| The incoming Trump administration is weighing a carrot-and stick approach to ending the war in Ukraine. It could either ease Russian sanctions, or ramp them up. |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The incoming Trump administration is considering two options to try to bring the Ukraine war to a swift end, in line with the US president-elect's campaign pledge. One involves some good-faith measures, like easing some of outgoing President Joe Biden's tough sanctions on Russian oil producers, potentially helping seal a peace deal. The other, we hear, involves ramping up those sanctions even further. It remains to be seen which one the president will choose, but strategy discussions involving both Biden and Trump officials are taking place, and some think tanks are being consulted. Trump has said a meeting with Russian President Vladimir Putin is being arranged, indicating that near-term negotiations to end the war may well be in the cards. — Saim Saeed Live From Davos | Get the Economics Daily newsletter for full on-the-ground coverage of the World Economic Forum. | |

| |

| Auto Warning | The EU's flagship decarbonization strategy needs a "reality check," according to Mercedes CEO Ola Källenius. In a letter to EU leaders, Källenius, who now leads the EU's main car lobby, warned that the stiff fines the bloc's automakers will likely pay for high carbon emissions would be better spent on innovation and investment. Amid flagging electric car sales, Europe's automakers are likely to miss this year's fleet emissions targets and trigger penalties. Pressing On | EU competition chief Teresa Ribera promised that the commission's probes into US tech firms won't go away, even as those firms appeal to the incoming Trump administration for support. There will be "no freezing" and "no reassessments" under the bloc's rules, she said. Meta chief Mark Zuckerberg has labeled EU antitrust fines as "almost a tariff." Falling Short | The EU's green bond program won't abide by its own rules for environmentally-friendly debt. That's a blow for proponents of the EU label, which lawmakers touted as a "gold standard" that would help stamp out greenwashing in the burgeoning market. But the stringent criteria are deterring bond issuers currently abiding by industry guidelines. The decision could slow uptake of the standard. Campaign Season | The stakes are high as Germany's parties campaign for votes in next month's snap election. Chancellor Olaf Scholz has the most to lose if the Social Democrats fall short as expected. The Christian Democratic Union-led conservatives under Friedrich Merz have a big lead in the polls, ahead of the far-right Alternative for Germany (whose co-leader is attending Trump's inauguration on Monday). Read our detailed overview of the party platforms here. | |

| |

| Changing Tone | Reform UK leader Nigel Farage said his party isn't anti-immigration and advocated a mixture of tax and spending cuts, seeking to put a more moderate face on his insurgent political movement in a bid to take it from the fringes to challenge for power. In an interview with our UK Politics Podcast, Farage repeated his offer to help Prime Minister Keir Starmer's Labour government in its relations with the incoming Trump administration. Additional Easing | European Central Bank officials judged that interest rates could be cut further if consumer prices develop in line with expectations, according to an account of their most-recent policy decision. The ECB is two weeks away from what's widely expected to be the fifth rate cut of this easing cycle. Still Alive | Prime Minister Francois Bayrou survived his first no-confidence motion in France's fractious parliament after the far right and Socialists abstained. If the center-left's partial backing endures, Bayrou stands a greater chance of passing a budget and surviving additional censure motions in the coming weeks. Budget Minister Amelie de Montchalin said she plans to limit temporary levies on companies to one year and will instead focus on taxing the rich. Power Play | Two of Italy's most prominent billionaire clans — the Del Vecchios and construction tycoon Francesco Gaetano Caltagirone — are emerging as key power brokers in the biggest reshaping of the country's banking sector for more than a decade. The two clans are positioning themselves to exert influence in any deal involving Monte dei Paschi, the once-troubled bank in which both have substantial stakes. | |

| |

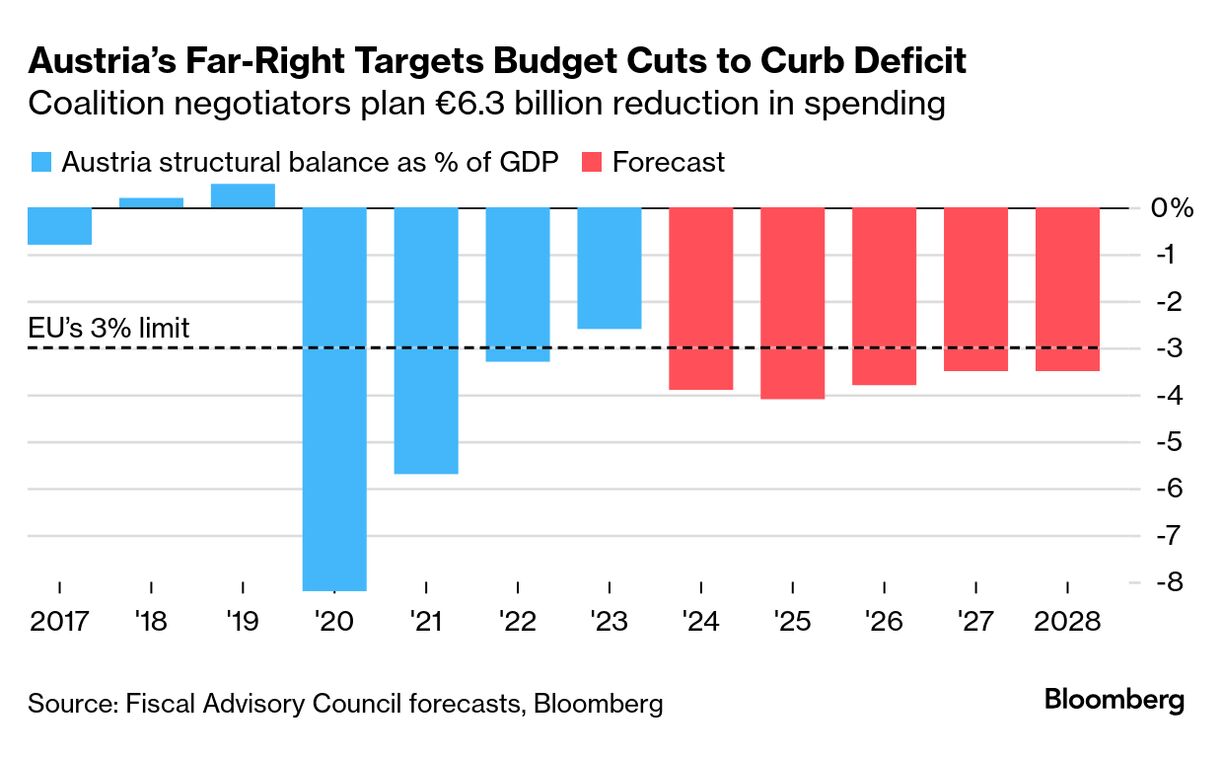

| The new far right-led Austrian coalition is proposing to cut €1.6 billion of payouts compensating households for a carbon tax, and slash about €500 million in subsidies introduced to promote emissions-free technologies. Tax incentives for electric vehicles and solar panels would also end. The proposed cuts are part of a €6.4-billion savings program meant to avoid an EU reprimand for an excessive deficit. | |

| |

- 11 a.m. German Chancellor Olaf Scholz, Swedish Prime Minister Ulf Kristersson news conference after talks in Berlin

- EU foreign affairs chief Kaja Kallas meets Palestinian Prime Minister Mohammad Mustafa

- EU Trade Commissioner Maros Sefcovic, EU Budget Commissioner Piotr Serafin meet EBRD President Odile Renaud-Basso

- EU Commissioner for International Partnerships Jozef Sikela meets Angolan President Joao Lourenco

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment