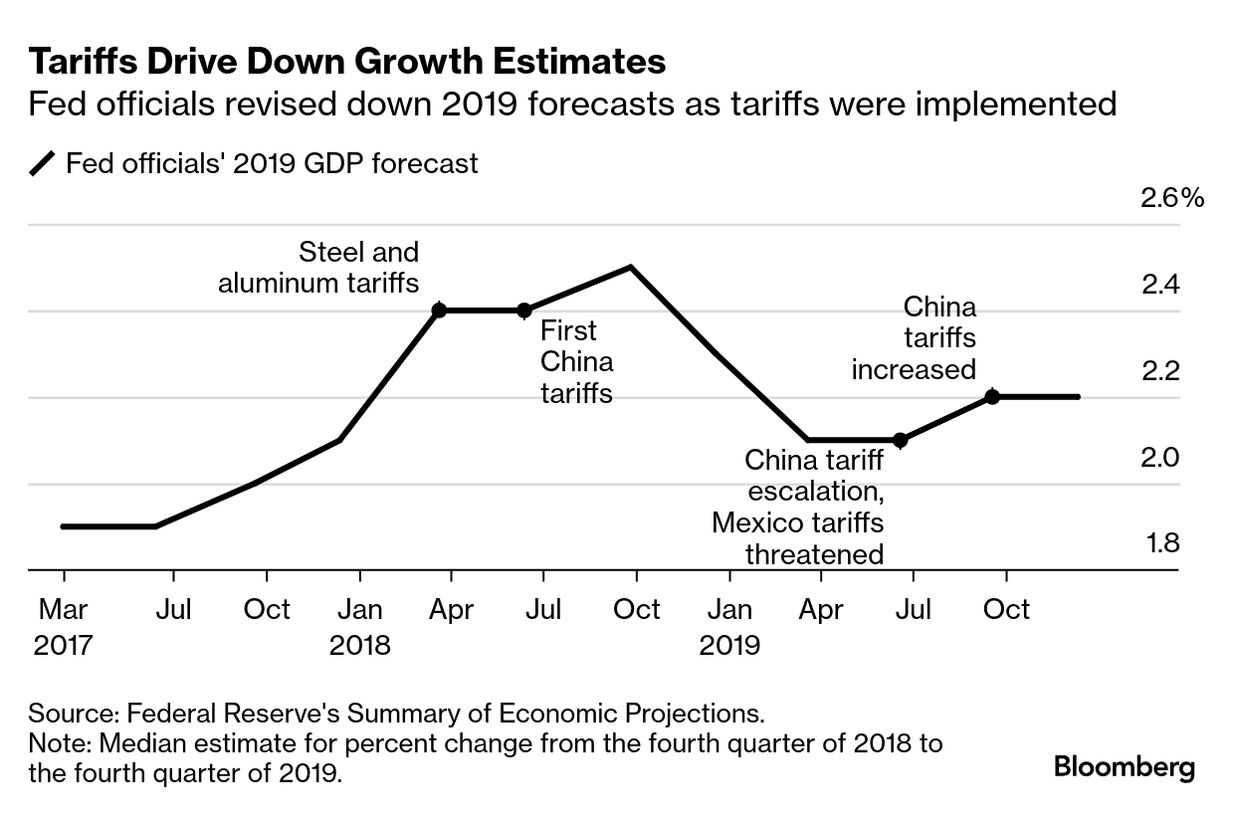

| Federal Reserve policy makers finish a two-day meeting today, wrapping up their first gathering under a second term of President Donald Trump that's already spreading uncertainty through America's heartland and across the world about US trade policy. "It changes by the hour," Michael Speetzen, the CEO of Minnesota-based off-road vehicle maker Polaris, said on a conference call Tuesday when asked about tariff discussions in Washington. "There's no telling where things could go." It's amid that sort of confusion that the Fed is trying to decide what to do next with benchmark borrowing costs. A written statement will be released at 2 p.m. in the US capital followed by a press conference by Chair Jerome Powell, whom Trump picked to replace Janet Yellen to lead the central bank in 2018. Powell will surely be asked about a new cloud over the outlook: the threat of US tariffs on imports from major trading partners and the retaliation that would follow. (Read our decision day guide here.) The livelier comments will be made behind closed doors, though the full discussion among members of the Federal Open Market Committee will stay a secret for five years. But a useful new reference for how the Fed reads an economy under the strain of regular tariff warnings and broader concerns about trade barriers emerged earlier this month in the transcripts from FOMC meetings in 2019. That was the last year before the pandemic and a peak period of strains between the US and China especially, but also Mexico, Canada and the European Union. Read More: Lutnick Pledges to Be Responsive to Business as Commerce Chief We scoured those 2019 transcripts and, as reported in today's Bloomberg Big Take, make the case that tariff threats and trade wars have consequences beyond faster inflation, a stronger dollar and higher interest rates. Trump's first-term trade policies were inhibiting economic growth, forcing manufacturers and other businesses to hold back on investments and hiring. And it wasn't just the companies directly in the crosshairs of Trump's higher import taxes that worried the Fed. "Even firms not directly exposed to the tariffs expressed concern that the renewed uncertainty will weigh on sentiment and investments," Cleveland Fed President Loretta Mester said at the June 2019 meeting. "Some contacts are beginning to reassess pending capital projects, and some smaller firms are holding off on acquiring financing for new projects because of the uncertainty surrounding trade policy and tariffs." What's also apparent in the transcripts is how the Fed's decentralized structure — 12 district banks across the country — helps it collect raw intelligence from, say, a chemical maker in Texas, a farm equipment dealer in North Dakota and a retailer in Georgia. "Contacts in the 11th District particularly cite the threatened trade tariffs against Mexico as having been the event that really jarred their thinking about the economic outlook for their businesses," Dallas Fed President Robert Kaplan said in July 2019. Read More: Wilbur Ross Says Trump Is 'Deadly Serious' About Using Tariffs Five years ago, Trump was publicly berating the Fed to lower interest rates to juice the economy heading into an election year, calling Powell naive and his colleagues "boneheads." Lately he's been saying he knows interest rates "much better than they do, and I think I know it certainly much better than the one who's primarily in charge of making that decision," according to comments he made on Jan. 23, in an apparent reference to Powell. Trump also said last week that if Saudi Arabia and OPEC to carry out his request to lower oil prices, "I'll demand that interest rates drop immediately." He might have to wait a while longer for the next Fed rate cut. That's because the FOMC is expected to take a break from an easing path that's seen three straight reductions since September and lowered the Fed's benchmark rate by a full percentage point. A main reason: uncertainty. Michael Feroli, chief US economist for JPMorgan Chase, said this week's meeting will be "a boring start to a tumultuous year for the Fed." Related Reading: —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment