| Chinese AI startup DeepSeek rocked global technology stocks, raising questions over America's technological dominance. Chip-related stocks N |

| |

| Markets Snapshot | | | | Market data as of 06:11 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Chinese AI startup DeepSeek rocked global technology stocks, raising questions over America's technological dominance. Chip-related stocks Nvidia and ASML are leading the plunge.

- Donald Trump also rattled overseas markets by announcing sweeping tariffs on Colombia before abruptly pulling the threat after reaching a deal on the return of deported migrants. The move sent the Mexican peso and South African rand lower.

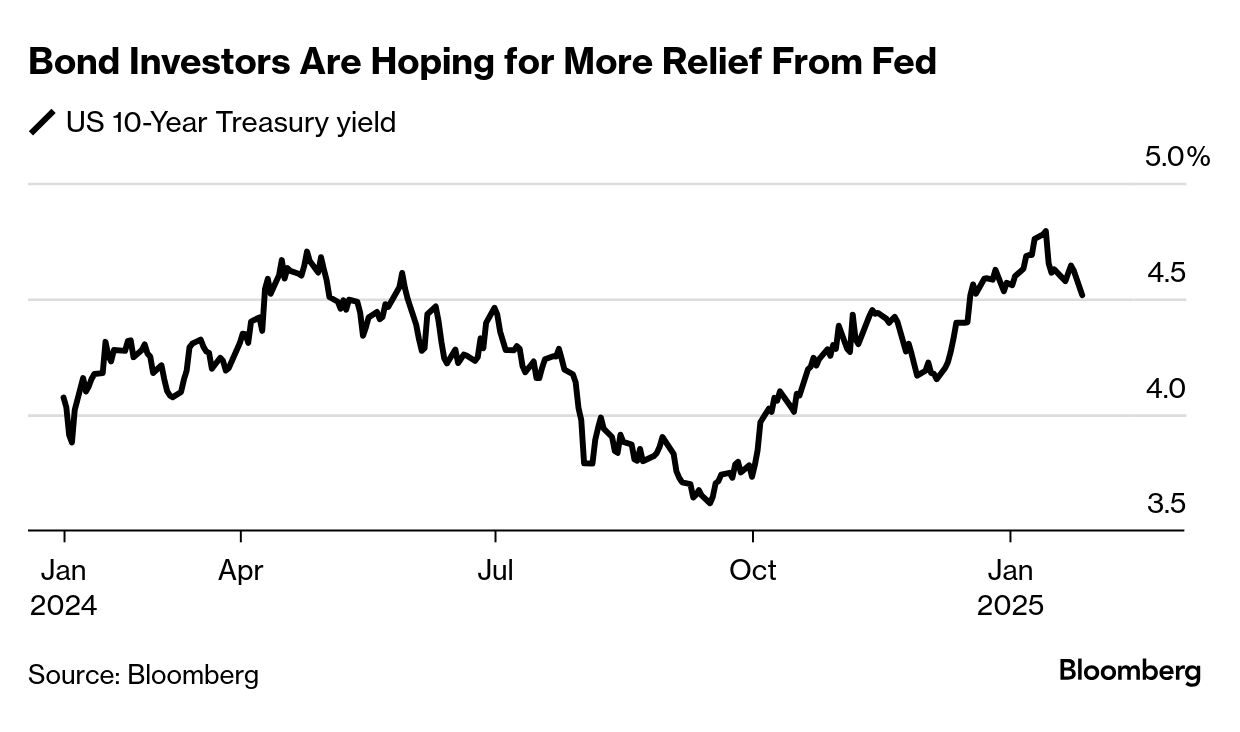

- Treasuries are rallying, with investors flocking to safer assets. The 10-year US yield fell as much as 10 basis points to 4.52%, the lowest since Jan. 2. Haven currencies including the yen and Swiss franc rose.

- China's economic activity unexpectedly faltered, breaking the momentum of a recovery sparked by stimulus measures and underlining the need for Beijing to do more to prevent another slowdown.

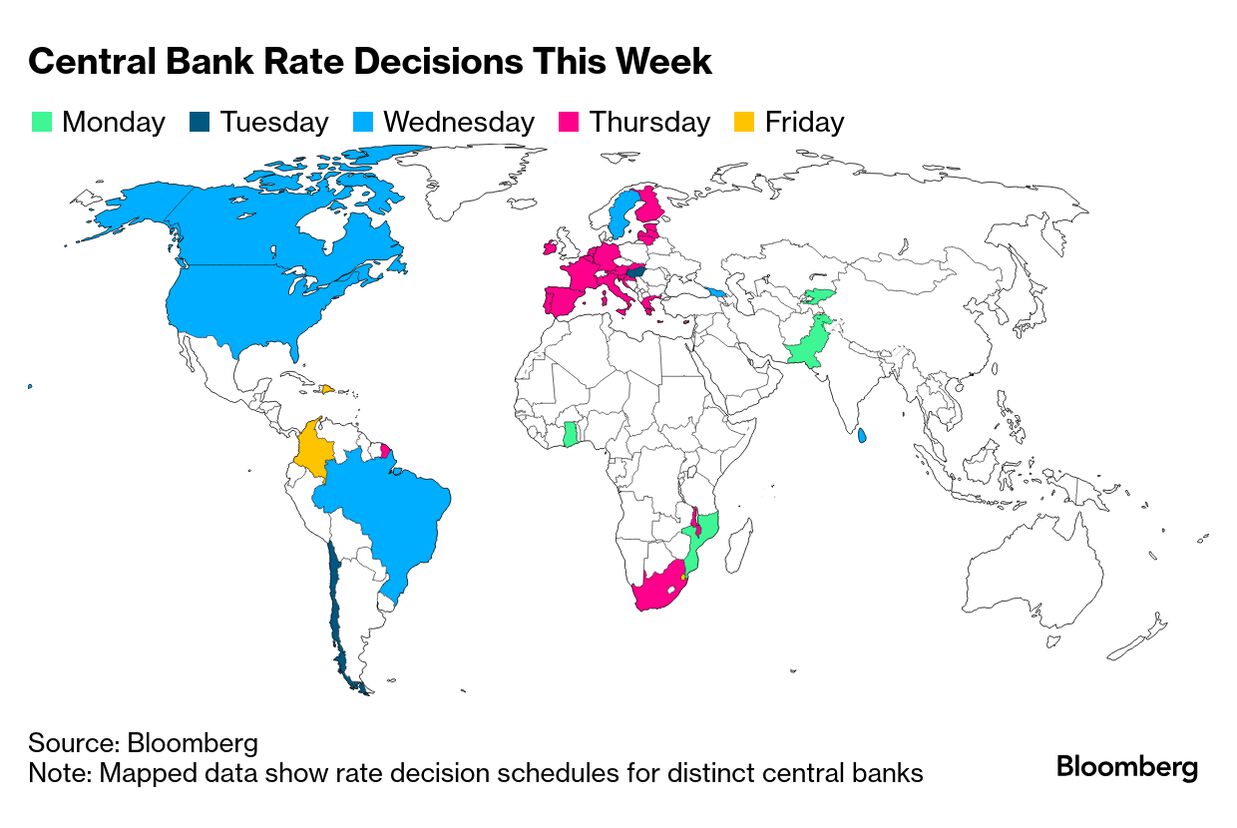

- The euro-area economy's sub-par performance is convincing the ECB that it can further loosen the shackles on growth by lowering interest rates this week for a fourth straight meeting.

| |

| |

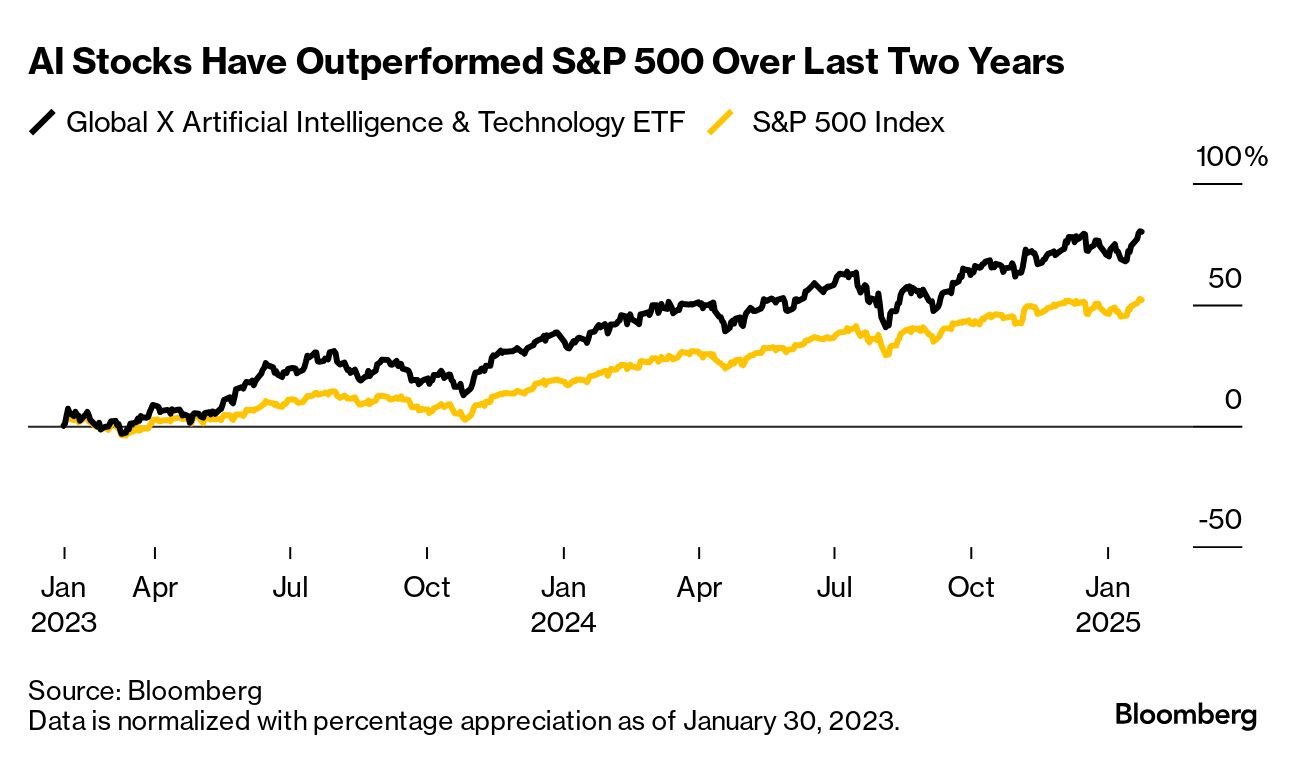

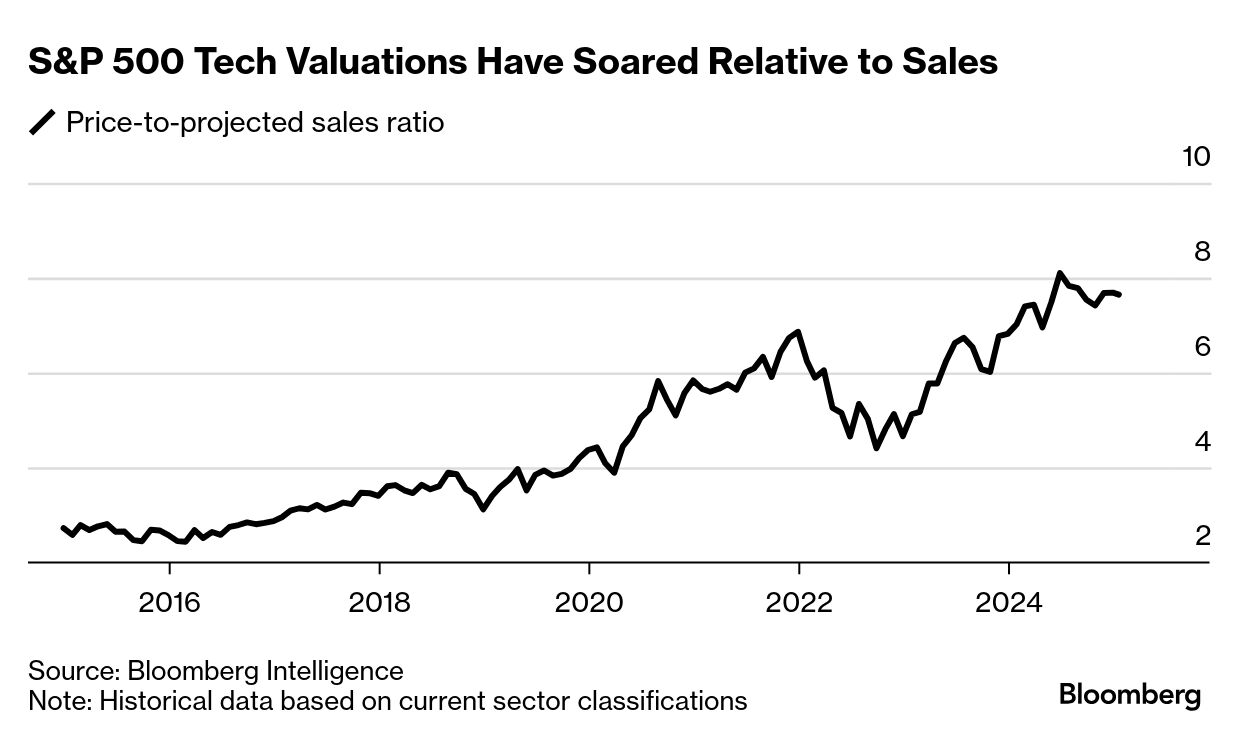

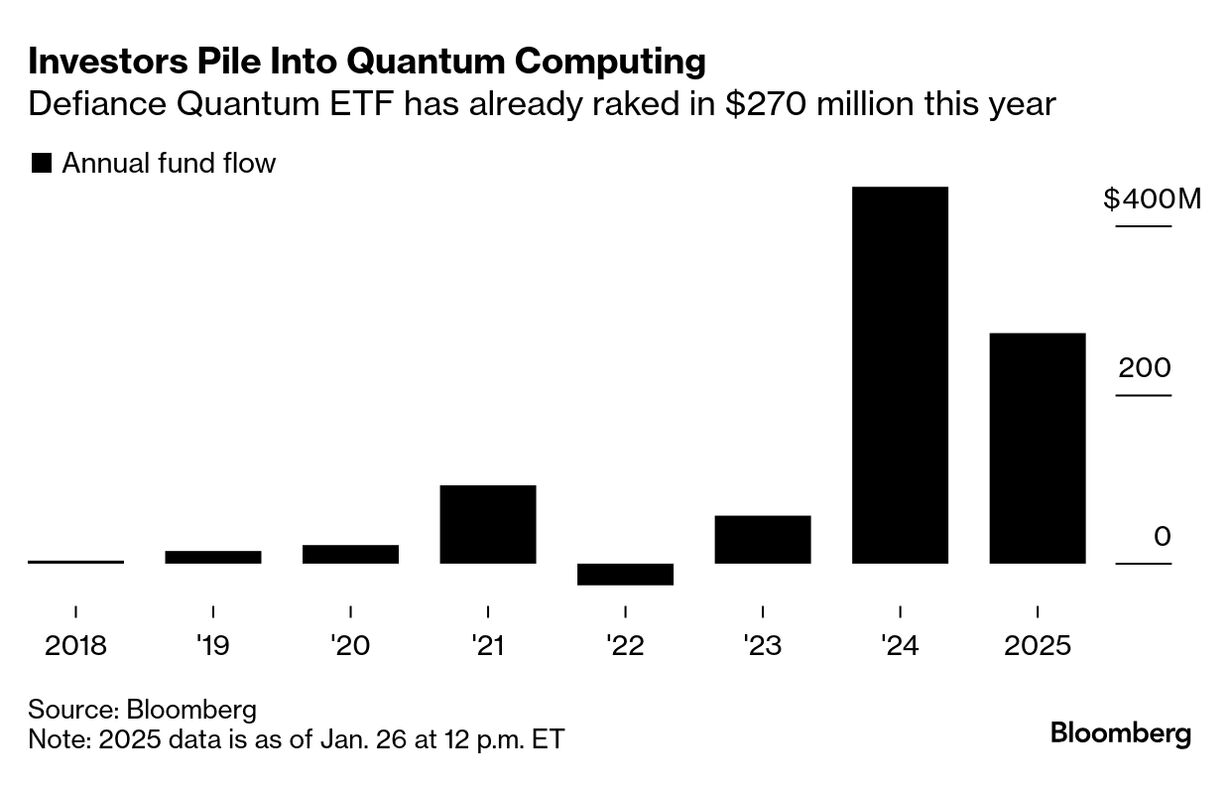

| That whooshing sound you're hearing this morning is speculative money rushing out of tech stocks and risky investments more broadly. The catalyst: the release last week of the latest version of DeepSeek, an AI assistant from a Chinese startup that has rocketed to the top of the download charts in app stores. Pundits are raving about the model, saying it compares favorably to ChatGPT while running on less-advanced chips. Click here for a QuickTake on DeepSeek. The sudden emergence of DeepSeek calls into question the underpinnings of the rally that's added $15 trillion to the value of Nasdaq 100 Index companies since the end of 2022. It's also another lesson in the risks of paying high valuations for emerging technologies in the hopes of reaping life-changing investment gains. "DeepSeek shows that it is possible to develop powerful AI models that cost less," said Vey-Sern Ling, managing director at Union Bancaire Privee. "It can potentially derail the investment case for the entire AI supply chain, which is driven by high spending from a small handful of hyperscalers." And the damage goes beyond Big Tech. As often happens in a market frenzy, investors loaded up on risk across the spectrum on the way up, and now they're dumping broadly on the way down. So Bitcoin is getting whacked too. There's plenty of fuel for the selloff, because speculative bets on crypto, AI, quantum computing and more have skyrocketed since the US election as traders increasingly have gone all-in on disruptive trends.

Case in point: the Defiance Quantum ETF. The exchange-traded fund, which tracks stocks of companies tied to quantum computing, has amassed more than $250 million this year. That's more than half its haul during all of 2024, data compiled by Bloomberg show. Wall Street is already anticipating the Magnificent Seven will report a slowdown in earnings growth when quarterly results come this week. Profits for the group are projected to increase 22% growth, the smallest increase since the first quarter of 2023. In a bull market, investors would look right past that slowdown to the promise of a bigger payoff down the road from the enormous sums that are being spent on AI projects. But market psychology shifted abruptly over the weekend, and this morning, at least, there's no appetite for risk. —Phil Serafino and Vildana Hajric | |

| |

| Trump and AI shares the investor spotlight this week with the Federal Reserve. Chair Jerome Powell and colleagues are set to pause their interest-rate cutting campaign on Wednesday by leaving the upper bound of their key rate unchanged at 4.5%. All eyes will instead be on Powell's subsequent press conference for clues as to what comes next. Here are the week's highlights, with a lot of Asia marking the Lunar New Year:

Monday: U.S. new home sales. Earnings from AT&T. Tuesday: U.S. durable goods and consumer confidence. Earnings from Boeing, Lockheed Martin, Synchrony, GM, Starbucks. Wednesday: Fed rate decision. Bank of Canada rate decision — a quarter-point cut is predicted. Brazilian central bank rate decision — a hike is expected. Earnings from Microsoft, Meta, Tesla, Progressive, IBM, Whirlpool. Thursday: First reading of U.S. gross domestic product for the last quarter. Bloomberg survey points to an annualized 2.7% increase. European Central Bank rate decision — a quarter-point cut is forecast. Earnings from Apple, Intel, Southwest Airlines, Dow, Northrop Grumman, Mastercard, Visa, Blackstone, UPS. Friday: Euro-area GDP report. 1% growth is projected. U.S. personal consumer expenditure data. Earnings from Exxon Mobil, Phillips 66, Chevron, AbbVie. | |

| |

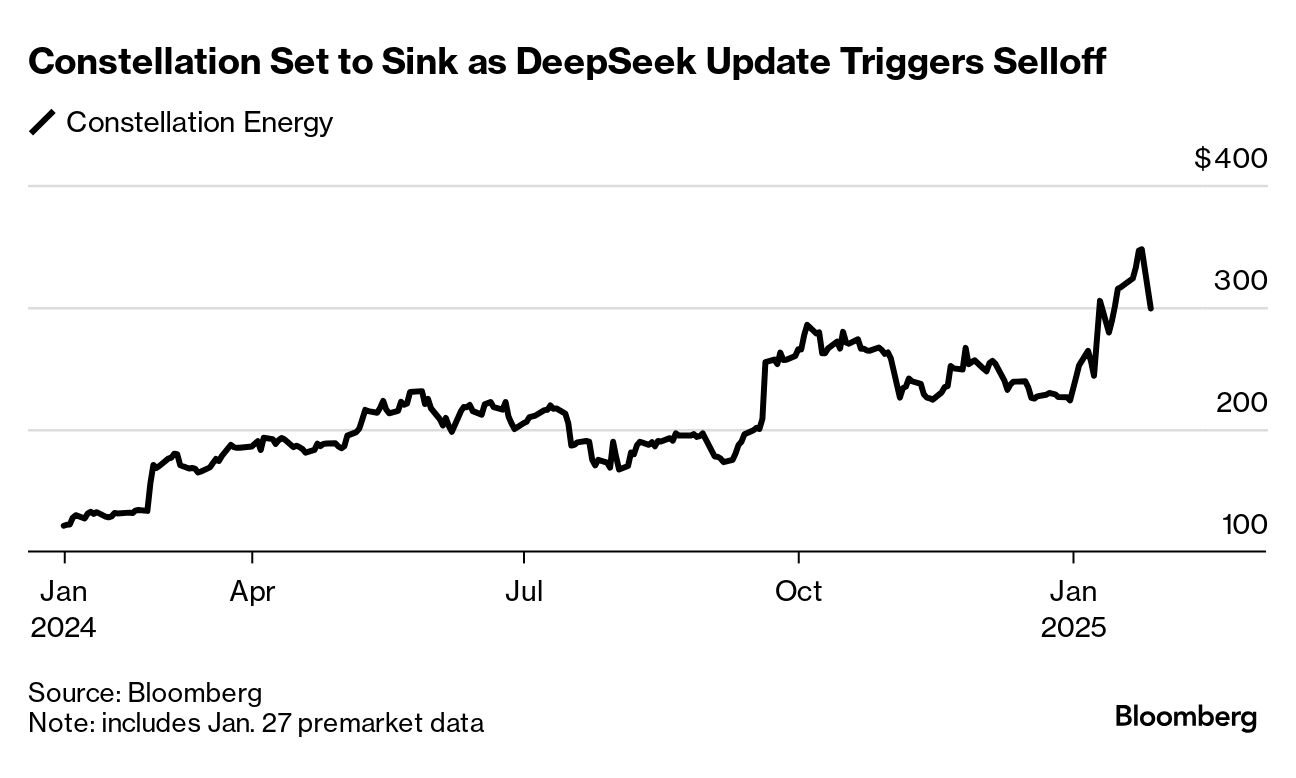

- Constellation Energy falls 11% and NRG loses 8.3% in early trading. The power producers, which in normal times aren't very volatile, have been part of the AI frenzy, on the view that all the computing power needed for AI data centers would lead to huge electricity demand.

- Makers of power equipment also slumping. Oklo, a developer of small nuclear reactors backed by OpenAI's Sam Altman, is down 14%. In Europe, Siemens Energy is plunging 19% and Schneider Electric is down 9%.

| |

What Fed means for the bond market | |

| In the bond market, Donald Trump's first week, at least, turned out far less destabilizing than feared. Traders hope the same goes for the latest shift from the Fed. If the central bank holds rates steady on Wednesday, it would mark the first pause in the rate-cutting cycle it kicked off in September. But yields have already jumped sharply since late last year as traders aggressively reset expectations for monetary policy on speculation that Trump's policies will fan inflation pressures and pour fuel on a strong economy. That may prime the market for more relief if Powell underscores his typical data-dependent approach and leaves the market's now modest rate-cut expectations intact. "It's going to be a year where the Fed can reduce interest rates twice, maybe once," said Ashok Bhatia, co-chief investment officer for fixed income at Neuberger Berman, on Bloomberg TV. "If you get that from the Fed, plus a little bit of deficit stabilization, that is a pretty strong outcome for the bond market." —Michael Mackenzie | |

Word from Wall Street | | "For me, more than geopolitical risks in the near future, it's all about earnings and earnings delivery. All eyes will be on these tech results, especially in the US. The market is priced for perfection; it needs to deliver perfection." | | Beata Manthey Equity strategist, Citigroup | | Click here to watch the Bloomberg TV interview. | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment