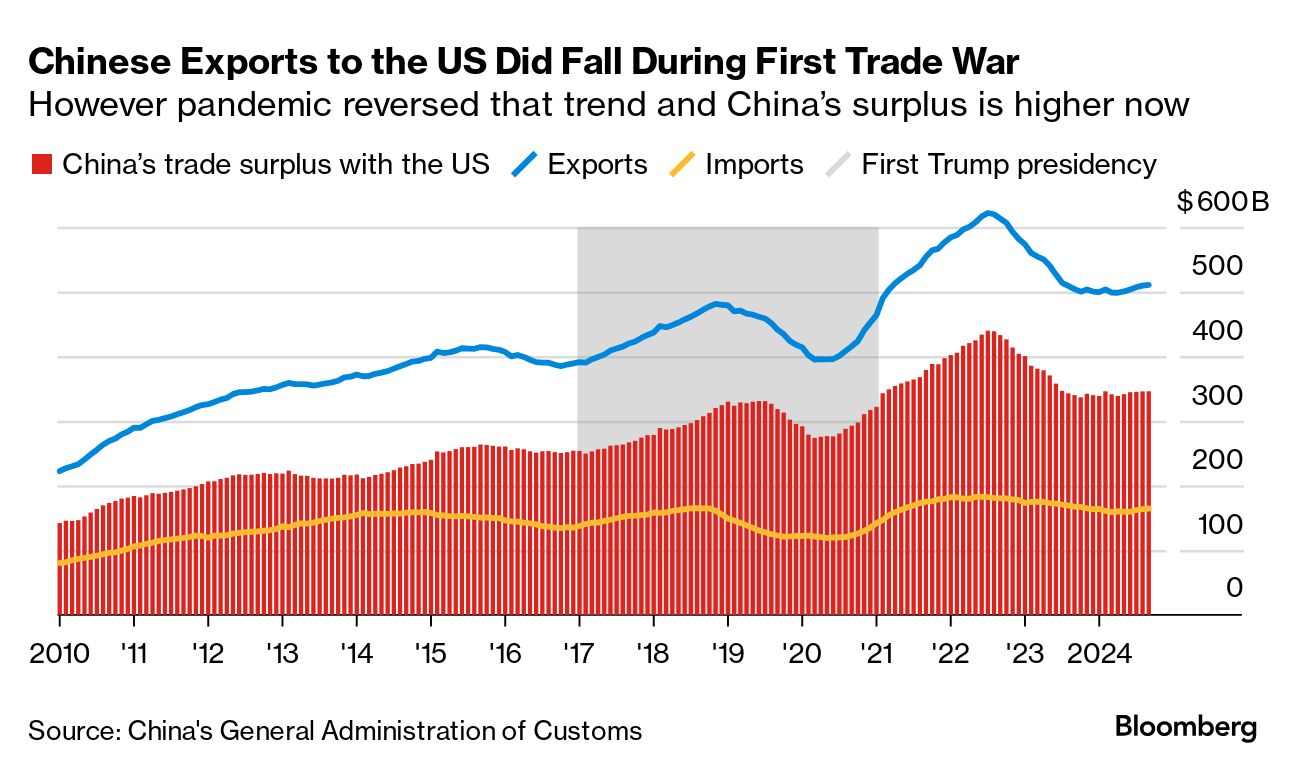

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at China's options if Trump delivers on his tariff threats. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. One of the biggest question marks now hanging over the global economic outlook is whether President-elect Trump will deliver on his campaign threat to impose 60% tariffs on all imports from China. Such a move would decimate commerce between the two nations, drive up inflation, and force a whole new rewiring of global supply chains. That makes the related question of what China would do in response equally pressing. We got a clue as to China's initial reaction to Trump's victory when officials on Friday announced details of a 10 trillion yuan ($1.4 billion) lifeline for indebted local governments but held off from any fresh stimulus blitz. Finance Minister Lan Fo'an promised "more forceful" fiscal policy next year, signaling bolder steps could come after Trump's inauguration in January. In short, Beijing is sticking with Plan A for now, seeking to fix shaky provincial government finances so basic services continue and asset sales can be avoided while trying to stabilize the property market. Continued export strength is giving officials cover to tend to those domestic frailties while overall economic growth remains roughly on track to meet this year's target for an expansion of around 5%. But 2025 looks altogether more challenging. Wang Tao at UBS expects the new Trump administration will impose additional tariffs on most imports from China in a staged manner starting in the second half of next year. That would lead China to respond with greater policy support to boost domestic demand and offset the external shock, she said, cutting forecasts for GDP growth to around 4% for 2025, and lower in 2026. Morgan Stanley economists led by Chetan Ahya say those China tariffs could come even sooner — in the first half of 2025. But they also note some key reasons why the hit to China's confidence might not be as sharp as it was back in 2018-19: - The world has been living with US-China trade tensions for seven years now

- Supply chains have diversified and US sales are a smaller slice of Chinese exports

- The revenue exposure of Chinese listed companies to the US/Canada has declined from 5.7% of total revenue in 2017 to 3.7% in 2024

That means China's President Xi Jinping is better prepared for a trade fight this time around. His options range from counterpunching by targeting American companies doing business in China and cutting purchases of US commodities like corn and soya beans to seeking a grand bargain with promises to buy more US energy and increasing investments in America — something Trump has signaled he'd be open to. Macquarie's China Economist Larry Hu says 60% tariffs would shave 2 percentage points off China's GDP growth in the next 12 months and leave Beijing "no choice" but to boost stimulus. But with so many variables, including whether Trump imposes across-the-board levies on the rest of the world too, China will hold fire for now. "History suggests that Beijing tends to react to the actual situation, but not preemptively," Hu wrote. - Policymaker Neel Kashkari said the Federal Reserve will need to wait for Trump to take office to judge an outlook that may already feature fewer US rate cuts.

- Bank of Japan board members in October discussed the need for caution on raising borrowing costs and offered no clear hint of a move in December.

- Australia faces the threat of short-term economic pain as a result of Trump's policy agenda, according to Treasurer Jim Chalmers.

- Thailand is set to appoint former Finance Minister Kittiratt Na-Ranong as the new Bank of Thailand chairman.

- Czech inflation accelerated in October, while Norway's underlying price measure slowed for the 12th consecutive month.

- Botswana's new leader unveiled the names of six members of his cabinet, including economist and Deputy President Ndaba Gaolathe as finance minister.

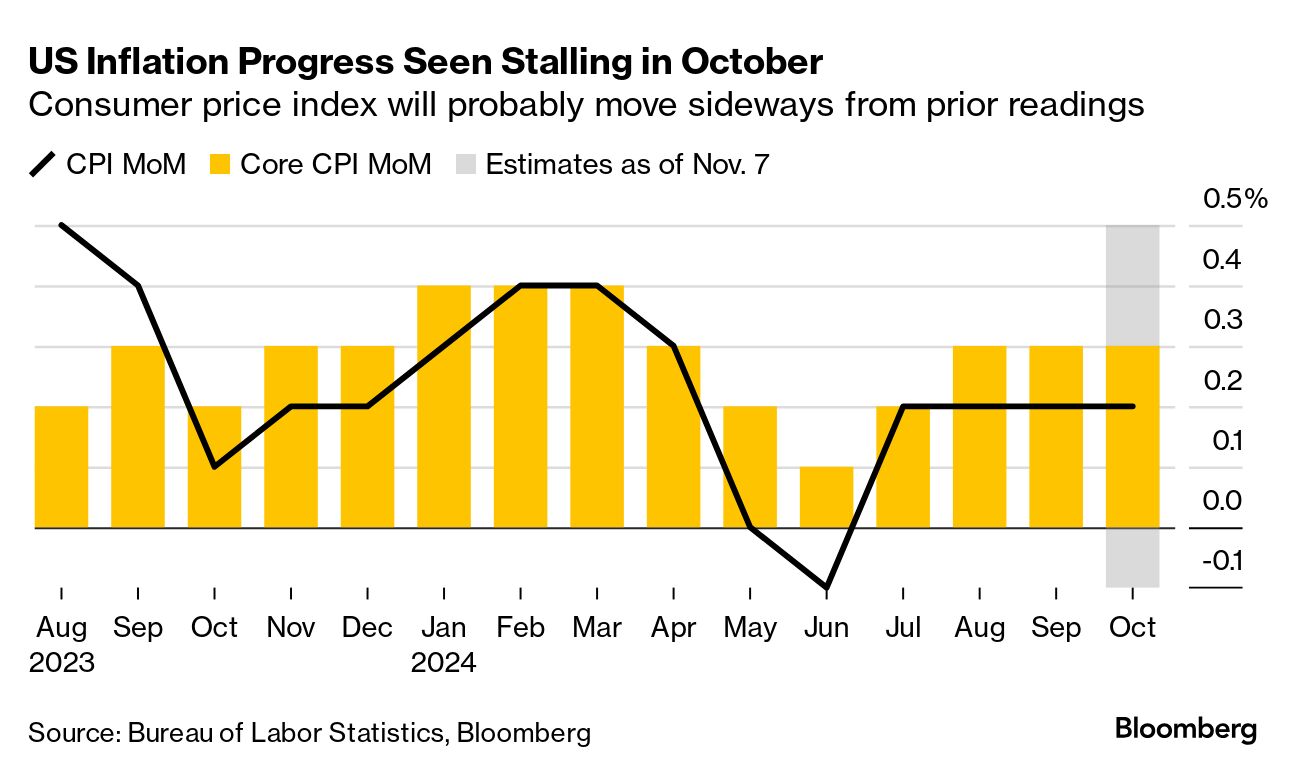

US inflation probably moved sideways at best in October, highlighting the uneven path of easing price pressures in the home stretch toward the Fed's target. The core consumer price index due on Wednesday, which excludes food and energy, likely rose at the same pace on both a monthly and annual basis compared to September. The overall CPI probably increased 0.2% for a fourth month, while the year-over-year measure is projected to have accelerated for the first time since March. See here for the rest of the week's economic events. The dollar strengthened in the wake of Trump's victory, in a reflection of the broad assumption that if he follows through on tariff hikes, that will be a major impetus to the currency. Expect China to counter that against the yuan. So says Wei He, a China economic policy analyst at Gavekal Dragonomics. You might think a cheaper yuan would be welcomed — after all, China has no inflation problem and currency depreciation would help make its exports even more competitive. But China views the currency "as a key variable affecting public confidence in the economy," Wei wrote in a note Friday. "A big decline in the headline exchange rate risks being taken as a sign that something is seriously wrong with China's economy, which could trigger capital outflows," he wrote. So the central bank now "is likely to reassert strict control" in order to prevent a "substantial decline," according to Wei. |

No comments:

Post a Comment