| |

| |

| Markets Snapshot | | | | Market data as of 06:28 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- The US blacklisted gaming company Tencent and Tesla battery supplier CATL for alleged links to China's military, threatening to escalate tensions between the two largest economies. Shares of both companies, which denied any ties to the military, slumped in China.

- Nvidia unveiled a raft of new chips, software and services, aiming to stay at the forefront of AI. The stock rose in premarket trading. Asian chip-equipment stocks rallied, as did Toyota, a customer for Nvidia's autonomous-driving products.

- Bridgewater Associates dismissed 7% of its workforce as the world's biggest hedge fund seeks to remain lean and maintain the flexibility to hire top talent, according to a person familiar with the matter.

- Mark Carney, the former governor of the Bank of Canada and Bank of England, said he's considering entering the race to replace Justin Trudeau as Canada's prime minister. Canada's currency strengthened after Trudeau said he plans to resign.

- The UK's long-term borrowing costs surged to the highest level since 1998 ahead of debt sales. US stock futures fluctuated and the dollar weakened.

| |

Sky-high stock valuations | |

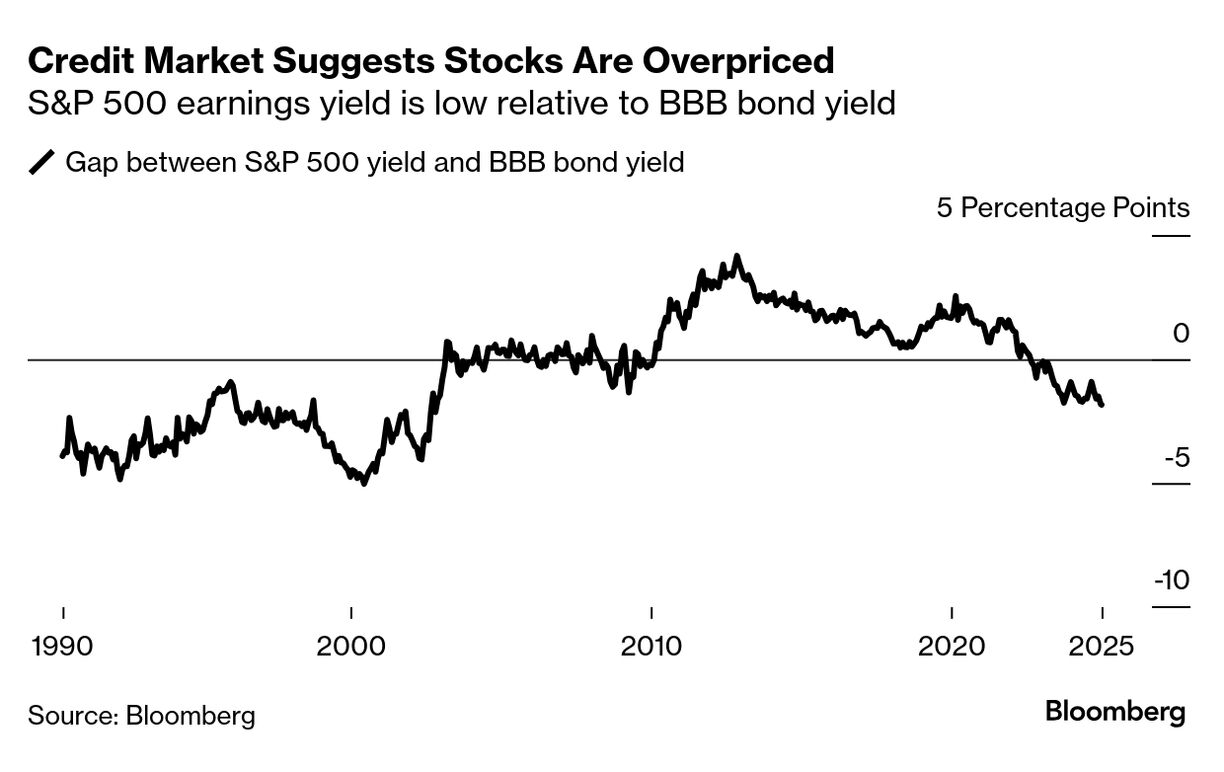

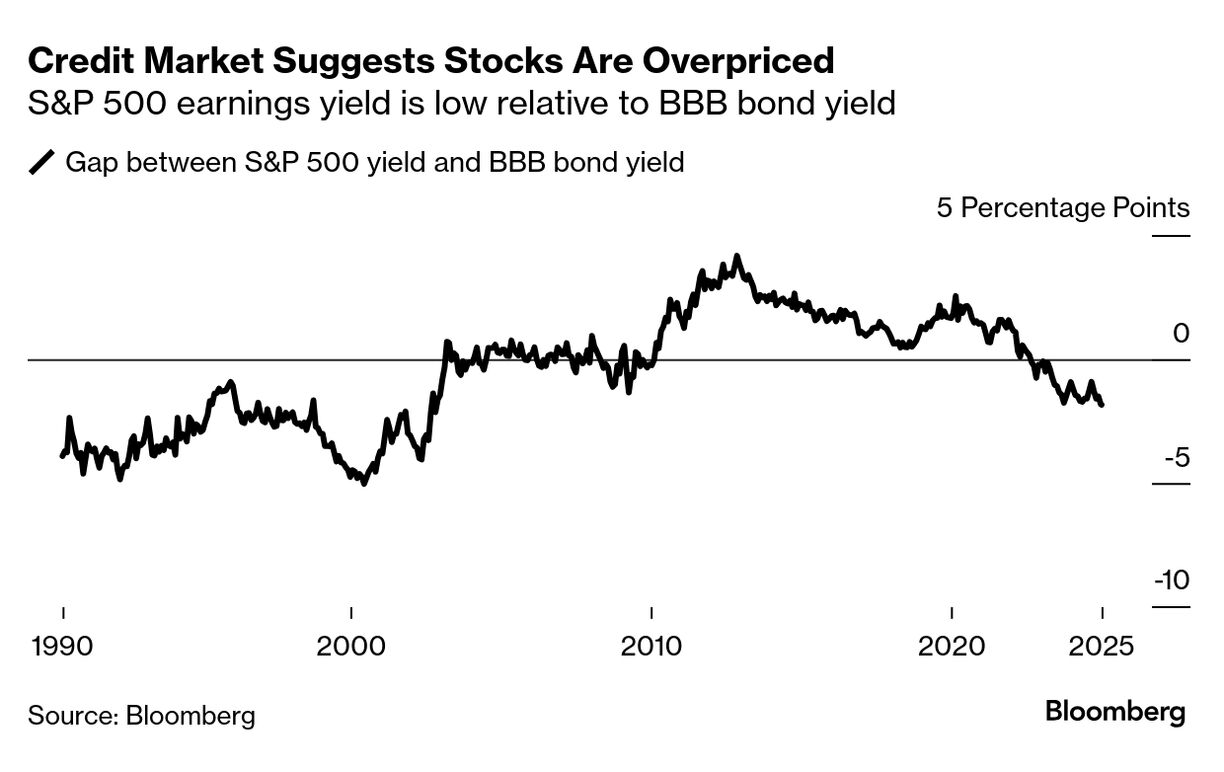

| Fixed-income markets are sending a warning to equity bulls: Stocks are close to the most overvalued against corporate credit and Treasuries in about two decades.

That's according to a metric that looks at how much profit companies can generate relative to their stock price, aka the earnings yield. And then compares that against how much yield an investor would earn from bonds.

The classic view is that stocks should have a higher "earnings yield" because they are so much riskier. But with equities hitting record after record, the reverse has been true and the S&P 500 keeps getting more expensive compared with anything else.

Bulls argue that valuations alone won't stop this rally, and indeed that's been the case for some time. However, nervousness about equity prices is starting to grow louder, especially with inflation worries surfacing again.  The current S&P 500 earnings yield stands at 3.7%, the lowest compared with Treasuries since 2002. Compared to the 5.6% yield on BBB-rated dollar corporate bonds, stocks are close to the lowest since 2008. "As Treasuries remain under pressure pushing yields higher, equity valuations should adjust lower to remain competitive," said Michael O'Rourke, chief market strategist at JonesTrading. Since the turn of the century, when the yield on equities has been lower than that on bonds, it tends to spell trouble for the stock market. Over that period, such a negative read has only ever occurred when the economy was experiencing a bubble or soaring credit risk, according to Ven Ram, a strategist for Bloomberg Markets Live.

A few contrarians see bond yields heading higher still, which would widen the gap, all things equal. Padhraic Garvey of ING Groep, for example, holds the view that the 10-year Treasury will climb to around 5.5% by the end of the year from 4.62% now. —Will Kubzansky and Denitsa Tsekova | |

| |

| Aurora Innovation soars as much as 72% in premarket trading. The self-driving technology company announced a partnership with Continental and Nvidia on driverless trucks. If the gain holds, it'll be the stock's biggest rise since 2021. —Subrat Patnaik | |

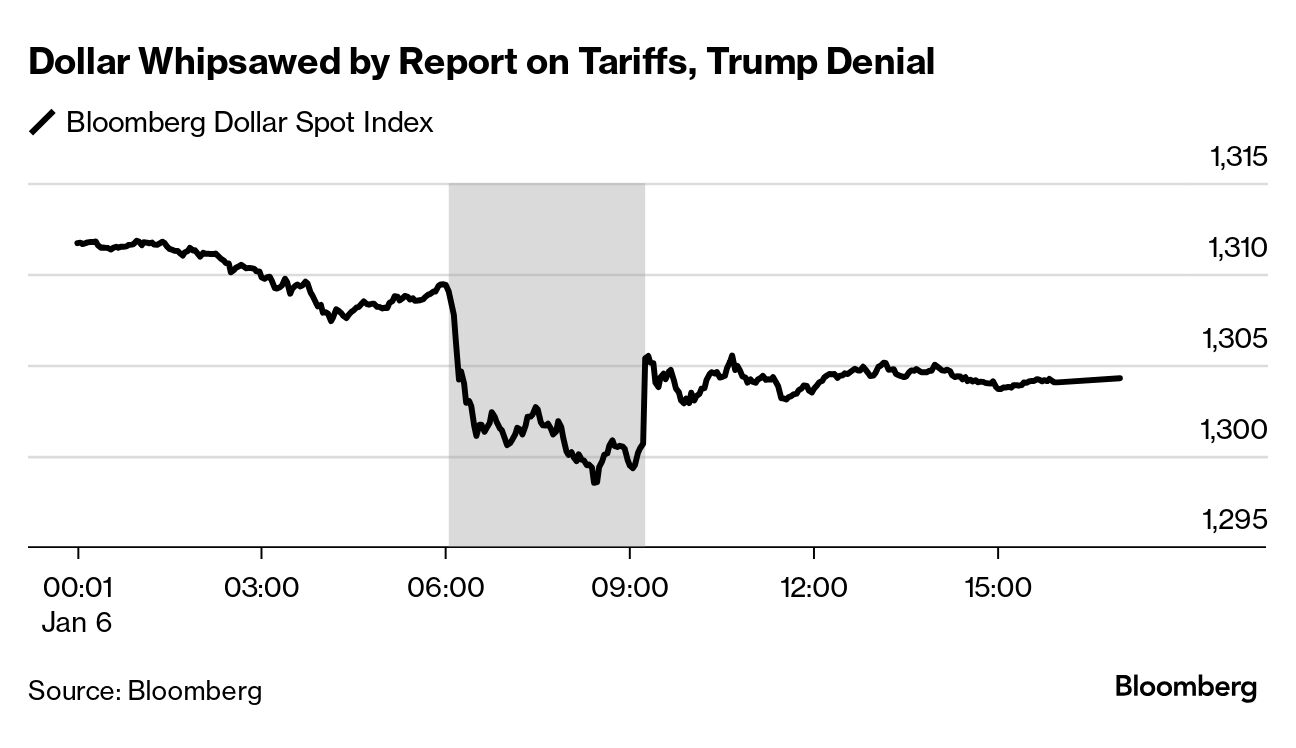

Trump shakes markets, again | |

| If anyone had forgotten what it was like to navigate markets in a Donald Trump presidency, Monday provided a bracing reminder. The dollar sold off around 6 a.m. New York time after the Washington Post reported that Trump's tariffs won't be as broad as initially feared, only to pare the losses when Trump took to Truth Social three hours later to say the report was incorrect. Volumes in the currency options market surged to $108 billion, driven in part by the tariff drama. That surpassed even the activity seen on days of big monetary policy announcements last month. European auto and luxury companies saw similar swings. The episode shows how Trump's use of the social media bullhorn is likely to stir up volatility. In his first term, he tweeted at least 100 times just on market moves alone, mentioning the "Dow," "Nasdaq," "bull run," "earnings" and "winning streak." "If we've learned anything over the years, it's that Trump is unpredictable. He loves shaking up markets, but the final outcomes are often less dramatic than his initial announcements,'' wrote strategists at ING. "As our traders say: welcome to the age of Trump 2.0.'' —Phil Serafino | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment