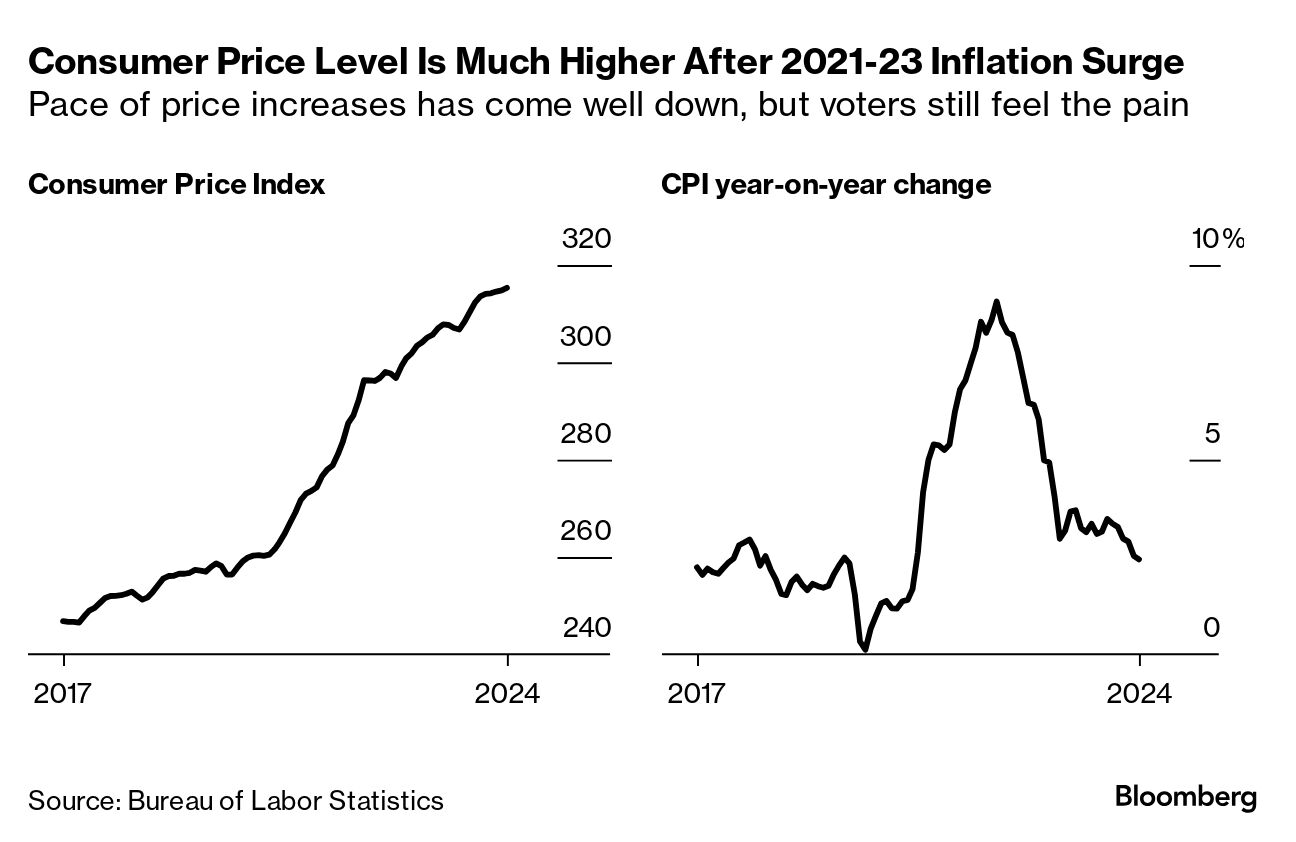

| I'm Chris Anstey, an economics editor in Boston, and today we're looking again at the issue of the incoming president and the Fed. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. It is probably fair to say that the current conventional wisdom is that Trump will put pressure on the Federal Reserve to lower borrowing costs after he takes office — seeking to boost growth and deliver on his campaign pledge to spur the economy. That indeed was the context for the questions to Fed Chair Jerome Powell last week about whether he would resign if pressured by the Trump administration, and what the Fed's perspective was on the legal authority to oust board members in leadership positions. Powell said he wouldn't resign and the president had no such authority. The general assumption is based in part on Trump's first term, when he repeatedly called for easier Fed policy and sometimes blasted Powell himself. (Bloomberg subscribers can see a record of those criticisms here.) But one thing that's very different today from 2018 and 2019 is inflation was notably lower. And, crucially, voters just expressed their anger over the cost of living in ousting the Democrats from the White House and Senate. In 10 key states, three-in-four voters cited inflation as a moderate or severe hardship over the past year, the majority of whom backed Trump, exit polls published by NBC showed. For some economists, that suggests it would be wrong to assume Trump would simply pick up where he left off and pressure the Fed to take rates right on down. All the more so if fresh data suggests sustained price pressures — the latest reading is due on Wednesday, with the CPI. "What would make more sense is for Trump 2.0 to tolerate some economic weakness (and put the blame on Biden/Harris) to arrest inflation," Stephen Jen, chief executive at Eurizon SLJ Capital, wrote in a note Monday. "I do not at all agree that Trump 2.0 will run the risk of stoking inflation." - Trump's penchant for chaos is one reason to be less pessimistic about the fresh wave of protectionism he has promised to unleash on the world.

- German investor expectations slumped after the government's collapse forced early elections on Feb. 23, and Trump's presidential win raised the risk of tariffs.

- Japanese Prime Minister Shigeru Ishiba pledged more than $65 billion of support for the nation's semiconductor and artificial intelligence sector over the next decade.

- European Central Bank official Olli Rehn said a December rate cut is likely and further reductions are possible.

- France's government plans to reduce the scale of proposed tax increases for employers, budget minister Laurent Saint-Martin said.

- Thailand's cabinet approved two additional holidays next year to encourage travel during long weekends, stimulating tourism and growth.

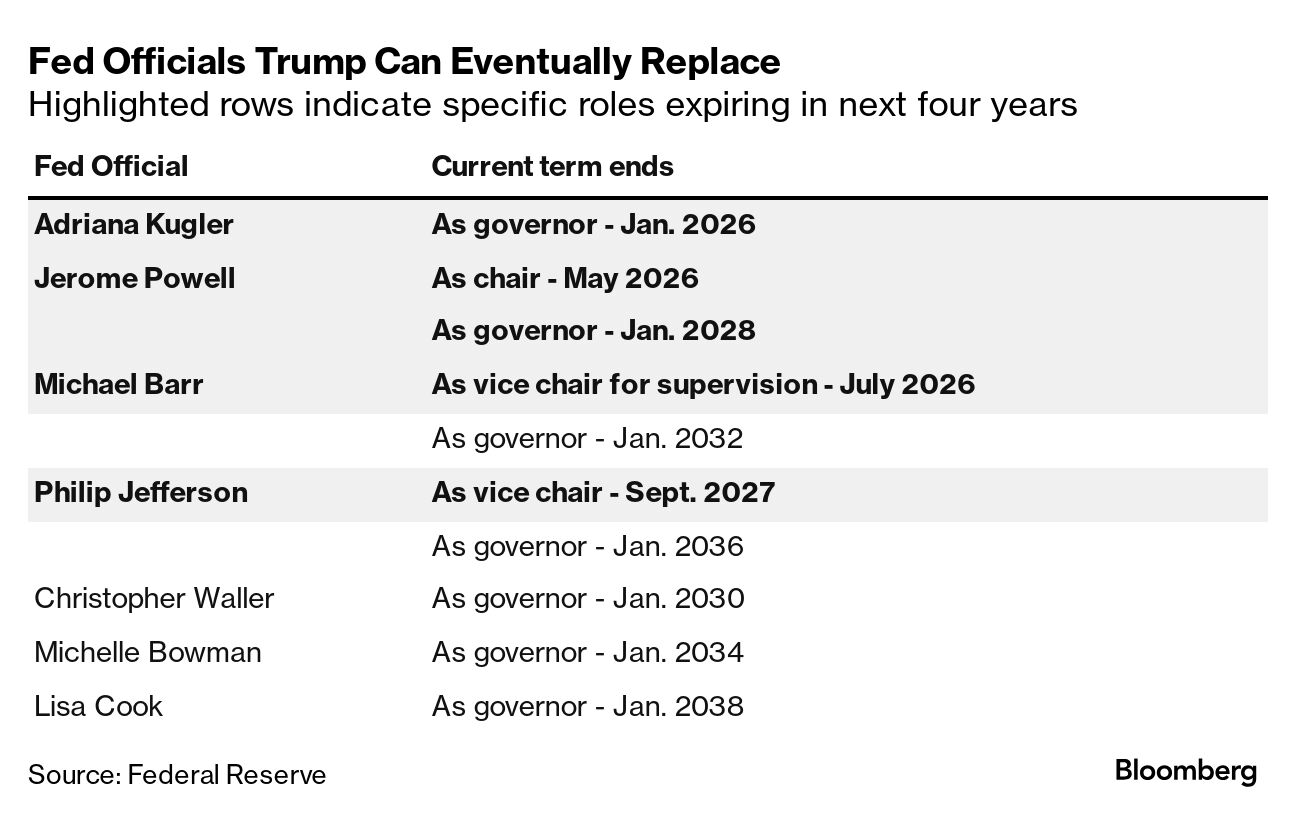

Just as Trump's approach toward Fed policy might be different in his next administration (see above) to his first one, Bloomberg Economics write that he may opt for more mainstream candidates for Board of Governor positions this time. Last time, Trump's unorthodox picks included Judy Shelton, who at one point advocated a return to the gold standard and opposed federal deposit insurance, and Stephen Moore, a conservative adviser to Trump whose political ties raised concerns over Fed independence. Neither won Senate confirmation. "We think Trump's struggle to get outsiders confirmed to the Fed board during his first term" will lead him "to nominate people with prior government experience," Stuart Paul and David Wilcox wrote Monday. "Those who fit the traditional profile" include former White House Council of Economic Advisers chair Kevin Hasset, ex-Fed Governor Kevin Warsh, current Governors Christopher Waller and Michelle Bowman and Dallas Fed President Lorie Logan, they wrote. "We think private-sector candidates and those from Wall Street face longer odds," Paul and Wilcox said. The next board vacancy opens at the end of January 2026, with the next one two years later, they noted. - Click here for the full note on the Bloomberg terminal.

|

No comments:

Post a Comment