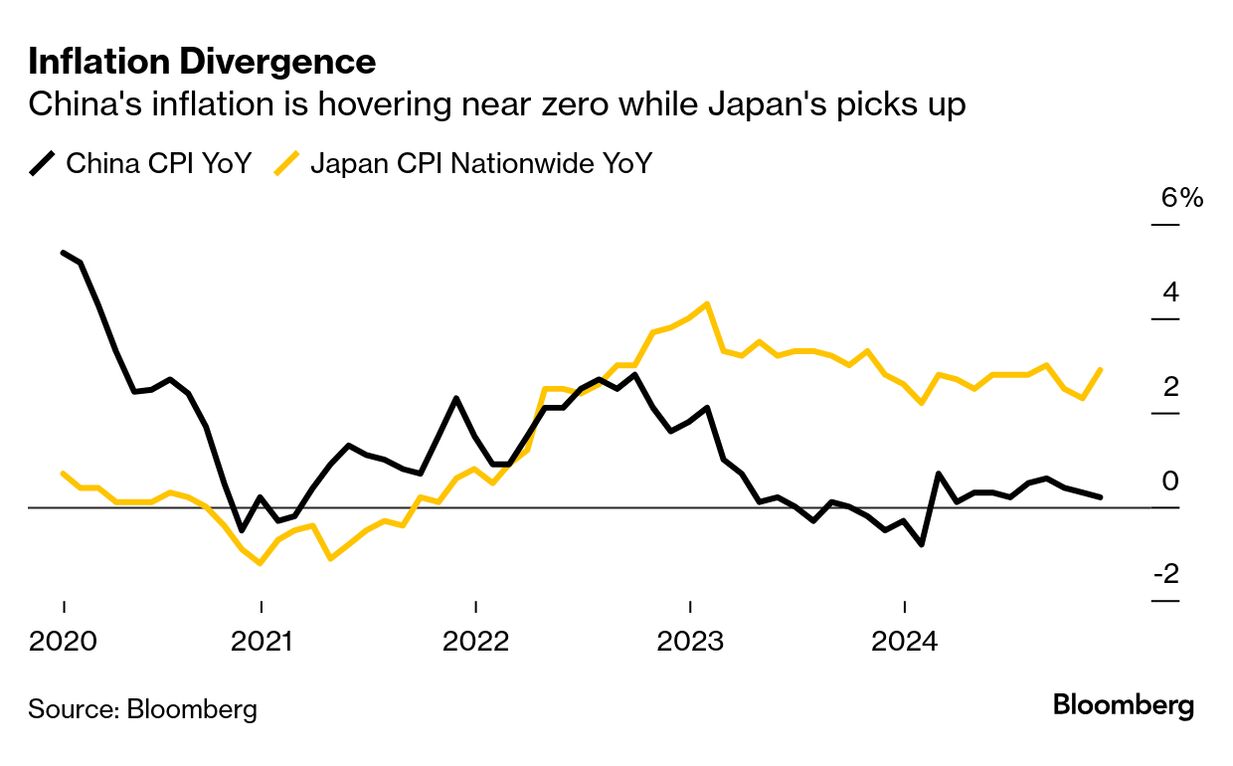

| Hi, this is Colum Murphy in Beijing, where like many others I was surprised this week that one of my favorite Chinese social media apps was invaded by … Americans? Xiaohongshu, which Americans are calling RedNote, took off in popularity because the US's top court indicated it was likely to uphold a law that would ban the TikTok social media app. Read our story about the craze here. That news overshadowed another TikTok surprise this week, namely that Chinese officials are at least thinking about having Elon Musk acquire the US operations of the short video app if the company fails to fend off a ban. Anyway, in the interim the total downloads of Xiaohongshu in the US surged, sending it to the top of the iPhone download charts.  The logo for the Xiaohongshu app, newly popular with Americans. Photographer: Raul Ariano/Bloomberg That was partly because Chinese companies make fabulous video apps and partly out of a bit of good old-fashioned American defiance of the government, which is worried about China collecting vast amounts of data from TikTok and using the app to influence people in the US. "I heard we were all mobbin' over here to show Uncle Sam how bratty we can be," a user named Sierra wrote in her first post on the RedNote. Read about the app Sierra and others like so much here. The interactions between Chinese and Americans were mostly good natured. People from China suffering from sliding wages asked about pay in the US. The TikTok "refugees," as some have referred to the Americans, asked if Chinese students also had to pledge allegiance to their flag. The episode was remarkable for the rare opportunity it afforded people from the two nations to interact with each other without their governments and politics getting in the way. Part of the reason for that is China banned American social media platforms including X and Facebook, and there are few foreigners on Weibo and the like. At the same time, fewer Americans are studying in China than in years past and travel between the two sides hasn't gotten back to what it was before the pandemic. Chinese leader Xi Jinping promised a while back to bring 50,000 US students to his nation to help repair ties with the US but how long he'll let the freewheeling discussions on RedNote last is unclear. Not long, going by precedent set by his government. Back in 2021, use of the American audio app Clubhouse took off in China. Thousands of people joined discussions on contentious subjects such as the Chinese government's activities in Xinjiang and were initially left alone by Beijing's censors. Then the ruling Communist Party stepped in because it is always fearful about its people getting ideas that aren't filtered though its state media and censorship complexes and because there are some topics it doesn't want widely discussed, lest that leads to movements challenging its control. Read an opinion piece that also expresses skepticism about the Xiaohongshu Spring here. China eventually blocked access to Clubhouse, meaning it was only available to the few people who took the illegal – and often laborious – step of using virtual private networks to get over the Great Firewall. For now, the new arrivals to Xiaohongshu were, like all good guests, pretty well-behaved. Yet there was just a hint of trouble brewing. "Is it ok