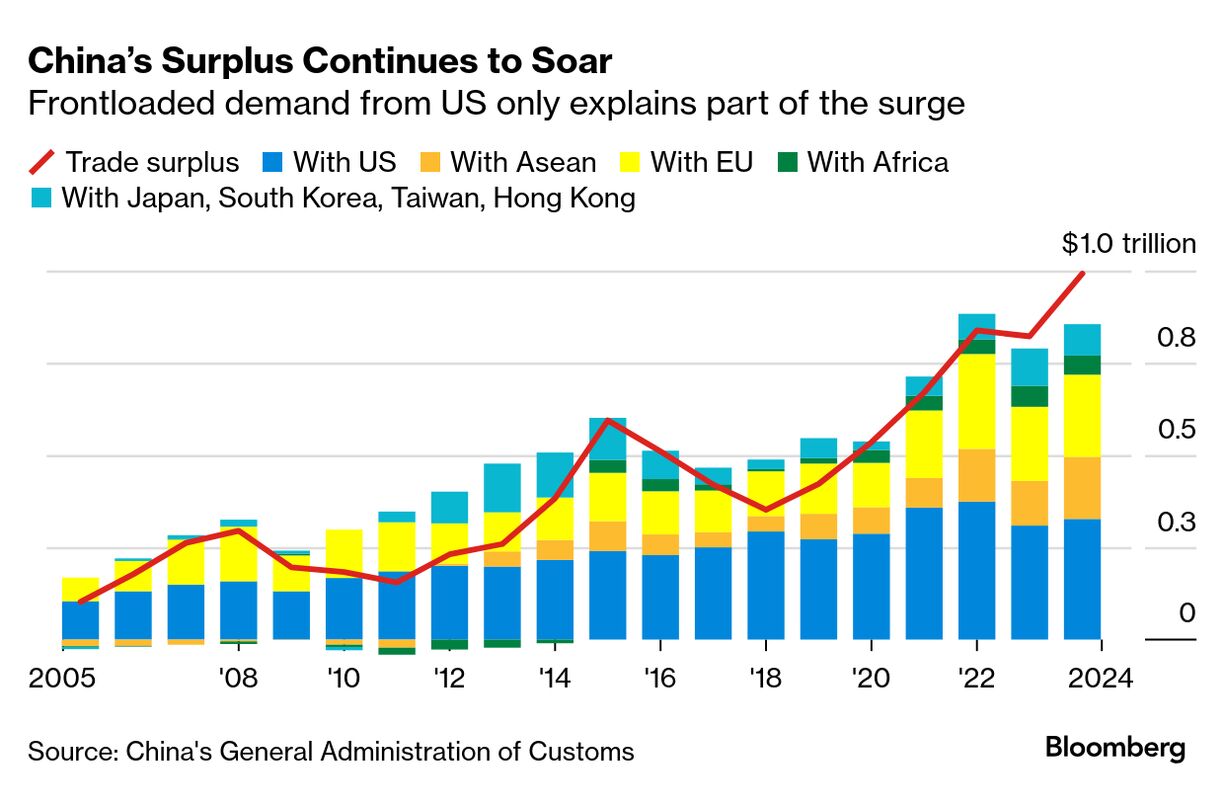

| China exported a record amount of goods last year, swelling its trade surplus to almost $1 trillion and underscoring how global commerce remains unbalanced despite government protectionism and efforts by companies to diversify their supplier bases. US importers trying to buy as much from China as they can before Donald Trump returns to the White House are driving part of the trade gap, with exports to the US in December rising to the highest in two years and taking the total for the year to $525 billion. The Chinese surplus with the 10 countries in Asean also jumped to a record, with part of that likely driven by exports of parts for electronics, to be assembled in Vietnam and then shipped to the US and elsewhere. Read More: China Vows 'Very Proactive' Fiscal Policy Before Trump's Return But the strength of demand for Chinese products is global — exports last year to Indonesia and Brazil grew by double digits, while shipments to France and Germany climbed more than 6%, buoyed by exports of millions of electric vehicles and other products. However, Chinese demand for the world's products didn't grow anywhere nearly as fast, with imports only expanding 1.1% last year, well below the 5.9% rise in exports. A big question now is whether China's efforts to boost the domestic economy can boost that demand for foreign goods, or will the world's second-biggest economy continue to rely on the rest of the world to make up for its weak economy and lackluster consumer demand. Another unknown: Whether Trump — who enters office one week from today — will use the latest figures from Beijing as more justification for one of his most consequential campaign promises of the 2024 election: imposing universal tariffs on China as a way to correct imbalances in the global trading system and boost job growth at home. Related Reading: —James Mayger in Beijing Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment