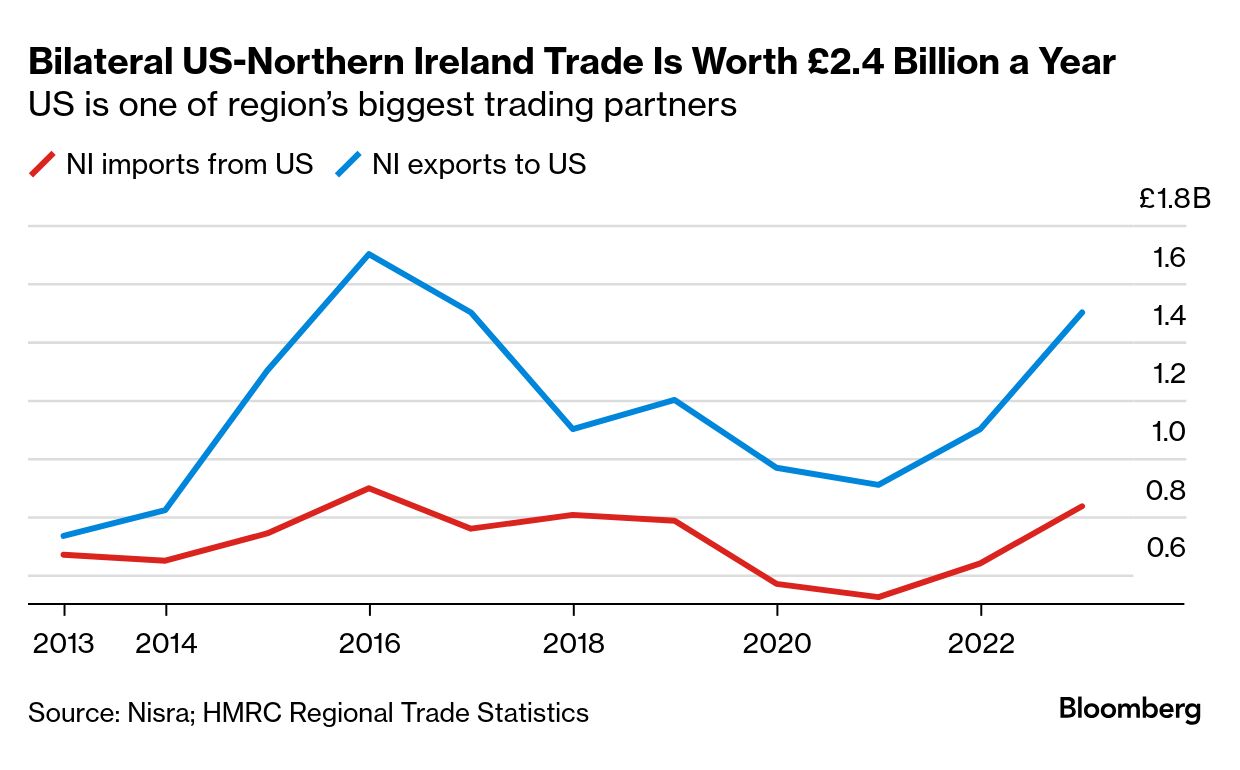

| Northern Ireland emerged from Brexit seemingly with the best of both worlds — smooth access to trade with Britain as well as its ex-partner, the European Union. But that's hit a snag. As President Donald Trump threatens tariffs on the EU, some business figures and officials in the UK region that shares a border with the Republic of Ireland wonder whether they'll be caught in the middle of a transatlantic trade war. The main uncertainty is what happens if the EU retaliated against any Trump measures by slapping tariffs on US imports. It could result in a duty on American imports into Northern Ireland that the rest of Great Britain could avoid, Bloomberg explains from Dublin. There could be some recourse to such a competitive disadvantage, such as a tariff reimbursement clause built into the Windsor Framework agreement. Even so, the extra layer of bureaucracy highlights the divergence between Britain and Northern Ireland in the five years since the Brexit breakup. Given years of painstaking negotiations hinged on fixing the Irish Sea border problem to appease British unionists in the post-conflict region, this has the potential to open a can of worms. It snarls the guarantee that Northern Ireland would have equal treatment within the UK internal market, while also remaining in the customs union. If Northern Ireland did get dragged into a tit-for-tat fight across the Atlantic that the rest of the UK appears to have dodged, the timing wouldn't be great for Prime Minister Keir Starmer who presented a more confident case for closer UK-EU ties this week. Read More: Trump's Tariff Threats Drive New Wedge Between UK and Europe "Trump's attitude puts a brake on that," said Jonathan Tonge, British and Irish politics professor at the University of Liverpool. "Starmer is not going to want to fully align with the EU that is subject to a trade war with the US." The potential fallout is a reminder to Westminster that — even nearly a decade after Britons vote to leave the bloc — Brexit hasn't been put to bed yet. (This episode of Bloomberg's In the City podcast looks at how the US president's unpredictability is a problem for Britain's prime minister.) - In a new research note available on the Terminal, Bloomberg Economics looks at which tariffs would cause most harm to the EU countries most likely to appear on Trump's naughty list, four product groups emerge: automotive goods, industrial machinery, chemicals and pharmaceuticals.

—Olivia Fletcher in Dublin Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment