- Donald Trump recaptured the White House with his Republican party set to control the Senate.

- With Trump at the helm again, the US economy is in for a wild ride.

- Democrats' best hope for power in Washington hinges on some fiercely competitive House races with big implications for fiscal policy.

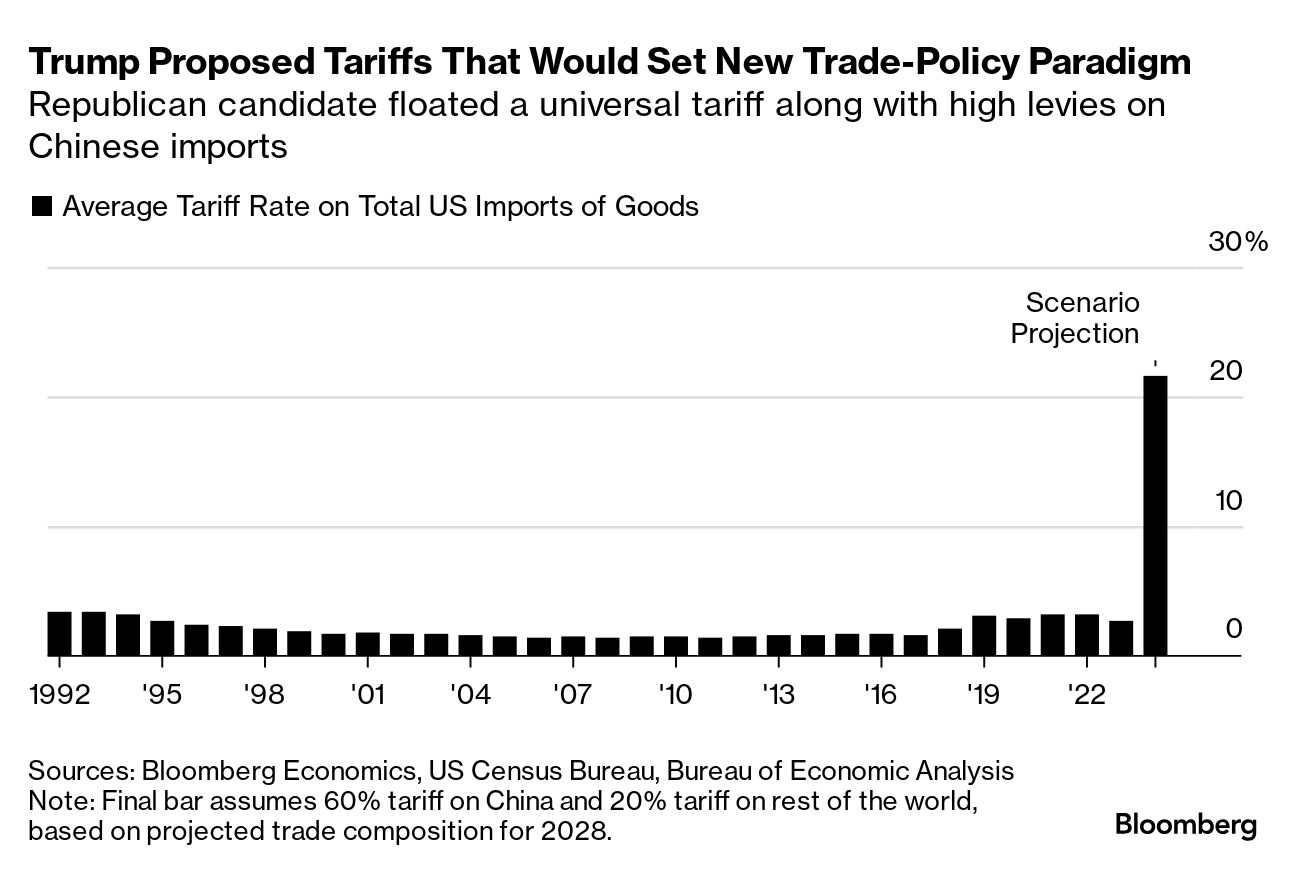

With Donald Trump set to return to the White House, the world is bracing for what may become the most consequential wave of tariff hikes since at least the 1930s. That makes a fresh study of the US era that saw both very high trade protection and rapid industrial expansion particularly timely. The paper, published this month by the National Bureau of Economic Research, looks at a period when average tariff rates were some 35% — putting even Trump's mooted 20% universal import levy in the shade. What's especially new about the research by Alexander Klein at the University of Sussex and Christopher Meissner of the University of California, Davis, is their painstaking digitization of data on tariff rates and industry-level data over the period from 1870 to 1900. Earlier analysis used case studies or data modeling. Read More: Full Results and Maps from the US Presidential Election Their main conclusion: Elevated tariff rates hurt productivity growth. In some sectors, companies were kept in business that otherwise might have been swept away by competition — a sort of analogue to a key criticism of the modern-day policies of ultra-low interest rates and quantitative easing by central banks, generating zombie enterprises. In other cases, big tariffs in an industry where there was only a handful of domestic firms gave them less incentive to invest. There's also some evidence for the argument that "import tariffs often act as a tax on exports," Klein and Meissner wrote. In petroleum, for example, "tariffs may have led to output and exports being smaller than they otherwise might have been." Where there was a low cost to start a business — such as textiles — protection provided by high tariffs led to a bigger number of firms. That also meant a higher number of workers, something Trump might be comfortable with. But productivity is what lifts standards of living over time, and a bigger number of low-paid workers would hardly be an ideal outcome. A 2019 assessment of the automobile industry cited by Klein and Meissner seems particularly apt at a time when the US appears at risk of falling behind the electric-vehicle transition. "US engineers and designers continued to address into the 20th century problems already solved" overseas, according to James Foreman-Peck of Cardiff University. A key reason for the backwardness: "the 45% US protective tariff." - Some Bank of Japan board members were skeptical of the potential merits of releasing an interest-rate path projection similar to the Federal Reserve's dot plot when authorities discussed the idea during their September meeting.

- Bank Indonesia's monetary policy will focus on maintaining stability in the short-term as a likely victory for Donald Trump in the US presidential election is set to heap more pressure on the rupiah, its governor said.

- German factory orders surged in September, a positive signal for an industry whose prolonged weakness may be ending. Separately, euro-area business activity held up better than initially reported in October.

- The US service sector expanded in October at the fastest pace in over two years, fueled by a pickup in hiring.

- Poland is likely to extend an interest-rate pause amid quickening inflation and a widening budget deficit as investors await fresh central bank guidance on when easing may begin.

- Higher UK borrowing costs have wiped out Chancellor Rachel Reeves' headroom against her main fiscal rule, raising the prospect of tax rises or spending cuts.

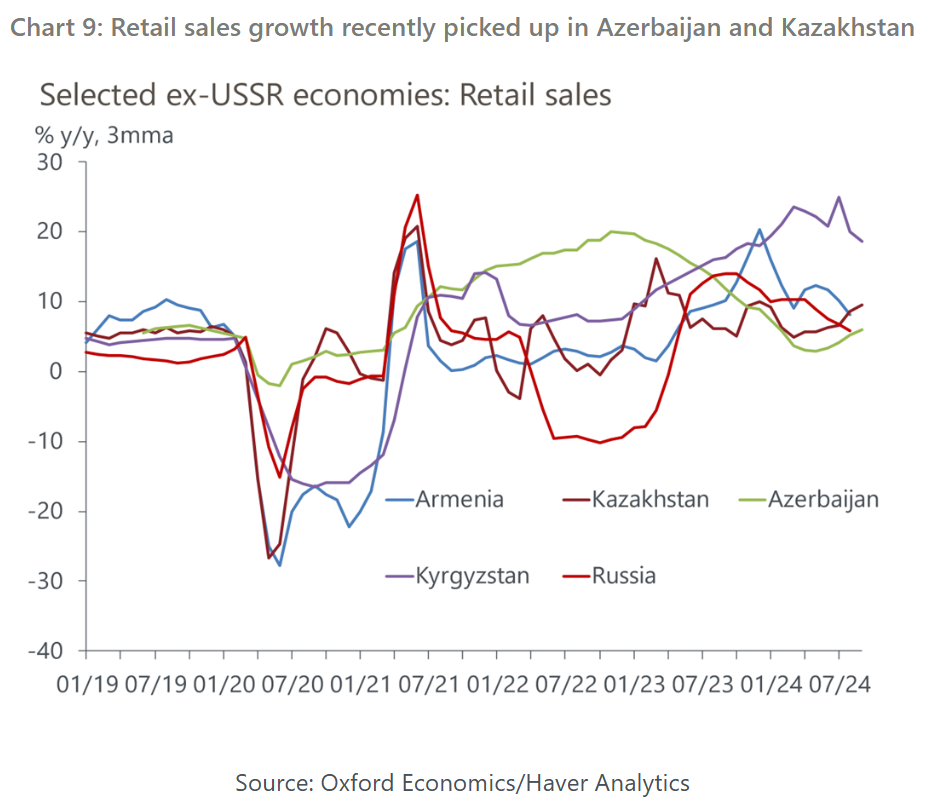

War has been good to the economies of the former Soviet Union, with regional manufacturers taking advantage of the gaps left from the exit of Western companies from the Russian market — something that's lifted nations from Kyrgyzstan in central Asia to Belarus on the European Union border, according to Oxford Economics. "While we see 2025-2026 growth moderating in most of the region, the outlook remains positive, underpinned by buoyant domestic demand," Tatiana Orlova wrote in a note this week. Remittances in some countries from their workers in Russia are above pre-war levels, and demand for that labor is also driving up local wages. Foreign direct investment in a number of countries has also climbed. "Russian companies ceased investing in countries that imposed sanctions on Russia and invested instead in neighboring countries that did not join Western sanctions," Orlova wrote. This is in turn bolstering trade links, she wrote. |

No comments:

Post a Comment