| US stock futures pointed to small gains on Wall Street on the last trading day of 2024. The so-called Santa Claus Rally has struggled to mat |

| |

| Markets Snapshot | | | | Market data as of 06:06 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- US stock futures pointed to small gains on Wall Street on the last trading day of 2024. The so-called Santa Claus Rally has struggled to materialize and Tuesday's cautious tone reflects lingering concern about an advance this year that was driven by a handful of US tech giants

- The US Treasury Department was hacked by a Chinese state-sponsored actor through a third-party software service provider, according to a letter the agency sent to Congress on Monday. Treasury described the intrusion as a "major cybersecurity incident"

- China's services activity expanded at the fastest pace in nine months and the manufacturing sector grew for a third straight month, suggesting Beijing's stimulus blitz may be working. The country's gross domestic product is expected to expand around 5% for the full year of 2024, President Xi Jinping said. Still, mainland stock gauges retreated

- Football star Lionel Messi carried out an initial public offering of his real estate properties, valuing the portfolio at €223 million. Edificio Rostower Socimi has been listed as a real estate investment trust and owns seven hotels, commercial real estate for shops and offices, as well as houses, according to its prospectus. Rostower posted loses in both 2022 and 2023

- European natural gas prices for February rose as much as 2.2% in anticipation of a halt in Russian flows via Ukraine on New Year's Day. A five-year deal between Moscow and Kyiv to move Russian gas to central Europe is set to lapse when the clock runs out on 2024

Markets Daily wishes all our readers a happy and healthy New Year! We'll be back on Thursday. ...and there's still time to let us know which assets will fare the best in 2025 via the Markets Pulse survey. | |

| |

| It was once the club every Wall Street institution wanted to join: the elite network of primary dealers who serve as gatekeepers of the world's biggest and most influential bond market, US Treasuries. Not so much anymore. Just as America's debt load is poised to balloon beyond already-record levels, a variety of forces has made membership in this vital cohort less coveted. In one telling example, Ken Griffin's Citadel Securities in September indicated that it had shelved, for now, its long-touted plans to join the group, with the rise of electronic trading allowing it to earn a spot as a market-making giant despite not being among the Federal Reserve's select counterparties. Formed in 1960 by the New York Fed to ensure the smooth functioning of a Treasury market that has since grown to nearly $29 trillion and is a benchmark for setting borrowing costs across the world, the current system of primary dealers stands at two dozen, about half the number at its peak in 1988, when US debt was a fraction of what it is now and before a wave of bank mergers. Those remaining in the ranks warn of mounting pressures in navigating their role. In interviews with Bloomberg News, they say it's getting tougher to fulfill their duty of bidding on new debt at the Treasury's regular auctions of securities and maintaining an active secondary market, blaming in part post-financial crisis regulations setting capital and leverage levels that they say constrain them. "Issuance has gone up almost threefold in the last 10 years and the anticipation is for it to close to double to $50 trillion outstanding in the next 10 years, whereas dealer balance sheets haven't grown at that magnitude," said Casey Spezzano, head of US customer sales and trading at primary markets dealer NatWest Markets and chair of the Treasury Market Practices Group, the government-debt watchdog sponsored by the New York Fed. "You're trying to put more Treasuries through the same pipes, but those pipes aren't getting any bigger." — Michael Mackenzie, Liz Capo McCormick and Alex Harris | |

| |

| While markets are otherwise loath to suspend trading, the death of a president has long been an exception. US stock markets will close Jan. 9, in observance of a national day of mourning for former President Jimmy Carter. The New York Stock Exchange, Nasdaq Inc.'s US equities exchanges and Cboe Global Markets Inc. will shut, the companies said. The bond market will close at 2 p.m. New York time, per the recommendation of the Securities Industry and Financial Markets Association. CME Group Inc. said its equities derivatives market will start trading as usual at 6 p.m. in New York on Jan. 8 and close at 9:30 a.m. the following morning. Stock futures trading will resume at 6 p.m. on Jan. 9. Carter died Dec. 29 at 100, and was the longest-living US president in history. The most recent national day of mourning came on Dec. 5, 2018, for the funeral of President George H.W. Bush. The closures are part of a long-standing American tradition that began after the April 1865 assassination of Abraham Lincoln. News of the 16th president's death carried "a sensation of horror and of agony which no other event in our history has ever excited," the New York Times reported. "Business was suspended. Crowds of people thronged the streets." — Isabelle Lee and Bailey Lipschultz | |

| |

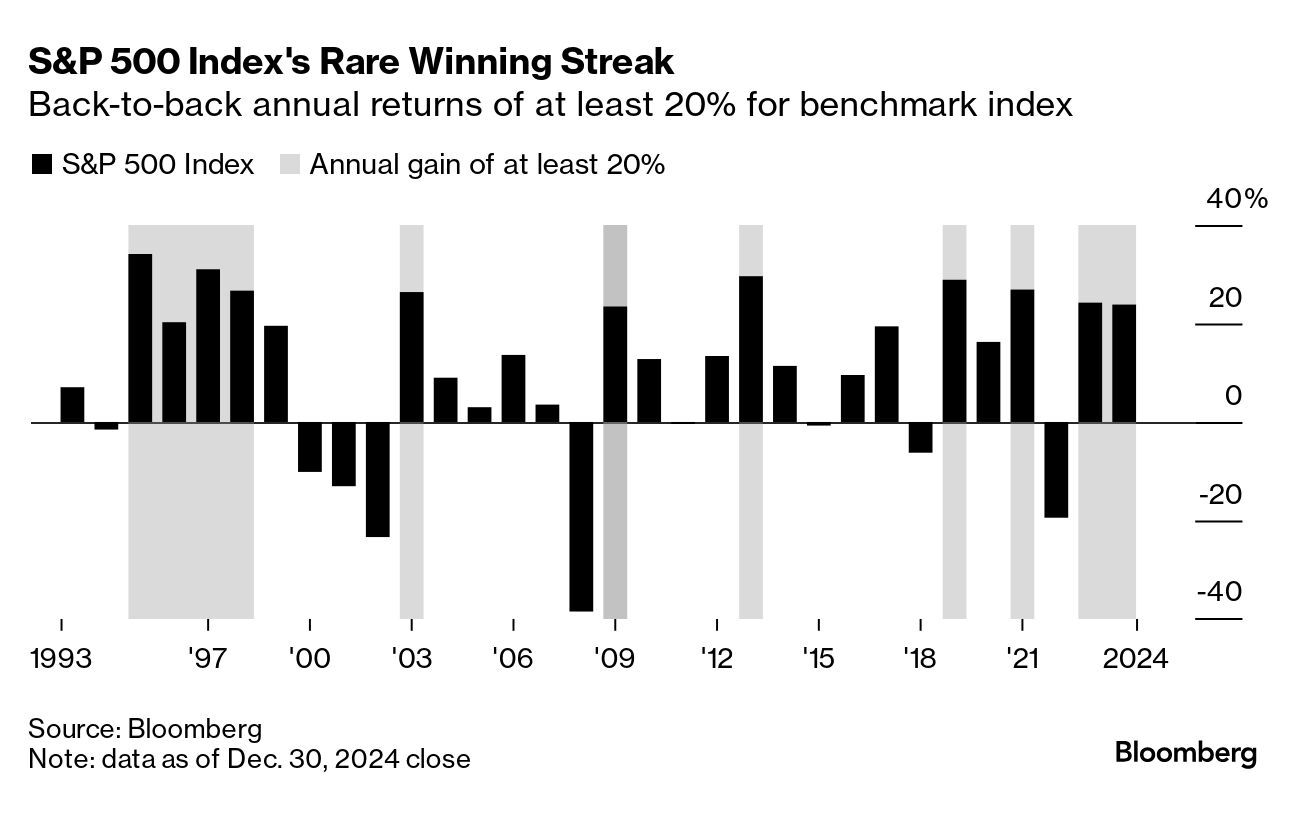

| The S&P 500 Index is on track to rally almost 24% in 2024, capping the strongest back-to-back annual run since the dot-com bubble of the late 1990s. Much of the boost to the benchmark index has come from the so-called Magnificent Seven stocks that have rallied about 69% this year, after more than doubling in 2023. The shares of Turkish brewer Anadolu Efes were set for their biggest two-day loss since 2001 after Russia's President Vladimir Putin handed management of the firm's joint venture with Anheuser-Busch InBev to a local company. Anadolu Efes fell 10% on Tuesday, extending its slump since Monday's publication of the decree to 19% — Subrat Patnaik and Sagarika Jaisinghani | |

