| I'm Tom Rees, UK economy reporter in London. Today we're looking at the year ahead for the Bank of England. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Note: Economics Daily will be off tomorrow, and resumes publication Jan. 2, when our year-ahead special series turns to China.

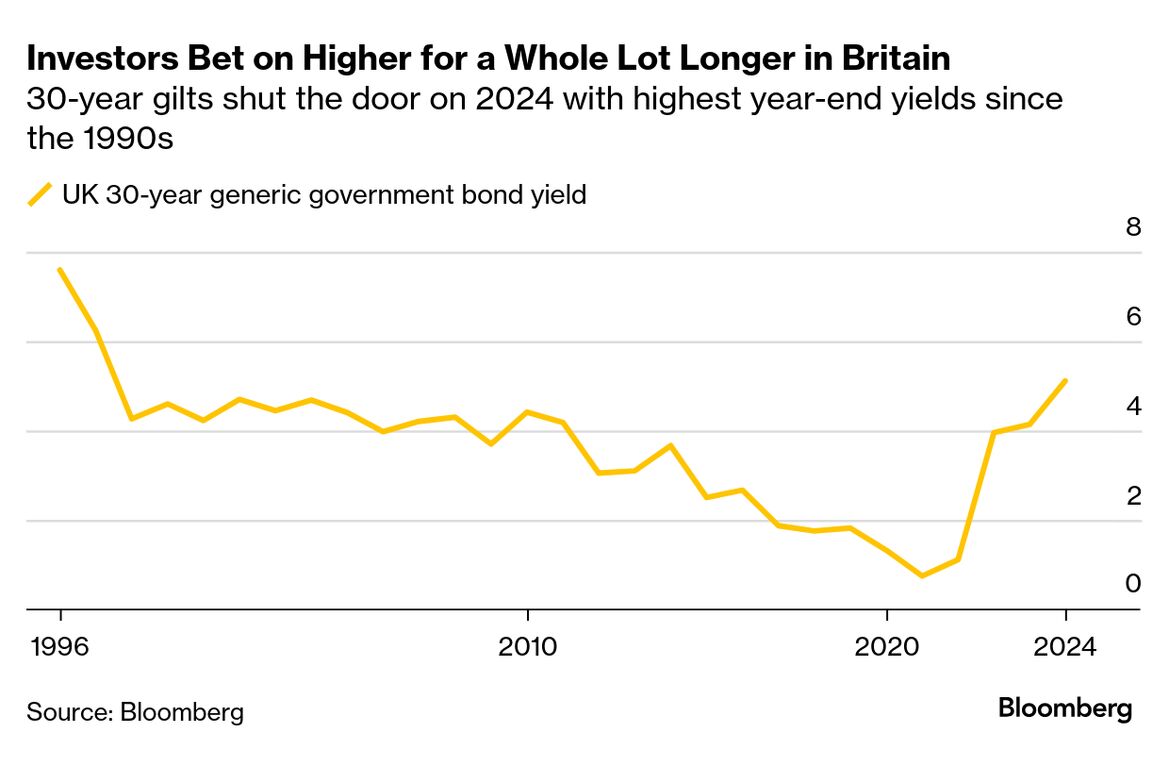

The Bank of England is expected to press ahead with cautious policy easing in 2025, even as new threats bubble up at home and abroad. Governor Andrew Bailey signaled shortly before Christmas that a "gradual" approach to interest rate cuts "remains right," pushing back against market bets on fewer reductions in the coming year. Two more rate-setters joined chief dove Swati Dhingra in calling for an immediate reduction at December's meeting, when the benchmark rate was left unchanged at 4.75%. The scale of support for cuts and Bailey's relaxed attitude to a surprise jump in wage growth boosted hopes of a quicker pace of rate cuts, including a move at the first meeting of the year in February. A third rate reduction of the cycle in February is not sewn up just yet. The BOE is waiting for more clues on how businesses will react to a huge increase in employer payroll taxes. The £26 billion ($33 billion) tax hike could prompt firms to push up prices, lower wage growth, take a hit to profits or cut jobs, complicating the response from BOE policymakers. Bailey also pointed to "heightened uncertainty" over geopolitics and trade ahead of Donald Trump's return to the White House, with a tariff spat potentially weighing on the already-slowing UK economy. While traders see a two-thirds chance of a cut at the next meeting, they only have one more fully priced in for the rest of 2025. Bailey has previously implied that gradual means four rate reductions over the next 12 months. The BOE will get an opportunity to reset market expectations in new forecasts that will be released alongside February's decision. It will also unveil its annual stocktake of the UK economy's growth capacity. By Feb. 6, officials will have a better sense of whether a sharp growth slowdown since the Labour party entered power was a blip, or marks a sustained downturn. The economy has contracted 0.1% over the first four months of data since Prime Minister Keir Starmer's landslide victory in July. Mounting concerns for the UK economy may see more rate-setters switch their focus from inflation to growth in 2025, a pivot that has already been seen in the eurozone. Data published Tuesday showed that UK credit card borrowing barely budged in 2024 as consumers scaled back purchases, signaling households will likely spend less in 2025, too. The Best of Bloomberg Economics | - Joining the exclusive Wall Street club of Treasury primary dealers was once coveted, but not so much anymore.

- Pending US home sales surged to the highest level since 2023 as homebuyers gave up waiting for lower mortgage rates and dove into the market.

- The IMF is set to review Argentina's $44 billion aid program next month, as the government negotiates a new loan.

- Canadians are less optimistic about the direction of their economy than they've been in more than a year, as Trump's tariff threats create uncertainty for one of the largest US trading partners.

- Singapore's Prime Minister Lawrence Wong said the economy performed better than expected in 2024, building a strong foundation for the city state to confront a more complex international environment next year.

- The Swiss National Bank continued to refrain from significantly influencing the franc even as the currency saw a third-quarter rally.

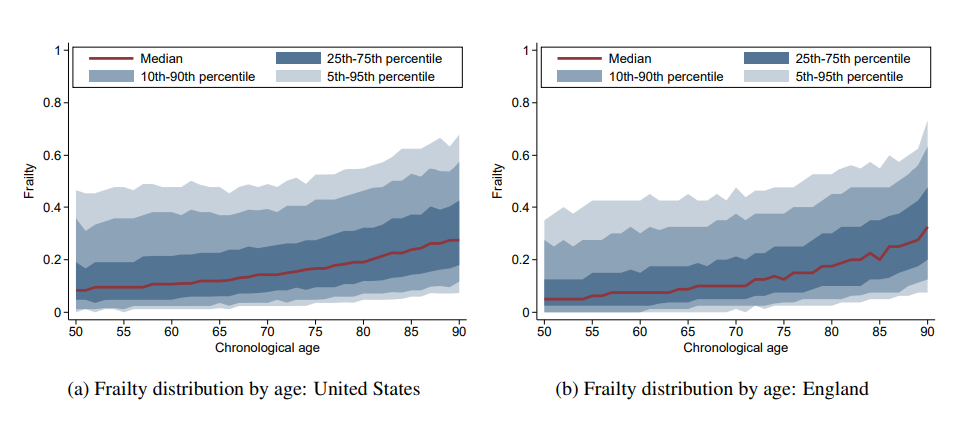

A group of Harvard and London Business School economists found that age is, indeed, just a number. Economic analysis on aging populations is inaccurate when focused solely on a number, they said in a National Bureau of Economic Research paper, since people age differently — among other variables. "Chronological age is an unreliable proxy for physiological functioning due to appreciable differences in how aging unfolds across people, health domains, and over time,'' said economists Rainer Kotschy, David Bloom and Andrew Scott. Relying solely on a number — for example, the average age of residents in Japan rising to 54 by 2050— fails to predict economic variables, or can predict outcomes that aren't even related to physiological aging. It's easy to measure and understandable to use age as a proxy, but it can't be the only variable. So rather than use the change in average age alone as a stand-in for the increased costs to the healthcare sector, researchers should also factor in physiological conditions and other factors, otherwise their findings may not be reliable. |

No comments:

Post a Comment