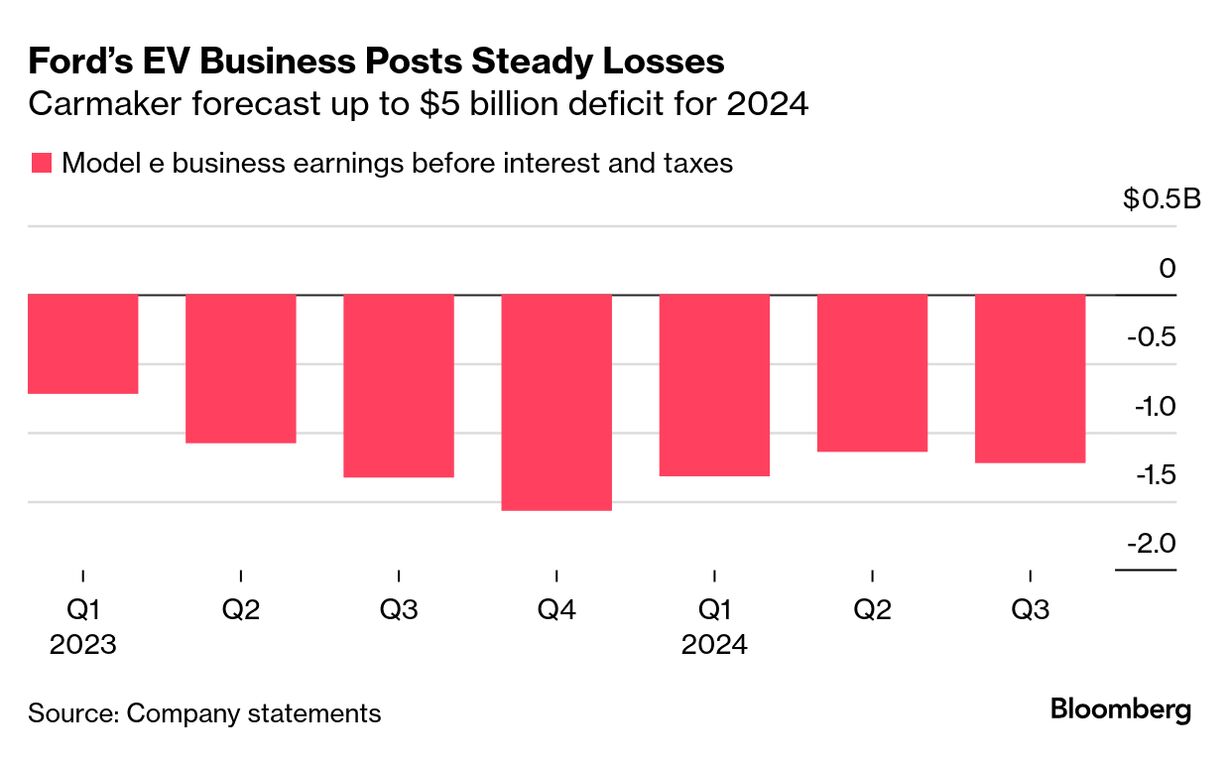

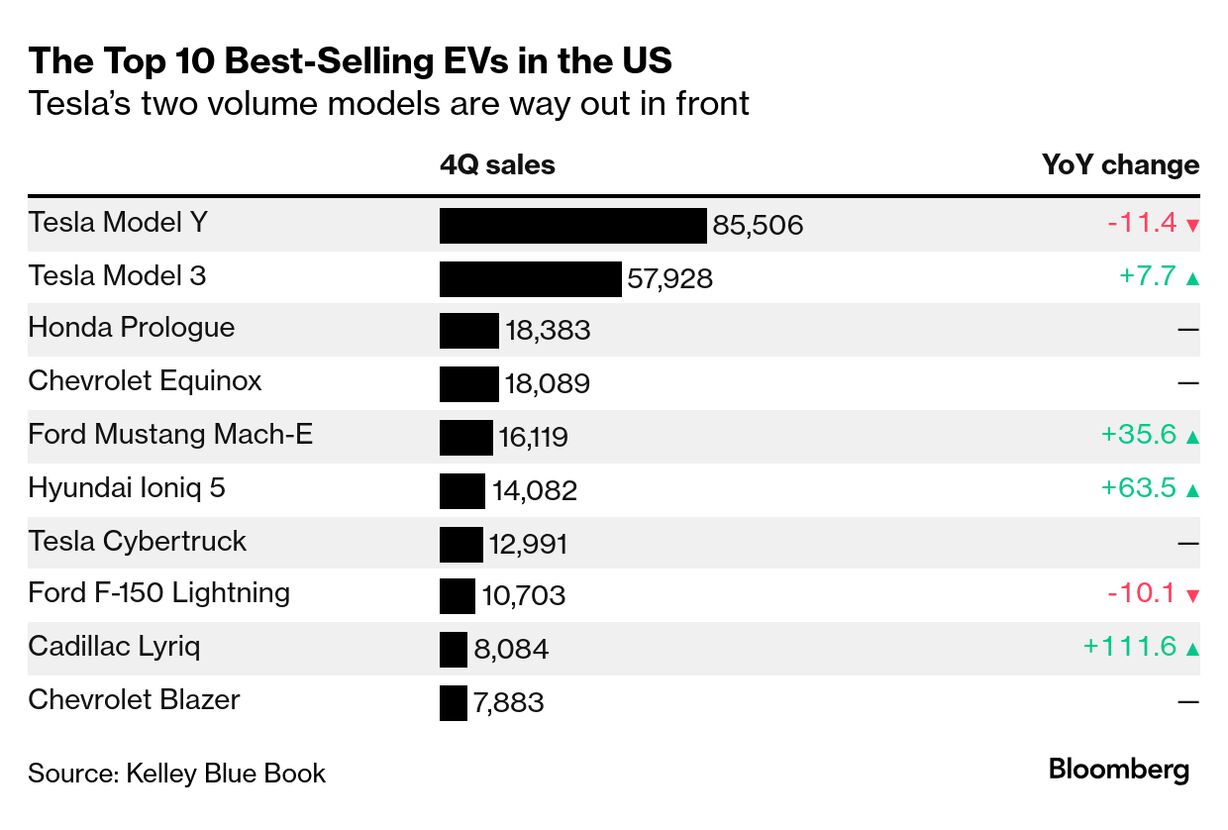

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Just a year ago, Jesse Acosta fell in love with the smoothness and speed of his new Ford F-150 Lightning, an electric version of Ford's best-selling truck. Now, he wants to get rid of it. The Lightning's stated range is 230 miles (370 kilometers), but Acosta has a hard time achieving that. As soon as he starts climbing through the mountains on the 130-mile trip from Fresno to his parents' place in Capitola, the load on the battery depletes the range until it's down to 40 miles of power. Though he's never been stranded, the fear of running out of juice spoils every trip. "I've had it for a year, and the one thing you can't discount is just how nerve-racking it is," Acosta, 41, said.  Jesse Acosta and his wife, Lei, outside their Ford F-150 Lightning electric pickup. Photographer: Jennifer Emerling/Bloomberg The EV market has turned as mainstream car buyers balk at high prices and spotty charging infrastructure. While the global slowdown hit every automaker, it's left Ford especially vulnerable because the company has no new EV models coming for more than two years. Ford abandoned plans to build 2 million electric vehicles by 2026, along with any near-term hope of earning a return on the tens of billions of dollars it's poured into developing battery-powered models. It will take years to execute on a strategy that could make Ford more competitive, and President Donald Trump may make that task more difficult. He's threatened to impose 25% tariffs on goods from Mexico, where Ford builds its Mustang Mach-E, and to strike a $7,500 consumer tax credit that helps dealers sell battery-powered cars. "Ford has stalled," said David Whiston, an analyst with Morningstar, who rates the stock the equivalent of a buy. "For the next couple years, it's probably going to be pretty ugly for them on the EV side." Ford is expected to give a forecast on its EV losses and overall business when it posts fourth-quarter results later today. CEO Jim Farley made what he called a "tremendous pivot" in August when he scrapped plans for a big, three-row electric sport utility vehicle — a model he earlier said would sidestep competition from Tesla and BYD. Ford determined it had no path to profitability because it would have to be high-priced to cover the cost of its big battery. By then, increasingly reluctant American EV buyers had shown "no willingness to pay a premium" for a battery-powered car over a traditional gas-fueled model, he said in an interview at the time. The move cost Ford around $1.9 billion. "We are working very hard on EV affordability, because I think that will be the catalyst for much wider adoption," Bill Ford, the company's executive chair and great-grandson of founder Henry Ford, told reporters at the Detroit auto show on Jan. 9. Farley now has the company's electric ambitions riding on two key plays. To better compete on price, a former Tesla executive and a small "skunkworks" team of Ford engineers and designers in California are developing a line of small EVs starting under $30,000. And to ease drivers' charging anxieties, Farley revealed in early January that Ford is engineering the base technology for extended-range electric vehicles, or EREVs. Those plug-in hybrids can lengthen a vehicle's driving distance to as much as 700 miles by adding a small internal combustion engine that doesn't drive the wheels and only acts as an onboard generator to recharge the battery. EREVs have become very popular in China, the world's largest market for battery-powered cars, and Farley was wowed by the technology during a visit there with his executives last spring. Ford plans to offer EREV versions of its SUVs, crossovers and Super Duty pickup, its most popular and profitable vehicles, according to people familiar with its plans. No automakers currently offer EREVs for sale in the US, but that will change soon. Stellantis will be the first to offer one later this year with its Ram 1500 Ramcharger. Volkswagen's new battery-powered Scout line of SUVs and trucks is slated to debut EREV versions in 2027. The problem is, neither Ford's lower-cost EVs nor its EREVs will arrive before 2027, according to the people with knowledge of its plans. That leaves the automaker with a pipeline empty of new offerings during a period when Ford Vice Chair John Lawler says 150 new plug-in models will flood the US market by 2026. General Motors already overtook Ford in EV sales in the second half of 2024, and Tesla's Cybertruck is now outselling the Lightning. In the short term, Ford is stuck with an aging EV lineup that it's struggling to make more competitive by slashing the cost to build them, repeatedly cutting prices and pausing production to reduce inventory. "It's going to be two years out before we see something that's affordable from Ford. I mean, how much cost can they strip out of a Mach-E to try to push that lower in the price range?" said Ivan Drury, a senior analyst for Edmunds. "The tables have turned against them." Ford is hoping it can lure car buyers in the meantime by adding new features to its existing EVs, such as a sporty rally version of the Mach-E it rolled out last year. A heat pump it's adding this year will extend battery life in cold climates, Marin Gjaja, head of Ford's EV unit Model e, said in an interview. "We are always looking for improvements and getting unnecessary costs out," Gjaja said. "The rate of competitive change means we can't sit still, we've got to keep grinding on this." The automaker is scaling back Blue Oval City, the massive manufacturing complex it is building in rural Stanton, Tennessee, near Memphis. That facility now will produce fewer than 100,000 electric F-Series trucks annually when it comes online in 2027, instead of the 300,000 previously planned, according to people familiar with the details. In the future, it could be modified to build EREVs, Gjaja said. "We have flexibility to create plants that can do different things," he said. Gjaja said Ford expects to command premium prices for the next-generation electric F-Series pickup, which many drivers use as a work truck. He says the company is counting on unspecified breakthroughs in battery technology to lower costs and make the model profitable. Acosta, the Lightning owner, needs a truck that can reliably transport the clothing accessories his wife sells through her retail business at street fairs. That's why he's anxious to replace his battery-powered pickup with a gas-guzzling Ford Super Duty. "We are looking at getting a trailer for my wife's business and there's just no way because that would cut the range in half," he said. "I absolutely would never go full EV again."  Photographer: NurPhoto/NurPhoto Honda and Nissan called into question an agreement reached less than two months ago to consider combining, casting doubt on their efforts to form one of the world's largest automakers. The pair are discussing various options, including the possibility of withdrawing from deal talks, according to separate statements issued Wednesday. The companies were responding to an earlier Nikkei newspaper report that said Nissan will pull out of an agreement with Honda because the two sides are unable to agree on terms.  A Cruise autonomous taxi navigating San Francisco in August 2023. Photographer: Bloomberg/Bloomberg General Motors is cutting almost half the workforce at its Cruise unit, according to an internal memo and people familiar with the matter, as part of previously announced plans to cease robotaxi services. Several of Cruise's leaders, including CEO Marc Whitten, will leave this week in the overhaul, the company revealed Tuesday in an email to employees sent by President Craig Glidden. The total staff reductions amount to about 1,000 positions, said the people, who asked not to be identified discussing private matters. |

No comments:

Post a Comment