| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at Trump's latest trade-war salvos. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Euro-area inflation unexpectedly accelerated, supporting the European Central Bank's cautious approach to lowering interest rates.

- China's manufacturing activity unexpectedly declined for a second month.

- Scott Bessent now determines sales of US Treasuries, and bond dealers are conflicted over what he'll do in a pivotal release due Wednesday.

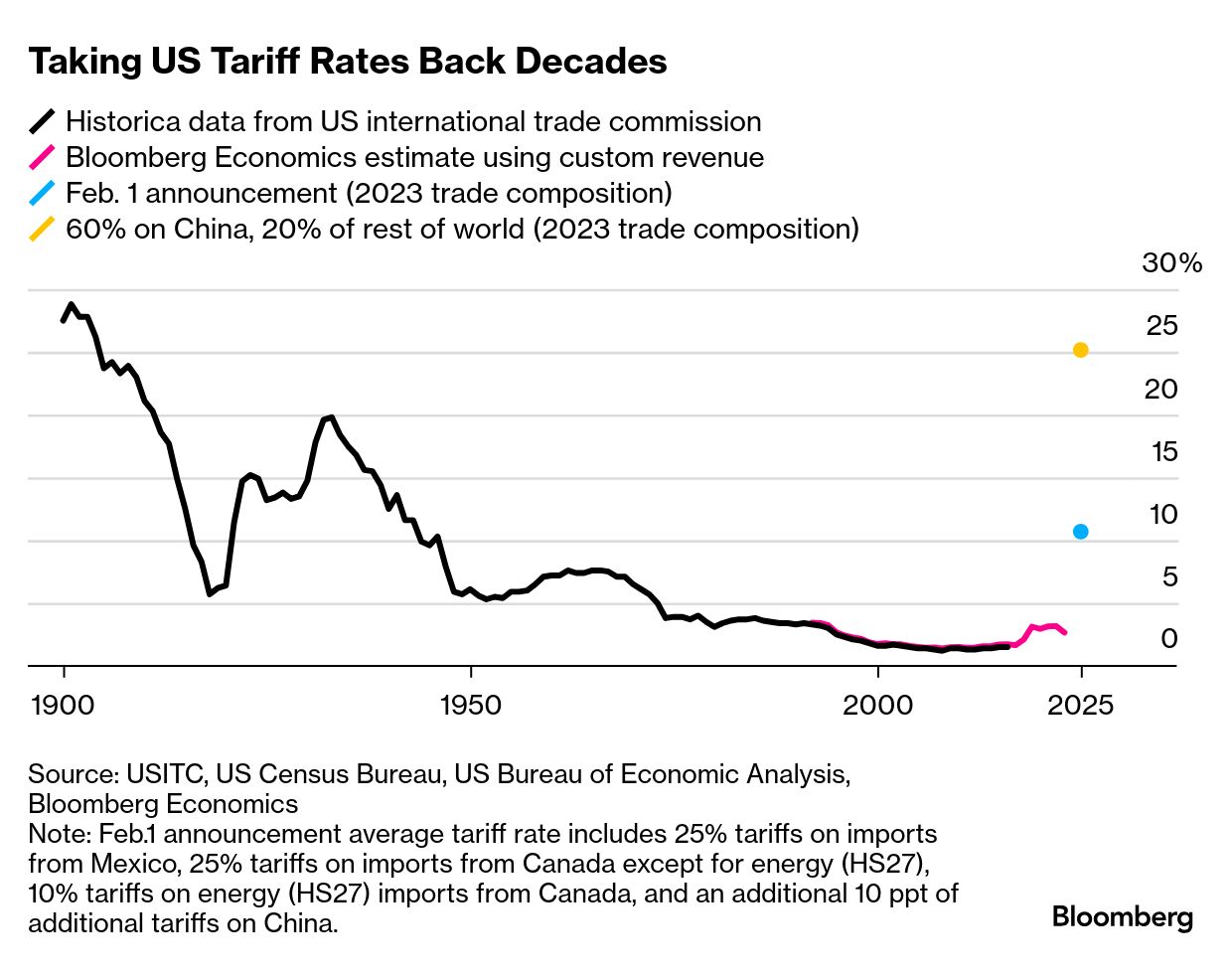

Economists have been cranking out reports on the potential impact of Donald Trump's tariff threats for months now. Come 12:01 a.m. Washington time Tuesday --when 25% tariffs on imports from Canada and Mexico and additional 10% levies on shipments from China kick in — their focus shifts from modelling "what if" scenarios to examining "now what" for a fragile global economy. Assuming no last-minute reprieve — something Goldman Sachs economists say can't be ruled out — a first round of price increases will ricochet through American households, raising prices for items including vegetables, fruits and cars. Bloomberg Economics say the tariffs on imports from the US's three largest trading partners will affect trade worth about $1.3 trillion, representing 43% of US imports based on 2023 data and close to 5% of US GDP. They estimate: - The action will raise the average US tariff rate from near 3% to 10.7%, based on current import patterns and deal a significant supply shock to the US economy.

- Models used by the Federal Reserve Board to estimate tariff impacts in Trump's first term suggest this could knock 1.2% off GDP and add around 0.7% to core PCE.

- For Trump's tariff targets, the impacts may be even larger — 16% of Mexican GDP and 14% of Canadian GDP is directly exposed to their goods exports to the US. China is much less exposed, with 2.3% of its GDP directly exposed to US imports.

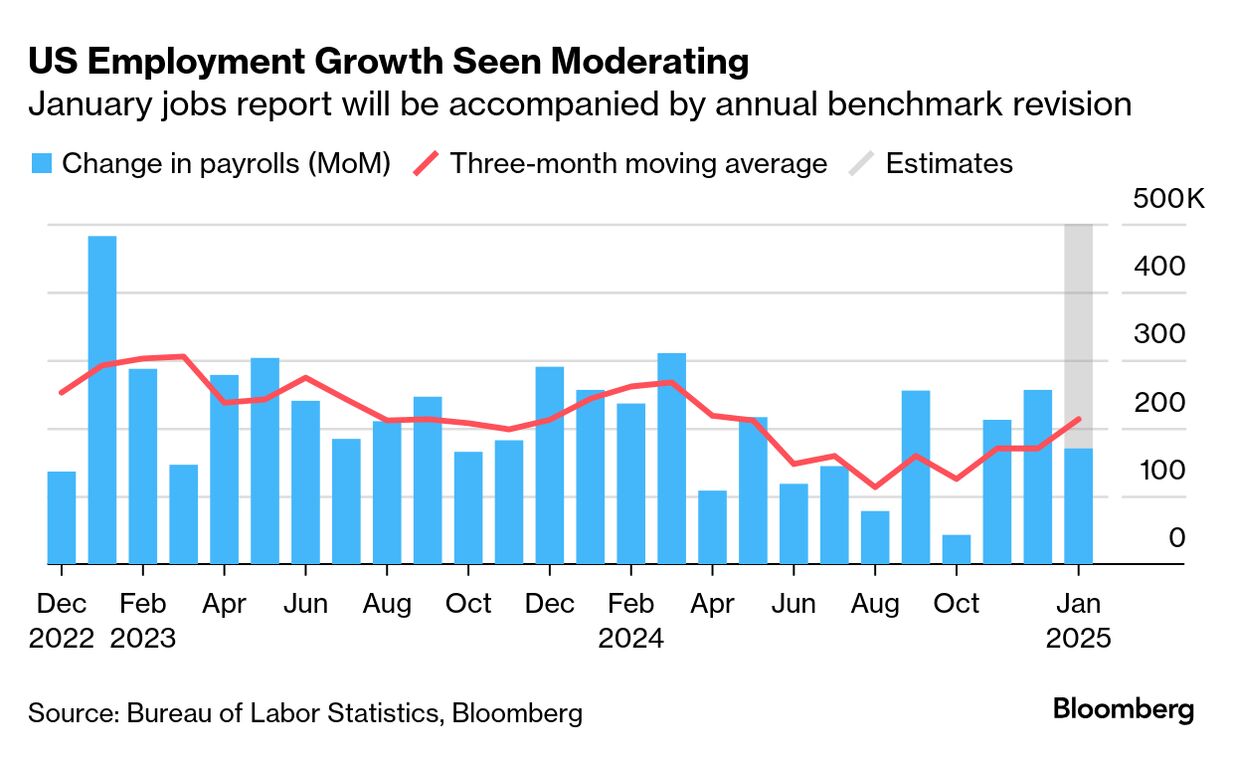

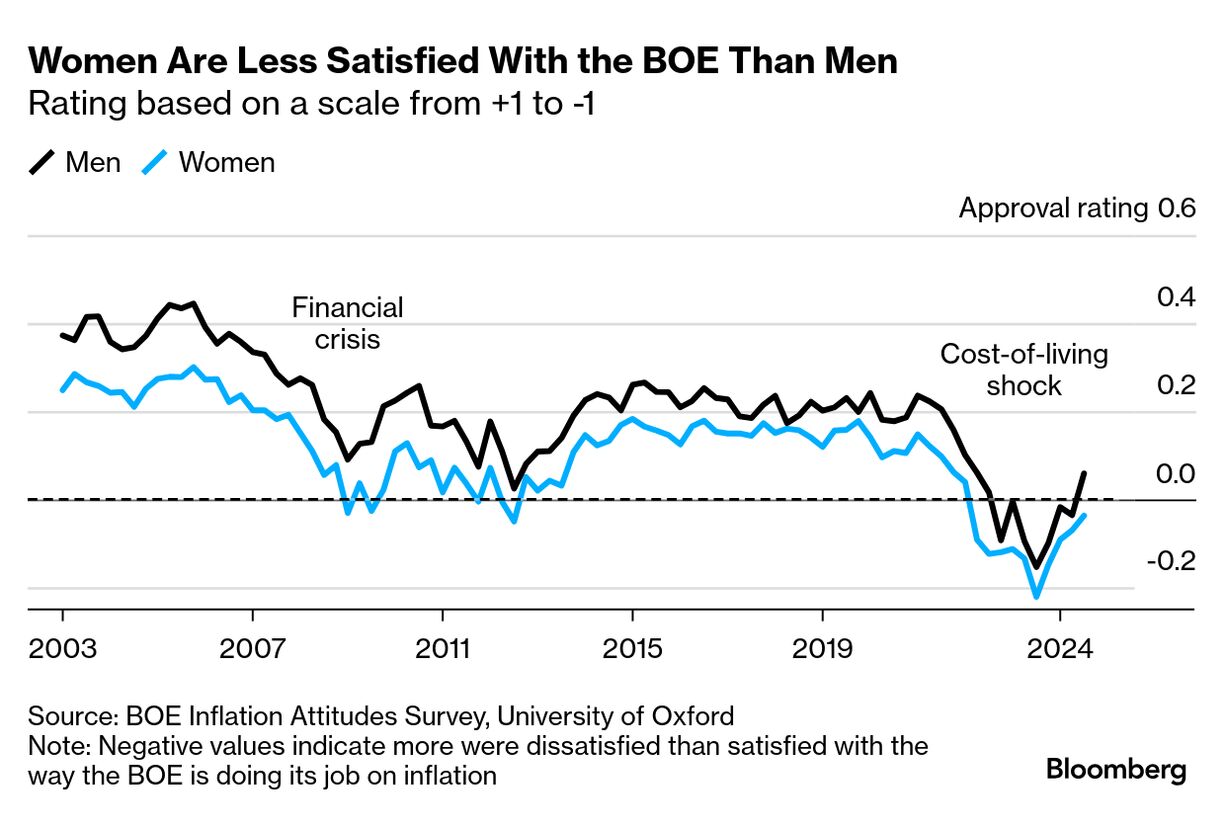

Terminal subscribers can read that research here. Then there's the financial market pass through. The knee-jerk reaction on Monday saw the dollar surge, oil jump and equity markets turn red. Whether such moves flow through to the real economy will depend on how lasting they are. But as we explained in Saturday's New Economy Newsletter, a stronger greenback actually offsets some of the tariff blow for American customers as it makes imports cheaper. While that's good for inflation, it also undermines Trump's efforts to boost America's competitiveness. Much now depends on what others do in response to Trump's salvo. Canadian Prime Minister Justin Trudeau unveiled a 25% counter-tariff, while Mexican leader Claudia Sheinbaum pledged retaliatory levies. China's Commerce Ministry issued a statement vowing "corresponding countermeasures," without elaborating, and vowed to file a complaint to the World Trade Organization. In remarks to reporters on Sunday night, Trump said he would hold separate calls on Monday morning with Trudeau and the Mexican leadership. "I don't expect anything very dramatic," Trump said of the planned calls. "We put tariffs on. They owe us a lot of money, and I'm sure they're going to pay." Stephen Jen, chief executive at Eurizon SLJ Capital, worries that if Trump proceeds with the tariffs on Canada, Mexico and China unconditionally, it will make future threats of tariffs "less credible." That's because other countries won't try to meet Trump's demands if they think "they are just excuses that could never change Trump's mind anyway." So just as a last-minute reprieve can't be ruled out, nor can a spiraling series of tit-for-tat moves that plunges the global economy into a new supply shock. Trump on Sunday night also reiterated a warning to the European Union that tariffs "will definitely happen," citing a large trade deficit with the bloc. Beyond the market fallout and tit-for-tat actions, there's an intangible impact from all of this on America's reputation as an economic and security partner, which Shawn Donnan explores in today's BigTake. As he writes, the latest tariff move swings a "wrecking ball through the regional compact at the foundation of US global competitiveness and economic power." The Best of Bloomberg Economics | The US labor market probably kicked off 2025 with another month of solid growth, while highly anticipated annual revisions are likely to showcase a noticeably more moderate pace of hiring over the past few years. Payrolls increased by 170,000 in January after larger advances over the prior two months, when the labor market was recovering from the impacts of hurricanes and a major strike, according to the median projection of economists surveyed by Bloomberg. The monthly jobs report on Friday will also include annual revisions from the Bureau of Labor Statistics. The agency will align the level of payrolls from March of last year to a more comprehensive job count from a quarterly survey derived from unemployment insurance programs. Elsewhere, likely rate cuts from the UK to India to Mexico, and inflation data from the euro zone, will be among the highlights. See here for the rest of the week's economic events. Women trust the Bank of England less than men and feel more squeezed by cost-of-living shocks, new research shows, underlining the challenge facing the central bank to improve its public reputation. Fewer women are satisfied with the performance of the BOE, according to the study, which was carried out by academics at the University of Oxford using data from a quarterly survey of household attitudes to inflation. Part of the reason why women have a more negative view of the BOE lies in how they respond to inflation, according to the analysis, which controls for factors like age and income. When faced with soaring prices, women tightened their budgets by saving more and shopping around in search of discounts. Men, on the other hand, simply ask for higher pay. "Women feel more financially squeezed while men may try to proactively avoid financial losses due to inflation," co-authors Michael McMahon and Lovisa Reiche wrote. |

No comments:

Post a Comment