| Donald Trump imposed tariffs on Canada, Mexico and China in the most extensive act of protectionism by a US president in almost a century. T |

| |

| Markets Snapshot | | | | Market data as of 06:45 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Donald Trump imposed tariffs on Canada, Mexico and China in the most extensive act of protectionism by a US president in almost a century. The move threatens to hobble the US economy and push up prices for consumers.

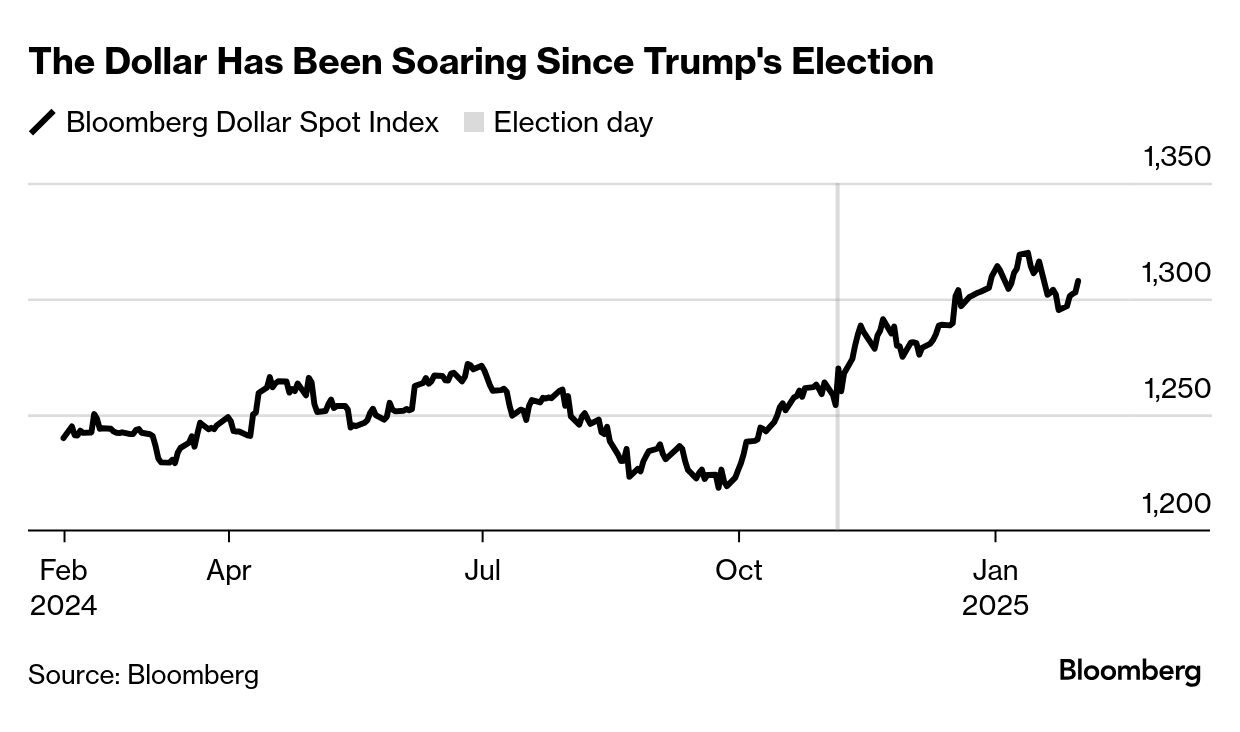

- The dollar index jumped 1% and stocks tumbled globally. The Canadian dollar sank to its weakest since 2003. Crypto was also hammered as Ether plunged 11% in a broad move away from risky assets.

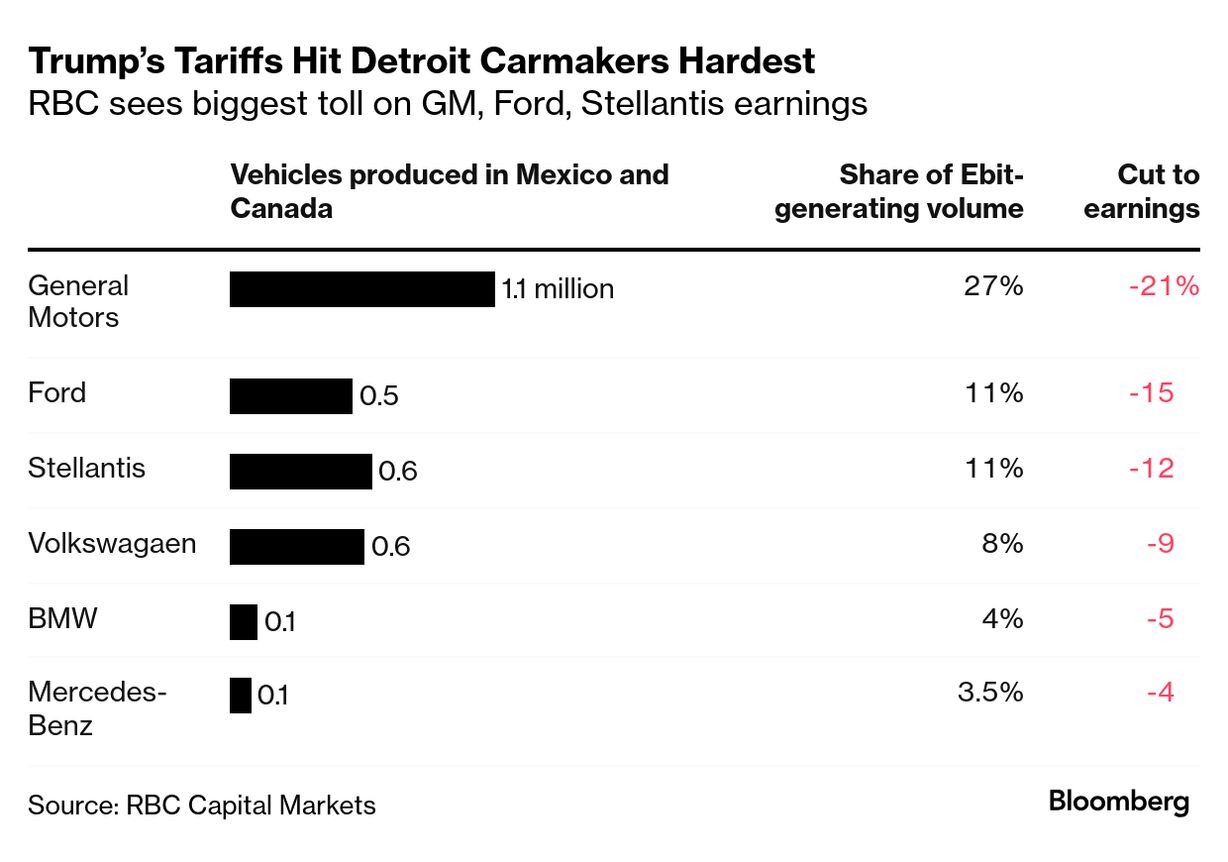

- Goldman Sachs Group strategists said there's a risk of a 5% slump in US stocks because of the hit to corporate earnings. RBC Capital Markets put the range at 5% to 10%.

- Energy markets also were rattled by tariffs that threaten to increase costs for American consumers and disrupt supplies. Gasoline futures soared as much as 6.2% in New York. West Texas Intermediate jumped about 2%.

- Elon Musk said his "DOGE team" of government efficiency enforcers is shutting down some payments to federal contractors, suggesting that the world's richest man may have access to sensitive systems used at the Treasury Department.

| |

Just another manic Monday | |

| For the second Monday in a row, investors are waking up to a big selloff. Last week, it was DeepSeek's low-cost AI model triggering a flight out of tech stocks. Today, it's Trump's trade war. In both cases, it's surprising that investors were surprised. The DeepSeek news was percolating in tech circles for days before markets reacted. And here's Deutsche Bank's Jim Reid on tariffs: "Standby for a manic Monday as the world tries to come to terms with the 'shock' tariff announcements from Mr. Trump's administration on Saturday night. I say shock but all Trump did was follow through on exactly what he's been saying he's going to do since November. The market has refused to take that threat seriously though, completely underpricing the risks. So, this leaves the weekend news as a severe shock."

It's enough to raise the age-old question: how efficient are markets really? The Nasdaq 100 Index sold off sharply on the days-old DeepSeek release, and then clawed back a big chunk of the losses on no particular news. Of course, there's a case to be made that investors were leaning the wrong way on tariffs. Everyone knew they were coming, but most of the money was on Trump doing something less severe as a negotiation tactic. "He seems to be like a poker player who's betting his whole stash on the first hand,'' said Steven Englander, global head of G-10 currency research at Standard Chartered. "The market just wasn't prepared for it." Wall Street banks including Goldman Sachs and JPMorgan say there's still plenty of money to be made buying the dollar. Goldman sees the dollar breaking parity against the euro. JPMorgan predicts the US currency to buy around 1.50 Canadian dollars for the first time in a generation. Another theme this morning is how market sentiment keeps flicking back and forth on the latest news surprise. As Peter Callahan of Goldman notes, it's only the first trading day of February and attention this year has jumped from a hot payrolls report (bearish) to a cool reading on inflation (bullish), to the Stargate AI investment plan (bullish), followed by DeepSeek and now tariffs. "Already one month down in a year that has proven to be a rocky, and narrative-rich, type of year with a new storyline to analyze and trade each week,'' Callahan wrote in a note to clients. Others have slightly different lists: With Trump's tariffs scheduled to go into effect at tomorrow, Bianco's hopes for a quiet week may be out of reach. Retaliation from Canada and Mexico is already in the works, and China may not be far behind. And there's the monthly jobs report. For traders, the ride might get bumpier from here. —Phil Serafino | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

| Monday – Institute for Supply Management releases January US manufacturing survey. Earnings from Tyson Foods, Palantir and Clorox.

Tuesday – The Treasury details plans for auctioning bonds and notes. A report is forecast to show about 8 million job openings in December. Earnings from Alphabet, UBS, Merck, PayPal, PepsiCo, KKR, Pfizer, Spotify, Advanced Micro Devices, Amgen, Mondelez, Vodafone, Diageo, Nintendo and Fast Retailing.

Wednesday – ISM publishes US services survey and a similar report is released in China. Earnings from Disney, Ford, Uber, Harley-Davidson, T. Rowe Price, Stanley Black & Decker, MicroStrategy, Costco, Novo Nordisk, Toyota and Nomura.

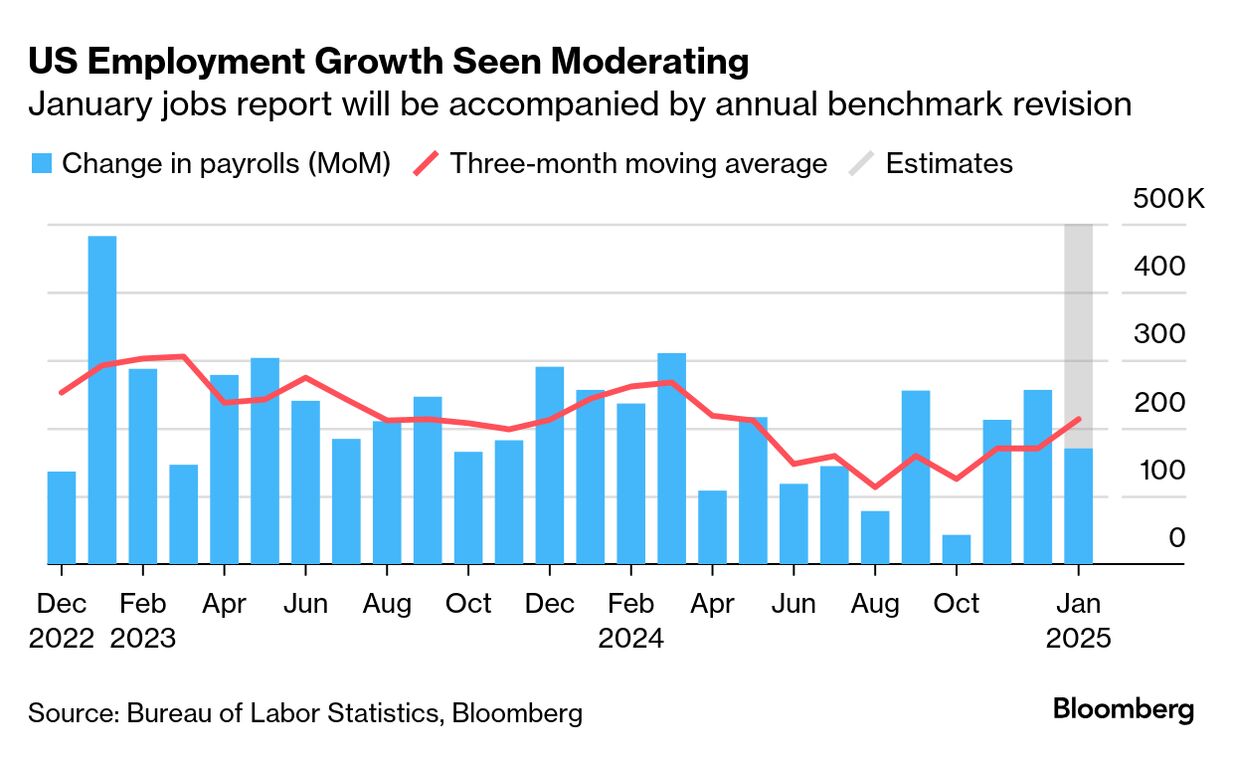

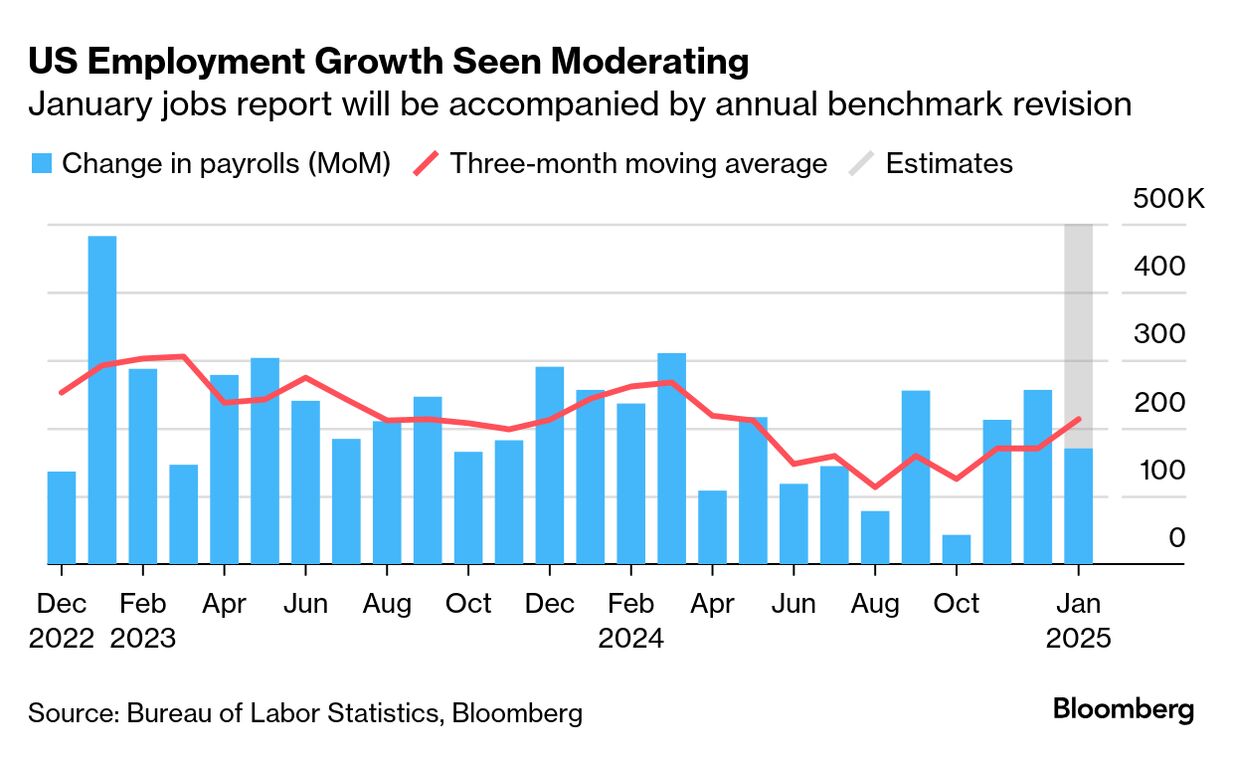

Thursday – Bank of England and Mexico central bank both expected to cut interest rates. Earnings from Amazon, ConocoPhillips, Roblox, Hilton, Bristol-Myers Squibb, Eli Lilly, Air Products, Hershey, Honeywell, Yum Brands, Take-Two, Societe Generale, L'Oreal, Nippon Steel and Nikon.  Friday – US jobs report for January (predicted to show 170,000 gain in payrolls) and revisions of past data. Canada releases its labor force survey for January. The Reserve Bank of India may start cutting rates. Click here for the full economic calendar.

Trade wars, tariff threats and logistics shocks are upending businesses and spreading volatility. Understand the new order of global commerce with the Supply Lines newsletter. | |

| |

- Auto shares are falling on concern Trump's tariffs will hurt sales from car factories in Mexico. In Europe, Volkswagen shares are down 6.4% and Stellantis, the owner of Jeep, is down 7.5%. Ford falls 4.2% in US pre-market trading. GM is down 7.4%.

| |

Will Bessent walk the talk? | |

| Scott Bessent will have to decide whether to act on his criticism of Janet Yellen's US debt management now he's in charge of the Treasury. Bond dealers are conflicted over what he'll do on Wednesday, when the Treasury announces its plans for issuing debt. In the past four quarters, it has advised that it didn't expect to increase issuance of longer-dated securities "for at least the next several quarters."

But some are braced for a tweak after Bessent previously accused Yellen of artificially holding down sales of longer-maturity Treasuries — which affect things like mortgage rates — to boost the pre-election economy. "This is going to be the key point of the statement on Wednesday," said Mark Cabana, head of US rates strategy at Bank of America. "I can't help but think it's a new administration, they want to have their own guidance." —Liz Capo McCormick | |

Word from Wall Street | | "You ended up with these give or take 10 stocks that really sucked up all the capital and valuations got very, very high. The big question is, when will we see that rebalance? Do we need to see some cyclical downturn first to purge and to normalize some of these valuations? In 2000, they were this high, and we know how it ended.'' | | Marko Kolanovic Former JPMorgan Chase strategist | | Read more from his interview on the Odd Lots podcast. | | |

| |

One number to start your day... | | 27% | | That's the plunge in Ether, the second-biggest cryptocurrency, at one point on Monday. It has pared losses to about 11%. | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment