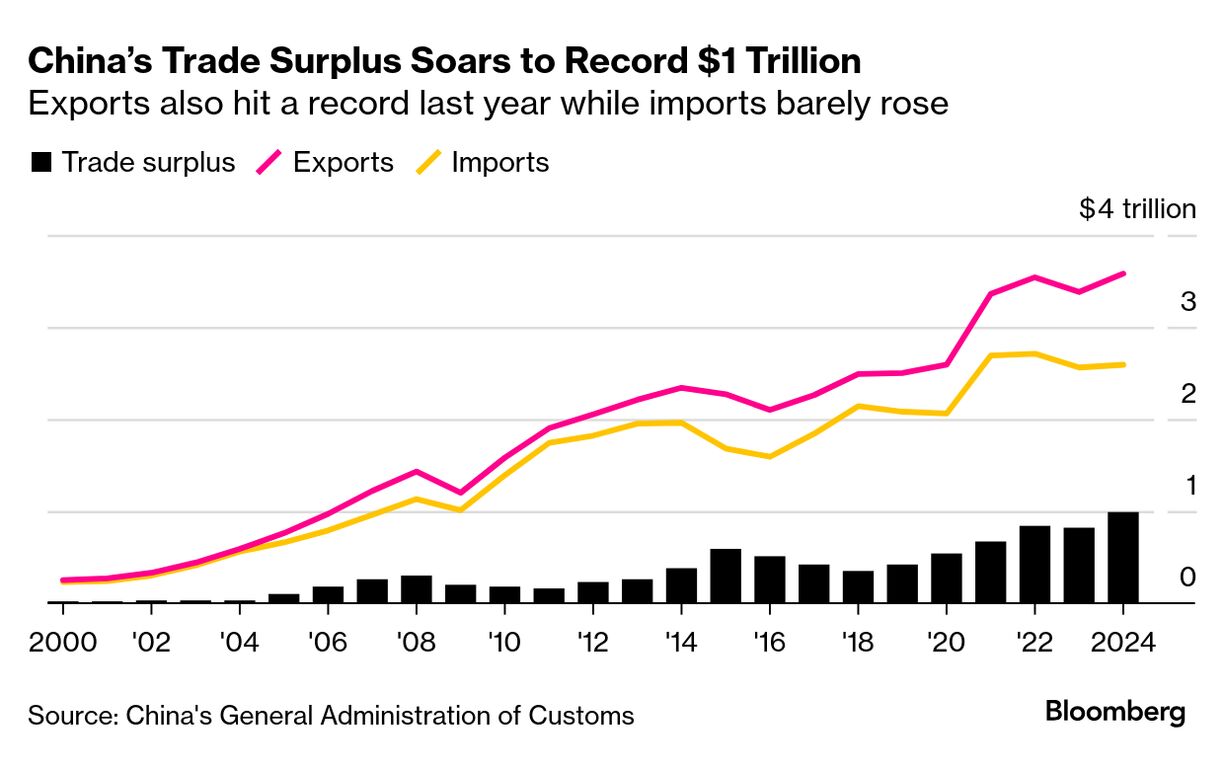

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at China's trade surplus with the US. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. China has just capped a stellar year for its exports with another surge in December. That'll likely make the target on its back even larger in the eyes of President-elect Donald Trump, who'll return to the White House next week. China's export engines have fired at a critical time for the economy as the property slump weighs on consumers and cash-strapped governments struggle to revive domestic demand. The export bonanza should be enough to get Beijing within reach of its growth target of around 5% for the year, data Friday is set to show. But it gets tougher from here. Trump has threatened steep tariffs on Chinese imports. While that's led to anecdotal reports of a rush to frontload orders before he takes office that may last a little longer, there's likely to be a hangover from that later on. China's leaders are betting they have the fiscal firepower to shield the economy from headwinds such as Trump's tariffs — a recently expanded program to encourage companies and consumers to upgrade appliances is one example of those efforts. And now there's increasing recognition that domestic consumption will need to pick up more of the growth impetus. "The priority of macroeconomic policy should shift from promoting more investment in the past, to promoting both consumption and investment, with more importance attached to consumption," central bank Governor Pan Gongsheng said in a speech at the Asian Financial Forum in Hong Kong on Monday. China will look to increase residents' income, step up subsidy support for consumers and improve social security to boost consumption, Pan said, expanding on an argument he began to make public last fall. The governor cited "insufficient domestic demand, especially consumption demand," and "low price levels" among top domestic challenges. Household spending — even counting goods and services provided to citizens by the government — accounts for only around 45% of gross domestic product, well below the 60%-80% level seen in most countries in the OECD. The Best of Bloomberg Economics | - The European Central Bank should continue lowering borrowing costs irrespective of what the Federal Reserve does, Governing Council member Olli Rehn said.

- The White House unveiled sweeping new limits on the sale of advanced AI chips by Nvidia and its peers, leaving the Trump administration to decide how and whether to implement curbs that have encountered fierce industry opposition.

- Justin Trudeau says Canada is ready to respond with counter-tariffs against the US if Trump follows through on his threat to begin a trade war.

- Bank Indonesia has pledged to continue its attempts to stabilize the rupiah, as the prospect of US policy rates staying high puts pressure on emerging markets.

- The Fed's independence won't be in jeopardy once Trump takes office, neither are inflation and the labor market, former Vice Chair Randal Quarles said.

- India's inflation eased last month, but a plunging currency may give the central bank reason to delay cutting rates just yet.

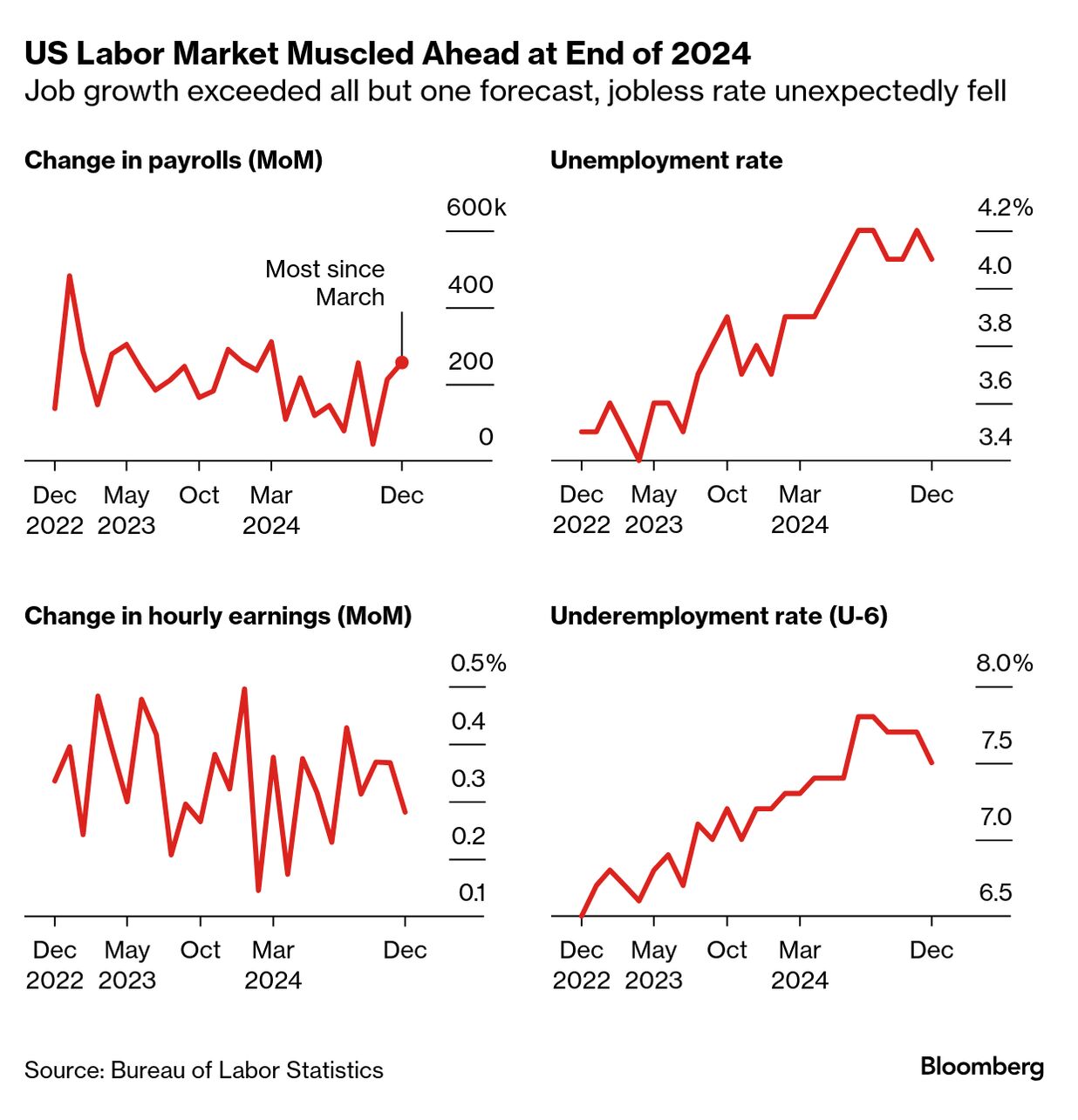

Underlying US inflation probably cooled only a touch at the close of 2024 against a backdrop of a resilient job market and steadfast economy, supporting the Fed's go-slow approach to further rate cuts. The consumer price index excluding food and energy is seen rising 0.2% in December after four straight months of 0.3% increases, according to the median projection in a Bloomberg survey of economists. The core CPI, a better snapshot of underlying inflation, is forecast to have risen 3.3% from a year earlier — matching readings from the prior three months. See here for the rest of the week's economic events. The much stronger-than-expected increase in US payrolls Friday spurred some economists to join investors in paring back expectations for Fed rate cuts. Citigroup is standing fast in anticipating some 1.25 percentage points of reductions this year. Citi's US team, led by Andrew Hollenhorst, wrote Friday that the 256,000 rise in December payrolls and the drop in the jobless rate to 4.1% would likely keep the Fed on pause not just this month but in March also. Yet their base case is for the labor market to soften going forward, spurring the Fed to resume rate cuts in May. Even if the unemployment rate remains in the low 4% range, Citi sees a "more dovish policy path than what the market is pricing" on the basis of a slowdown in inflation. In that scenario, the Fed might wait until June and then potentially move every other meeting — for 75 basis points in 2025. That compares with new projections, released Friday, of 50 basis points from JPMorgan Chase and just 25 from Barclays. Bloomberg House at Davos: Against the backdrop of the World Economic Forum on Jan. 20-23, Bloomberg House will be an unparalleled hub where global leaders converge to chart a path forward. Join us for breakfast, afternoon tea or a cocktail. Meet thought leaders, listen to newsmakers, sit in on a podcast taping, have a candid conversation with our journalists and help us identify the trends that will impact the year ahead. Request an invite here. |

No comments:

Post a Comment