| |

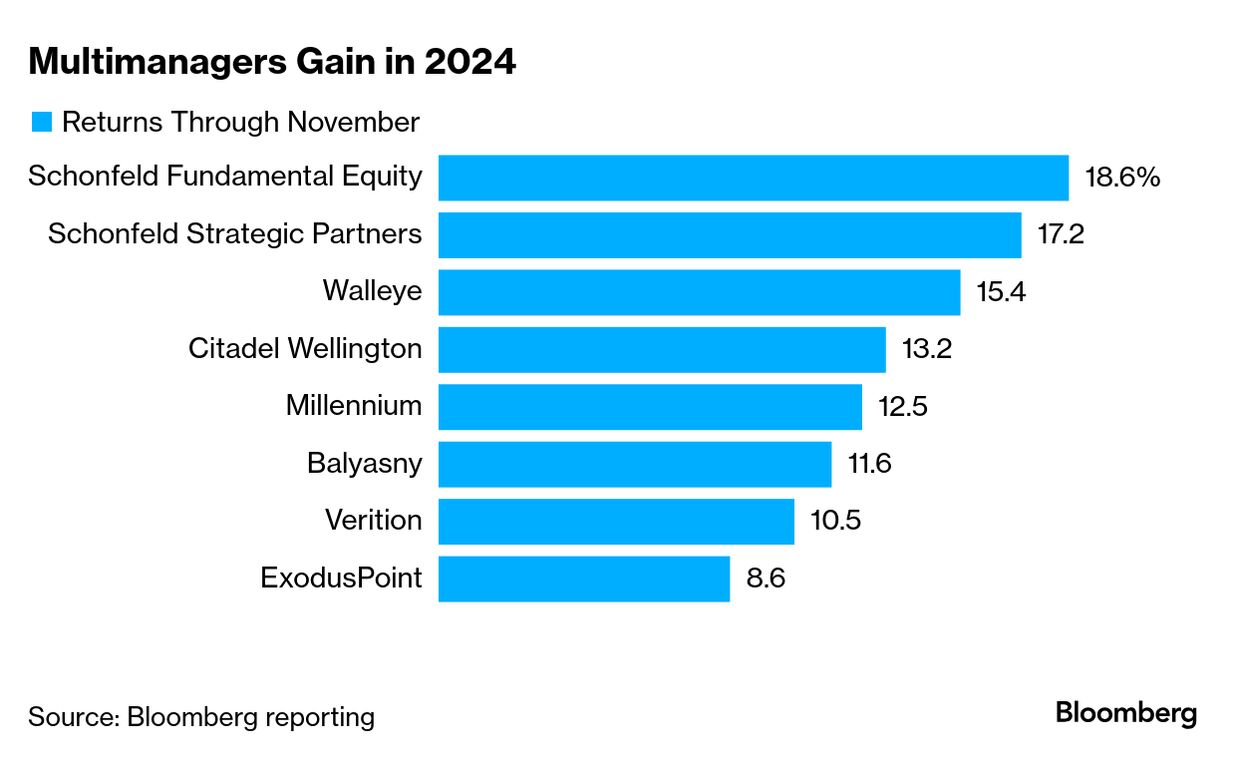

| Citadel founder Ken Griffin was only half right last month when he said the multistrategy hedge fund boom had "come and gone." Yes, the amount of money these multimanager funds oversee has dipped from last year — partly because some, including Citadel, have returned billions of dollars of profits to clients. But the firms, also known as pod shops, are still in their heyday — and several rank among the world's largest hedge funds. Demand for the biggest among them is strong, performance improved this year and the war for talent to trade their billions continues to rage. Griffin said he expects some consolidation among the smaller multimanagers, most of which have sprung up over the past 15 years. There are now 53 such firms, which oversaw a combined $366 billion at the end of June, down from $369 billion a year earlier, Goldman Sachs Group Inc. said in a September report. Net outflows totaled about $31 billion over that span, according to Goldman's calculations, the first time since at least 2017 that more money went out than in. Even so, it wasn't all because clients were looking to exit. About one-third of the outflows was attributed to the hedge funds sending cash back unilaterally, worried that managing too much money would weigh on performance. Some of the bigger players expect to do so again in 2025. — Katherine Burton, Hema Parmar and Nishant Kumar | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment