| European Union policy makers — at least the ones who slept through US election results late Tuesday — woke up Wednesday morning to the realization that the tensions with America that dominated Donald Trump's first administration are likely to find echoes in his second. The painful truth is the EU faces a reckoning, with Trump now declared the convincing winner of the US presidential vote (Click here to monitor our US election results page.) The Big Take: How the World Is Prepping for a Trump or Harris Victory EU officials are preparing for a difficult relationship with the US, including more protectionism coming from the White House and a possible tariff war — on top of existing trade tensions with China. The transatlantic list of grievances already includes America's green subsidies, steel and aluminum levies and a long-running dispute between Boeing and Airbus. This all comes just as Europe is realizing how it was caught flatfooted by the paradigm shift in the global world order, partly pushed by China's comeback as an assertive economic power and successive US administrations' efforts to counter it. "The era of geopolitical outsourcing is over" Polish Prime Minister Donald Tusk wrote on X over the weekend, even before the US result was known, capturing the zeitgeist in some EU capitals. Read More: EU's Jorgensen Wants Cheaper Energy, End to Russian Fuel Imports Trump's return to the White House could serve as a catalyst for the Europeans to boost their autonomy, through possible measures including bolstering defense preparedness or increasing their joint resources.

His election "marks the beginning of the most difficult economic moment" for Germany in particular, said Professor Moritz Schularick, president of the Kiel Institute for the World Economy. "In addition to the domestic structural crisis, the country now faces massive foreign trade and security policy challenges for which we are not prepared."

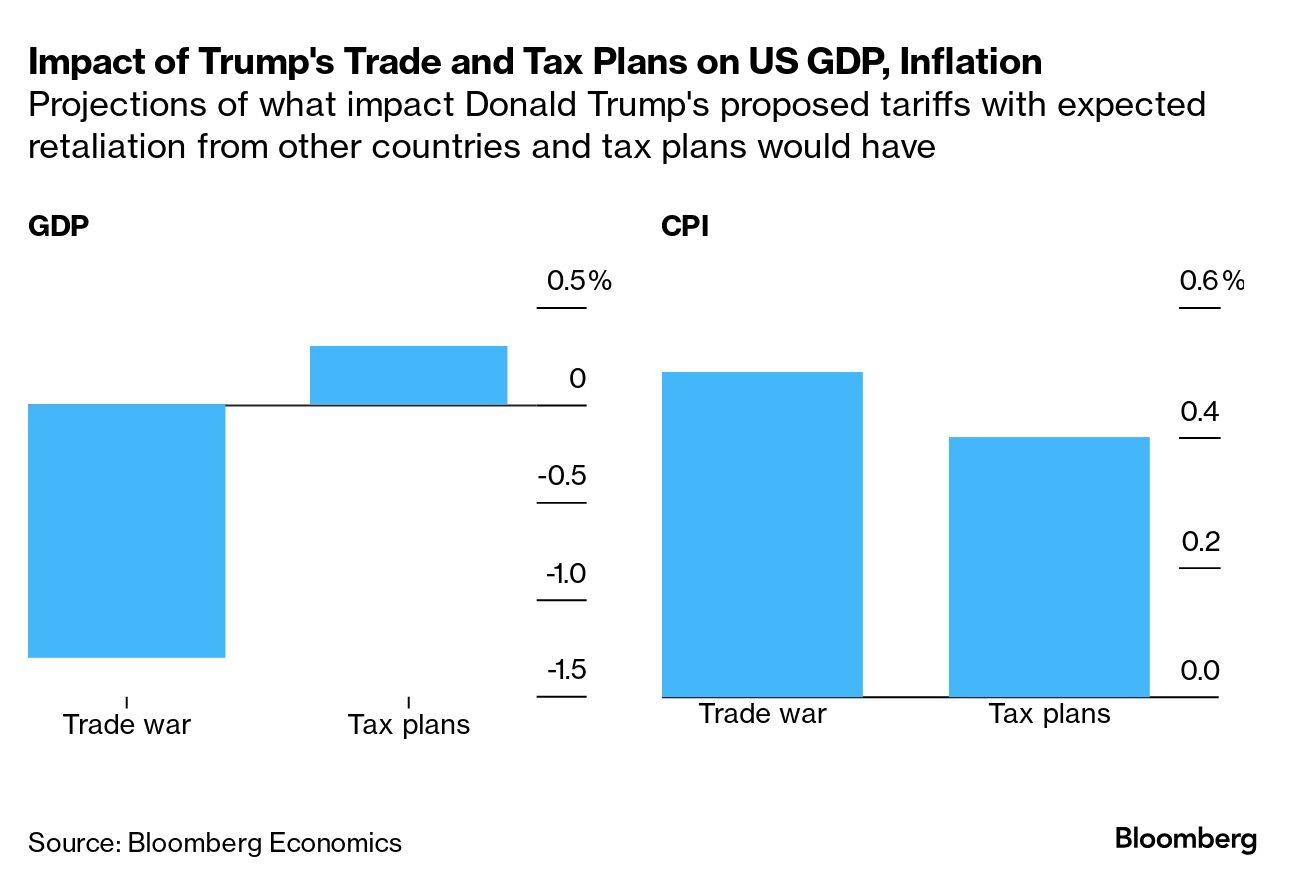

The leadership change will also test the 27-nation bloc's resolve to protect its interests, at risk of triggering a trade war with its closest ally if the Republican slaps 10% to 20% tariffs on all imports, as he has proposed. Pre-Tariff Rush

Judah Levine, head of research at Freightos, predicted that the expectation of impending tariffs when Trump takes office in January may lead importers to accelerate shipments beforehand, raising freight rates as shipping companies are inundated with demand. Points of discord with President Joe Biden's administration include America's massive green subsidies plan, as well as the failure of the two sides to solve the steel and aluminum tariffs. Brussels would push for solving these matters, also including the Boeing-Airbus dispute, once the new US administration is in place, but revamping the World Trade Organization as the EU would like remains an elusive goal regardless of the winner of the election. Trump slapped tariffs on billions of dollars in European imports over the aircraft dispute during his first administration. While the EU and the US under Biden agreed to a five-year truce that suspended the duties in 2021, there's no guarantee that Trump will abide by it once he takes office in January. On trade broadly, "I will come with an offer of partnership and cooperation," says Maros Sefcovic, the senior EU official lined up to take over the portfolio in the coming weeks. - How would China react if Trump regains the White House and imposes substantial new tariffs? Beijing's retaliatory targets could be similar to the last time — particularly agricultural and energy exports from Republican-leaning US states, according to a new analysis on the Terminal from Bloomberg Economics.

—Jorge Valero in Brussels and Eric Martin in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment