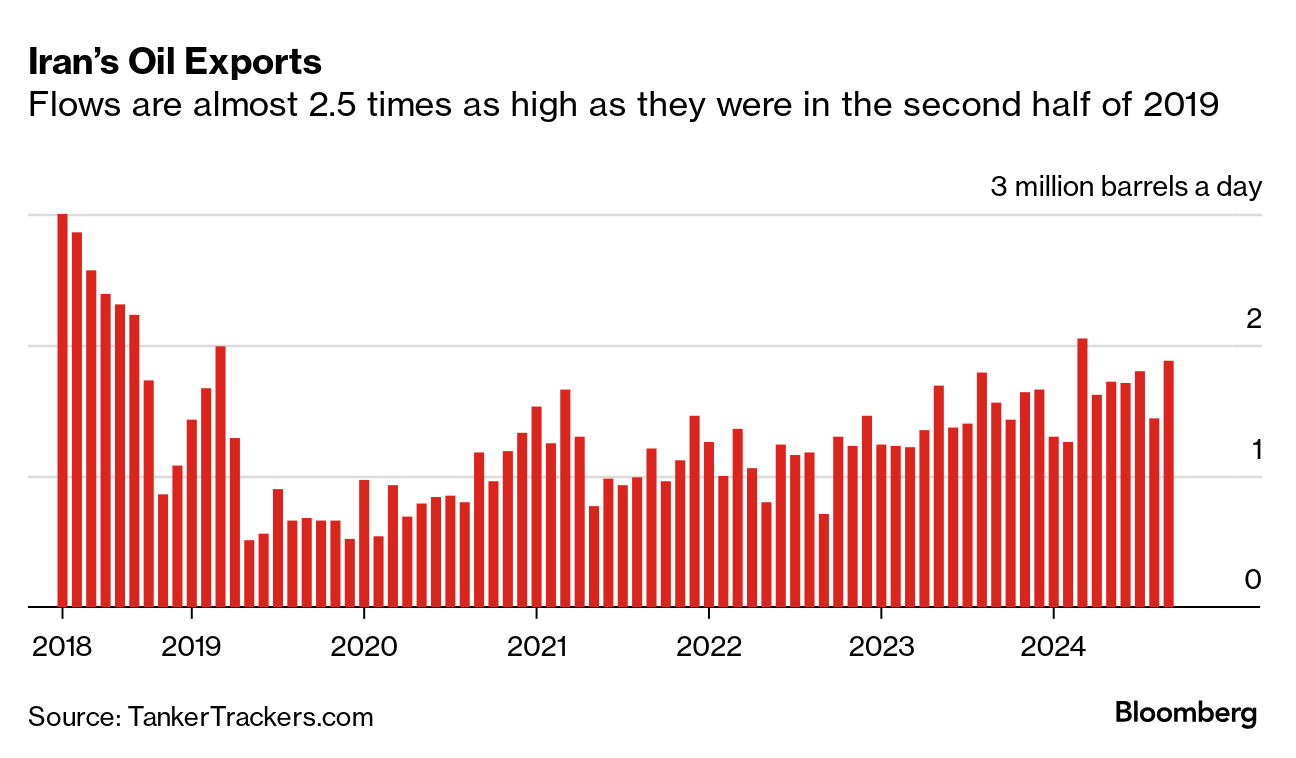

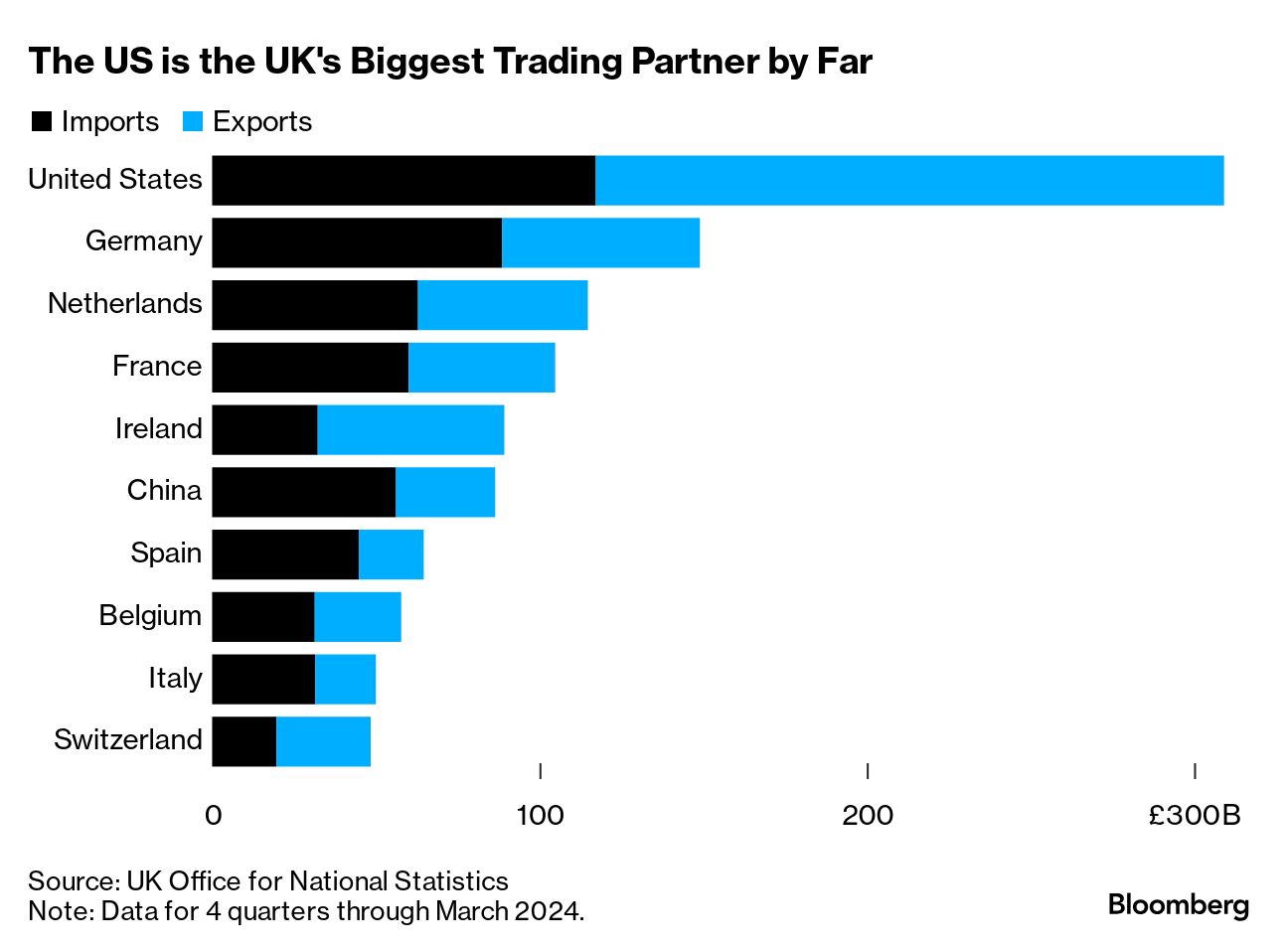

| President-elect Donald Trump has hinted that he wants to use sanctions "as little as possible" in his second term in office, citing his preference for tariffs as a tool of economic diplomacy. "I stopped wars with the threat of tariffs," he said at the Economic Club of New York on Sept. 5, without going into details. "Sanctions have to be used very judiciously. We have things much more powerful actions than sanctions, we have trade, but we cannot lose our dollar standard." Trump is not alone in his skepticism of trade and financial sanctions as an instrument of economic statecraft and he is far from the only person to talk about the challenge they pose to the primacy of the US dollar. Whole books have been written on that subject and Democrats and Republicans alike have expressed their concerns. Read More: US Imposes Sanctions on Suppliers of Russia's War Machine His comments have been viewed by some as an indication that he will remove some of the sanctions imposed on Russia over the Ukraine war. While that is possible — Trump has not indicated what exactly he will do to end that conflict before he gets into office as he has promised — it is unlikely for the simple fact that once sanctions are put in place, they are very hard to remove. In fact, Trump was a fan of the measures during his first term, proudly brandishing a Game of Thrones-inspired poster proclaiming "Sanctions Are Coming" when his administration re-imposed sanctions on Iran after pulling out of the Joint Comprehensive Plan of Action in 2018. And his administration set a record for imposing sanctions, with new measures coming about three times per day. The Biden administration released a report on US sanctions policy in 2021, finding that the number of sanctions had increased by nearly 1,000% in the years between 2000 and 2021. Dollar Alternatives The report included a sobering note: "American adversaries — and some allies — are already reducing their use of the US dollar and their exposure to the US financial system more broadly in cross-border transactions. While such changes have multiple causes beyond US financial sanctions, we must be mindful of the risk that these trends could erode the effectiveness of our sanctions." The report was heralded at the time as the potential beginning of a new era in sanctions policy, with a more circumspect government willing to remove some sanctions that no longer seemed to be effective. Humanitarian groups worried about the measures' effect on aid shipments were encouraged by its findings. Read More: An Indian Pharma Firm Is Sending Nvidia Chips to Russia at War Then Russia invaded Ukraine and the Biden administration ramped up its use of the measures. Officials sought to coordinate sanctions with allies so that they would be multilateral, and not the product of only one country, but the exercise demonstrated their enduring popularity. Sanctions are often the first tool policymakers reach for in conflict, because they impose an economic cost without putting troops in harm's way. Their popularity in this regard makes them hard to resist and even harder to remove. Trump is likely to face push-back from Democrats and Republicans in Congress if he were to simply begin removing sanctions on Russia or any other country, for that matter. If he were to impose more, however, he's likely to hear very little criticism. Related Reading: —Daniel Flatley in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. (Correction: Last Thursday's edition misspelled the name of BNY Chief Executive Officer Robin Vince. We regret the error.) |

No comments:

Post a Comment