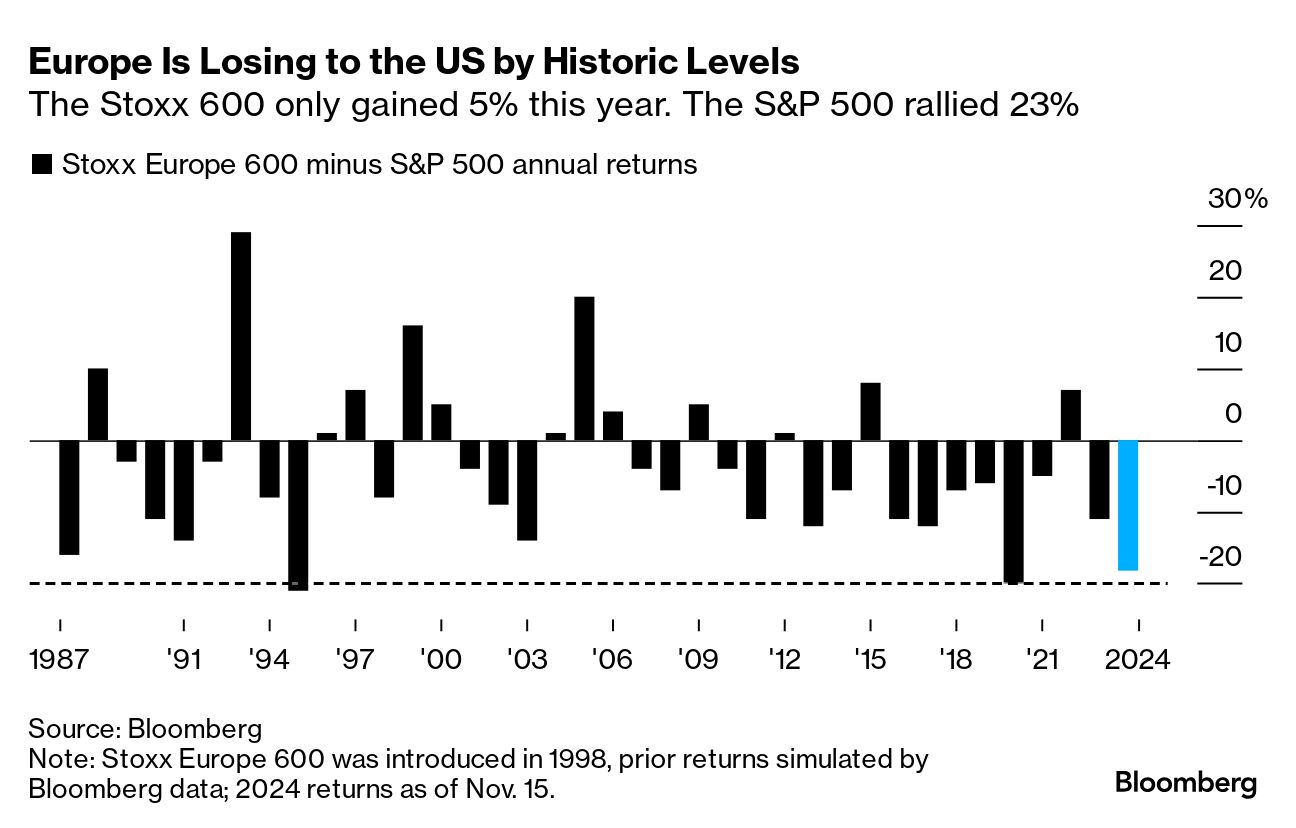

| Plenty of finance gurus will argue the benefits of diversification mean that you should put a chunk of your investments outside the US. But for years, choosing Europe — home to a dormant stock market, brittle currency, crisis-ridden political system and stagnant economy — has been a losing trade.

Now those problems may get worse. Donald Trump's plans to cut taxes and gut regulation is making US stocks more attractive, and Europe faces new tariffs against its biggest companies and the prospect of further investment outflows. Not to mention the war to the east that looks to be escalating today. "Europe is hit from all sides and you have risk aversion coming back," said Luca Paolini of Pictet Asset Management. "It's difficult to see what can save it." European stocks have retreated since Trump's win and the euro has skidded towards parity with the dollar, reinforcing an unequal status quo that took hold years ago: Europe generates weaker economic growth than the US and, in turn, far less wealth for those who invest in its markets. Two factoids show just how unequal the two are: - At $63 trillion, the total value of US stocks is now four times bigger than all of Europe's bourses combined. Ten years ago it wasn't even twice the size.

- Europe doesn't have a single public company valued at more than $500 billion. The US has eight worth more than $1 trillion.

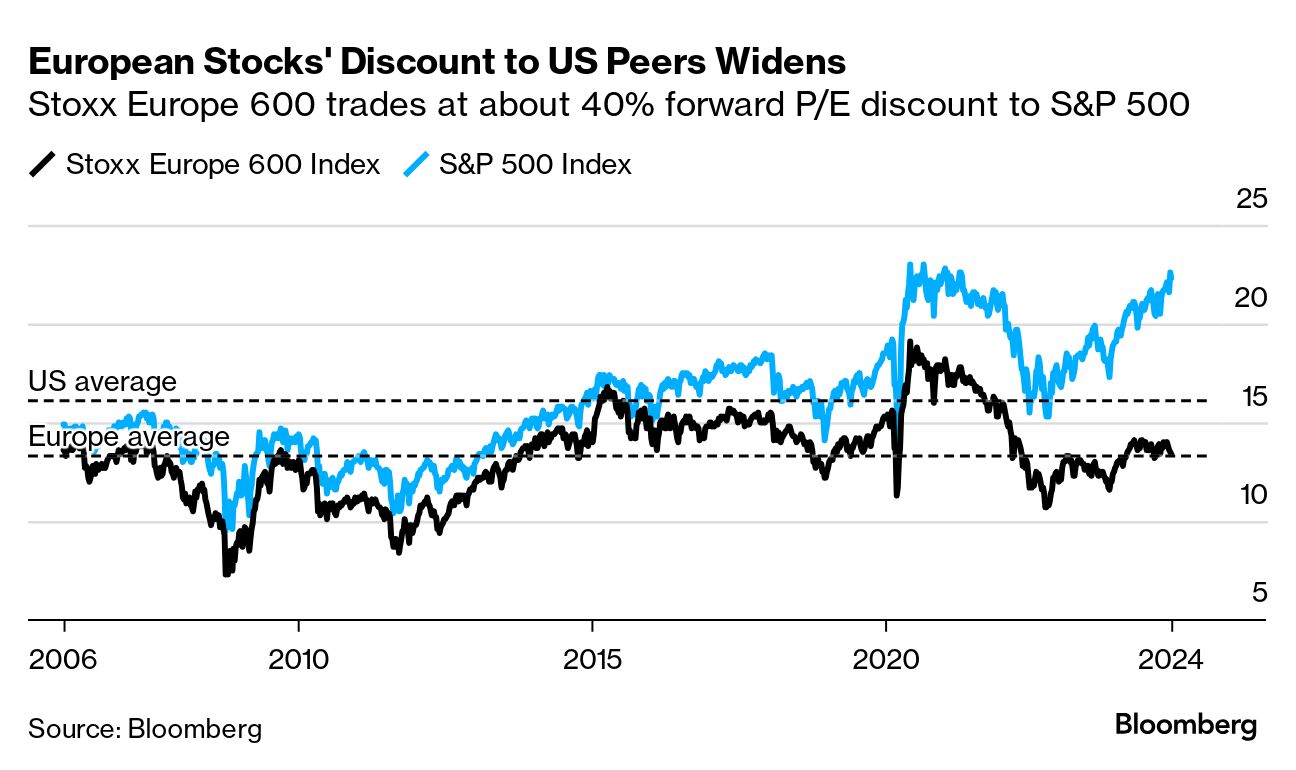

The Stoxx Europe 600 Index is trading at a record 40% discount to the S&P 500 and this year's underperformance is on track to be among the worst on record. The euro has slumped to its weakest level in over a year. Jon Levy at Loomis Sayles says Trump's America First agenda may be just the jolt Europe needs to force it to take action on improving the attractiveness of its assets. "It's not a low growth, low rates forever type of trap," Levy said. "For all Trump's actions there are counteractions and those matter just as much." —Michael Msika and Alice Atkins |

No comments:

Post a Comment