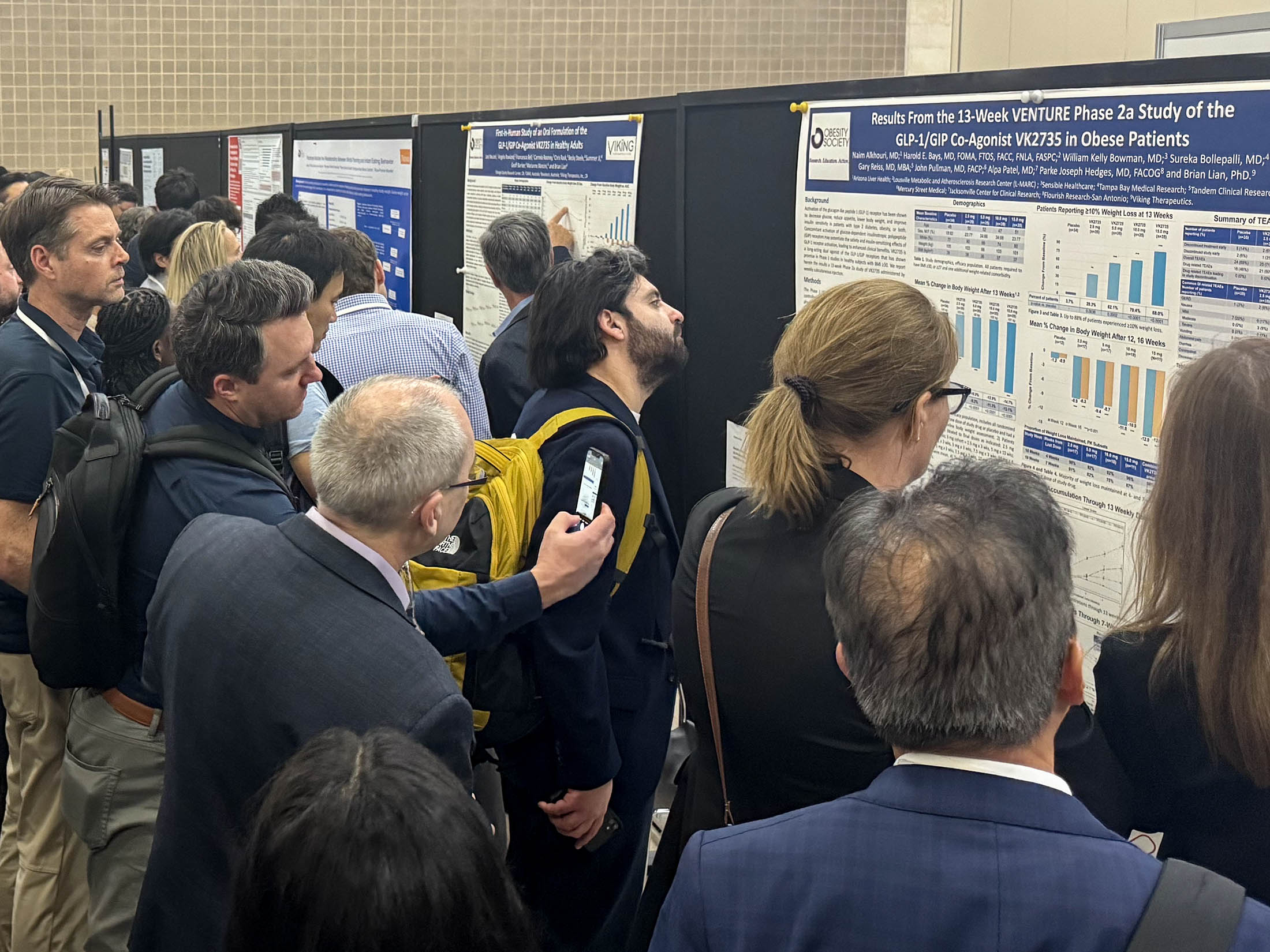

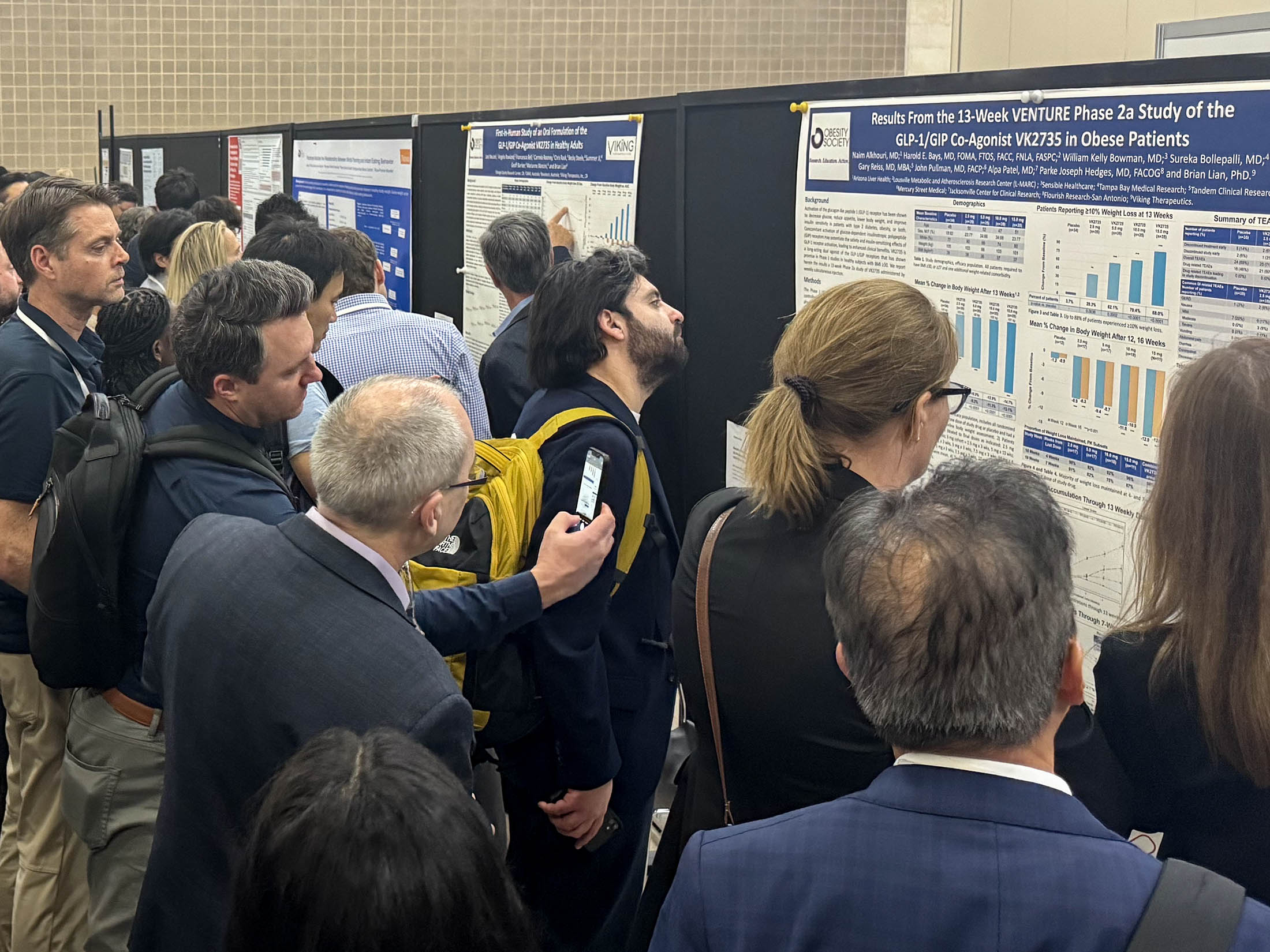

| For ObesityWeek veterans, this year's conference in San Antonio was noticeably different from past confabs. As one doctor put it to me: "There's a lot more suits." That's because the once-sleepy gathering of obesity specialists caught Wall Street's attention amid soaring interest in pharma's most lucrative space. A lot has changed since the first ObesityWeek over a decade ago. For one, the launch of highly effective obesity shots has shifted conversations away from diet and surgery to focus more on the latest and greatest in pharmaceutical innovation. This year, top players like Novo Nordisk and Eli Lilly were omnipresent — Novo with Wegovy banners hung around the convention center and Lilly with a cherry red booth in the middle of the exhibit hall — but excitement came from next-generation hopefuls like Viking Therapeutics and Zealand Pharma.  ObesityWeek attendees study fresh research data. Photographer: Madison Muller/Bloomberg On Sunday night, investors and analysts crowded around Viking's posters for a glimpse at new data from its experimental weight-loss pill. The next day, interest swung to early-stage studies from AstraZeneca. By Tuesday, investors had moved on to promising data from Zealand that hinted at a weight-loss drug with potentially fewer side effects than popular shots like Ozempic. Here are five takeaways from this year's conference: 1. Pills are coming — soonViking Therapeutics and AstraZeneca both presented data from early-stage studies of weight-loss drugs that can be taken by mouth, rather than injected. Viking's drug stole the show, Bloomberg Intelligence's Michael Shah said. But questions remain about scalability for the small biotech and Chief Executive Officer Brian Lian told me the company is actively exploring partnerships to that end. 2. Move over, GLP-1Joon Lee, an analyst at Truist Securities, told me he expects focus going forward to shift from GLP-1 to another gut hormone: amylin. You may recognize it from Novo Nordisk's next-generation drug CagriSema. Amylin has emerged as potentially a more tolerable option compared with GLP-1 drugs, which tend to have high rates of side effects like nausea and vomiting. Combinations like the one Novo is testing are seen as promising, but Zealand's CEO Adam Steensberg told me he thinks the key is more amylin, less GLP-1. 3. Percentage of weight loss doesn't tell the full story Analysts and investors have been hyperfixated on percentage of weight loss as a means to assess a drug's potential success. But unlike other diseases like diabetes, obesity doesn't have a standard recommendation for how much weight patients should lose to be considered "healthy." Other tools like waist-to-hip ratio or body composition scans, which are not yet widely used, may paint a fuller picture of patients' overall health and help doctors determine what "optimal" weight loss should look like, according to obesity medicine specialist Lou Aronne. 4. Compounding is everywhere More and more patients are turning to compounded drugs. Obesity medicine experts are concerned about the proliferation of untested weight-loss drugs, but they're equally as concerned about patients' inability to continue on treatment due to access or affordability. It's becoming increasingly difficult for patients to stay on the name-brand drugs long term. I heard some wide-ranging estimates at the conference, but the general consensus is a lot of patients are taking compounded drugs, and it's not only due to shortages of the name-brand meds. 5. Obesity is just the tip of the iceberg Treating obesity has wide-ranging health benefits, the full scope of which we're only beginning to understand. While Wegovy is already approved in heart disease, Lilly's Zepbound is expected to get approval in sleep apnea later this year. At the conference, researchers shared studies on how treating obesity can affect everything from fertility to mental health. "Metabolism isn't what it used to be — it now includes CNS, cancer, OA, sleep apnea, fibrosis," Richard DiMarchi, a professor of chemistry at Indiana University, told me in an email. — Madison Muller |

No comments:

Post a Comment