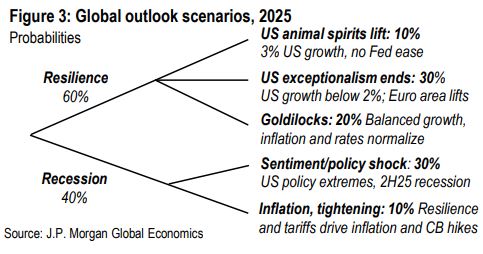

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at a series of US growth downgrades at major banks. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. It's not clear where Trump will take US tariff rates on major trading partners, with April 2 looming as a key date for decisions on making access to the American market "reciprocal" with how foreign nations are deemed to treat US goods. Some economists have seen enough to already make changes to their forecasts for US growth, concluding that bigger tariff increases than previously anticipated will curb spending and add to inflation, while others suggest they're on the lookout to do so. Trump told Fox News' Sunday Morning Futures that the economy faces "a period of transition," declining to rule out the potential for a recession. Here are a few perspectives from research notes circulated Friday: Morgan Stanley The bank's US economists, led by Michael Gapen, on Friday lowered their 2025 GDP growth call to 1.5% from 1.9%, measured on a fourth-quarter versus fourth-quarter basis. "While our baseline outlook is that the economy avoids a recession, we acknowledge that accelerated policy implementation and front-loaded policy uncertainty push recession risks higher. We think the trigger for a downturn would most likely come from a downdraft in equity markets." Goldman Sachs Larger tariffs are "likely to hit GDP harder through their tax-like effect on disposable income and consumer spending and their effect on financial conditions and uncertainty for businesses," a team including Michael Abecasis wrote Friday. The bank took its 2025 forecast down to 1.7% from 2.2% (fourth quarter on fourth quarter.) "We have also raised our 12-month recession probability slightly from 15% to 20%." That's only a "limited amount" of change for now, because "the White House has the option to pull back if the downside risks begin to look more serious." If the administration remained committed even in the face of much worse data, "recession risk would rise further." JPMorgan Chase For now, JPMorgan is holding off on full US forecast revisions until the April tariffs are clear. Michael Feroli, the bank's chief US economist, wrote Friday, "Whipsawing policy changes make forecasting growth and inflation this year an especially fraught exercise." The bank did trim its first-quarter estimate to 1% from 1.5%, thanks in part to a widening in the trade deficit. The Trump administration has been open in recognizing there will be a bumpy path as the US adapts to new policies of higher levels of protection against imports and a downsizing in the federal government. Trump and his aides have predicted that, in time, a recipe of tax cuts, deregulation and energy production will take the expansion rate back up. JPMorgan's team has one scenario where "US animal spirits lift" to secure 3% growth, and that's calculated at a 10% probability. Tied for the most-likely scenario — at 30% chance for each — is "US exceptionalism ends" with growth below 2%, or "sentiment/policy shock," where extreme policies trigger a recession in the second half of this year. The Best of Bloomberg Economics | - Chinese tariffs as high as 15% on US agricultural goods take effect Monday, and Beijing also plans tariffs on rapeseed oil, pork and seafood from Canada.

- UK wages for new hires rose at the slowest pace in four years. Meanwhile ministers plan to slash the number of civil servants and use AI to boost efficiency.

- Trump's rapidly-changing policies toward Europe and Ukraine are boosting support for increased defense spending in France and the UK, new polls show.

- As Japan grapples with an aging population and chronic labor shortages, more companies are turning to service robots. Meanwhile, the country's workers saw their base pay rise at the fastest clip in 32 years.

- Egypt's inflation plunged by almost half as the impact of a currency crunch that fed a black market for dollars a year before finally wore off.

- Thailand plans to inject as much as $4.4 billion to push growth beyond 3% this year amid headwinds from global trade tensions to a volatile local currency.

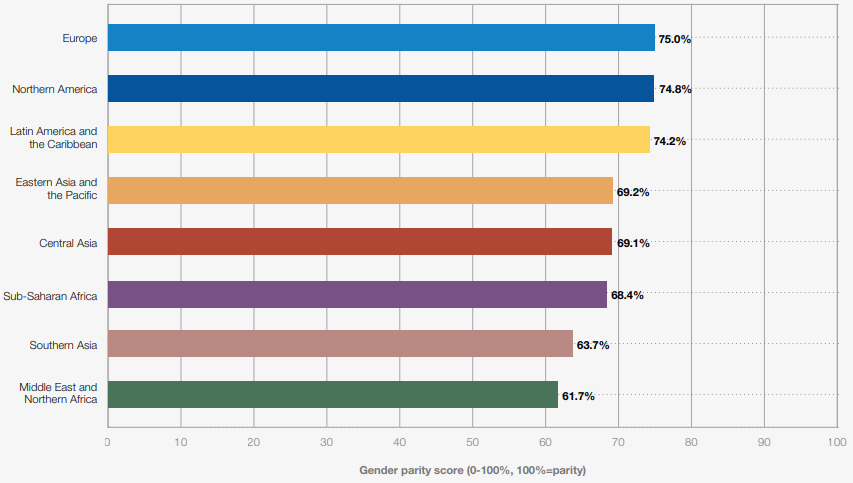

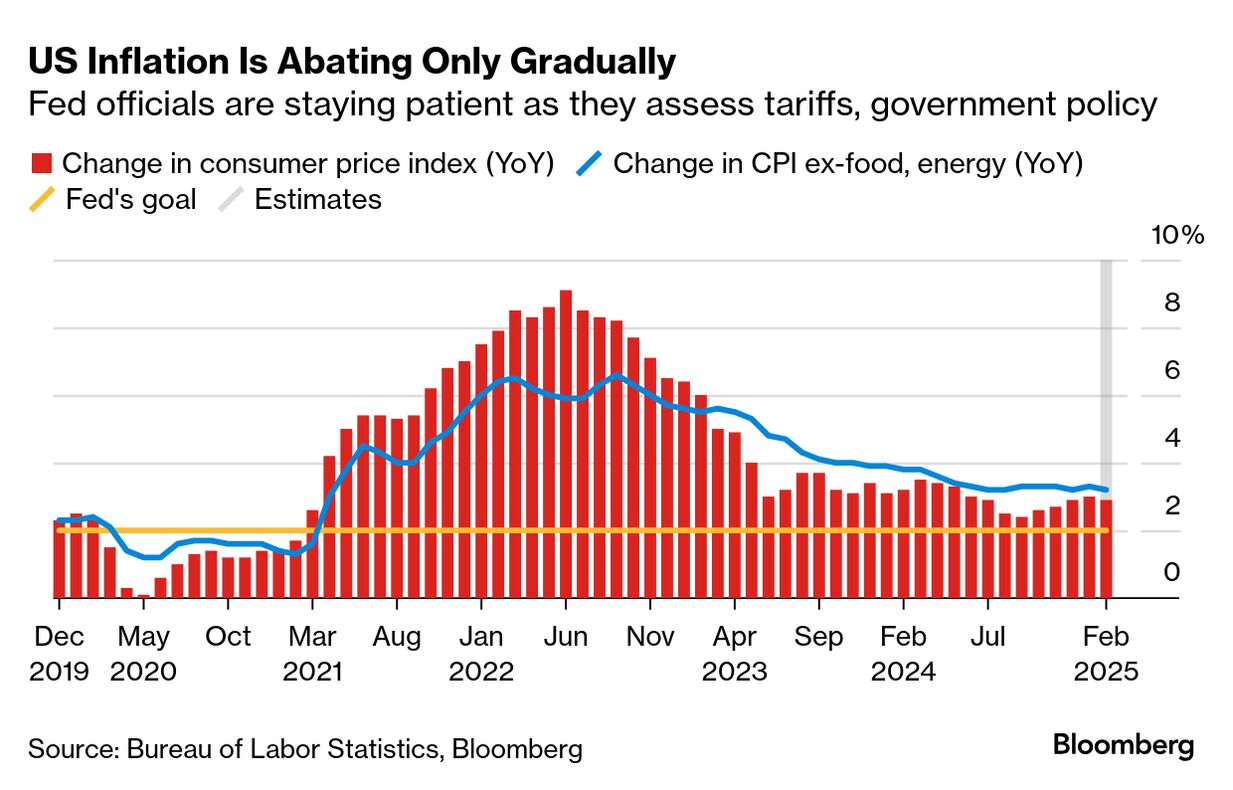

US consumer prices probably rose in February at a pace that illustrates plodding progress on inflation for Federal Reserve officials content to remain on the sidelines as they assess a policy whirlwind from the Trump administration. Bureau of Labor Statistics figures on Wednesday are projected to show that the consumer price index minus food and energy climbed 0.3%, based on the median estimate of economists surveyed by Bloomberg. While less than January's 0.4% gain in January, the magnitude of the increase leaves annual price growth elevated. The so-called core CPI probably rose 3.2% from February last year. The data will inform the Fed's preferred price gauge, which isn't due until after the March 18-19 policy meeting. Interest-rate setters — now in a blackout period ahead of that gathering — have an inflation goal of 2%. Elsewhere, a rate cut in Canada, inflation releases from Russia to Brazil, growth data in the UK and a key speech by the European Central Bank president are among highlights. See here for the rest of the week's economic events. Gender equality gains have stalled and at this rate, it will take 134 years to reach full parity, according to a report by JPMorgan Chase & Co. Despite increasing participation by women in the workforce globally — including a record level in the US — female representation in senior leadership roles remains at the low level of about 32% globally, JPMorgan said. Regional progress in closing gender gaps  Note: Population-weighted averages, 146 countries. Source: World Economic Forum, Global Gender Gap Index 2024 via JPMorgan. White men dominate the highest-paying jobs in the US and women continue to be underrepresented in key executive decision-making power, the report said. The gender pay gap increased to about 17% in the US last year and remained unchanged at almost 13% in Europe, JPMorgan said. - For the latest on how institutions and companies are confronting gender, race and class, subscribe to the Equality newsletter.

|

No comments:

Post a Comment