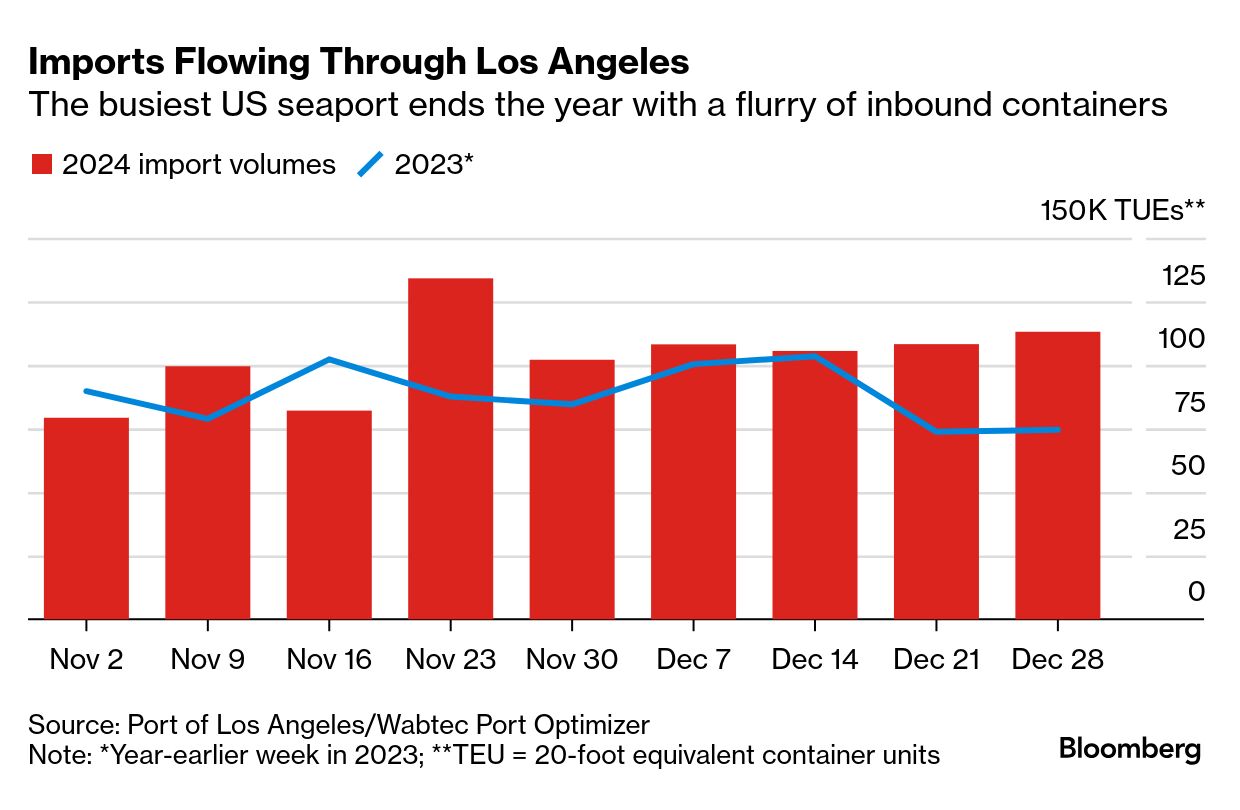

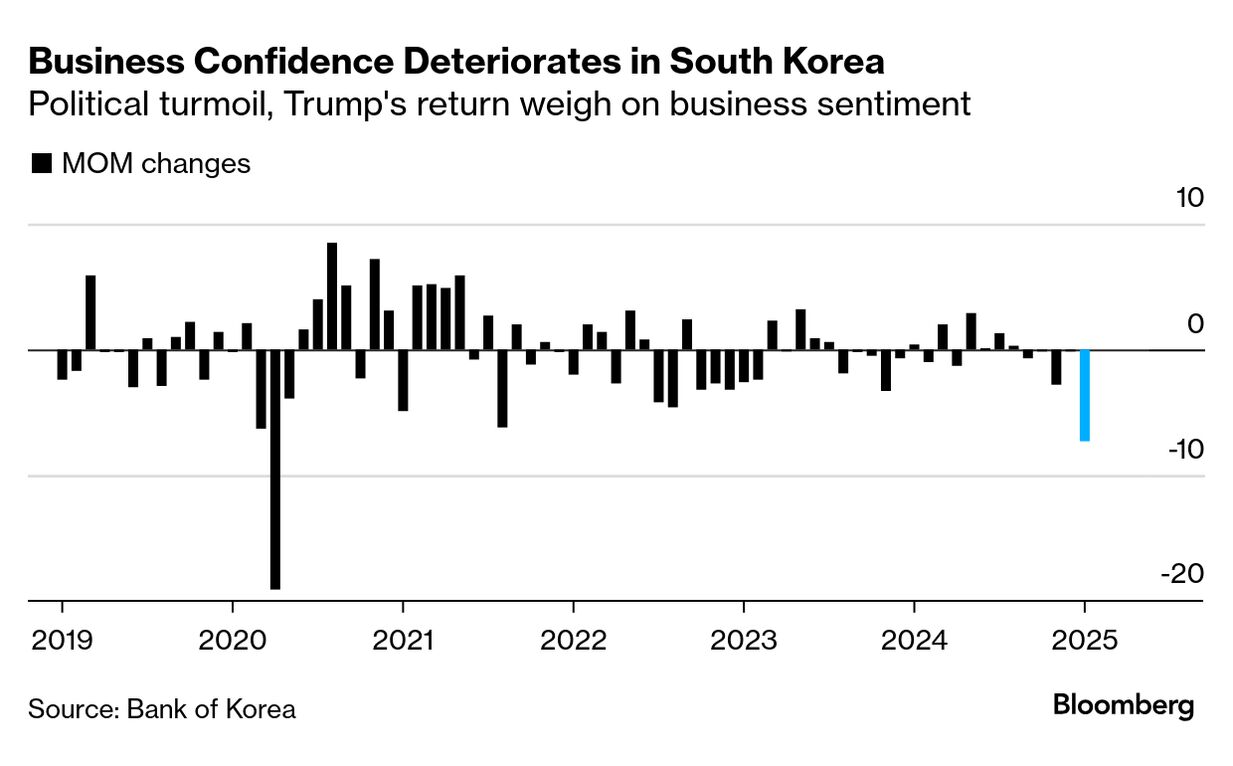

| The busiest port in the US is heading until 2025 handling a flurry of imports as companies try to beat President-elect Donald Trump's tariffs on Chinese goods and a strike that threatens to shut trade gateways on the eastern half of the country. This holiday week the Port of Los Angeles will handle about 129,000 inbound containers, a 73% increase from the comparable week a year ago, according to estimates in the Wabtec Port Optimizer's latest readings on Monday. That would cap a strong year in which imports rebounded from a post-pandemic slump in 2023. Trump says his favorite word in the dictionary is "tariff." But perhaps the least favorite entry for businesses, consumers and economists is "uncertainty," like the kind that surrounds his plan for widespread increases in import taxes. "The big thing right now is the uncertainty — what exactly is it going to hit, when is it going to hit, how is it going to hit?" Ryan Petersen, founder and CEO of Flexport, said last week on Bloomberg Surveillance. Investec economist Ellie Henderson, speaking on Bloomberg Television, said the outlook for 2025 is shrouded in uncertainty until "pen is put to paper" on Trump's trade policies. Here are several drivers of the big unknowns for global trade in 2025: Trade wars. The self-proclaimed Tariff Man returns to office on Jan. 20 and Trump has spent the weeks before the election threatening Mexico, Canada, China and the European Union with higher duties on imports unless leaders take specific action ranging from cracking down on illegal migration to buying more American energy exports. Big Take: Trump's Tariff Threats Are Setting Off a Global Supply Chain 'Freakout' Earlier this month Bloomberg Economics laid out a plausible scenario for how Trump might deploy his tariffs starting in mid-2025, with levies on China tripling by the end of the following year. "Anyone with a trade surplus with the US should be feeling very uncomfortable right now," BMO Capital Markets senior economist Jennifer Lee told Bloomberg TV last week. US port gridlock. Dockworkers at East and Gulf Coast ports may walk off the job unless they can reach a new contract with their employers by the Jan. 15 deadline. (The International Longshoremen's Association went on strike for three days in early October and the disruptions were immediate if short-lived.) Trump weighed in recently, siding with ILA workers. Lately, their employers are digging in their heels on the use of automated equipment. Tariffs and a strike could be potent headwinds for the global economy. Carsten Brzeski, the global head of macro research at ING, said one possibility is "a counterintuitive surge in global trade in the first months of the year as companies frontload exports to the US." Big Take: A $2 Trillion Reckoning Looms as Ports Become Pawns in Geopolitics Geopolitical turmoil. The Red Sea was the arena for Houthi shipping attacks throughout 2024, and with missiles still flying, ships are expected to continue diverting around South Africa heading into next year. Now comes Trump with his eye on reasserting US control of an even more important waterway for the nation's economy — the Panama Canal. Panama's president stood his ground. In both cases, geopolitical conflict in vital waterways and Washington's worries about China's maritime industry dominance pose more uncertainties for international commerce. But there's potentially good news in shipping that might actually offset the higher costs that Trump's tariffs will create. Cargo carriers have ordered a lot of new vessels that will come on line in 2025, easing upward pressure on freight rates that are ending this year on the rise. And if the Red Sea violence subsides and traffic flows normally again, "that will instantly bring the price of ocean freight down by two-thirds, maybe more," Petersen said. —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment