| Market data as of 06:14 am EST. Market data may be delayed depending on provider agreements. President Donald Trump said the US economy face |

| |

| Markets Snapshot | | | | Market data as of 06:14 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- President Donald Trump said the US economy faces "a period of transition," deflecting concerns about the risks of a slowdown as his early focus on tariffs and federal job cuts causes market turmoil.

- US equity futures dropped as concerns about the health of the American economy weighed on investors' appetite for risk. Investors sought the safety of fixed-income assets, pushing Treasury yields lower. Stocks in Asia and Europe also declined.

- Mark Carney won the race to become Canada's next prime minister, putting the former central banker in charge of the country just as Trump's administration threatens its economic outlook.

- House Republicans announced a spending bill to keep US government agencies open through Sept. 30, daring Democrats to vote against it and risk a disruptive March 15 shutdown.

- Taiwan Semiconductor's revenue climbed 39% in the first two months of the year, quickening from 2024 in a sign of resilient demand for the Nvidia chips that power AI development

| |

| |

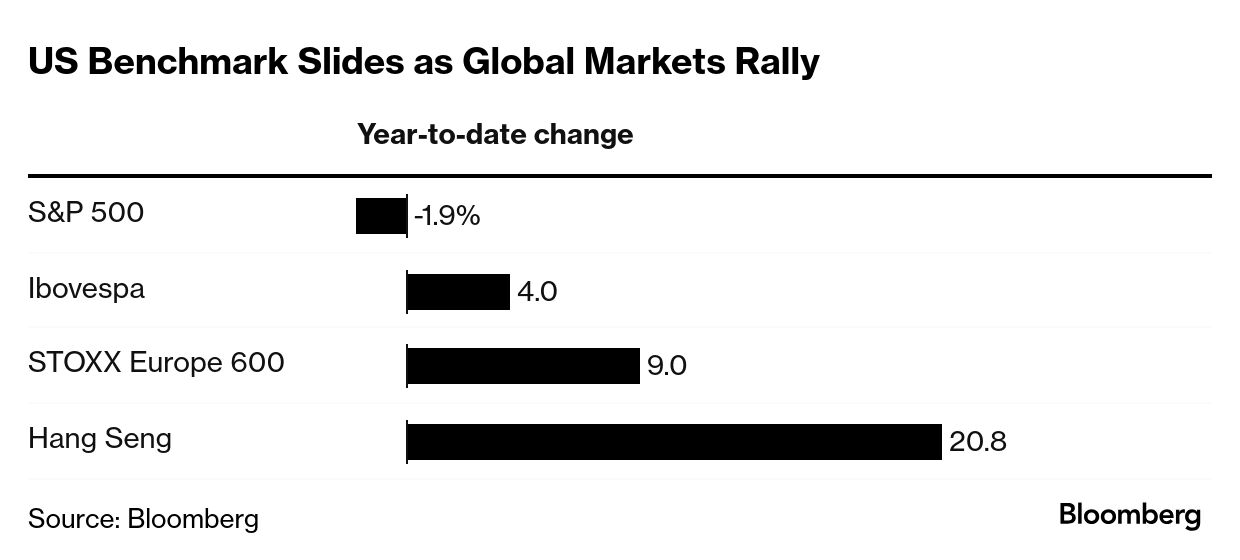

| The "Trump Bump" risks becoming the "Trump Slump" across financial markets. Having been elected with a "pro-growth" plan, President Donald Trump's erratic tariff agenda, aggressive posture towards Ukraine and push to slash government payrolls are uniting with an already weakening economy to ignite investor fears of stagflation and perhaps even recession. To recap: - The S&P 500 Index has wiped out all of its gains since Trump was elected in November.

- The technology-heavy Nasdaq 100 Index briefly slumped into a correction Friday after plunging more than 10% in 17 days, with Nvidia erasing almost $1 trillion in market value in two months.

- Two-year Treasury yields have fallen sharply on bets the Federal Reserve will resume cutting interest rates.

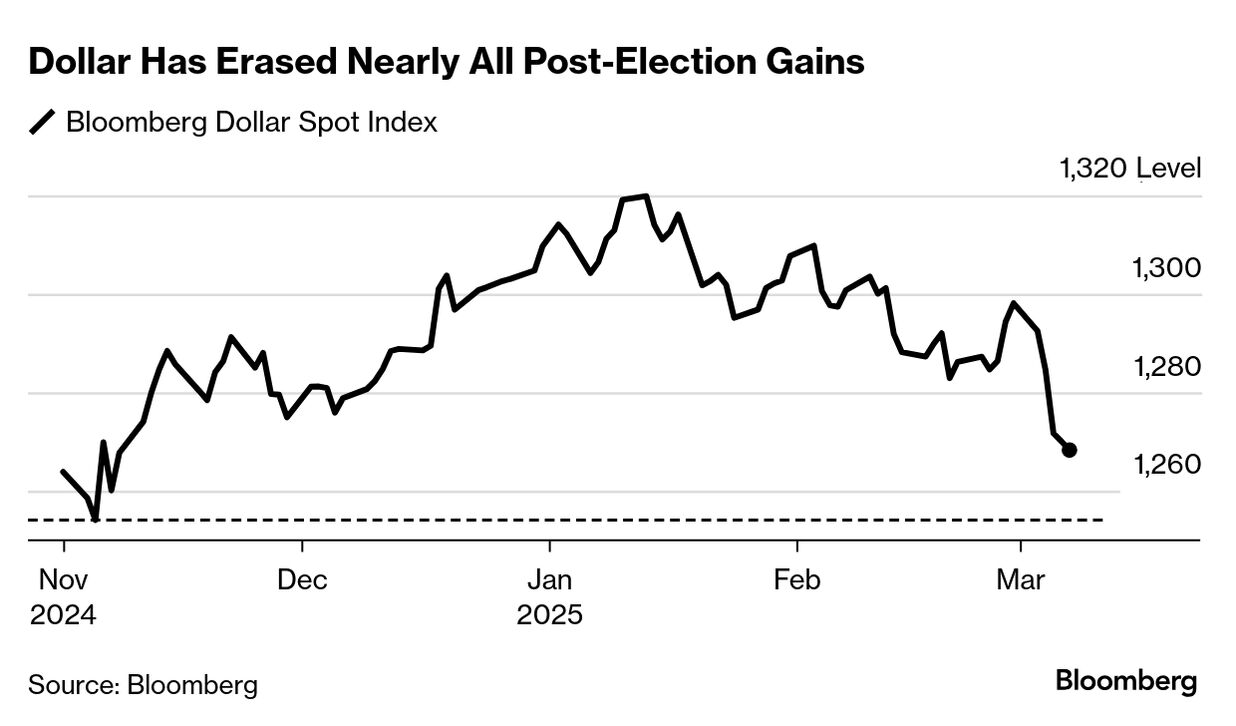

- The dollar is now around 4% below the post-election peak it reached in January and it fell last week to its lowest since November.

- JPMorgan economists now see a 40% chance of recession this year "owing to extreme US policies."

Markets are also fluctuating wildly in response. The Cboe Volatility Index — which measures expectations for S&P 500 swings over the next month — last week rose to a level rarely seen since the Covid era. "Be prepared for more 'Trump pumps' and 'Trump dumps,'" said Dennis Dick, head of markets structure and a proprietary trader at Triple D Trading. "The president never stops talking. It feels like my head is on a swivel." Such a backdrop is forcing the administration to change tone. While still talking of a "Golden Age," they are also warning of short-term pain ahead of longer-term gain. In an interview on Fox News' Sunday Morning Futures, Trump spoke of a "transition." In last week's speech to Congress, he talked about a "disturbance" and Treasury Secretary Scott Bessent has said the US needs a "detox." The mood in markets is certainly undermining the president's "America First" vibe, with the plan to turbo-charge government spending in Germany and the emergence of AI startup DeepSeek in China also drawing attention and money elsewhere.

The S&P 500 has underperformed relative to the rest of the world and the US's share of world market value has also slipped since peaking above 50% this year. Of course, investors write off the US at their peril and sentiment can turn on a dime. "American exceptionalism will remain but it's certainly taking a major hit," said Troy Gayeski, chief market strategist at FS Investments. —Simon Kennedy | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

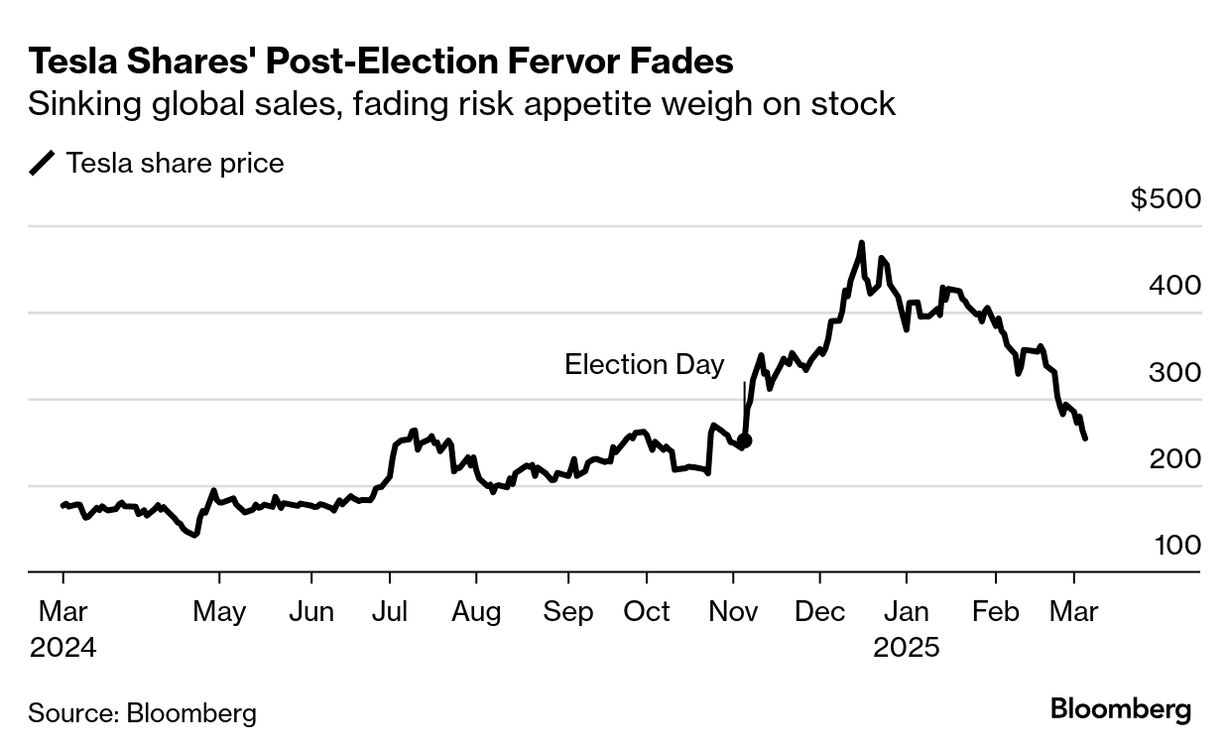

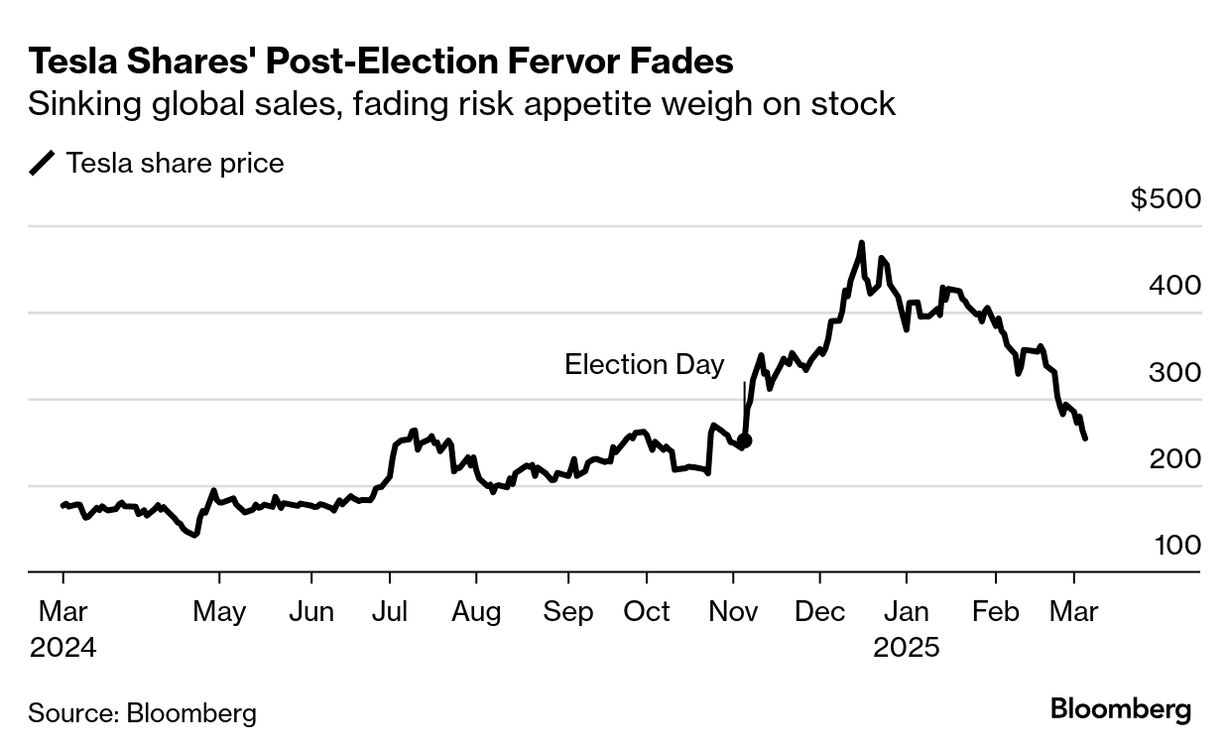

- The Magnificent Seven stocks are slumping as the broader market selloff intensifies. Tesla is down 3.3%, inching closer to erasing its post-election gains. Among other decliners, Nvidia is down 2.5%, Meta falls 1.7%, Amazon drop 1.6% while Apple, Alphabet and Microsoft are down about 1%.

- DoorDash jumps 4.6%. S&P Dow Jones Indices is adding the the food-delivery company to the S&P 500 along with Williams-Sonoma, TKO Group and Expand Energy.

- MicroStrategy, Coinbase and Riot Platforms are falling along with other cryptocurrency-exposed stocks as Bitcoin drops for a fifth consecutive session. President Trump's long-awaited order last week to create a strategic Bitcoin reserve disappointed the market.

- Ryanair rises 6.7% in Dublin after the Irish low-cost airline said non-EU nationals are allowed to invest in the firm's ordinary shares listed on Euronext Dublin and depositary shares listed on Nasdaq.

- Oracle is slated to publish financial results after the market closes, with investors expecting additional bookings and expenses stemming from the Stargate joint venture with OpenAI. —Subrat Patnaik

| |

| |

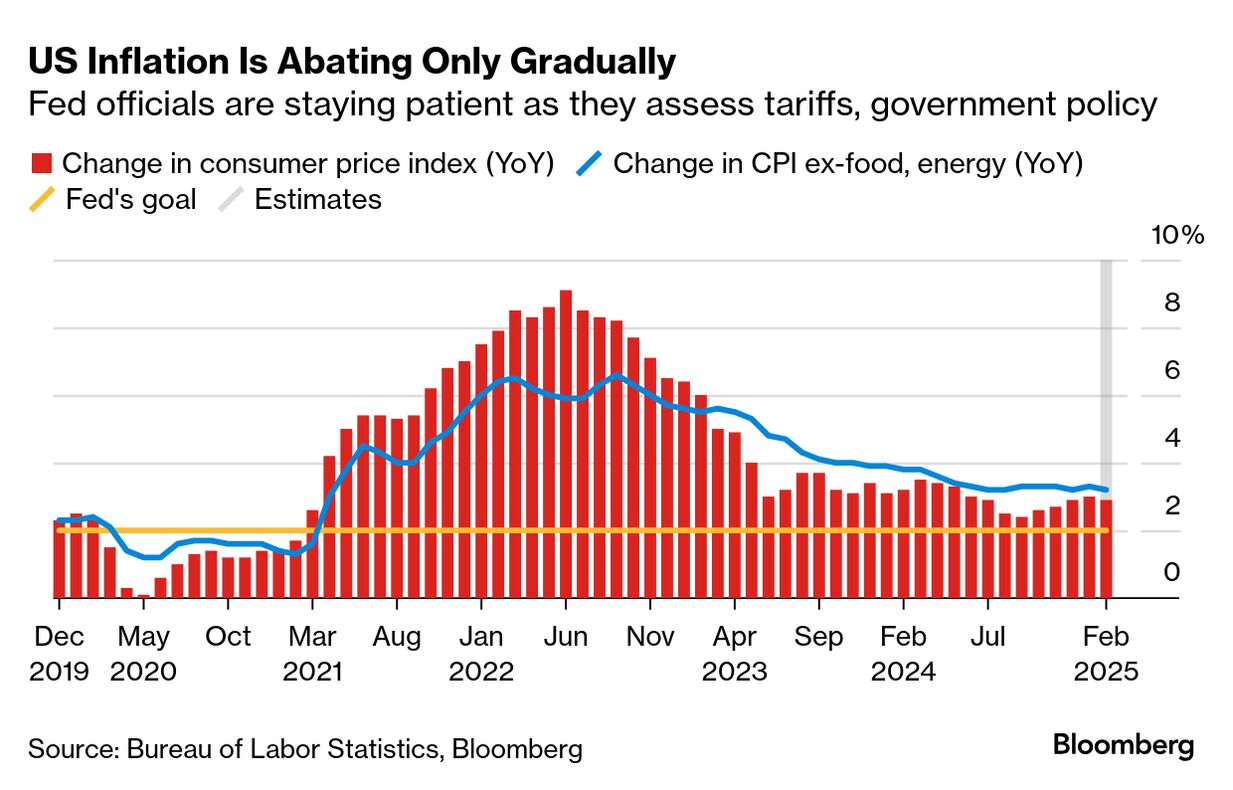

| US consumer prices on Wednesday provide another snapshot of how sticky inflation is even as the economy slows and what room the Federal Reserve has to cut interest rates. Monday - CERAWeek energy conference in Houston, through March 14. European Union finance ministers meet in Brussels. Oracle reports earnings after the market closes. Tuesday – Japan releases gross domestic product data for the fourth quarter. Volkswagen releases earnings. High-ranking Ukrainian diplomatic and military officials, including defense and foreign ministers, to meet with US counterparts in Saudi Arabia. Japan will publish final gross domestic product estimates for the fourth quarter. Earnings are due from Ciena, Dick's Sporting Goods and Kohl's. Wednesday – US consumer price index (forecast to show prices minus food and energy climbed 0.3%). Bank of Canada predicted to cut interest rates by another 25 basis points. Russia will publish inflation figures. European Central Bank President Christine Lagarde and fellow central bankers speak in Frankfurt. Adobe reports after the close. Thursday – US producer price index, euro-zone industrial production Friday – UK GDP data, European inflation reports and University Michigan report on US sentiment. | |

| |

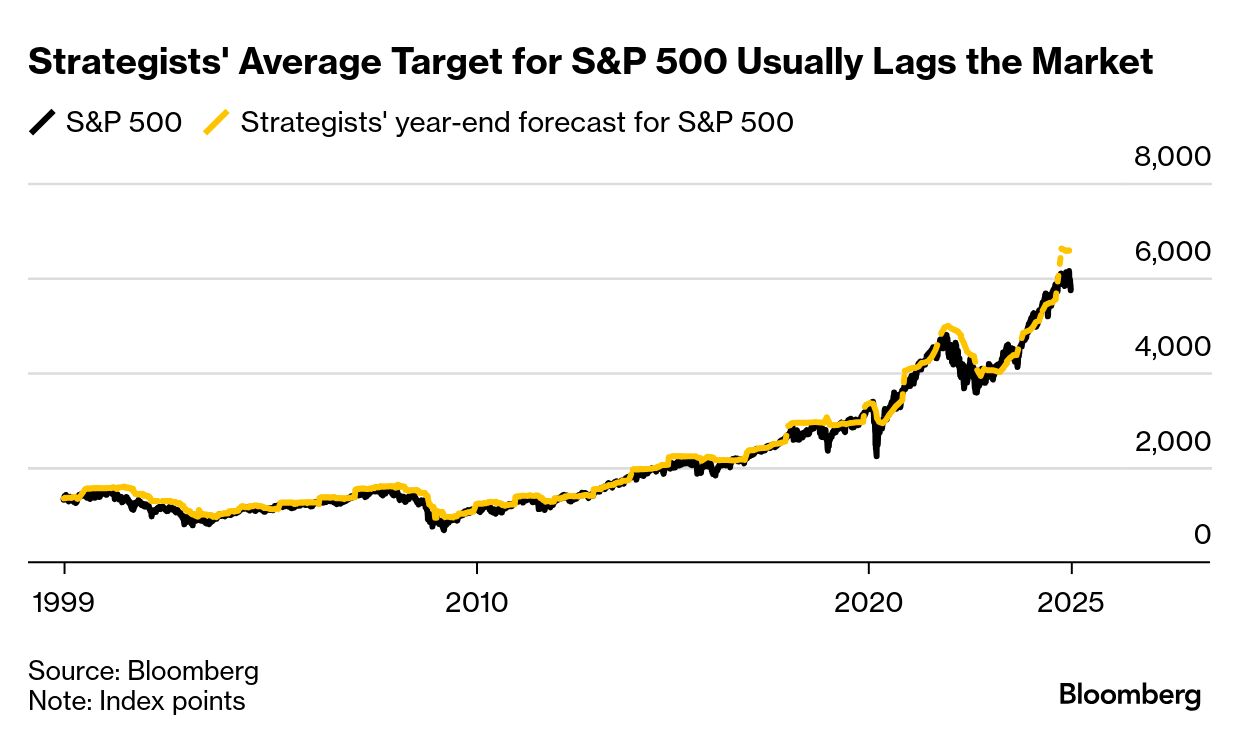

| For two consecutive years, stock-market prognosticators lifted their targets for the S&P 500 over and over again to keep up with an unrelenting rally. Now, less than three months into the year, strategists at firms including JPMorgan Chase and RBC Capital Markets are starting to temper bullish calls for 2025 as Trump's tariffs stoke fears of slowing economic growth and send US equities into a tailspin. JPMorgan's strategy team warned on Thursday that their year-end forecast for the S&P 500 of 6,500 — a roughly 13% gain from Friday's close — may not materialize. RBC's Lori Calvasina lowered her bear case for the S&P 500 to 5,600 from 5,775. "I don't think anybody has more conviction today at all: more uncertainty, yes — a wider band of outcomes, yes," Michael Kantrowitz, Piper Sandler's chief investment strategist, said. —Alexandra Semenova | |

One number to start your day | | $696 billion | | The decline in Tesla's market value from its post-election high. Click here and here to read more. | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment