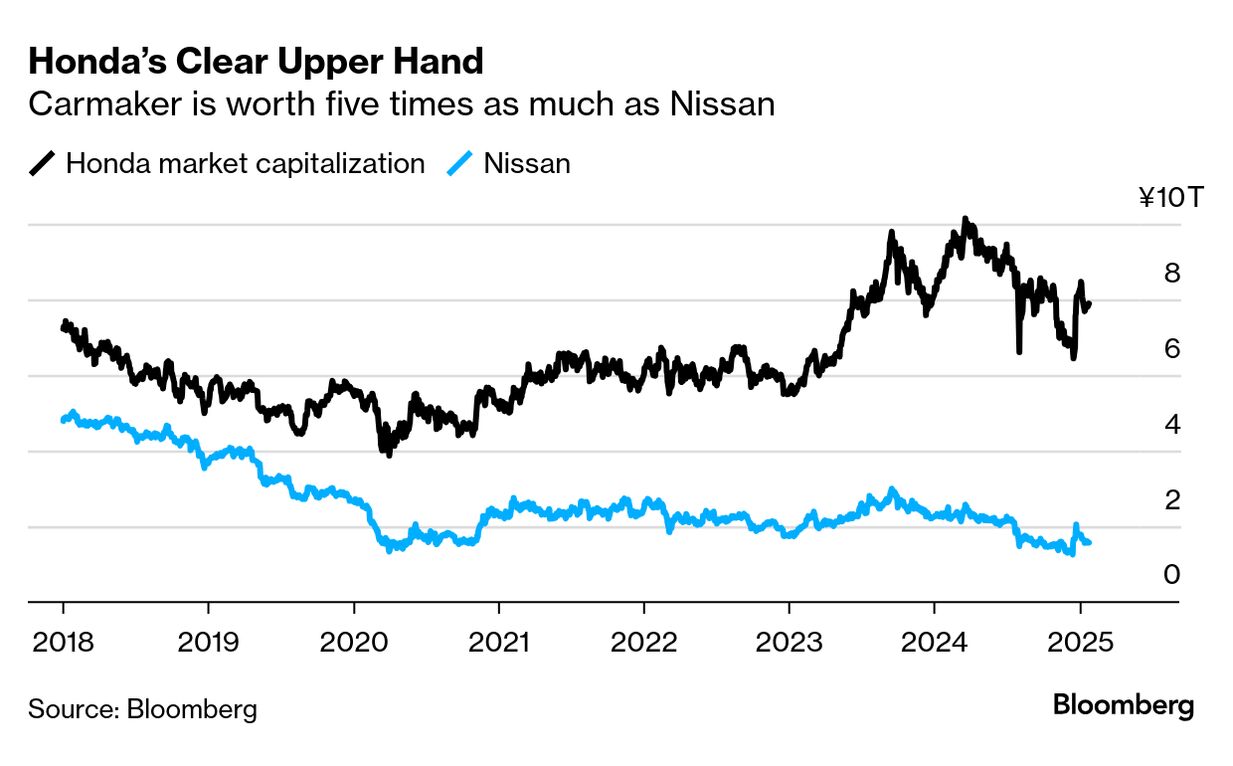

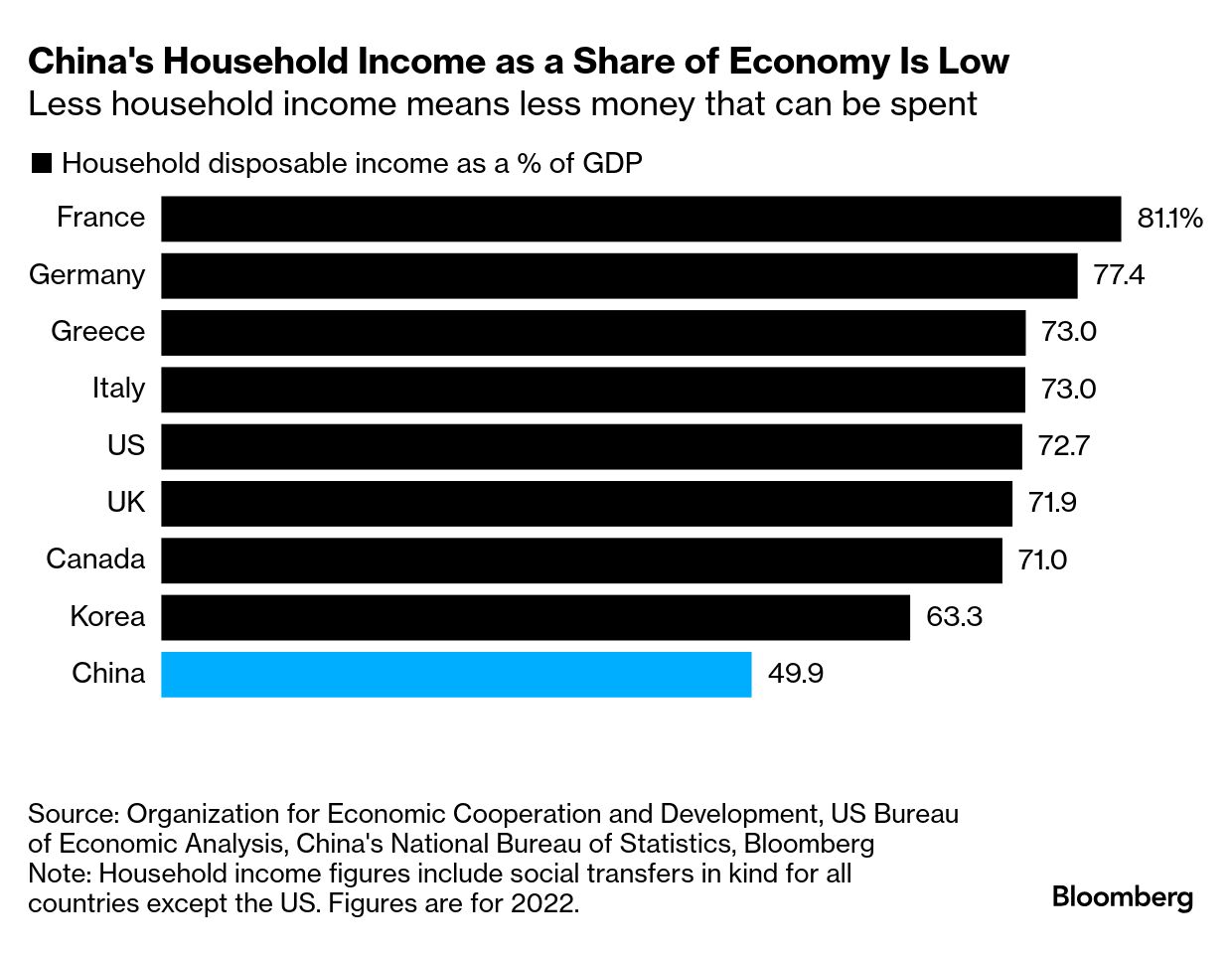

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. When Honda offered Nissan a lifeline last month, it made one thing clear: Nissan has to get its house in order and arrest the decline of its business. Nissan has taken some steps since then to cut costs and invest in its own growth. But according to people familiar with the matter, it isn't planning to close any factories. That risks irking Honda, which is looking for wholesale change from its smaller peer. If the goal is to formalize a framework for negotiations as early as this week, and finalize the deal in June, Nissan has a narrow window to prove it can turn things around. "It's important to show that they're restructuring, cutting fixed costs and so on, but this can't be done within four or five months," said Julie Boote, an automotive analyst at London-based research firm Pelham Smithers Associates.  Nissan CEO Makoto Uchida, Honda CEO Toshihiro Mibe and Mitsubishi Motors CEO Takao Kato at a Dec. 23 news conference. Photographer: Kiyoshi Ota/Bloomberg Last week, Nissan said it will end production of AD compact vans at a plant in Japan late this year. The following day, the company announced plans to build a lithium iron phosphate battery plant — funding for which was announced by the government in September — in the southern Japanese city of Kitakyushu. Closing part of one factory — just 7,000 AD vans were produced during the 2023 fiscal year — and opening another won't address the core issues that triggered Nissan's current financial crisis. An outdated product lineup, overcapacity and shaky leadership are among the reasons why the manufacturer is rapidly losing ground in the US and China. A fuller picture of Nissan's plight surfaced in November, when the automaker announced a 94% drop in net income during the first half of its fiscal year and said it would have to terminate 9,000 employees. Nissan also said it would need to reduce production capacity by 20% and lowered its annual profit forecast for the fiscal year ending in March by 70%.  Nissan signage at the Tokyo Auto Salon earlier this month. Photographer: Kiyoshi Ota/Bloomberg About 6,700 of those 9,000 job cuts will be made in Nissan's production units, according to a Nikkei report last week. In Thailand, about 1,000 workers will be reassigned or cut this year, and roughly 6% of staff at the company's North American unit have applied for voluntary retirement, the newspaper said. A separate report over the weekend suggested that Nissan may trim as many as 2,000 jobs in the US in 2025. By shutting down some production lines at plants in Tennessee and Mississippi, Nissan could reduce US output by about 25%, the report said. A Nissan spokesperson declined to comment, noting that the report wasn't based on any official company announcement. Job cuts aside, Nissan has a long road ahead to show it can regain sounder financial footing. If it can't, its frailty could result in a share-transfer ratio that's much more favorable to Honda. Using a six-month average of the pair's respective market values — Honda is worth around $51 billion to Nissan's $10 billion — one scenario is a holding company that's about 17% owned by Nissan shareholders and 83% by Honda, Boote wrote in a report last week. Honda may push for an even bigger slice, which is sure to anger some Nissan shareholders. "While the process would take account of Nissan's historical financial statements, it would also include assessments of future operations, which is, of course, to some extent guesswork," Boote said. "Asset valuations could differ widely depending on whether impairment losses or write-offs are taken into account." Mitsubishi Motors was expected to announce this month whether it will be part of the combined entity. That's looking less likely — Yomiuri reported that the carmaker will bow out and focus on strengthening its own foothold in Southeast Asia. No legacy brand is safe from the rapid rise of electrified cars in China and the US, two of the most important auto markets in the world. While Japanese manufacturers like Honda and Toyota are struggling to keep up with EVs in China, the gas-electric hybrid cars they pioneered are very much in demand in North America.  A Honda dealership in Tokyo. Photographer: Kiyoshi Ota/Bloomberg Nissan, meanwhile, has neither the EVs nor the hybrids to compete in either region. Ponz Pandikuthira, Nissan's chief planning officer for operations in the Americas, put an upbeat spin on things last week, saying in an interview that the company sees "very little risk of having to downsize our production capability" in the Americas, since Nissan has already trimmed capacity in recent years. Pandikuthira said Nissan globally has some ¥1.5 trillion ($9.7 billion) in cash reserves as a "safety cushion." The company currently is generating enough free cash flow to break even and expects to be able to continue doing so for at least another nine to 12 months. Honda is a smart company with a solid balance sheet and wouldn't risk tarnishing that if it really felt that Nissan were heading toward a cash crisis, Pandikuthira reasoned. "I see a very optimistic future," he said. Honda's executives, however, have been pretty quiet since Dec. 23, when executives signed the memorandum of understanding to start discussions toward a business integration. With big question marks lingering over what Honda can gain by folding Nissan into its business, one wonders whether the former's management team feels the same way. — By Nicholas Takahashi and Chester Dawson On past occasions when China's economy ran into trouble, the government rode it out using cheap loans and subsidies to boost manufacturing, homebuilding and infrastructure investment. These no longer look like viable options. Many parts of China now have more roads, railways and homes than are needed. And if its factories churn out more stuff, it's not clear who would buy it in a world tilting toward protectionism. The clearest way to support growth, economists say, is to boost consumption. Yet it's not clear what would bring the country's 900 million working-age citizens to open their wallets. To encourage households to spend, the government is expanding a state subsidy program that's provided discounts on home appliances and cars to include smartphones and tablets. Economists see this as a temporary fix that could bring forward planned purchases but result in less spending in the future. |

No comments:

Post a Comment