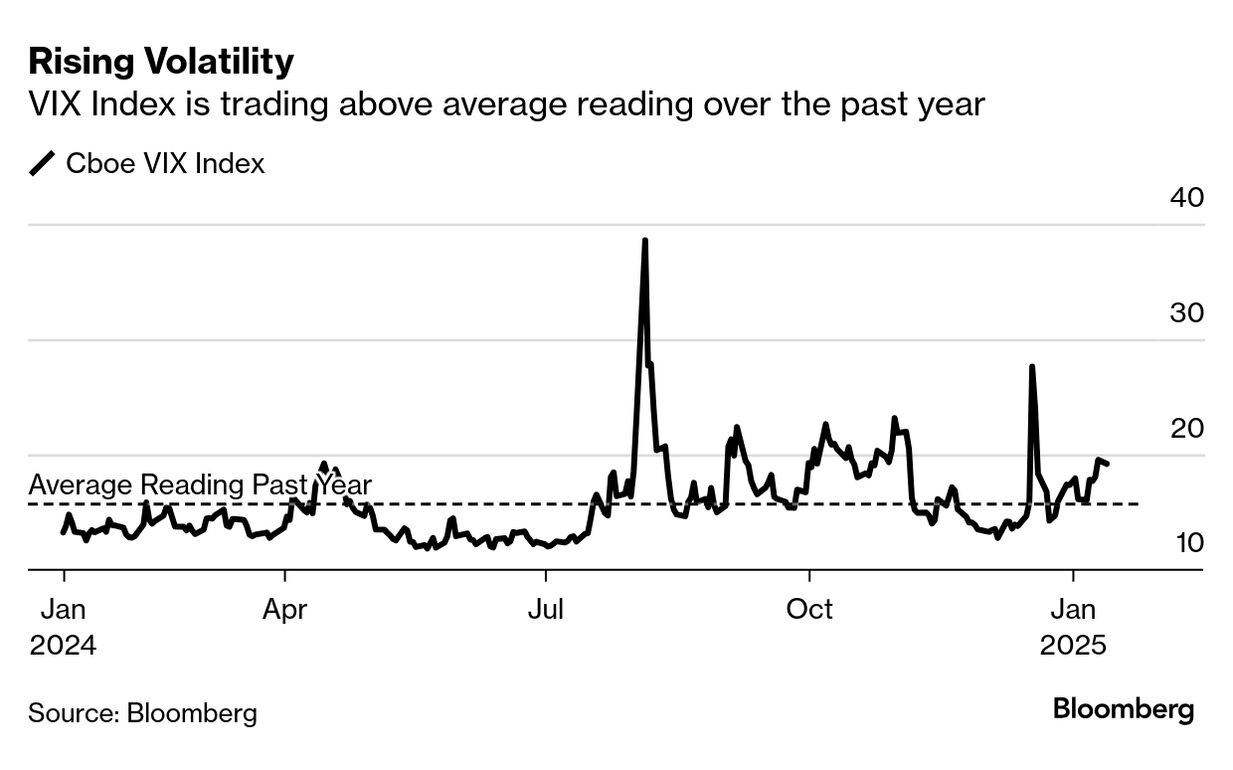

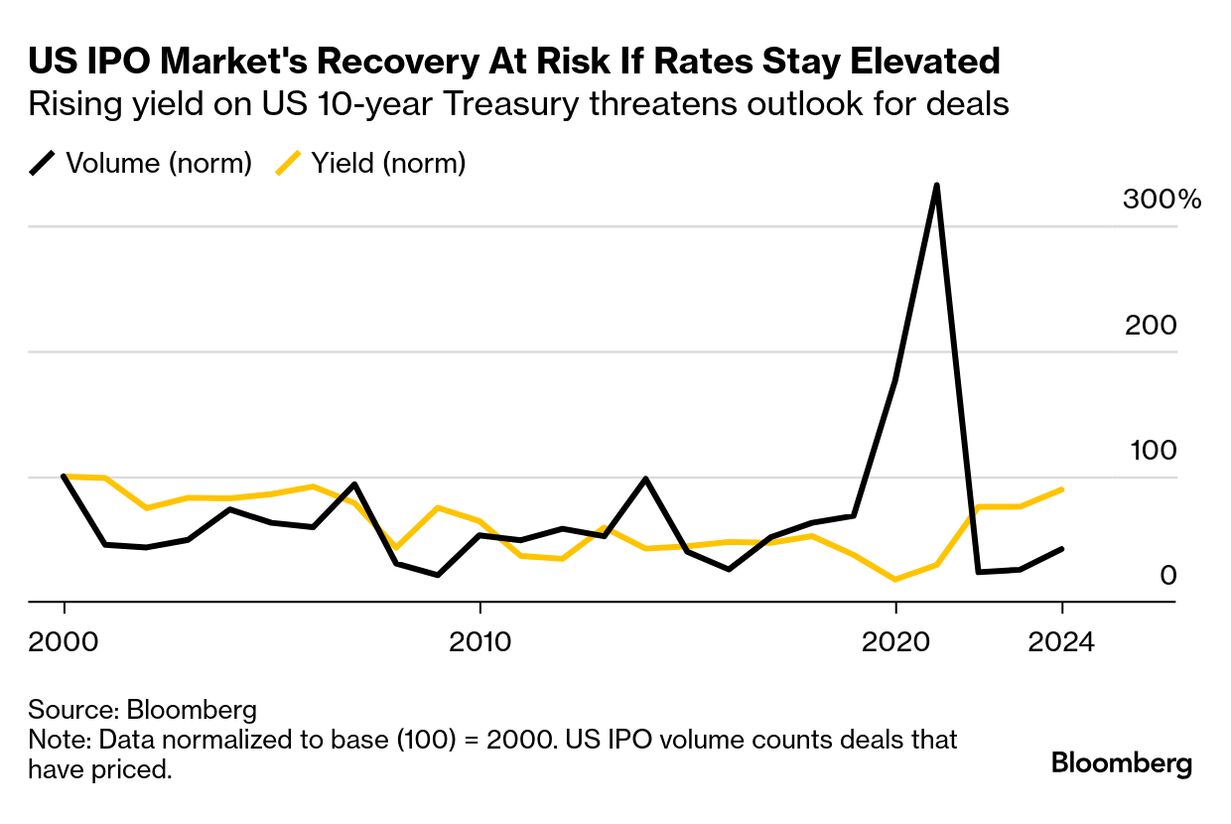

| Options traders are bracing for fresh bouts of volatility tied to Wednesday's key US consumer price index report. The S&P 500 Index is expected to move 1% in either direction tomorrow, based on the cost of at-the-money puts and calls, according to Stuart Kaiser, Citigroup's head of US equity trading strategy. That's the largest implied move ahead of a CPI print since the regional bank turmoil in March 2023. To put it in perspective, the reading rivals the implied move for Jan. 29 — the Federal Reserve's next upcoming interest-rate decision — and it's higher than the next jobs report, due on Feb. 7. The inflationary theme returned to the fore last week when the jump in December's jobs growth underscored the resilience of the US economy, forcing a cohort of economists to pare their forecasts for interest-rate cuts by the Federal Reserve. Investors are becoming increasingly concerned that Trump's tax and trade agenda will fuel price pressures. Yields on benchmark US 10-year Treasury climbed Monday to 4.8%, capping a more than percentage-point jump since mid-September. "Given the elevated volatility, a cool CPI number could quickly rally the S&P 500 back above 5,900," said Brent Kochuba, founder of options platform SpotGamma. "We now see some large long put positions below that, so if CPI is hot then we could see the S&P 500's rate of decline increase, which would correspond with a big VIX jump." Wednesday's CPI report, set to be released at 8:30 a.m. in Washington, is forecast to show the core reading — which excludes food and energy costs — to have risen by 0.2% in December from a month earlier, down from 0.3% in November. Traders will get a preview of the inflation picture with today's release of US producer prices. Investors who can look beyond any short-term volatility in stocks may find that they're still the best asset to hold in a climate of stubborn inflationary pressure. While the likes of gold, Treasury bills and even Bitcoin are touted as inflation hedges, US stocks are the asset class that most consistently beats inflation, according to data compiled by the Goldman Sachs's wealth management investment strategy group: Equities which have outperformed 100% of the time going back to 1926. Home prices have outperformed 90% of the time, while intermediate-duration Treasuries did so three-quarters of the time. At the bottom of Goldman's list were gold and commodities, which bested inflation only 57% and 34% of the time, respectively. —Jessica Menton and Vildana Hajric |

No comments:

Post a Comment