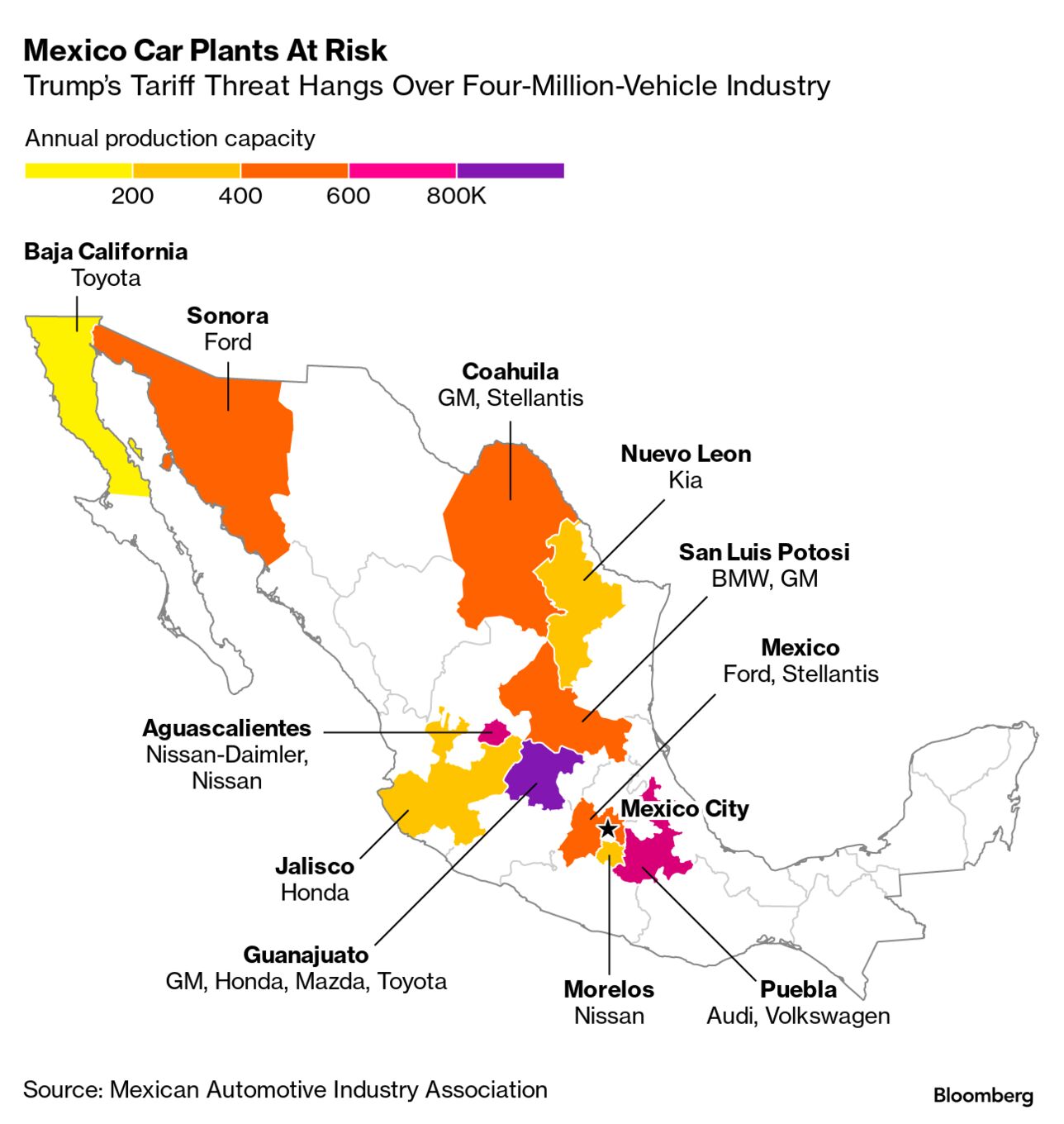

| In his first two weeks in office President Donald Trump has launched all manner of economic wars, big and small. There was the quiet war on global tax reforms he began on day one. There was an hours-long war of words with Colombia in which he threatened the economic equivalent of nuclear strike over a diplomatic skirmish. His desires for control over Greenland and the Panama Canal didn't reach economic war-like status but felt like they're a fight for another day. On Saturday, though, Trump launched the biggest of them all when he became the first president since Richard Nixon in 1971 to invoke economic emergency powers to levy tariffs against Canada, Mexico and China. And, to raise the stakes, in doing so to roll out the largest act of protectionism by the US since 1930 and the Smoot-Hawley tariffs that then provoked a truly global trade war. Because this is Trump, there is always a chance that he will announce a sudden victory and roll back his tariff threats before they take effect at a minute after midnight in Washington tonight. Market Turmoil Early Monday, financial markets around the world responded not with panic, but in ways that might be expected if things are going to get more expensive and uncertain. The dollar rallied. Equities fell in Asia and Europe, and US stock futures were sharply lower before the open. Treasury yields rose, as did oil prices. But all the language emerging from his Mar-a-Lago estate over the weekend indicated he was digging in and spoiling for more fights. The European Union tariffs are "definitely" coming and soon, he told reporters late Sunday. "He seems to be like a poker player who's betting his whole stash on the first hand," Steven Englander, global head of G-10 FX research at Standard Chartered, told Bloomberg TV. Read More: EU Leaders Say They'll React to Trump's 'Stupid Tariff War' This is, of course, what some experts foretold when the Biden administration stepped up the use of sanctions and other economic tools like export controls against Russia and China. Economic Warcraft What polite company calls "economic statecraft" could easily turn into economic warcraft. Especially in the hands of an unrestrained leader like Trump, Abraham Newman and Henry Farrell warned after publishing their 2023 book "Underground Empire" on America's weaponization of the global economy. His supporters, of course, see Trump's economic warfare as the work of a president finally leveraging American power to get what he wants and the country needs rather than dilly-dallying around with ineffective diplomacy. But there's a big question surrounding all this. If this is what Trump's economic warfare looks like two weeks in, what will it look like a year or two from now? His weekend tariff move, as we write in today's Bloomberg Big Take, amounts to swinging a wrecking ball through the North American supply chains that have been the foundations of US economic power for decades. What will his tariffs look like if amid market turmoil he rolls them back in the weeks to come? Or if they yield the economic damage to the US and its neighbors that so many in business and economics expect? Read More: China Can Draw Lessons From First Trade War in Tariffs Countdown What happens if these tariffs are indeed followed by many more? And what happens when the world stops paying attention and moves on to trade not with the US but with other countries less prone to economic bullying? United Front All wars including economic wars are ugly. But the world may be better prepared for the bully this time and ready to stand up to Trump's new steroid-charged version of throwing American economic power around. The EU in 2023 introduced new "economic coercion instruments" that give it the power to limit trade and investment flows from offending nations. The worst-kept secret in Brussels is that they were inspired by Trump's first term and the realization the EU needed better defenses in the Age of Trump. Officials in other economies will tell you they were preparing their own responses to tariffs and other acts of US economic warfare long before he won November's election. Who knows where it will all end, or when? But what we learned in Trump's first term is that nobody wins a trade war. Even if they are bigger and there are more of them, it's not clear anything will be different this time. —Shawn Donnan in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment