| I'm Brendan Murray, an economics editor in London. Today we're looking at the year ahead for global trade. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The US economy exceeded expectations in 2024, as household spending held up, buoyed by the labor market. But there are troubling signs ahead.

- Spanish inflation quickened more than anticipated, staying above 2% for a second month on base effects and supporting the case for gradual ECB interest-rate cuts.

- China's central government urged local authorities to offer handouts to people struggling with the cost of living ahead of the lunar new year holiday.

Companies around the world are scrambling to get ahead of President-elect Donald Trump's threatened tariffs on the US's biggest trading partners in 2025. But with just three weeks left until Inauguration Day, many economists can only venture a guess as to how Trump's trade wars will influence the growth outlook, or answer one of next year's most pressing questions: Will central bankers keep lowering interest rates if tariffs spark new inflationary pressures? "Anything can happen — there's even talk about possible rate hikes depending on what happens with tariffs and inflation," BMO Capital Markets senior economist Jennifer Lee told Bloomberg TV last week. "So right now it's like anything goes." If Trump's favorite word in the dictionary is "tariff," perhaps the least favorite entry for businesses, consumers and economists is "uncertainty," like the kind that surrounds his plan for widespread increases in import taxes. "The big thing right now is the uncertainty — what exactly is it going to hit, when is it going to hit, how is it going to hit?" Ryan Petersen, founder and CEO of Flexport, said last week on Bloomberg Surveillance. Here are three drivers of the big unknowns for global trade in 2025: Tariff sheriff returns. The self-proclaimed Tariff Man returns to office on Jan. 20 and Trump has spent the weeks before the election threatening Mexico, Canada, China and the European Union with higher duties on imports unless leaders take specific action ranging from cracking down on illegal migration to buying more American energy exports. Earlier this month Bloomberg Economics laid out a plausible scenario for how Trump might deploy his tariffs starting in mid-2025, with levies on China tripling by the end of the following year. "Anyone with a trade surplus with the US should be feeling very uncomfortable right now," Lee said. US port gridlock. Dockworkers at US East and Gulf Coast ports may walk off the job unless they can reach a new contract with their employers by the Jan. 15 deadline. (The ILA — the largest maritime workers union in North America — went on strike for three days in early October and the disruptions were immediate if short-lived.) Trump has weighed in recently, siding with ILA workers. Their employers are digging in their heels on the use of automated equipment. Carsten Brzeski, the global head of macro research at ING, said one possibility is "a counterintuitive surge in global trade in the first months of the year as companies frontload exports to the US." Geopolitical turmoil. The Red Sea was the arena for Houthi shipping attacks through 2024, and with missiles still flying, ships are expected to continue diverting around South Africa heading into next year. Now comes Trump with his eye on reasserting US control of an even more important waterway for the nation's economy — the Panama Canal. Panama's president stood his ground. In both cases, geopolitical conflict in vital waterways is another cloud over international commerce. Big Take: A $2 Trillion Reckoning Looms as Ports Become Pawns in Geopolitics Heading into 2025, there's potentially good news in shipping that might actually offset the higher costs that Trump's tariffs will create. Cargo carriers have ordered a lot of new vessels that will come on line in 2025, easing upward pressure on freight rates that are ending this year on the rise. And if the Red Sea violence subsides, allowing traffic to flow normally again, "that will instantly bring the price of ocean freight down by two-thirds, maybe more," Petersen said. The Best of Bloomberg Economics | - Treasury Secretary Janet Yellen said her department is likely to begin taking special accounting maneuvers in mid-January to avoid breaching the US debt limit, and asked lawmakers to take action defending the "full faith and credit" of the US.

- China may start selling its products to Europe at discounted rates if the US starts a trade war by imposing new tariffs, European Central Bank official Klaas Knot said.

- Argentina sold some $803 million in hard-currency reserves last week after officials rushed to meet a surge in demand from importers for dollars.

- Turkey's president said rates will fall in 2025. Meanhwhile, Finance Minister Mehmet Simsek said the country won't undermine next year's inflation forecast when increasing taxes on fuel and tobacco.

- Vietnam's birth rate has sunk to a record low with the total fertility rate falling to 1.91 children per woman, marking the third consecutive year it's dropped below the replacement level.

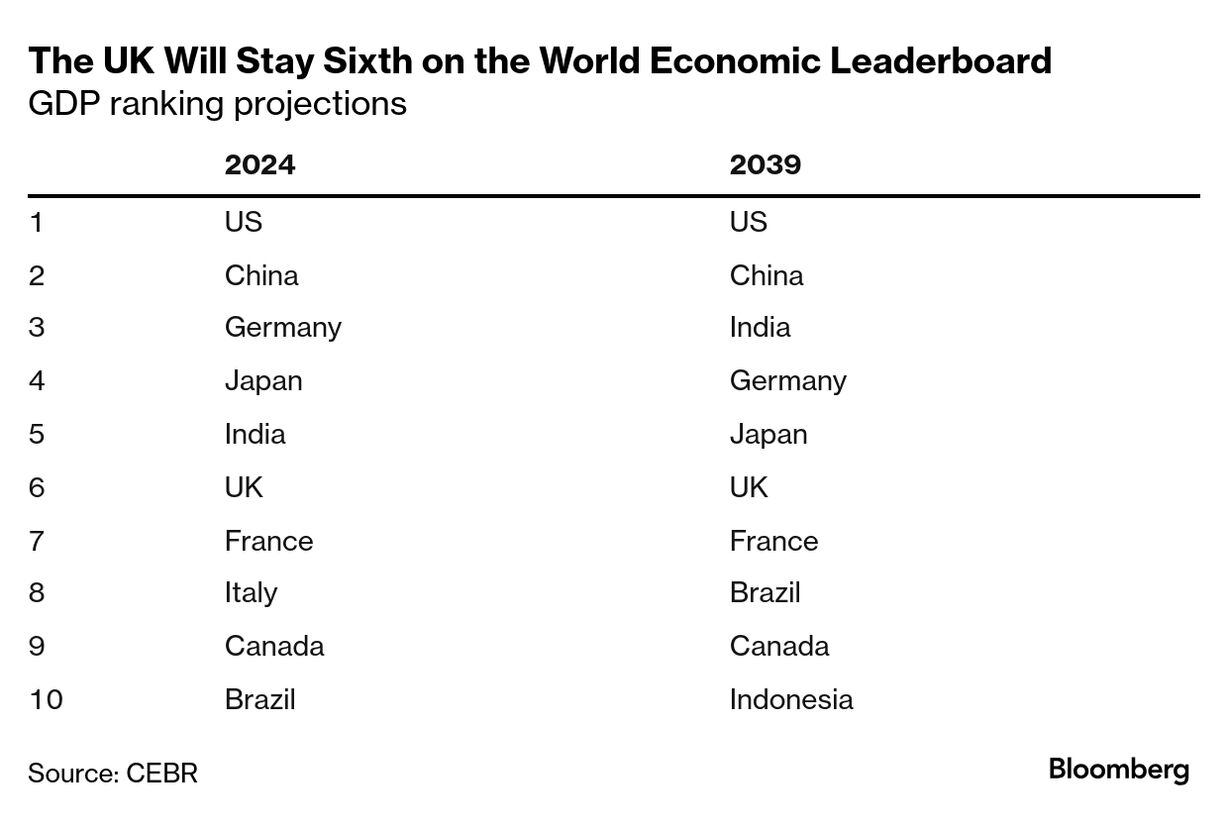

The UK will outperform its struggling European peers in the next 15 years, helping it to cling onto its place among the world's biggest economies, according to long-term projections. Britain and France will remain in sixth and seventh position by 2039, respectively, as Germany, Italy and Spain slip down the leaderboard, the Centre for Economics and Business Research predicted. The upbeat assessment will be welcomed by Prime Minister Keir Starmer after official figures showed the economy has failed to grow since his Labour government took power in July. Survey data point to a dismal final quarter that is expected to spill over into 2025. |

No comments:

Post a Comment