| I'm Molly Smith, an economics editor in New York. Today we're looking at the US jobs report. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The Bank of England just cut interest rates but struck a hawkish tone by signaling fewer hikes — follow our blog here.

- US Treasury Secretary Scott Bessent said the administration's focus with regard to bringing down borrowing costs is 10-year Treasury yields.

- The more President Donald Trump threatens tariffs on the US's trading partners, the more the worry of another inflation wave troubles global economists.

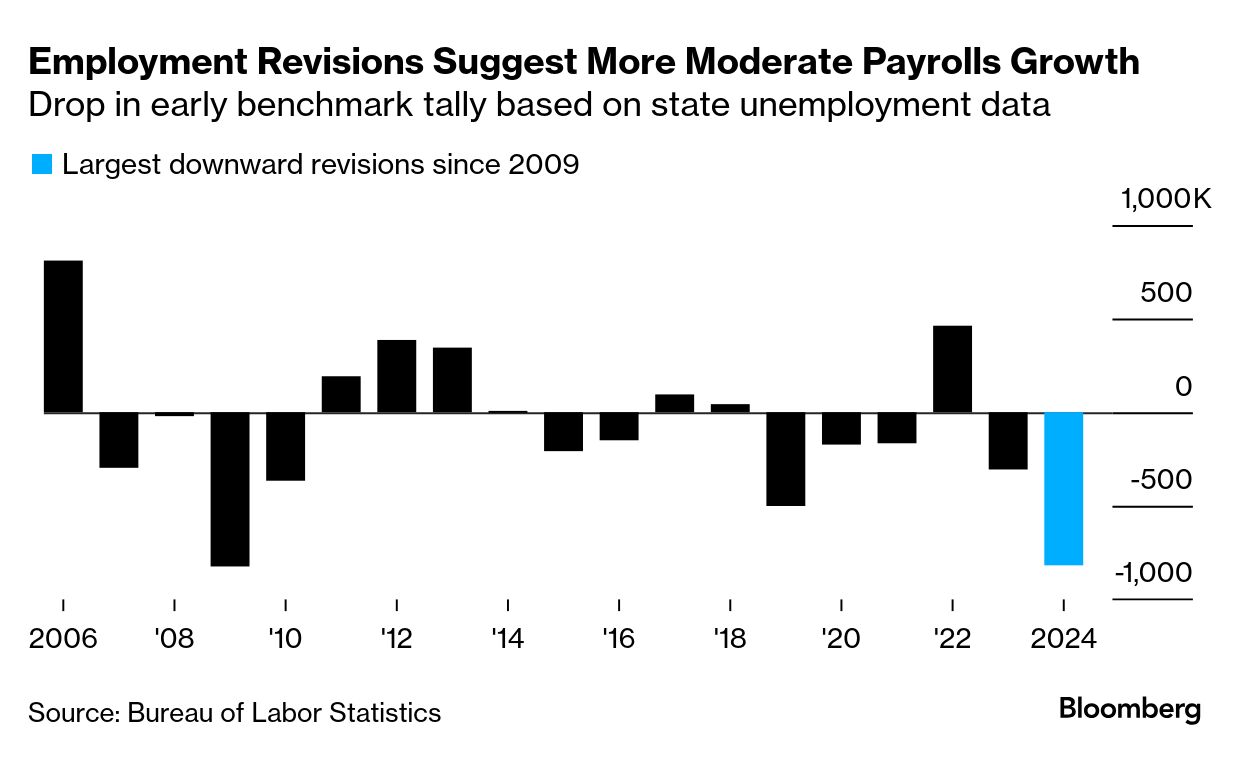

In this week of uncertainty, if you were looking for a straightforward report on how the US labor market has been doing in the monthly employment data due Friday — don't. The January payroll numbers will be hard to parse because of the wildfires in Los Angeles and cold weather in other parts of the country. And annual revisions that are often overlooked will be scrutinized for clues on whether the job market was or wasn't as resilient as initially reported. Back in August, the Bureau of Labor Statistics published a preliminary estimate of what the payrolls revision would come to — projecting a downward adjustment of 818,000 in the year through March 2024, the most since 2009. Most economists don't think the final number will be quite that severe in the report Friday, but a markdown of at least 600,000 jobs would still be historically large. The report will also include revisions to the household survey, which is used to calculate the unemployment and participation rates. They will incorporate new population estimates from the Census Bureau, which were boosted by a surge in immigration. Friday's jobs report will likely show artificial jumps in the labor force and employment as a result of these adjustments, according to a Brookings analysis. And the unemployment rate won't be comparable to prior months. "We see a risk that a large population adjustment this year could lift the aggregate unemployment rate by raising the weight of recent immigrants, who tend to have higher unemployment rates than the general population," Bloomberg economist Chris Collins said in a note Wednesday. - On the latest Trumponomics podcast: Host Stephanie Flanders, Bloomberg's head of government and economics, Anna Wong, chief US economist at Bloomberg Economics, and Bloomberg senior writer Shawn Donnan discuss what exactly US President Donald Trump may be trying to accomplish with his tariff threats and trade wars. Listen on Apple, Spotify, or wherever you get your podcasts.

The Best of Bloomberg Economics | - The European Central Bank is about to reveal a crucial piece of information for monetary policy with new estimates of the neutral rate.

- The Bank of Japan's most hawkish official flagged the need for two or more hikes in borrowing costs by early next year, and its former governor said deflation is over.

- German corporate leaders urged the next government to move quickly to unlock investment and get Europe's largest economy growing again.

- The Czech central bank governor, in an interview, appeared unruffled by resistance to his bid to buy Bitcoin for reserves. He and his colleagues may cut rates today.

- Mexico's central bank will likely double the pace of easing in its decision on Thursday.

- Bank of Korea Governor Rhee Chang-yong pushed back against mounting speculation of a rate cut later this month.

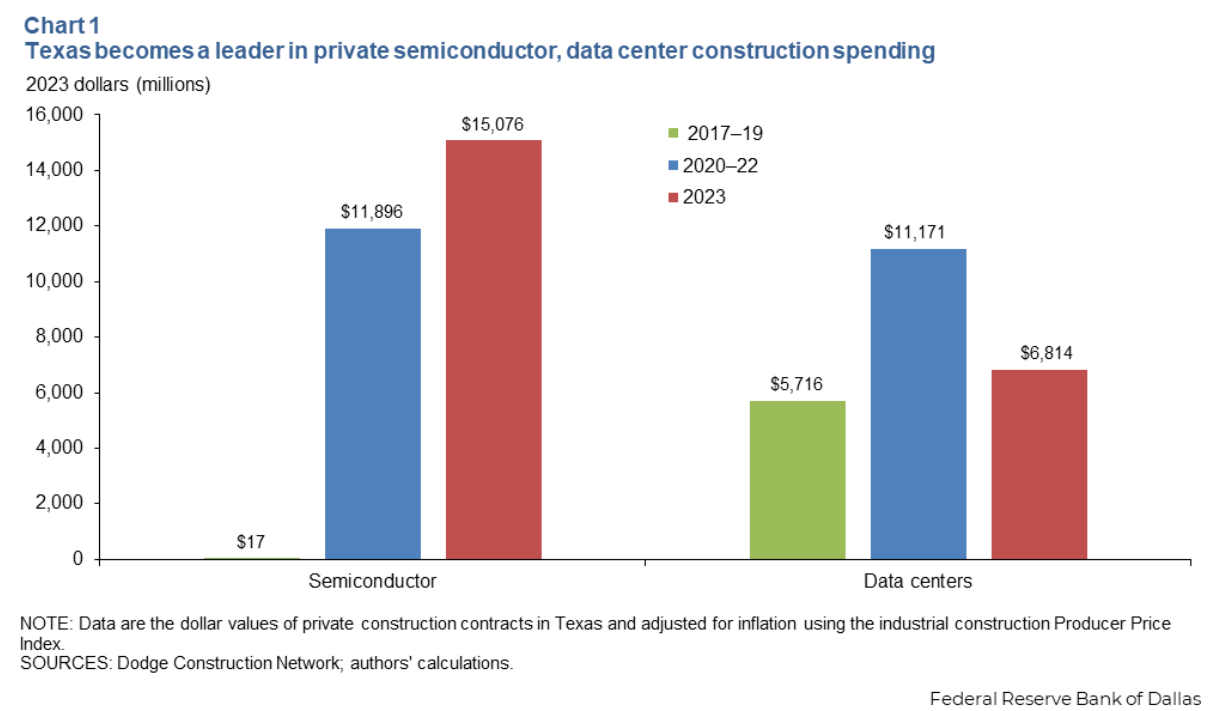

Texas, which has an economy bigger than Italy's but with a much smaller population, has been propelled in recent years in part by a boom in tech and energy construction, according to the Federal Reserve Bank of Dallas. While a Republican-run state, analysis by Dallas Fed economists Jesse Thompson and Prithvi Kalkunte showed that a trio of programs enacted by former President Joe Biden, a Democrat, "have supercharged construction of technology and energy-transition-related projects" in Texas. The trio includes the Inflation Reduction Act, a bipartisan infrastructure bill and the Chips and Science Act. Pre-pandemic, Texas accounted for a negligible share of semiconductor plant construction contracts in the US, but that soared to almost 24% — more than $15 billion — in 2023, the duo found. "Since mid-2022, after many of the recent federal industrial policy programs were enacted, Texas is responsible for more than $289 billion, amounting to 16.5 percent of the value of total US nonresidential and nonbuilding construction contracts." |

No comments:

Post a Comment