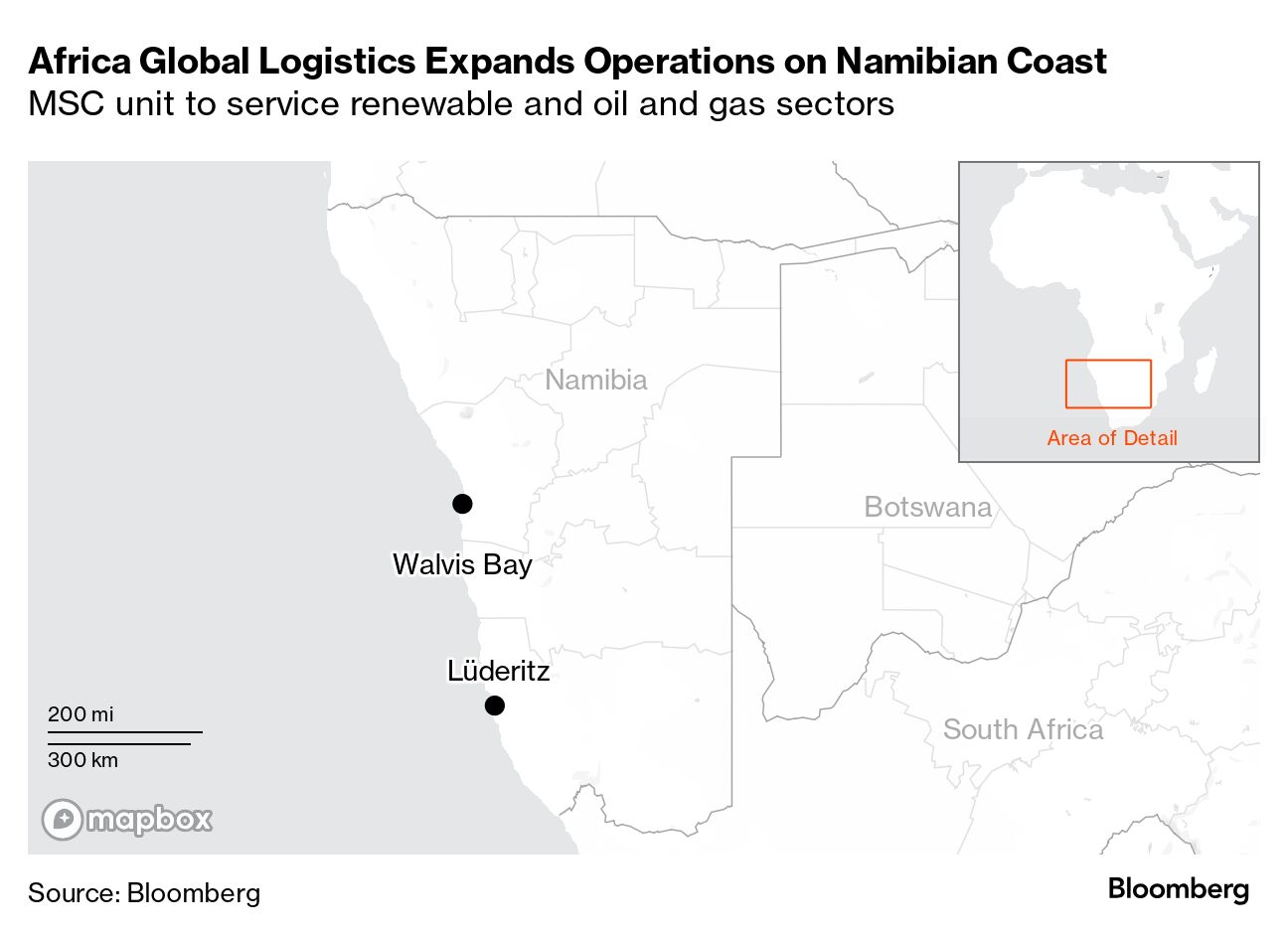

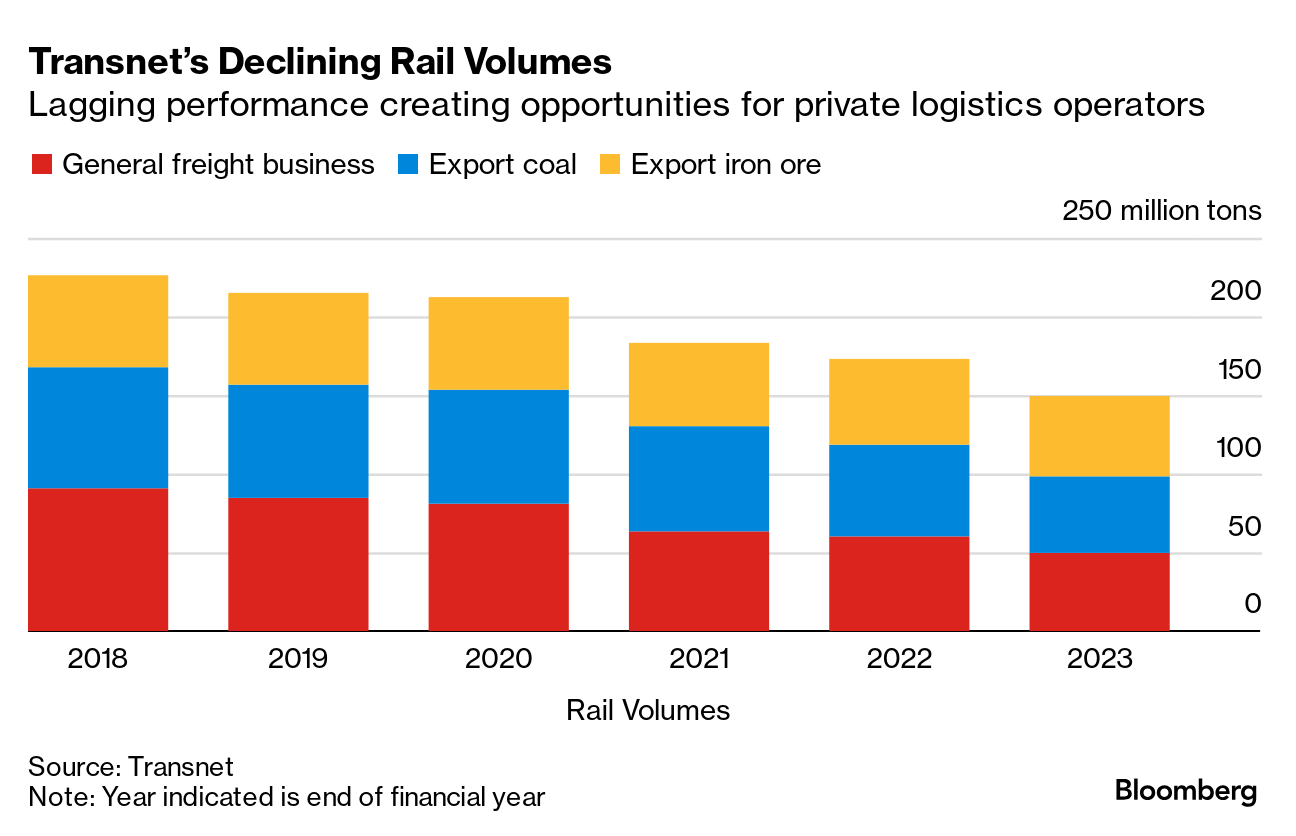

| Unloading wind turbine blades around 80 meters (263 feet) in length at a former whale and seal hunting outpost on the coast of Namibia is one of the more remote examples of growing opportunities found by Africa Global Logistics on the continent. "That's quite a challenge in a place like Luderitz," Koen Rombouts, AGL's managing director for the southern African corridor, said in an interview last week, describing the project location that's lined with sand dunes with minimal infrastructure in place. In addition to supporting the construction of renewable energy stations, AGL — a unit of MSC Mediterranean Shipping Company, the world's largest container shipping line— will also service the oil and gas industry using the harbor, along with Walvis Bay, the main port further up the coastline. (Read the full story here.) AGL will invest as much as 40 million euros ($43 million) by 2030 to build warehouses and buy heavy equipment in Namibia, where TotalEnergies, Shell and Galp Energia SGPS have made offshore oil discoveries in the past couple years. A number of MSC units already have existing operations there — from trucking equipment to mines in the region and bringing minerals back, to operating the main container terminal, where it's widening and deepening the port. "It's a very good example of what our group today is capable of — seeing what's at stake in that country and what's to come," Rombouts said. Read More: Scramble for Critical Minerals Spurs an African Rail Revival Angola's Port of Lobito is another growing export hub in southern Africa that's drawn investment from the US and European Union as part of a corridor to export copper and cobalt. AGL started operations at the terminal in March and has an investment plan of 200 million euros for the facility and region, according to its website. "Our main driver in many places in Africa is connecting the hinterlands to the ports," according to Rombouts, adding that the Lobito corridor "has started out better than expected." Still, what's moved to that port in Angola by rail might end up at a million tons a year, a small fraction of what South Africa's state-owned Transnet SOC moves by train, he said. Transnet Decline A decline in performance by Transnet, whose rail volumes plummeted to 150 million tons last year from 226 million in 2018, has boosted the expansion of nearby ports. Mozambique in January approved an extended deal for DP World, Grindrod and other operators to run the port in Maputo along with a $2 billion upgrade. Transnet needs partnerships to boost volumes and AGL would be interested in participating on the rail corridor running from Durban to Johannesburg, Rombouts said. Another possibility would be involvement in mineral shipments that move on the railway network including coal, iron ore and manganese. Read More: DP World Plans $3 Billion Investment in African Ports by 2029 Some of Transnet's efforts to bring in partners haven't gone as planned. A process to sell almost half of the main container terminal in the southeastern city of Durban has been held up by a court challenge by Maersk. Philippine billionaire Enrique Razon, who chairs International Container Terminal Services, which won the bid, said on Monday that it was "well-run, rigorous and transparent." In the meantime, AGL is watching Transnet developments and weighing potential participation, Rombouts said. "We're identifying opportunities," he said. Related Reading: —Paul Burkhardt in Cape Town Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment