| I'm Chris Anstey, an economics editor in Boston, and today we're looking at Fed Chair Powell's big day. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Trump's threat for tariffs as part of his "golden age" promise could impact inflation and rate risks in the US, but the hit to economic growth may matter more.

- Chancellor Rachel Reeves said the UK doesn't have to choose between its climate goals and pursuing economic growth.

- It's not just the Fed that decides interest rates today: Sweden just cut, Canada is likely to the same, while Brazil is predicted to hike by a full percentage point.

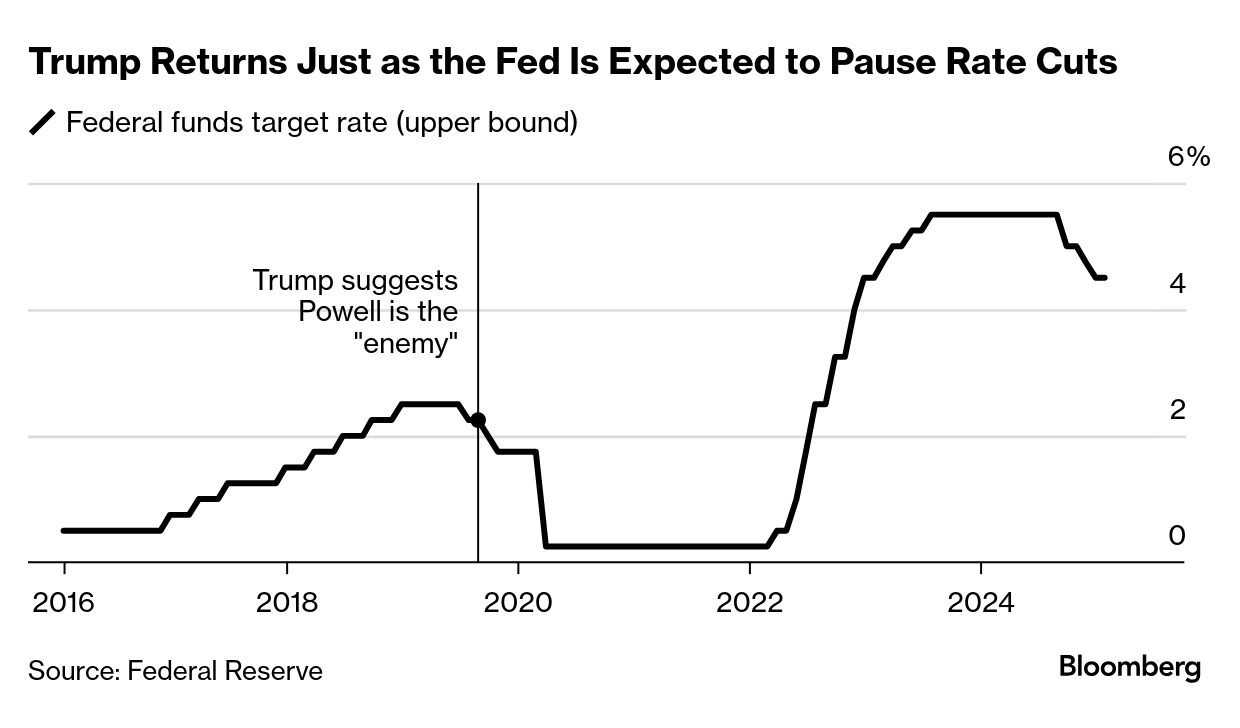

The Federal Reserve's benchmark rate will — in all likelihood — be unchanged on Wednesday. But that's pretty much the only thing that's the same as when Chair Jerome Powell and his colleagues last met in December. With Donald Trump back in the White House, the landscape is completely different for US monetary policymakers. While President Joe Biden and his top aides almost never chimed in on rates, Trump has championed the right of the commander-in-chief to weigh in. In 2019, he even blasted Powell for not lowering borrowing costs, querying whether he was a bigger US enemy than China's president. The Fed lowered rates at the last three meetings under Biden, bringing the benchmark down by a cumulative 1 percentage point, with the upper bound of the target range now 4.5%. But with the latest job-market data showing surprising strength, and inflation still notably above the Fed's 2% target, further cuts are seen by Fed watchers as off the table at least until March. Assuming Powell offers no fresh guidance on near-term rate cuts, that begs the question as to how Trump will respond, especially given that he has repeatedly called for lower rates this month. It's worth noting, though, that those calls have so far been formulated quite differently than the 2019 ones. Trump has suggested that lower rates are predicated on inflation coming down, which he anticipates will be the result of his policy focus on reducing energy costs. "With oil prices going down, I'll demand that interest rates drop immediately," he told the Davos conference via video link last week. "It just economically works that way," he explained at the White House days later. "When the oil comes down, it'll bring down prices, then you won't have inflation, and then the interest rates will come down." He reprised previous assertions that he's better than Powell at judging the appropriate level of rates. But he also said of Fed policymakers that "I'm guided by them very much," before concluding, "If I disagree, I will let it be known." In other words, this isn't quite a full-throated browbeating of Powell and his colleagues, at least not yet. What may be more challenging for the Fed in the immediate future is figuring out how to approach tariff hikes, their potential impact on inflation expectations and implications for monetary policy. In the first Trump administration, tariff increases came against a backdrop of below-target inflation. The current threats of new levies, by contrast, come on the heels of the worst cost-of-living surge in four decades — which makes for an even bigger challenge when it comes to the Fed. Powell, whose term as chair is due in May 2026, could find it's a long 16 months ahead. What do you need to know from the Fed's first rate meeting of 2025? Bloomberg's Molly Smith, Catarina Saraiva, Enda Curran and Carter Johnson will discuss the decision, market reaction, comments from Powell and economic impacts from Trump's first week in office. Join our Live Q&A on Jan. 29 at 4:30 p.m. ET. The Best of Bloomberg Economics | - Trump's surprise announcement Monday night that he would halt trillions of dollars in federal spending sowed panic in Washington.

- Canada can work with the US to weaken China's dominance of supply chains, said Chrystia Freeland, the politician vying to replace premier Justin Trudeau.

- Spain's economy, the top performer among the euro zone's biggest members, expanded strongly at the end of last year.

- Australia's inflation eased, opening the door to a rate cut next month.

- Chile's central bank paused its cycle of rate reductions, and Sri Lanka also held.

- The success of DeepSeek's new AI model points to how China might eventually achieve an even bigger technological breakthrough in the face of US export curbs.

In its outlook for sovereign debt markets in 2025, Institute of International Finance economists advised keeping an eye on efforts in the New York state legislature to revamp legislation over how debt workouts are handled. About half of developing nation hard-currency debt — around $800 billion as of a mid-2024 tally — is governed by New York law, making the state the most important jurisdiction for those bond issuers. Some state legislators have advocated bills that would limit investors' ability to litigate against sovereign issuers to get bigger payouts in debt workouts.  The New York State Capitol Building Photographer: Angus Mordant/Bloomberg "Private creditors have expressed significant concerns about the implications," and are working on options to reduce their risks, the IIF team led by Emre Tiftik wrote in a recent note. One possibility is New York loses as much sway as it now has. The IIF flagged that Sri Lanka, under pressure from bondholders, has agreed to allow the governing law for its new debt instruments to be changed. |

No comments:

Post a Comment