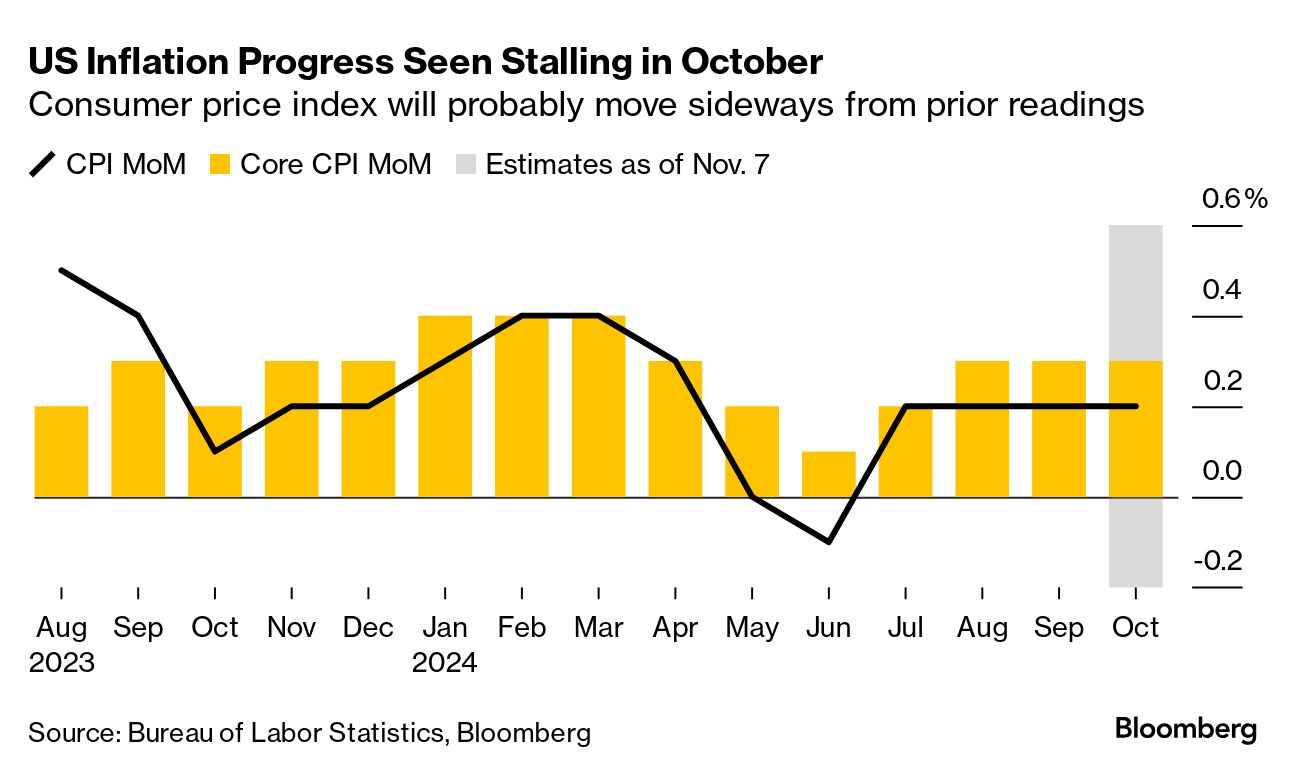

| US inflation data, due Wednesday, is the key economic report of the week. Overall CPI probably increased 0.2% for a fourth month, while the year-over-year measure is projected to have accelerated for the first time since March. Those readings could underscore concern that inflation hasn't been quelled, especially as Trump's promises to cut taxes and throw up large tariffs threaten to rekindle inflation.

"We need to finish the job," Federal Reserve Bank of Minneapolis President Neel Kashkari said Sunday on CBS's Face the Nation. "We want to have confidence that inflation is going to go all the way back down to our 2% target." Retail sales numbers will be released on Friday, while Fed Chair Jerome Powell, Governor Christopher Waller and New York Fed President John Williams are all scheduled to speak during the week. China publishes a range of economic reports toward the end of the week and the UK gives a snapshot on its growth on Friday. Meanwhile, US earnings reports will slow to a trickle this week, with just nine S&P 500 firms scheduled to release results. Home Depot will give investors a key read into the state of the consumer. Disney, Cisco, Shopify and Spotify will highlight a smattering of tech earnings following a lackluster showing from the Magnificent 7. US-listed Chinese technology stocks will be the other key area to watch. Alibaba and JD.com also report. Check out the full economics week ahead. |

No comments:

Post a Comment