| With Donald Trump unleashing chaos around the world, the EU is playing a delicate game of power politics. |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. With Donald Trump unleashing chaos around the world, the EU is playing a delicate game of international power politics. To counterbalance the growing importance of China, we're told that the European Commission is pursuing closer security cooperation with India — and that the EU's executive arm has an official visit to the country planned for Feb. 28. At the same time, Commission President Ursula von der Leyen is making overtures to Beijing about exploring deeper trade and investment ties. Still, even as Brussels is keeping its options open, it also isn't looking for a fight with the US. The EU is ready to pursue any discussions with Trump in order to avoid damaging the bilateral relationship, which, as Commissioner Maros Sefcovic put it, the bloc sees as "the most important artery of global trade." —Jorge Valero Germany Votes | Join Bloomberg Television for a special live panel discussion at 10 a.m. CET with Commerzbank CEO Bettina Orlopp, RWE CEO Markus Krebber and Bilfinger CEO Thomas Schulz as part of the "German Election Broadcast Special: Perspectives from Business & Finance." Watch it here. | |

| |

| Freeze Frame | US allies expect Keith Kellogg, Trump's special envoy to Russia and Ukraine, to present the plan to end Russia's war on Ukraine at the Munich Security Conference next week, we're told. Some options that may be on the table include freezing the conflict and leaving territory occupied by Russian forces in limbo while providing Ukraine with security guarantees. Still Here | French Prime Minister Francois Bayrou survived two no-confidence motions yesterday, assuring the adoption of a 2025 budget following months of political turmoil. The premier used a special constitutional provision to force the budget through parliament without a vote, triggering the motion. Bank Check | Germany, France and Italy are asking other EU member states to join their call to launch an "ad hoc" review of the bloc's banking competitiveness by the end of this quarter, we're told. The review could result in options that would help lenders compete with huge American rivals. US Withdrawal | With a climate change skeptic now in the White House, the future of multi-billion-dollar green energy projects around the world have suddenly been cast into doubt. European nations have signaled their commitment to keeping up so-called Just Energy Transition Partnerships in Indonesia, Vietnam and South Africa, but it's unclear whether they'll be willing to fill the financial hole left by Washington. | |

| |

| Say Nothing | Business figures and unionist lawmakers in Northern Ireland are increasingly concerned about getting caught in a tit-for-tat fight if Trump slaps tariffs on the EU, we're told. As part of the so-called Windsor Framework — and by virtue of sharing a border with Ireland — the region is de-facto part of the bloc's customs union. Bitcoin Scrutiny | The Czech Republic's central bank chief has given little indication that he's moved by blunt scrutiny of his proposal to to invest a portion of the country's reserves into Bitcoin. The ECB took a notably dim view. Instead, Ales Michl told us he views it as a debate on how monetary policymakers should adapt to sweeping technological change. Maritime Safety | Denmark will ramp up inspections of older ships transporting Russian oil through its narrow straits. The move represents a significant change as Denmark has long maintained that it wouldn't interfere with Russian vessels due to a free passage treaty from 1857. Slow Deployment | EU member states are failing to improve their ability to quickly deploy armed forces, the bloc's court of auditors said. The EU budget now includes €1.7 billion in funding for military and civilian transport infrastructure, which will last until 2027. America First | The share of US travelers planning a European vacation has dropped from 45% in 2024 to 37% in 2025 — the lowest level since 2021, according to a report. The main reason given is the cost, followed by a preference for domestic travel. | |

| |

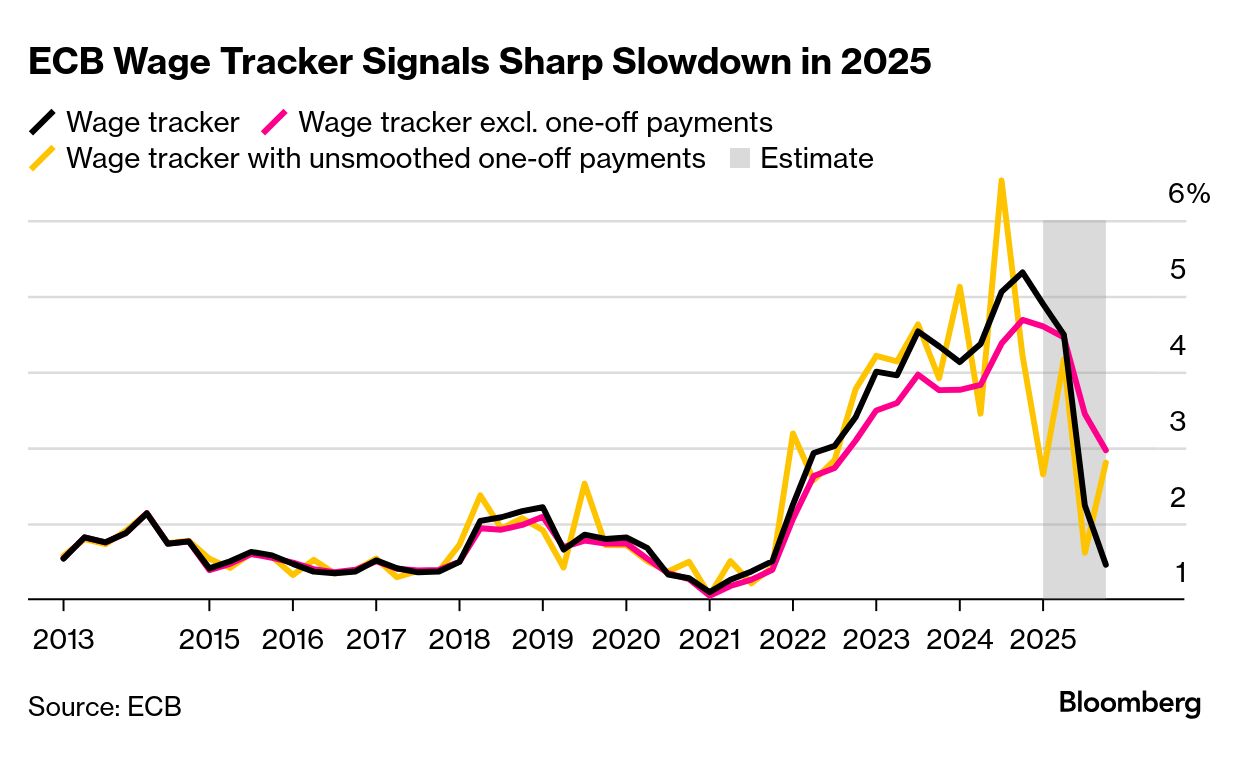

| The ECB tracker of future euro-zone pay growth continued to signal a sharp slowdown this year, cementing hopes for future interest-rate cuts. Salaries are estimated to rise by 1.5% in the fourth quarter of 2025, significantly down from the 5.3% peak recorded a year earlier, according to data published yesterday. The information came as the ECB plans to publish fresh estimates for the neutral rate on Friday — the level that neither limits nor stimulates the economy. | |

| |

| All times CET - 11:15 a.m. Climate and Tax Commissioner Wopke Hoekstra speaks on tax priorities at parliamentary panel

- College of Commissioners visit Gdansk for presidency trip (Feb. 6-7)

- EU Foreign Affairs Chief Kaja Kallas meets NATO Secretary-General Mark Rutte, ICC President Tomoko Akana

- Trade Commissioner Maros Sefcovic meets representatives of the EU Chamber of Commerce in China

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment