia-Pacific economist at Natixis. "China retaliated focusing on Trump's staunchest voters in the agriculture sector. But that is not going to stop him." The tariffs bring American import levies to their highest average level seen since 1943, according to the Budget Lab at Yale. That would lead to as much as $2,000 in additional costs for US households — a risky move for a president who rode to the White House in part on resentment against the inflation seen under his predecessor. Trump has indicated more tariffs are to come, including in April reciprocal tariffs on all US trading partners that have their own levies or other barriers on American products, as well as sectoral taxes of 25% on cars, semiconductors and pharmaceuticals. Those tariffs are also poised to be cumulative — in addition to any across-the-board tariff on a particular nation. Trump has also said a 25% tariff is in the works for the European Union and is investigating levies on copper and lumber imports. Steel and aluminum tariffs are also set to take effect on March 12, further impacting Canada and Mexico. Anyone still doubting those moves had best think again. The Best of Bloomberg Economics | - Trump also said China and Japan are tinkering with their currencies, a claim rejected by Tokyo.

- TSMC plans to invest an additional $100 billion in US plants, prompting Taiwan to downplay concerns the chip company is being Americanized.

- South Africa's economy expanded at the slowest pace in four years in 2024.

- Australia's central bank board expressed caution about future policy easing. Meanwhile, Hungary's new central bank leadership sees no room to cut rates.

- Thailand is preparing to allow limited sales of alcohol on Buddhist holidays to cater to tourists, the latest step in the country's effort to woo more overseas visitors.

- Singapore's public housing system is strained by an overheated market.

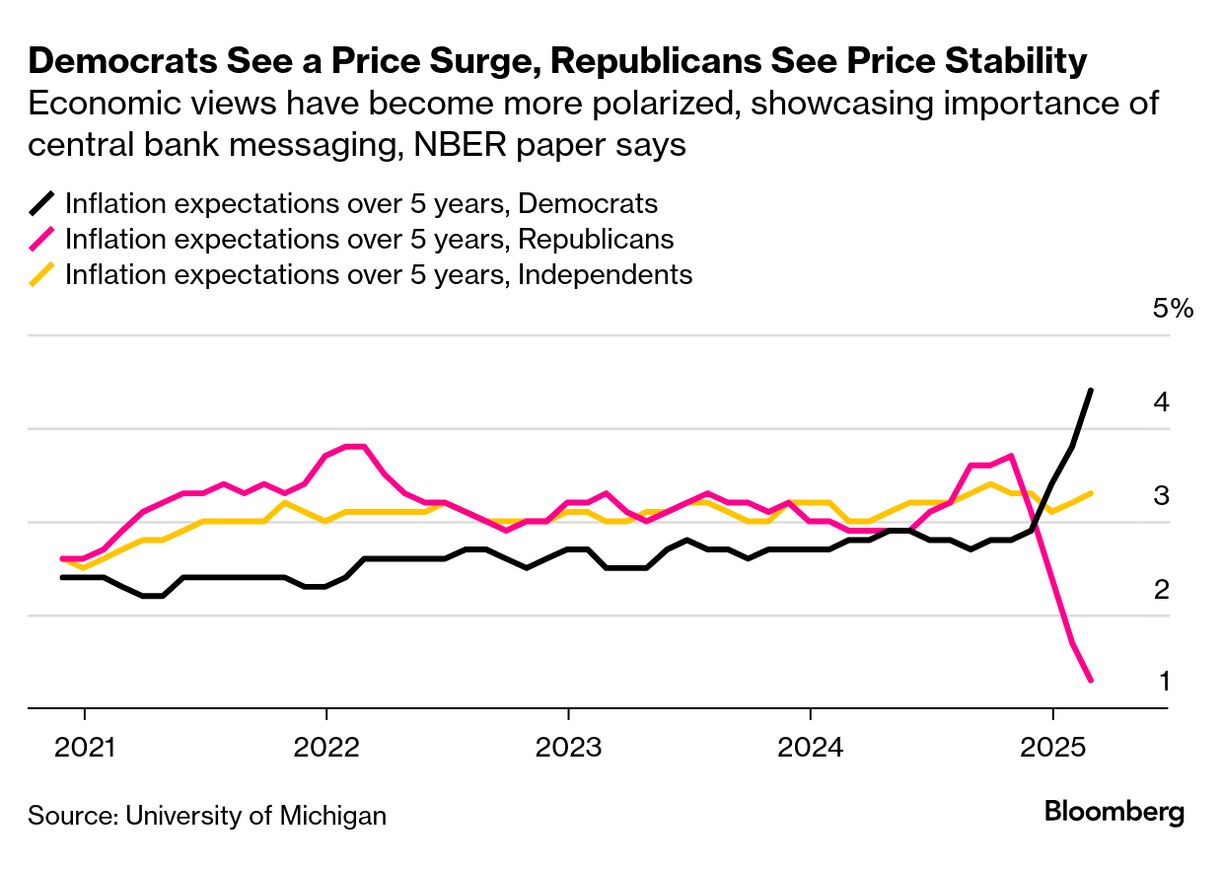

Political polarization is coloring how the public views the Fed — along with, of course, a lot of other things. The good news for policymakers is that communication can help build confidence in the US central bank, a new National Bureau of Economic Research paper shows. "For the Fed and other central banks, actively managing communications is essential to maintain credibility and to ensure effective policy transmission in a politically polarized environment," authors Pei Kuang, Michael Weber and Shihan Xie wrote. It's also important because, they said, "greater perceived independence and trust in the Fed are associated with lower inflation expectations." The researchers conducted a survey on presidential inauguration day, Jan. 20, with over 5,600 participants, asking questions about perceptions of Fed independence and testing various messaging techniques. "Providing information about the Fed's institutional structure, its nonpartisan objectives, and its policy track record significantly increases trust in the institution and reduces perceptions of political bias," they wrote. |

No comments:

Post a Comment