| Tariff uncertainty is creeping into an otherwise optimistic outlook for Texas manufacturers in 2025, according to the latest survey from the Federal Reserve Bank of Dallas. The Dallas Fed's monthly poll results include commentary from unidentified respondents, and as Bloomberg's latest Odd Lots newsletter points out, there was some improvement in optimism month-over-month. (Click here to sign up for the daily Odd Lots newsletter.) Here's what some manufacturers said in Monday's report during a survey period that followed President-elect Donald Trump's threats to impose tariffs on some of the US's biggest trading partners: - Plastics and rubber maker: "Tariffs are a concern. Particularly the ones on goods from Mexico are the biggest existential threat to this business in its 70 years."

- Computers and electronics: "Widespread tariff risks are causing significant change in our business and a potential loss of orders."

- Food producer: "Talk of tariffs on imported materials and ingredients is a big uncertainty generator for our operations."

- General manufacturer: "Things are looking good for domestic business, but we are concerned about international trade and supply disruption with geopolitical conflict and trade concerns."

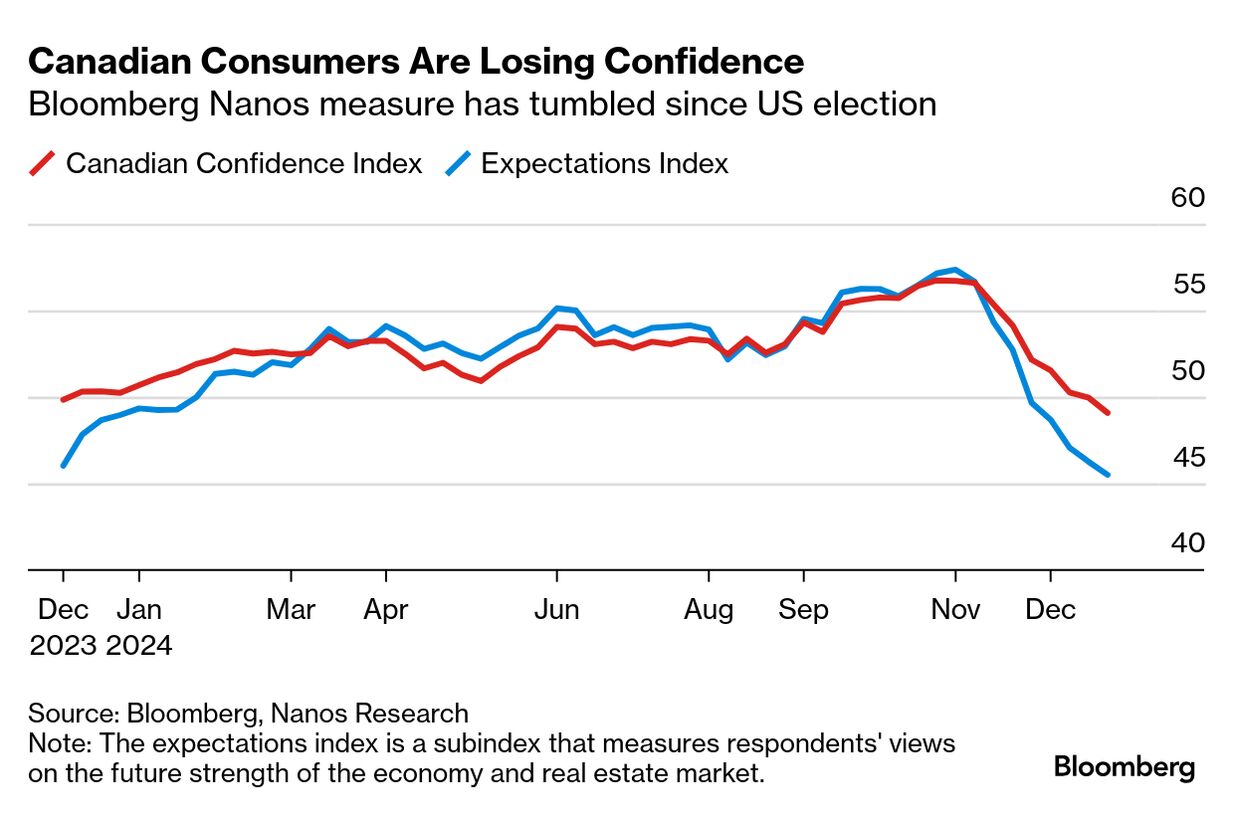

Big Take: Trump's Tariff Threats Set Off a Global Supply Chain 'Freakout' Such worries extend beyond Texas. Canadians are less optimistic about their economy because of Trump's tariff threats, with the Bloomberg Nanos Canadian Confidence Index reaching its lowest level since November 2023. In Europe, European Central Bank Governing Council member Klaas Knot said he's concerned China may start selling its products to Europe at discounted rates if the US starts a trade war by imposing new tariffs. Big Take: Germany's Economy Is Unraveling Just as Europe Needs It Most In such a situation, "there is a chance that the Chinese will start offering their goods in Europe at lower and lower prices," Knot said in an interview published in Dutch newspaper Volkskrant on Monday. "We are already seeing that happening in the steel market," he said. "In this way, China is, as it were, exporting its deflation to us." Related Reading: —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment