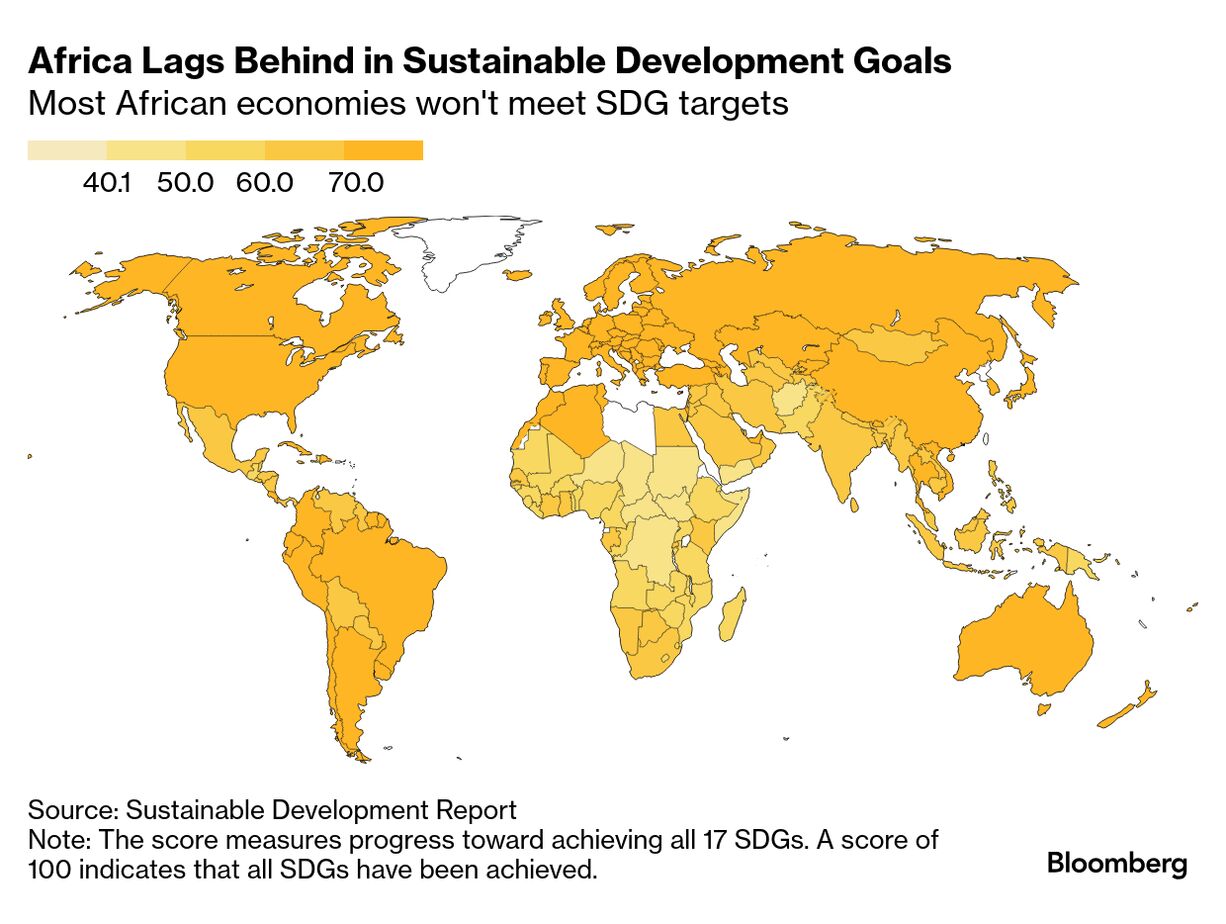

| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it's headed. Sign up here to have it delivered to your email. For our year-end special edition, we look at what to expect in 2025, what the risks are and the opportunities that lie ahead. It's South African President Cyril Ramaphosa's opportunity to shine. Hosting the leaders of the Group of 20 largest economies in 2025 puts his nation in the spotlight and at the forefront of global diplomacy. Ramaphosa's challenge will be to bridge the yawning divide between superpowers on trade and geopolitics. It's a goal that eluded previous host, Brazil's Luiz Inácio Lula da Silva. Many labeled the recent G-20 gathering in Rio de Janeiro the most disorganized in recent memory — so the South African leader has been set a low bar.  US President Joe Biden, Ramaphosa and Indian Prime Minister Narendra Modi at the G-20 summit in Rio de Janeiro. Photographer: Pablo Porciuncula/AFP/Getty Images That's where the good news ends. To forge his status as a key leader of the Global South, Ramaphosa will have to ensure issues that resonate with emerging nations are high on the global agenda before he hands over the G-20's presidency to Donald Trump — who wants the largest economy to put itself first. Tackling Africa's perennial debt crises will be a good start. More than 60% of governments on the continent spend more on servicing their obligations than on health care, according to a recent United Nations report. The total burden has more than doubled to $685 billion in the past decade. It's little wonder, then, that most African countries aren't going to meet poverty-reduction goals set by the UN. Ramaphosa can nudge the G-20 to push for reforms to global financial rules (something that's been on the table for decades), press for more affordable funding instruments to be made available and, of course, cut poor nations' debt load. While the heads-of state summit will take place in November, talks on these issues have already kicked off. Facilitating loans to countries or helping them sell international bonds denominated in their own currencies, as China has done with its panda securities and India with its masala bonds, could be an easy win from the high-level talk shop. Nigeria has contemplated issuing a naira-denominated jollof bond for several years, but it's never got off the ground.— Arijit Ghosh Here's a roundup of what our sub-Saharan Africa bureaus will be watching for: Nigeria: Risk of Policy Collision | The economy of Africa's most-populous nation appears to have stalled and its future prospects may hinge on the outcome of a tug of war between fiscal and monetary policy. Nigerian President Bola Tinubu intends boosting government spending by a third in local-currency terms next year, plans that will test the central bank's resolve to tame inflation. The 49.7 trillion-naira ($32 billion) budget is based on projections that oil production will surge and tax collection will more than double. That's a tall order.  An anti-government protest in Lagos in August. Photographer: Benson Ibeabuchi/AFP/Getty Images The government has a history of missing its revenue targets by wide margins, forcing it to borrow to plug the shortfall. Tinubu's proposed policy changes include increasing the value-added tax rate — a measure that will in itself add to pricing pressures and give the central bank less scope to lower borrowing costs. The consumer inflation rate currently stands at almost 35%, despite policymakers having raised the key interest rate to a record 27.25%, with a devaluation of the naira currency among the main drivers. — Anthony Osae-Brown Elsewhere in West Africa: Juntas Target Mines | International mining companies operating in Mali, Niger and Burkina Faso could be in for a torrid time next year, with cash-strapped military juntas appearing intent on squeezing them for additional taxes and seizing their assets if they refuse to pay up. Mali is demanding that Barrick Gold, the world's second-biggest bullion producer, cough up $500 million and has issued an arrest warrant for Chief Executive Officer Mark Bristow. Australia's Resolute Mining has meanwhile been hit with a $160 million charge following the adoption of a new mining code.  General Abdourahamane Tiani, head of Niger's junta, attends a rally in Niamey to mark the first anniversary of his coming to power in a July 2023 coup. Photographer: Boureima Hama/AFP/Getty Images In Niger, Vancouver-based GoviEx Uranium's mining permits were withdrawn while the government took control of French company Orano's Somair uranium mine. Burkina Faso's rulers have warned it will take similarly harsh action against multinationals that don't comply with revamped mining laws aimed at ensuring the state derives greater benefit from the country's natural resources. The juntas may well up the ante as they struggle to contain Islamist insurgencies and fund their budgets following a withdrawal of support from the UN, US and Europe. One key West Africa nation to watch in 2025 will be Ivory Coast, the world's largest cocoa producer, which is due to hold elections in October. Incumbent leader Alassane Ouattara has yet to announce whether he'll seek a fourth term, but he's being pushed to run by the ruling Rally of Houphouëtists for Democracy and Peace. — Moses Mozart Dzawu East Africa: New Taxes, Debt Restructuring | Kenyan President William Ruto needs to pull off a delicate balancing act in 2025. He was forced to backtrack on plans to increase taxes earlier this year after violent protests erupted and claimed dozens of lives. He's subsequently reintroduced several of the revenue-collection measures to enable his administration to access International Monetary Fund financing. He faces ongoing opposition from his compatriots who say he should focus on tackling graft and the misuse of state funds. The risk of renewed unrest remains high.  William Ruto. Photographer: Krisztian Bocsi/Bloomberg Ethiopia continues to pursue debt-restructuring talks that investors will keenly watch. The authorities instituted a series of other economic reforms this year that enable them to tap IMF funds, with more to come next year. Prime Minister Abiy Ahmed's administration is also likely to continue with its quest to gain direct access to the ocean. While his administration signed a deal almost a year ago that was aimed at securing it passage to the Red Sea via Somaliland, it stoked tensions with Somalia, which considers Somaliland to be part of its territory. The two nations have agreed to work together to resolve their differences, but it remains unclear how the standoff will be resolved. Tanzania is scheduled to hold national elections before the end of October. While incumbent leader Samia Suluhu Hassan will likely be the frontrunner in the presidential race, her Chama cha Mapinduzi party risks losing support due to public anger over high living costs. Hassan's administration missed a February deadline to conclude a host government agreement for a $42 billion liquified natural gas project that would be the country's largest foreign investment yet, and will look to wrap it up in 2025. — Helen Nyambura Southern Africa: Protests, Elections | Protests have rocked Mozambique since disputed elections in October and they show no signs of abating heading into the new year. While the official results confirmed by the nation's top court showed the ruling party's Daniel Chapo securing the presidency, opposition leader Venâncio Mondlane insists he was the rightful winner and has called on his supporters to continue taking to the streets to ensure democracy is upheld. Some 278 people have died during the protests so far, according to Decide Platform, a local monitoring group. Chapo has said he'll be open to talks after he takes office on in mid-January.  A protester next to a burning barricade in Maputo on Dec. 23. Photographer: Amilton Neves/AFP/Getty Images South Africa will be hoping for a credit-rating upgrade after S&P Global Ratings raised the outlook on its assessment of the nation's debt to positive from stable. The change reflects improved political stability following May elections and the formation of a business-friendly coalition government. Malawi is due to hold elections in September, with President Lazarus Chakwera expected to seek another term. His predecessor Peter Mutharika and former central bank Governor Dalitso Kabambe are among the other likely contenders. — Colleen Goko-Petzer |

No comments:

Post a Comment