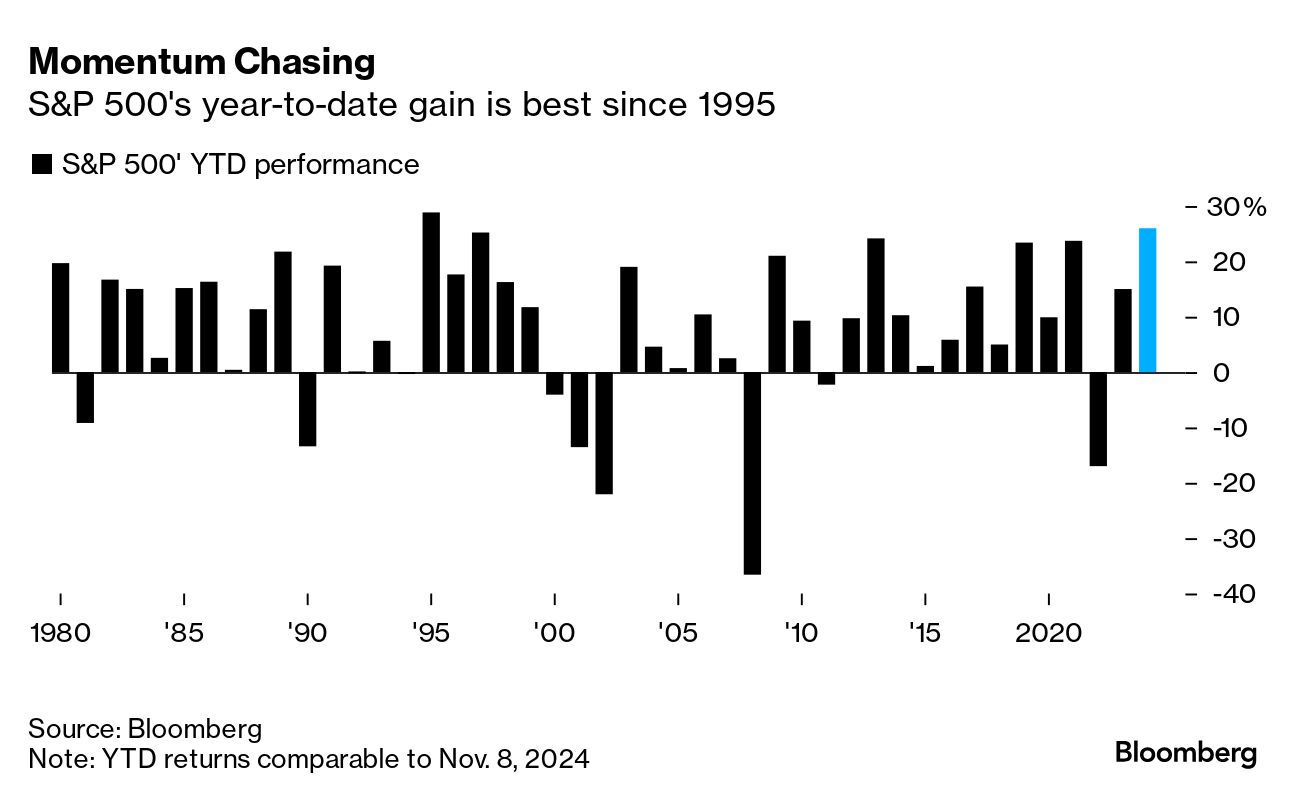

| All year, stock pickers have been caught off-guard by the never-ending rally in risk assets. Now, with the S&P 500 notching its 51st record of the year, following Donald Trump's presidential victory, catching up with the boom is becoming a career-defining matter. This, in a nutshell, is one reason bulls have taken control. Forget oncoming tax cuts and deregulation for now -- there's even more fuel left to power a stock run-up that is already the best for this time of year since 1995. That helps explain why fund managers in that Bank of America survey report that their exposure to US stocks surged last week. The number of fund managers overweight US stocks nearly tripled to a net 29%. And Citigroup says investors last week pushed their exposure to the S&P 500 to the highest in three years. Given how quickly this rally unfolded, it wouldn't be a surprise at all to see it run out of steam for a bit, as the Citi strategists warn. But the Trump tailwind is a powerful one. Before last week's election, active managers, from mutual funds to hedge funds, had underperformed the market by either keeping their equity holdings too lean or pivoting toward the wrong stocks. So, with Trump's return to the White House reigniting animal spirits -- driving the S&P 500 above 6,000 -- these money managers are under pressure to make up for the lost ground. Especially with just weeks left before the end of 2024. In fact, it's a trend that plays out year in, year out. Bank of America notes that stocks with the highest volatility, known as beta, have tended to beat the market in the final two months, in part thanks to investors diving into high-octane shares in a bid to juice their performance. Funds tracked by BofA have been particularly allergic to risk taking this election season so far, suggesting there's even more pressure this time round for investment managers to get bullish. With cautious institutions poised to chase the rally, no wonder Goldman Sachs strategists led by David Kostin see room for even more equity gains. "As political uncertainty declines and investor positioning normalizes, an increase in length should support the typical pattern of S&P 500 appreciation following presidential elections," they wrote in a note. —Lu Wang |

No comments:

Post a Comment