| Hi, it's Ian in San Francisco. The chip industry saw major successes and failures during the past year. But first... Three things you need to know today: • OpenAI is considering a corporate change to become more like a for-profit company

• AT&T and Verizon say their networks are clear of the China-linked Salt Typhoon hacking operation

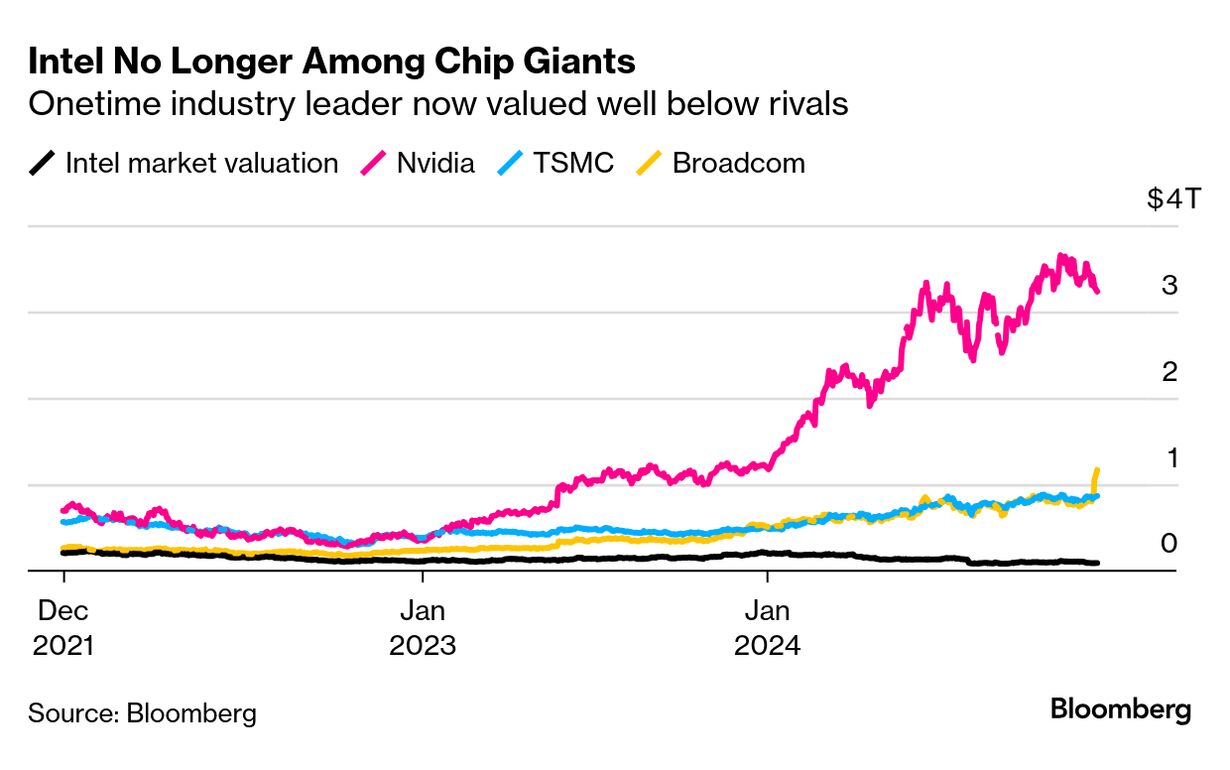

• Nvidia supplier Ibiden weighs a faster expansion to keep up with AI demand The best of times, the worst of times | Of the 10 public companies in the world that investors value at more than $1 trillion, a third are in the chip industry. Broadcom Inc. joined Taiwan Semiconductor Manufacturing Co. and, of course, Nvidia Corp. in that exclusive club in 2024, capping a remarkable reevaluation of what was once a sleepy corner of the technology industry. Nvidia co-founder Jensen Huang traveled the world pushing everyone to start using artificial intelligence (and his hardware) while his company continued to deliver implausible growth. While the debate continues about whether AI is real or just the latest tech bubble, there has been a clear bet that the makers of the fundamental components of that technology are going to win regardless. In a year in which these three companies that used to be niche players in their own industry achieved a combined value of more than $5 trillion – bigger than Japan's total gross domestic product — that should have been the story. But two other longtime chipmakers came close to stealing the limelight — for the opposite reasons. The semiconductor industry has always been a brutal place. The tiny components can cost hundreds of millions of dollars and years to design and bring to market. Trying to manufacture them at scale requires facilities that cost more than $20 billion to build and equip, and those factories become obsolete in as little as five years. The economics have always made it a high-stakes game, and the increasing complexity has upped the ante to the point where it's only a shrinking list of names that can afford to play. Arguably the two companies that understood best how to survive in this environment were Intel Corp. and Samsung Electronics Co. For decades, both dominated their respective areas with a simple formula: Invest heavily, even when demand is going through one of its all-too-frequent slumps, and move faster than the opposition to bring out new technology so when customers come flooding back, you vacuum up the bulk of lucrative surges in demand. In 2024, however, a struggling Samsung replaced the head of its chip division. Onetime also-ran SK Hynix Inc. is blowing past it in growth and taking market share, bolstered by the ability to more quickly produce the new types of memory that are central to AI computer systems. Samsung also has been falling further behind TSMC in the foundry business of manufacturing chips for other semiconductor companies. While Samsung still has time to course-correct and deliver AI-related memory in the kind of volume that's required, faith in its once-unquestioned leadership has been undermined. The chip unit of the company gained an edge over Japanese rivals in the early 1990s with relentless investment and delivery of new products. After 30 years far in the lead, it's now hearing footsteps close behind. That South Korean drama pales in comparison with the Intel show. As recently as two years ago, Intel had almost three times the annual revenue of Nvidia. In 2024, one division – data center – at Nvidia will have more than twice Intel's total sales. While Samsung has one task – get into volume production of high-bandwidth memory as fast a possible – Intel is beset on all sides. Nvidia has pillaged its data center chip stronghold, TSMC has taken leadership of manufacturing, Advanced Micro Devices Inc. is chipping away at its microprocessor franchise, and Broadcom is reaping the rewards of helping Intel's biggest customers design their own chips. Intel's board ran out of patience in December with the man who'd been brought back to save it, Pat Gelsinger. His co-CEO temporary replacements were then forced to admit at a technology conference that the decision on whether to split the company up, to pull apart what made it the biggest chipmaker for decades, will be made by their successor. If 2024 was a tough year for a pioneer of the industry, 2025 carries the possibility of its name disappearing. —Ian King The conflict over whether TikTok will be sold or banned in the US reaches another critical stage on Jan. 10 with a hearing before the Supreme Court. President-elect Donald Trump weighed in, urging the court to pause the ban. The company and the Justice Department filed dueling arguments over the law that requires a sale by the video app's China-based parent company or a shutdown by Jan. 19. Fintechs face a changing US regulatory environment in 2025. Delivery Hero shares fell after regulators blocked the sale of its Taiwan unit to Uber. Netflix attracted 24 million viewers to its first live NFL game broadcasts on Christmas Day. |

No comments:

Post a Comment