for us to be gay on here?" asked one American, apparently aware of the party's dim view of LGBTQ rights. Chinese users suggested their new American friends steer clear of politics. What We're Reading, Listening to and Watching: The term "Japanification" has been used a lot recently to describe the mounting signs that China is starting to resemble its Asian neighbor during decades of economic stagnation that started around 1990. There's lingering deflationary pressure, slowing manufacturing activity and slumping stocks. Oh, and the bond market is giving the world a huge hint that China may be on the cusp of a prolonged malaise similar to Japan's "lost decades." Read our Big Take on that here and a story about the deflation situation in China here. Investors have been piling into China's $11 trillion government bond market, sending yields on sovereign notes to all-time lows, in the belief that authorities will need to keep interest rates low to support the economy. Bearishness over the world's second-biggest economy has also been hammering the yuan. Some of that pessimism eased on Friday, when China said that it met its 2024 growth target of 5%.  Unfinished residential buildings in Liaoning province. Photographer: Andrea Verdelli/Bloomberg There are some other similarities between Japan's boom-and-bust cycle in the 1990s and again in the 2000s, and present-day China. There's a rapidly aging (and shrinking) population and a property slump that has whacked consumer sentiment so hard that the government has had to cut interest rates and signal stimulus is coming to get people to spend again, to little effect. There are key differences, too. Japan was an advanced economy when its troubles began. China is pretty firmly a middle-income nation, which is both good and bad for Beijing. A lower economic base may mean the country has more room to grow. China of 2025 is also more dynamic in some ways than Japan of 1990, with a range of big industries it dominates, such as electric vehicles and shipbuilding. There's also some optimism that assertive decision-makers in Beijing can fix their problems by force of will. Yet a shrinking population worries Chinese policymakers, who fear the nation will get old before it gets rich. Richard Koo, an economist well-known for drawing parallels between Japan and China, says that the malaise can only cured by the government borrowing money and then spending it. "Borrow, baby, borrow" isn't exactly a phrase seen on a lot of bumper stickers in Beijing these days. Still, top officials have said boosting domestic demand is a top priority this year. It took decades for Japan's economy to escape the deflationary spiral and for the stock market to recover its record high. In the meantime, the world gave up on the Land of the Rising Sun as a major growth driver. Japan does seem to be finally regaining its mojo. People are more willing to spend as the economy normalizes, with salaries and interest rates rising and deflation looking more like a thing of the past. At a recent annual new year party for Japanese corporate leaders in Tokyo, many CEOs fairly brimmed with confidence, citing large cash piles, little concern about debt and optimism about the economy for 2025. That's a far cry from the vibe in Beijing. We'll see how long it takes for that to change. |

No comments:

Post a Comment