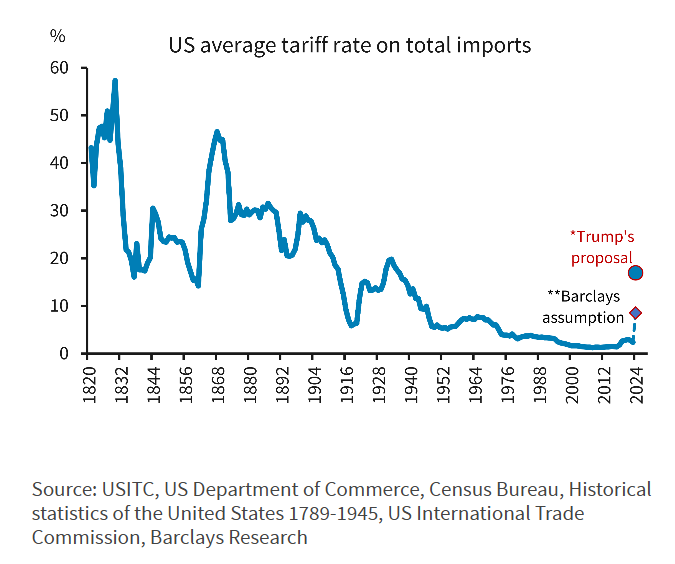

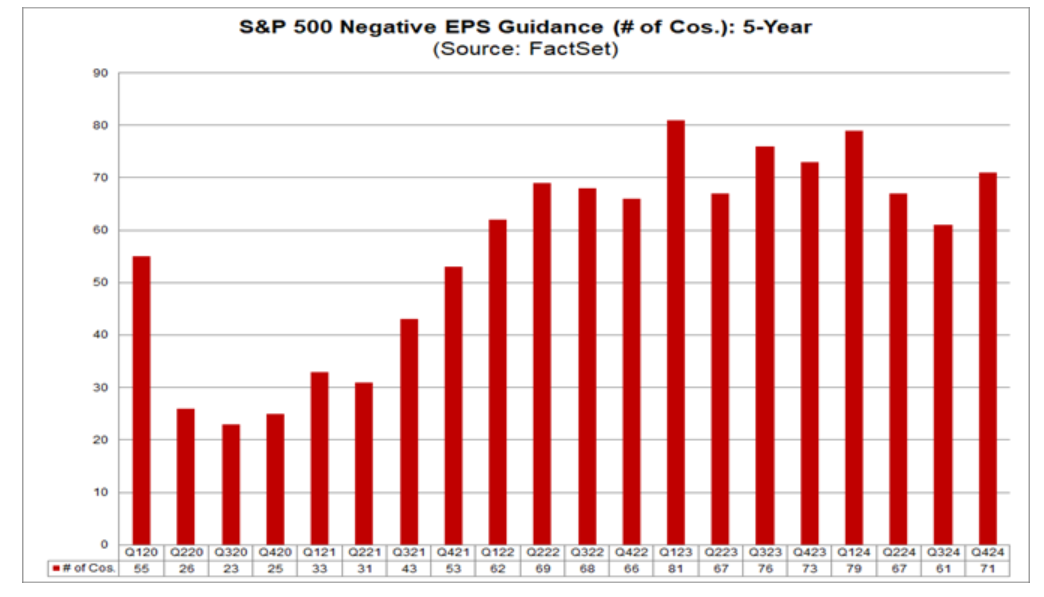

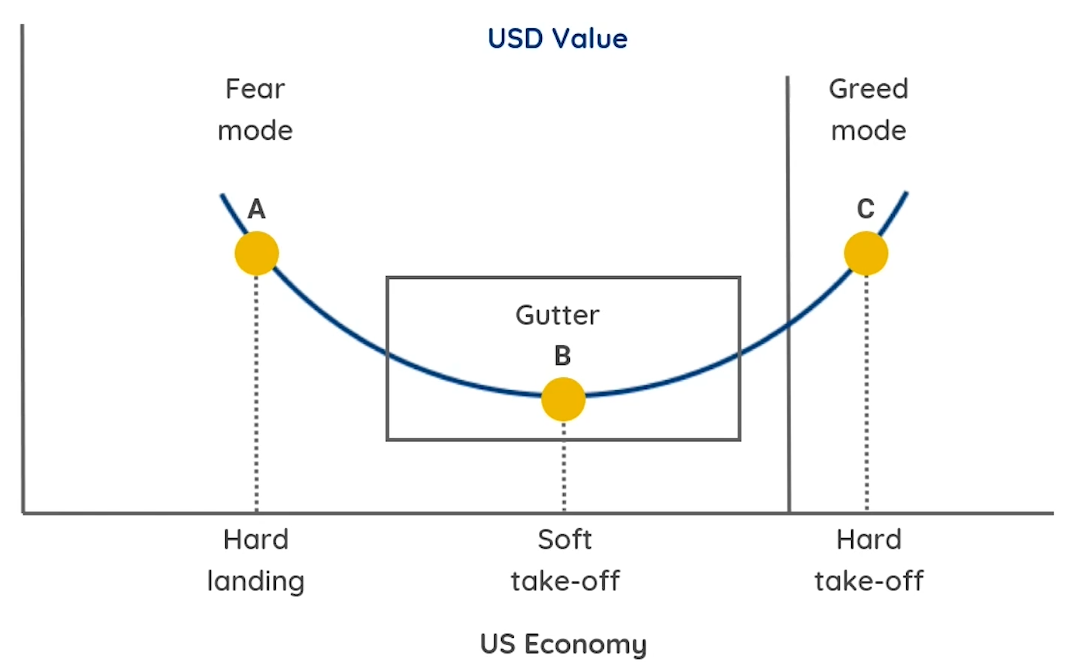

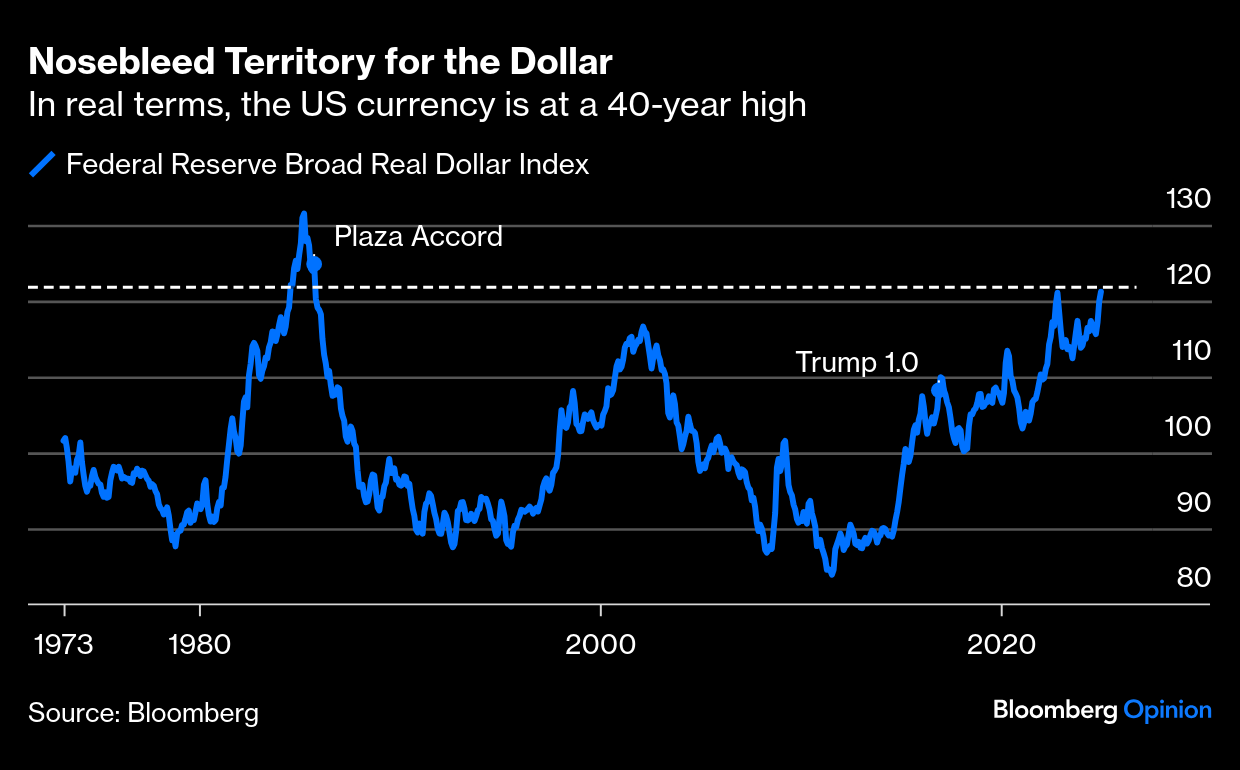

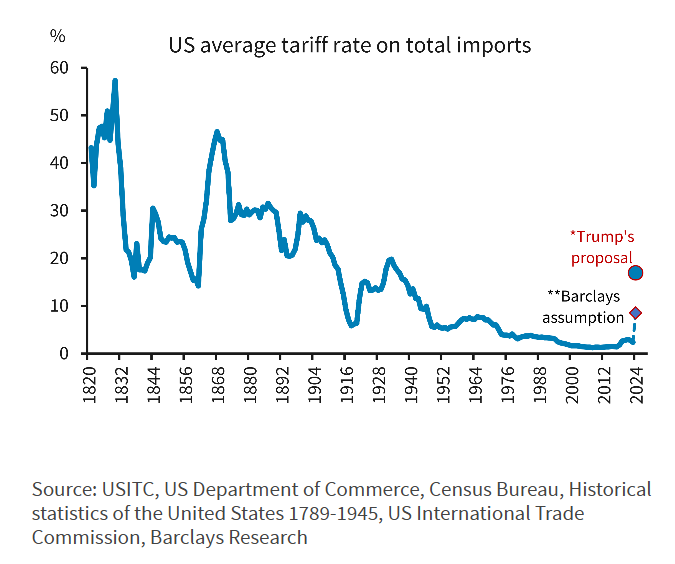

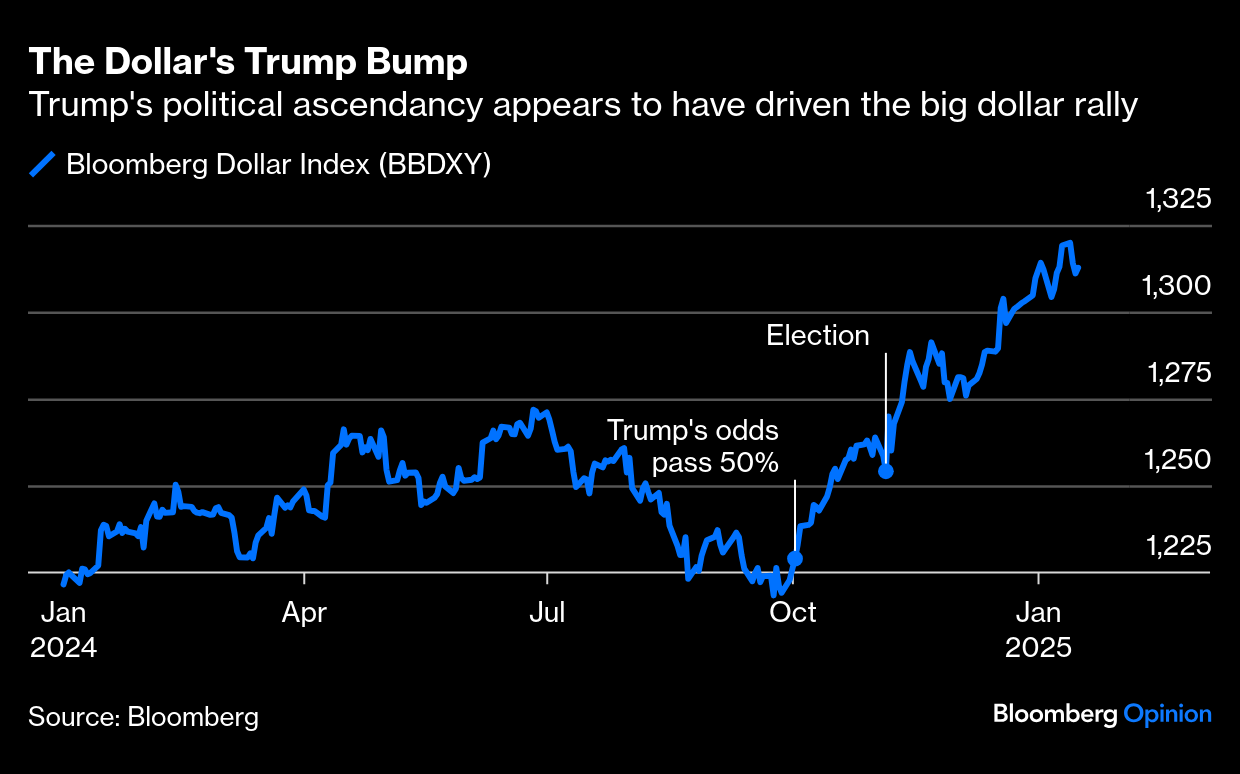

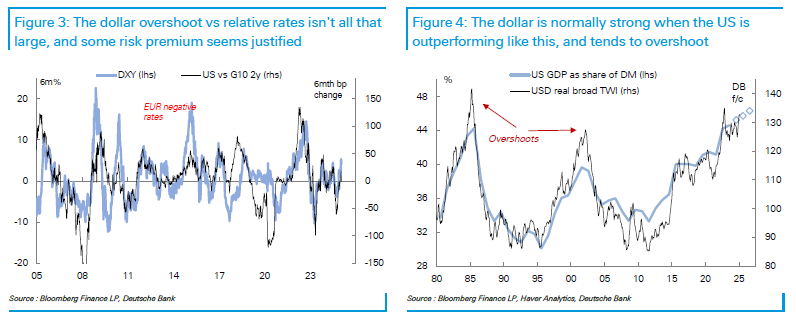

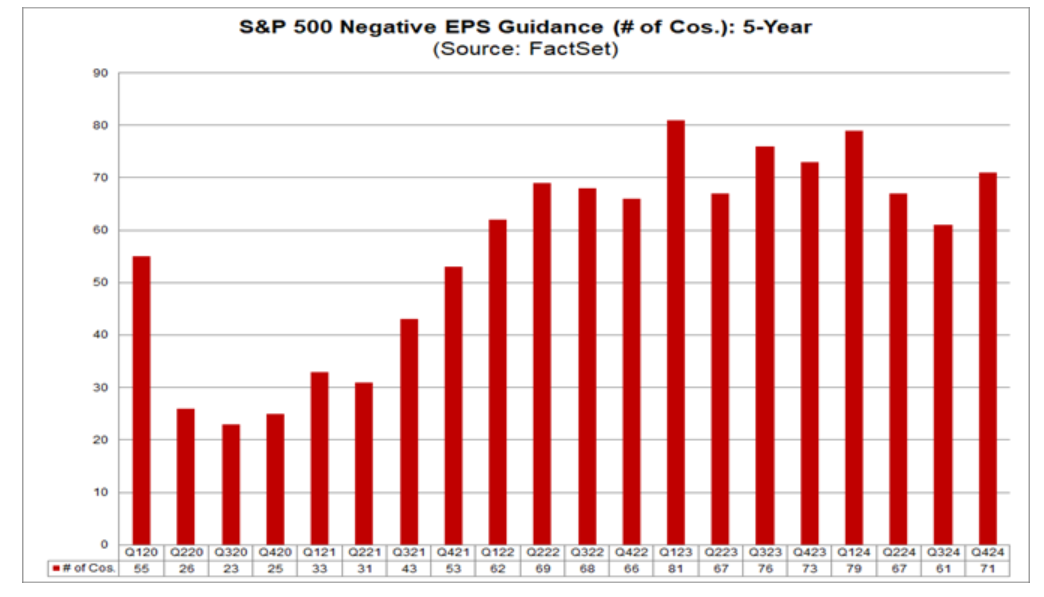

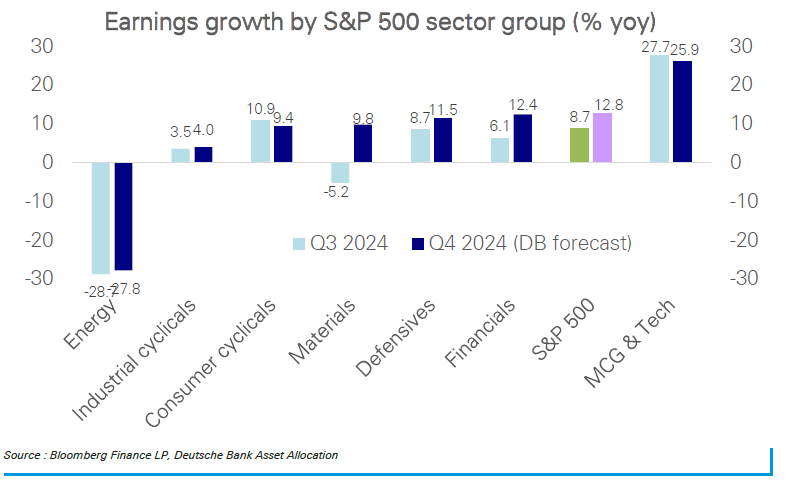

The Dollar's Trump Checklist | To many practical purposes, Donald Trump took over as US president two months ago. He's told us what he intends to do, and markets have adjusted accordingly. But only on Monday can he enact actual specific policies, and there is feverish speculation that it will instantly bring a raft of executive orders. In this last Points of Return before the second Trump era begins (the US has a long weekend to celebrate Martin Luther King Day, so markets will be closed on inauguration day), we offer this road map to the most important financial variable confronting him: the US dollar. The Smile The dollar moves with what the foreign exchange strategist Steven Li Jen described as a "smile." The model has gained wide currency in the decades since he promulgated it, and is illustrated with this diagram from the website of Jen's firm, Eurizon SLJ Capital: Because the dollar is a haven, it rises in times of trouble, even if the difficulties emanate from the US. It also gains when the US economy is booming. Its performance will be wishy-washy during "soft landings" when growth is unexceptional and nobody is that worried. This Goldilocks combination can be good for stocks and bonds, but for the dollar it's bad. A few months ago, the world was positioned for just such a meh outcome. Rates were falling as central banks looked likely to engineer a soft landing after the post-pandemic inflation. Then came the Trump victory, and data suggesting that the economy had far more puff than people had thought. Yields rose, as did the dollar. Much of the rest of the world, meanwhile, is terrified of what's to come. Perversely, the dollar seems to be at both ends of the smile. Strength at home has combined with a sharp increase in the perceived risks everywhere else. Precedents Recent history offers little guidance. Trump has taken office once before, but in very different circumstances. The dollar is far stronger now. The Fed's measure of the real, broad dollar, taking into account different rates of inflation, puts it at its strongest (and for the purposes of exporters least competitive) level in 40 years: When Trump took office eight years ago, the long-term bull market for Treasury bonds (meaning yields moved steadily downward) was in full swing. That is over. Comfortable assumptions that there is a lid on yields no longer apply. Traders working today, in bonds and forex, have no experience of a dollar this strong, or of rates that are steadily rising: And that's before Trump arrives and reveals exactly how he's going to go about levying tariffs. This matters because the secular trend toward ever lower barriers to trade has endured much longer even than the downward drift in bond yields. Some of Trump's pronouncements, if enacted, would reverse this in truly spectacular fashion. Even the more moderate and targeted tariffs that Wall Street currently expects would represent a historic shift. This chart from Barclays Plc, which we first published last year, indicates the scale of what now seems possible:  Another factor seemed new and temporary eight years ago but now is taking on some of the trappings of permanence. US and German yields traced each other very closely for years, but that changed with the euro zone crisis at the beginning of the last decade. Euro zone government yields dropped to zero and below as the European Central Bank promised to do "whatever it takes" to save the euro, and big differentials in favor of the US have steadily become the norm: Finally, inflation is higher than it was eight years ago, and has brought higher rates in its wake. And Trump 2.0, with four years to prepare a detailed plan, may well be far more focused and consistent than the first version, so the comparison may not in any case be that helpful. Put all of this together, and both sides of the smile are working. Risks are high, particularly outside the US, and that prompts flows into the dollar; but those risks seem to be skewed to the upside, so good news for the US is also pushing up the currency. It's never possible to prove causation, but the dollar's rally overlaps almost perfectly with his improving political fortunes: What Next? No foreign exchange strategist disagrees that tariffs will be dollar-positive to an extent. The currency market will move to counteract them, because that's what it does. But there's still room for intense disagreement over how far this will go, and whether raised tariffs are already in the price. Jonas Goltermann of Capital Economics says that "both economic theory and the experience during the 2018-19 US-China trade war suggest that an increase in US tariffs would, all else equal, result in a stronger dollar," while sharp dollar moves in response to press reports about tariffs in recent days confirm that it's having an effect. More Trump-aligned figures downplay tariffs and assert that inflation is still primarily about the Fed and monetary policy. Kevin Warsh, a former Fed governor often mentioned as a possible Trump nominee to replace Jerome Powell, opined in the Wall Street Journal that a 10% tariff increase "shouldn't be statistically significant" for inflation, and that the Fed should "look through" one-time price changes. Trump's nominee for Treasury secretary, Scott Bessent, told Congress on Thursday that for every 10% tariff increase, currency markets tended to move about 4% to readjust its impact. Dan Clifton of Strategas Research Partners commented that if this is true, "the Chinese yuan has moved almost identically to that 4% rate since the election and is close to pricing in the first 10% of tariffs." He added that that the fall for the euro since the election might also reflect tariffs. Certainly, the dollar's rally has come further than rate differentials on their own can explain. However, the foreign exchange market does tend to overshoot, particularly when the US is performing well, so Deutsche Bank argues that this is not necessarily surprising (and, therefore, that it may not be necessary to invoke tariffs to explain the rally to date): It's a fascinating picture where arguments on all sides are going to seem political. But as it stands, it's reasonable that uncertainty is elevated — and hence, given thesmile, that the dollar is also looking overvalued for now. If earnings season were a red carpet event, Wall Street's appearance would be grand and magnificent. The nation's biggest banks have already handily beaten expectations. But as with the dollar, it's very hard to separate politics from the debate over where earnings will go next. Serial optimists in Donald Trump's pro-growth agenda point to likely good results as the dawn of great things. But companies are actually trying to talk down expectations somewhat more than usual. FactSet notes that 106 S&P 500 companies have issued quarterly EPS guidance for the fourth quarter. Of these companies, 71 were negative — above both the five-year average of 56 and the 10-year average of 62:  Beyond the rise in negative guidance, the consensus still points to thoroughly robust S&P 500 earnings growth near double digits. Analysts at Deutsche are forecasting nearly 13% growth in the just-ended quarter, typical outside of recessions. This would mark the highest year-over-year growth rate since the fourth quarter of 2021 (at 31.4%) when the Fed was still holding rates effectively at zero. Global growth supports this, but low oil and commodity prices and the dominant US dollar, which tends to shrink multinationals' overseas earnings, are headwinds. Outside of energy, where earnings are expected to fall 28%, analysts forecast broad-based growth across sectors:

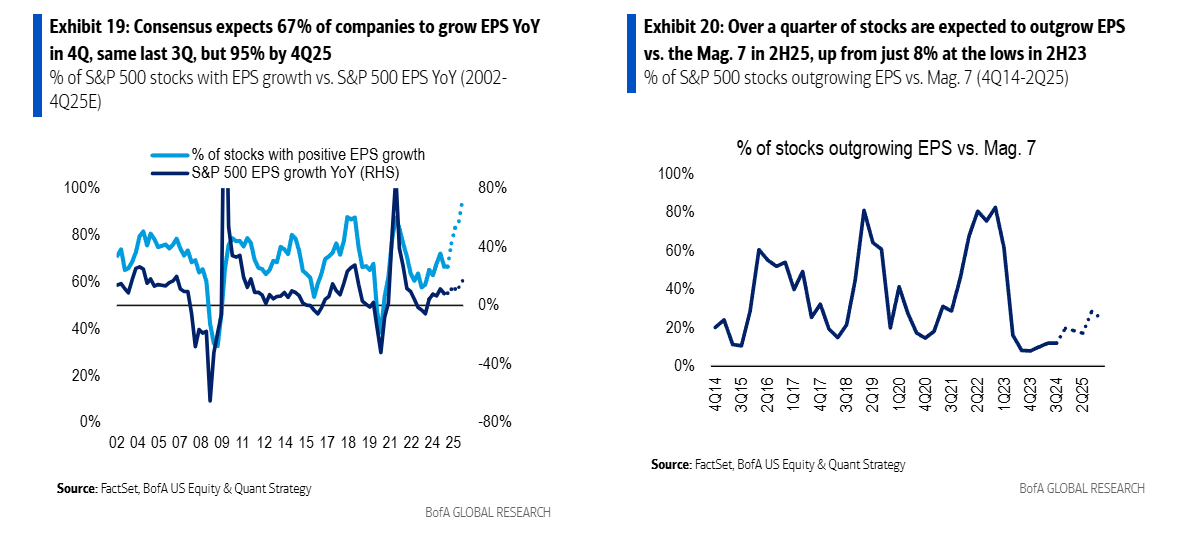

Thanks to companies' usual game of lowering expectations ahead of results, earnings will likely be far better than these forecasts. FactSet's analysis shows that the actual growth rate of S&P earnings has exceeded the Street's final estimates in 37 of the past 40 quarters. The only exceptions were the pandemic-hit first quarter of 2020, and the last two quarters of 2022 when the Fed's rate-hiking regime got into high gear. On average, the earnings growth rate has come in by 5.4 percentage points ahead of expectations.

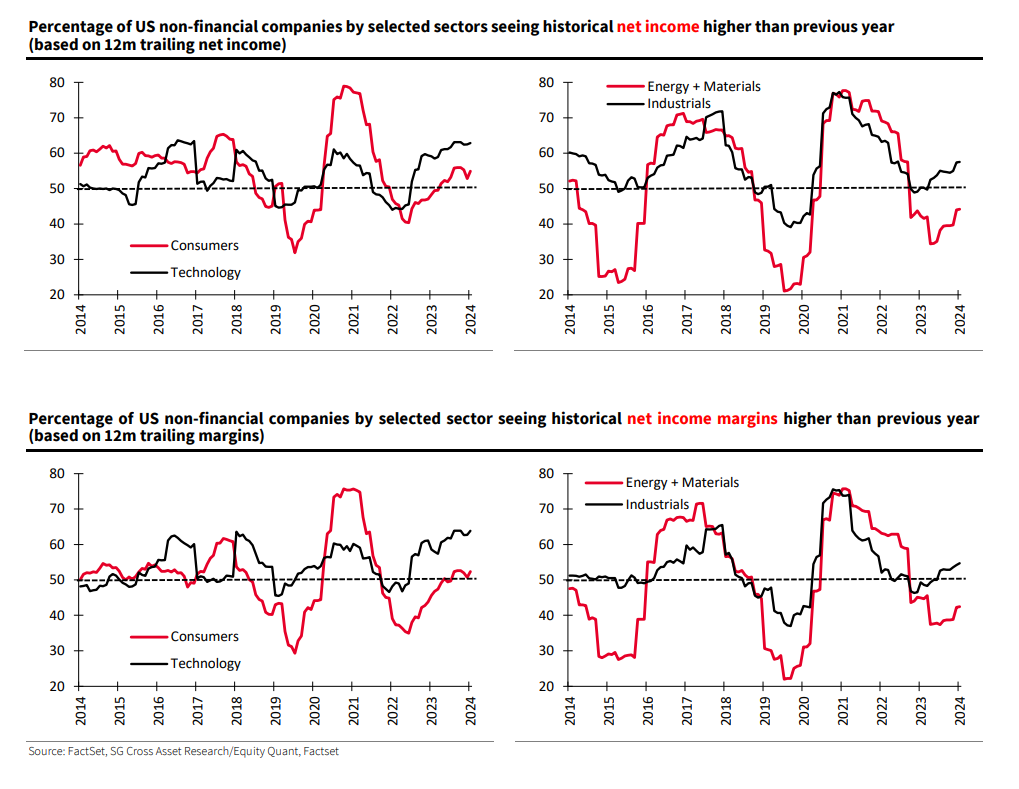

Even if earnings growth is a virtual certainty, the more difficult task is for companies to back up the post-election optimism. In particular, can the Other 493 (the S&P 500 excluding the Magnificent Seven tech platforms) start to improve on their fundamentals? As shown in this Societe Generale chart, technology has done far better than other sectors in juicing both profits and markets, so this is a big task ahead: Still, that's not an insurmountable task for the Other 493, providing the economy recovers on cue. Bank of America's analysts predict an improvement in the fundamentals in 2025 driven by a cyclical rebound in manufacturing. With half of S&P earnings tied to manufacturing, that should lead to volume growth, driving better operating leverage and margins: Some of this is about animal spirits. A consumer splurge post-election is expected to boost retail earnings. And much depends, of course, on the exact policy mix chosen by Trump, and whether it has the desired effect of reviving US manufacturing. BofA's Ohsung Kwon and Savita Subramanian see corporates unleashing capex, while tariffs provide additional wind in manufacturing's sails: We believe tariffs are initially positive, driving demand pull-forward and potentially igniting a restocking cycle. Companies so far cited they're better positioned to mitigate the impact this time compared to 2018 for two reasons: 1) China exposure has been reduced by over a third, and 2) tariffs never went away (current effective tariff on China: 20%).

If CEOs repeat that story in their earnings calls over the next few weeks, they might help to boost the stock market more than any policy that emanates from the White House. —Richard Abbey To celebrate Martin Luther King Day weekend, you could watch this or this or this. He had a rare ability to inspire. And there's also celebratory music from Stevie Wonder, U2, Nina Simone, OMD and Aretha Franklin. Have a great weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment